Aramco retains status as most valuable Middle Eastern brand in global ranking, followed by ADNOC and stc

Aramco's brand value has witnessed a slight decrease to USD41.6 billion in 2024. While largely influenced by revenue changes, this decrease is also associated with a dip in perceived quality and reliability. That said, Aramco remains the most valuable Middle Eastern brand by a significant margin.

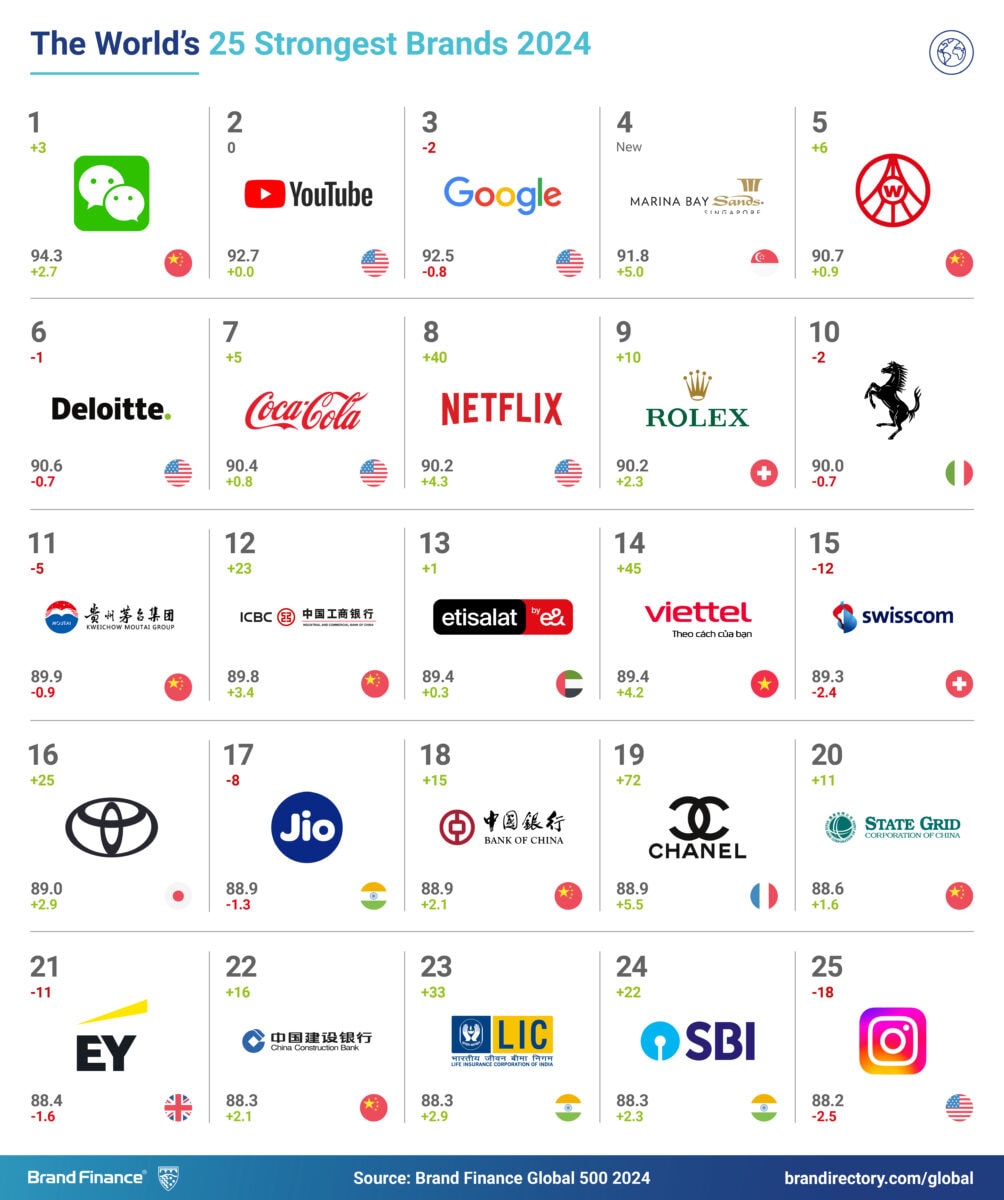

