View the full Brand Finance US 500 2023 report here

Amazon has retaken top spot as the USA’s most valuable brand despite its brand value falling 15% this year from US$350.3 billion to US$299.3 billion. Amazon was previously the world’s most valuable brand from 2018 to 2020.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The United States’ most valuable and strongest brands are included in the annual Brand Finance US 50 2023 ranking.

Amazon’s brand has fallen by over US$50 billion this year, substantially in connection with its fall in brand strength, with its brand rating falling from AAA+ to AAA as consumers evaluate it more harshly in the post-pandemic world. Despite its fall in value this year, Amazon’s brand is still up 36% in value since the beginning of the COVID-19 pandemic.

David Haigh, Chairman & CEO, Brand Finance committed:

“Our research has found that Amazon’s brand value comes from its strong position in both B2C and B2B sectors of the economy, as it is a key global market leader in the massive markets of both online retail and online cloud computing services.

It is continuing to expand into new verticals such as bricks and mortar retailing, acquisition of film studios, and payment processing. Further, with Amazon’s full online retail services available in just 18 nations, there remains further scope to expand its geographic reach.”

FanDuel is fastest growing brand from the US, up 259% to US$3.4 billion

New entrant FanDuel is the fastest growing brand in the ranking, more than tripling in brand value to US$3.4 billion. This rapid growth is primarily due to the gambling brand’s revenue forecast increasing and a Brand Strength Index score increase to 74 out of 100, with a corresponding AA rating. FanDuel is leading the expansion of the US online gambling market, which has flourished since 2018 when restrictive US gambling restrictions were repealed in some States.

Bite taken out of Apple as it falls to be second most valuable American brand

Apple has fallen to be the United States’ second most valuable brand. Its brand value is down 16% from US$355.1 billion to US$297.5 billion, to move from slightly above Amazon’s brand value to now be slightly below Amazon’s brand value.

Laurence Newell, Managing Director Brand Finance, North America, commented:

“Despite challenges faced by Apple this year, the brand continues to innovate, invest in long-term growth plans. Apple’s high level of customer loyalty and continued strong customer response to new products saw the installed base of active Apple devices hit an all-time high in 2022.”

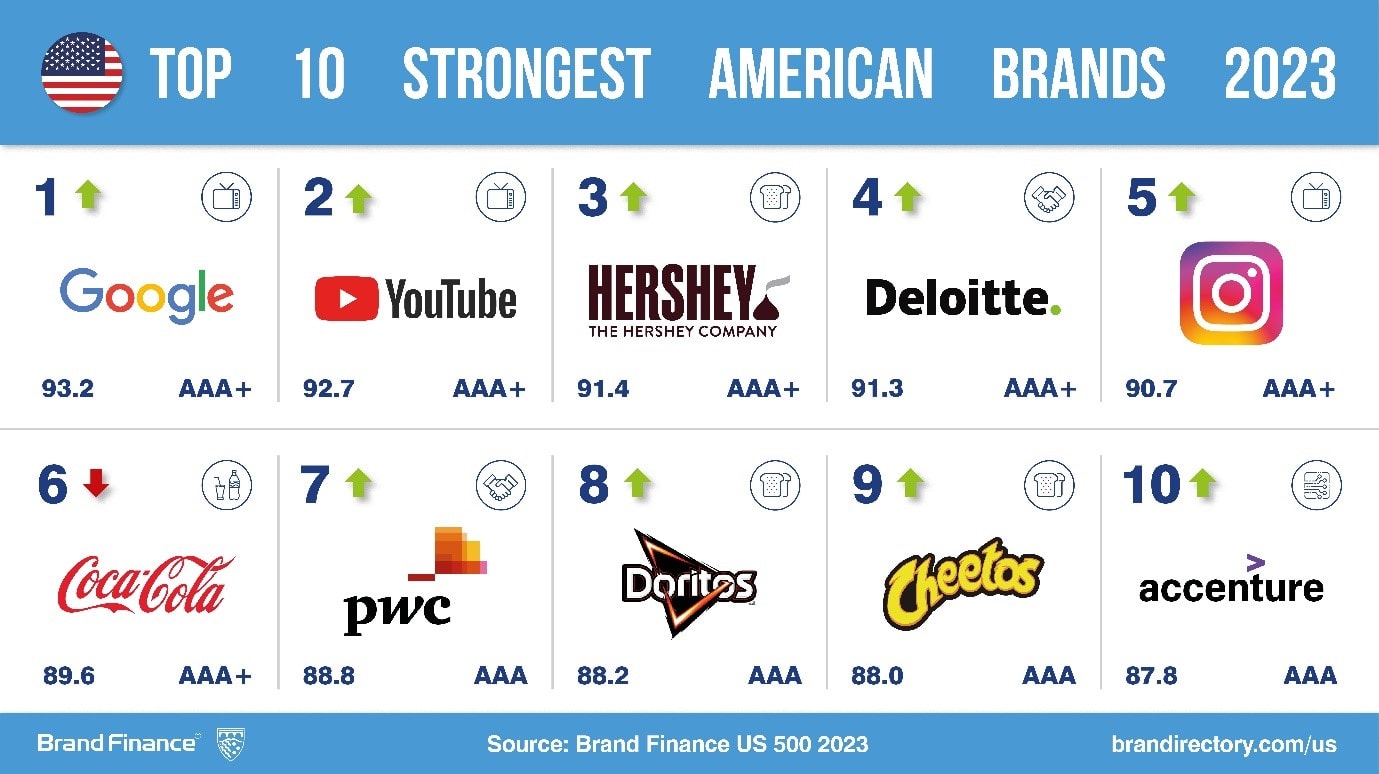

Alphabet owns USA’s strongest and second-strongest brands in Google and YouTube

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

In brand strength, Alphabet Inc, the parent company of both Google (brand value up 7% to US$281.4 billion) and YouTube (brand value up 24% to US$29.7 billion) achieved a rare one-two ranking as the United States’ two strongest brands. Both brands have now overtaken last year’s strongest brand, Coca-Cola, which is now the US’ sixth strongest brand, after a 4-point Brand Strength Index (BSI) score reduction.

Amazon has the highest Sustainability Perceptions Value of any US brand at US$19.9 billion, followed by Tesla

As part of its analysis, Brand Finance assesses the role that specific brand attributes play in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand.

Amazon has the highest sustainability perceptions value of any US brand at US$19.9 billion. Like many of the world’s top brands, Amazon has a huge scope for impact due to the sheer scale of its operations. It is important to note that Amazon’s position at the top of the table is not an assessment of its overall sustainability performance. Instead, it highlights the value that Amazon has tied up in the sustainability perception of stakeholders.

View the full Brand Finance US 500 2023 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The United States’ most valuable and strongest brands are included in the annual Brand Finance US 500 2023 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance US 500 2023 ranking.

Media Contacts

Michael Josem

Associate Communications Director

T: +44 (0)7624 488 557

m.josem@brandfinance.com

Laurence Newell

Managing Director, Brand Finance North America

T: +1(214)803-3424

l.newell@brandfinance.com

Follow Brand Finance on LinkedIn, Twitter, Facebook, and YouTube.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.