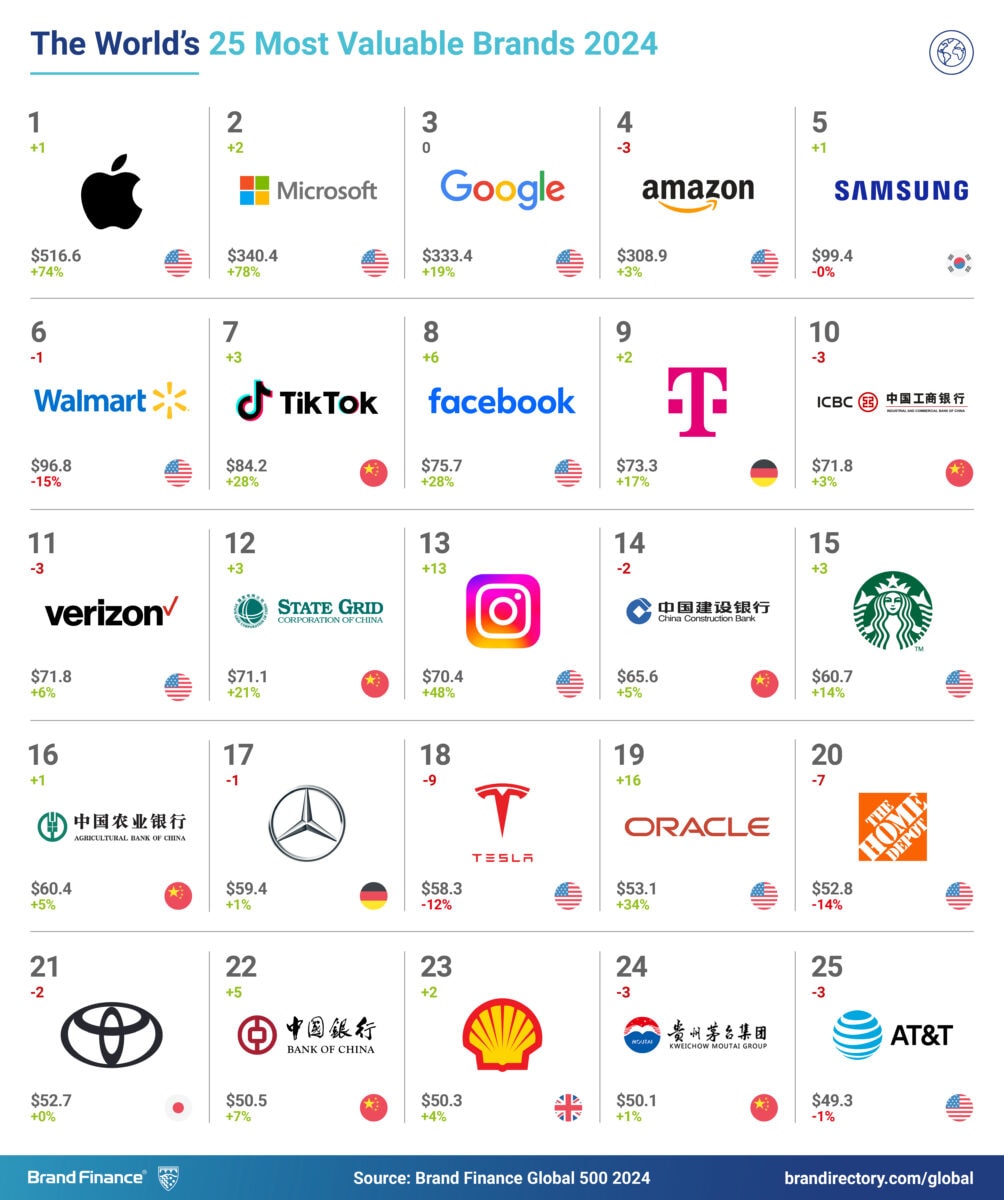

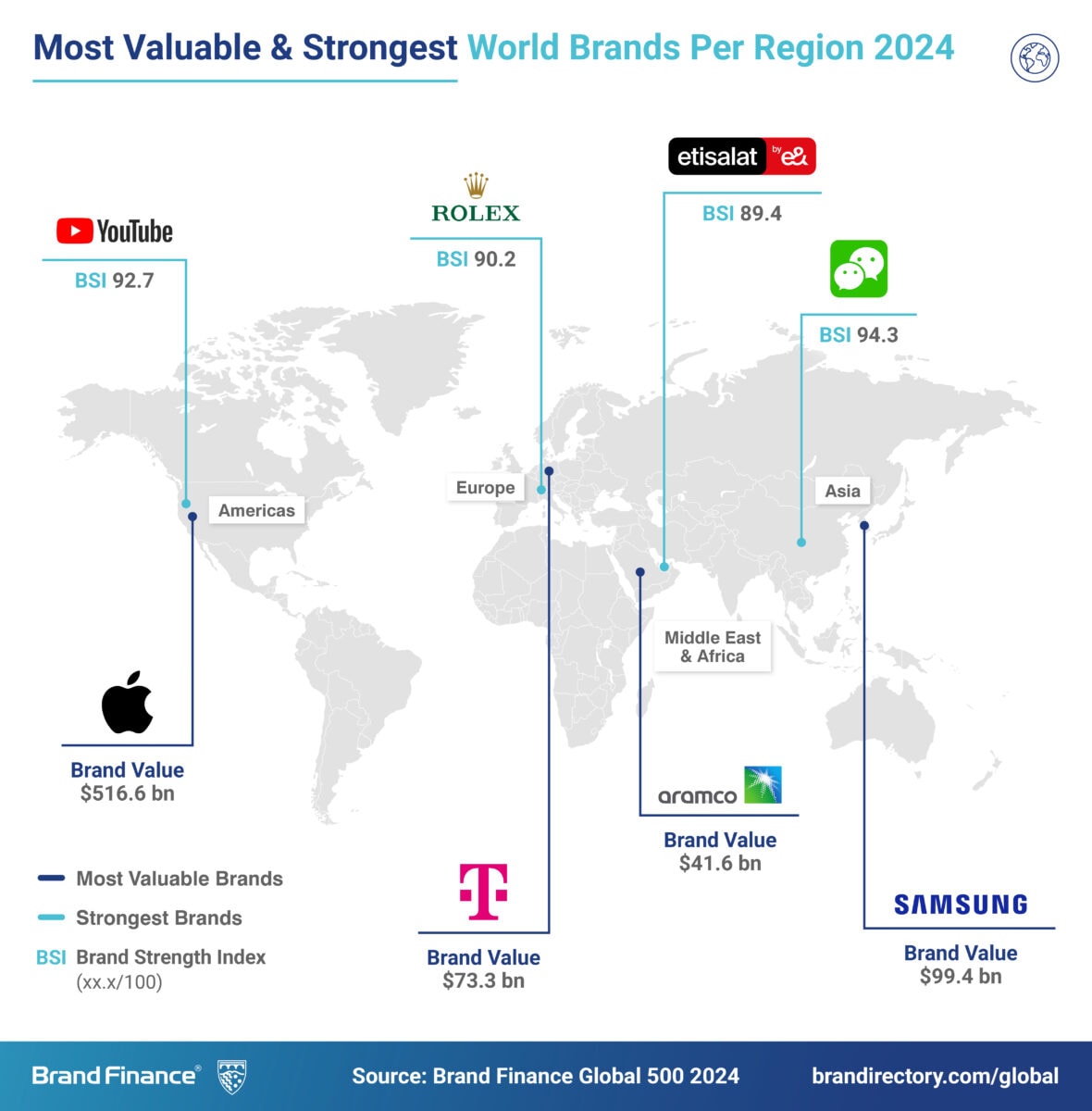

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest global brands are included in the annual Brand Finance Global 500 2024 ranking.

ADNOC, the second most valuable Middle Eastern brand, has grown its brand value by 7% to USD15.2 billion, driven by a 1-point improvement in its BSI to 80. It is also now an AAA- rated brand. ADNOC recently made a strategic investment in Storegga, a company that focuses on the development of global carbon capture and storage projects. ADNOC's brand strength has also improved due to its commitment to decarbonisation; it is one of 50 founding signatories of the Oil and Gas Decarbonisation Charter (OGDC) that is a global commitment to speed up climate action across the industry, launched at COP28.

David Haigh, Chairman and CEO of Brand Finance, commented:

“We are witnessing several brands from a wide array of sectors on the cusp of breaking into the top 500. The region is investing heavily in tangible and intangible away from the oil industry and as such many brands are making the step up from being strong regional players to becoming brands with global aspirations.”

etisalat by e&, e&’s telecoms brand, is strongest Middle Eastern and African brand, and strongest telecoms brand in the world

e& group’s telecom vertical, etisalat by e&, has retained its position as strongest brand in the Middle East and Africa as well as the strongest telecom brand in the world, scoring 89.4 in the Brand Strength Index. The telecom operator has benefited from being part of a larger technology group, e&. This also means that e& has retained its ranking as the most valuable portfolio of TMT brands in the Middle East and Africa, with an increase of 15% on last year to a total brand value of USD17 billion. Key contributing factors include its ongoing Manchester City Football Club partnership, 5G network leadership, innovative customer experience initiatives, and participation in global events like the Formula 1 Grand Prix in Abu Dhabi and COP28.

stc breaks into top 150 brands globally

stc (brand value up 12% to USD13.9 billion) has shown impressive growth and entered the top 150 within the Global 500 ranking this year. This achievement makes stc the first consumer brand in the Middle East to enter the 150 most valuable brands globally. stc has taken significant strides in its expansion strategy, integrating specialized subsidiaries in digital infrastructure, IoT, cloud computing, cybersecurity, business outsourcing, telecommunications, and fintech. stc’s acquisition of an interest in Telefonica, one the largest telecommunications companies in the world marks a key milestone in stc’s growth journey in 2024.

Banking brands QNB and Al-Rajhi Bank see solid brand value and strength growth

QNB, (brand value up 10% to USD8.4 billion) has increased its brand value and strength in this year’s ranking, maintaining its AAA rating. As the region’s largest financial institution, the brand’s growth success stems from a combination of robust financial performance, and a strong reputation amongst consumers both internationally and abroad.

Al-Rajhi Bank, the region’s second strongest brand, has grown its brand value by 13% to USD6.4 billion. It also has a brand strength index of 85.07, along with a AAA rating. Brand Finance research found that customers were considering Al-Rajih more frequently and were more willing to pay higher prices for premium services from the bank.

Apple achieves remarkable 74% growth in brand value, reclaiming its title as the world’s most valuable brand by huge margin

Apple has achieved exceptional brand value growth this year, increasing by USD219billion (74%) to USD517 billion, reclaiming its title as the world’s most valuable brand by a huge margin. Apple has achieved a remarkable brand value increase, even as iPhone volume share has largely plateaued, as its strategy of finding new markets, expanding its ecosystem, and encouraging upgrades to higher-value iPhones has been highly effective. Apple has maintained its position as the dominant player in the premium smartphone market, with 71% value share.

Artificial Intelligence sector booms as NVIDIA becomes world’s fastest growing brand

Brand Finance research found significant gain amongst brands that have heavily invested in AI, seeing NVIDIA (brand value up 163% to USD44.5 billion) become the world’s fastest-growing brand. A key supplier of chips in the AI space, NVIDIA is perceived as highly innovative while familiarity, consideration, and recommendation levels all increased year-on-year, according to Brand Finance research.

Tesla drops out of top 10, falling to 18th place

Tesla (brand value down 12% to USD58.3 billion) has dropped out of the top 10, falling to 18th place in the ranking. Tesla has been harmed by its large exposure to the Chinese EV market, and BYD (brand value up 20% to USD12.1 billion) has now overtaken Tesla to become the world’s largest EV maker. While Tesla’s brand strength remains high overall, rated AAA-, Brand Finance research shows a significant fall in reputation. Tesla’s close association with Elon Musk, a controversial leadership figure, creates added reputational risk for the brand.

View the full Brand Finance Global 500 2024 report here

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.