View the full Brand Finance Saudi Arabia 50 2022 report here

View the full Brand Finance Middle East 150 2022 report here

Oil and gas giant Aramco has once again been crowned Saudi Arabia’s, and the Middle East’s, most valuable brand, according to the latest report by leading brand valuation consultancy Brand Finance.

Every year, Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Saudi Arabia’s top 50 most valuable and strongest brands are included in the Brand Finance Saudi Arabia 50 report, while the Middle East’s top 150 most valuable and strongest brands are included in the Brand Finance Middle East 150 report.

This year, Saudi Arabia’s national oil company has seen its brand value increase by 16% to US$43.6 billion, which sees the brand account for just under 50% of the total brand value in the Brand Finance Saudi Arabia 50 2022 ranking. Following a difficult period for the oil and gas sector at the start of the COVID-19 pandemic, oil prices rebounded in 2021, buoyed by the natural gas crisis that saw businesses turn to crude products.

The increase in demand saw Aramco’s third-quarter profits more than triple year-on-year, helping push its market valuation to US$2 trillion. In a sign of confidence and ambition for continued growth, Aramco announced plans to increase its production capacity from 12 million barrels a day to 13 million by 2027. The company has continued to invest heavily in its brand to support growth in both core and growth businesses through a global campaign as well as investments in sports – from Formula 1 to golf.

stc is nation’s strongest brand

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. According to these criteria, stc is Saudi Arabia’s strongest brand, with a Brand Strength Index (BSI) score of 85.7 out of 100 and a corresponding AAA brand strength rating.

In addition to being the nation’s strongest brand, stc also saw its brand value increase by 16% to US$10.6 billion, which saw it consolidate its position as Saudi Arabia’s 2nd most valuable brand for the 3rd consecutive year.

The impressive results come off the back of particularly strong growth in the business and enterprise sector. The brand also continues to play a key role in KSA’s 2030 vision through continued investment and diversification. Last year stc announced it would be investing US$400 million to build the largest cloud enabled data centre in the MENA region, and saw its subsidiary stc Pay awarded one of the first digital banking licenses in Saudi Arabia.

Andrew Campbell, Managing Director Brand Finance Middle East, commented:

“stc’s brand has continued to go from strength-to-strength in the wake of its successful rebrand in 2019, and through strategic expansions the brand has evolved to become more than a telecoms company. stc continues to be a leader in the digital transformation in Saudi Arabia, with the success of stc Pay being a standout highlight.”

SABIC sits in third

SABIC has retained its position as the third most valuable brand in Saudi Arabia. This year it saw its brand value increase by 16% to US$4.7 billion, meaning it is now more valuable than it was before the COVID-19 pandemic. The chemicals brand saw its profits rebound last year, with revenues up 56% year-on-year thanks to increased sales volumes and higher average product prices.

SABIC is keenly aware of the important part its brand plays in helping it achieve its vision of becoming the preferred world leader in chemicals. Last year saw increased synergies between SABIC and Aramco, following the announcement that SABIC would be taking responsibility for the marketing and sales of a number of Aramco petrochemicals and polymers products. At the same time, Aramco took responsibility for the offtake and resale of a number of SABIC products. These changes will help to strengthen both brands through improved customer offerings, as well as increasing operational efficiencies.

In line with its purpose of ‘Chemistry that Matters™’, SABIC reaffirmed its commitment to sustainability following its announcement at the Saudi Green Initiative summit that it plans to achieve carbon neutrality by 2050, and reduce greenhouse gas emissions by 20% by 2030. This year saw SABIC launch the first certified circular polycarbonate resin and blends in the industry, which are created by upcycling mixed plastic.

Andrew Campbell, Managing Director Brand Finance Middle East, commented:

“SABIC’s impressive growth in this year’s ranking shows it has taken another step towards its ambition of being the world’s leading chemicals brand. SABIC launched its global brand campaign in 2019, which has continually evolved to keep pace with the changing trends in the world. The focus on the brand has undoubtedly unlocked growth for SABIC, and it has continued to leverage its brand equity – evidenced through the newly established SABIC Agri-Nutrients Company.”

Mobily sees fastest growth in top 10 over course of pandemic; fastest-growing Saudi telecoms brand over past year

Over the course of the COVID-19 pandemic, Mobily is the fastest-growing brand in the top 10 of the Brand Finance Saudi Arabia 50 ranking, with its brand value growing 39% in the last two years to US$1.5 billion. Mobily has successfully retained its brand rating of AA+ and recorded a brand value growth of 18% over the last year which makes it the fastest-growing telecoms brand in Saudi Arabia.

The telecoms brand is continuing to improve its 5G network coverage, in addition to achieving strong growth in its fiber-to-the-home segment. The B2B segment has also achieved excellent results by growing customer relationships and facilitating key government projects, including the Kingdom-wide health information system. Looking to the future, Mobily has announced its ambition to venture into offering mobile financial services (MFS). The foray into MFS aims to accelerate cashless payments in the country, in line with KSA’s Vision 2030 ambition of 70% payments done digitally by 2030.

Banking sector sees strong performance

Banking brands continue to perform well in the Brand Finance Saudi Arabia 50 2022 ranking, with the sector having four brands feature in the top 10. Al-Rajhi Bank is the most valuable and strongest banking brand in the country with a brand value of US$4.3 billion and BSI score of 84.3. It is joined in the top 10 by SNB (brand value US$3.2 billion), Riyad Bank (US$1.2 billion) and SABB (US$750 million).

SNB is the rebranded entity following merger between NCB and Samba and is the highest new entrant in the ranking this year in 5th. Although it performed well in this year’s ranking in both the brand value and BSI rankings, SNB will need to ensure it continues to invest in its brand in order build equity among key stakeholders. As with any large merger, SNB will need to tackle organisational and cultural challenges – but with the proper investment its brand can be a uniting force to help navigate these issues.

Riyad Bank is seeing its BSI score grow at the fastest rate within the Saudi banking sector this year, with a 3.4-point increase to 70.9. The brand strives to become the best bank in KSA by 2025 by being the most profitable, most efficient, the bank of choice, and by being digitally enabled. The bank has consolidated its strength in the B2B side of its business, which has seen its share of the SME loan portfolio increase to 13.4% in the kingdom, compared to 4.7% in 2015. This is a key pillar of the brand’s strategy, which also supports the nation’s Vision 2030 strategy to grow the non-oil sector.

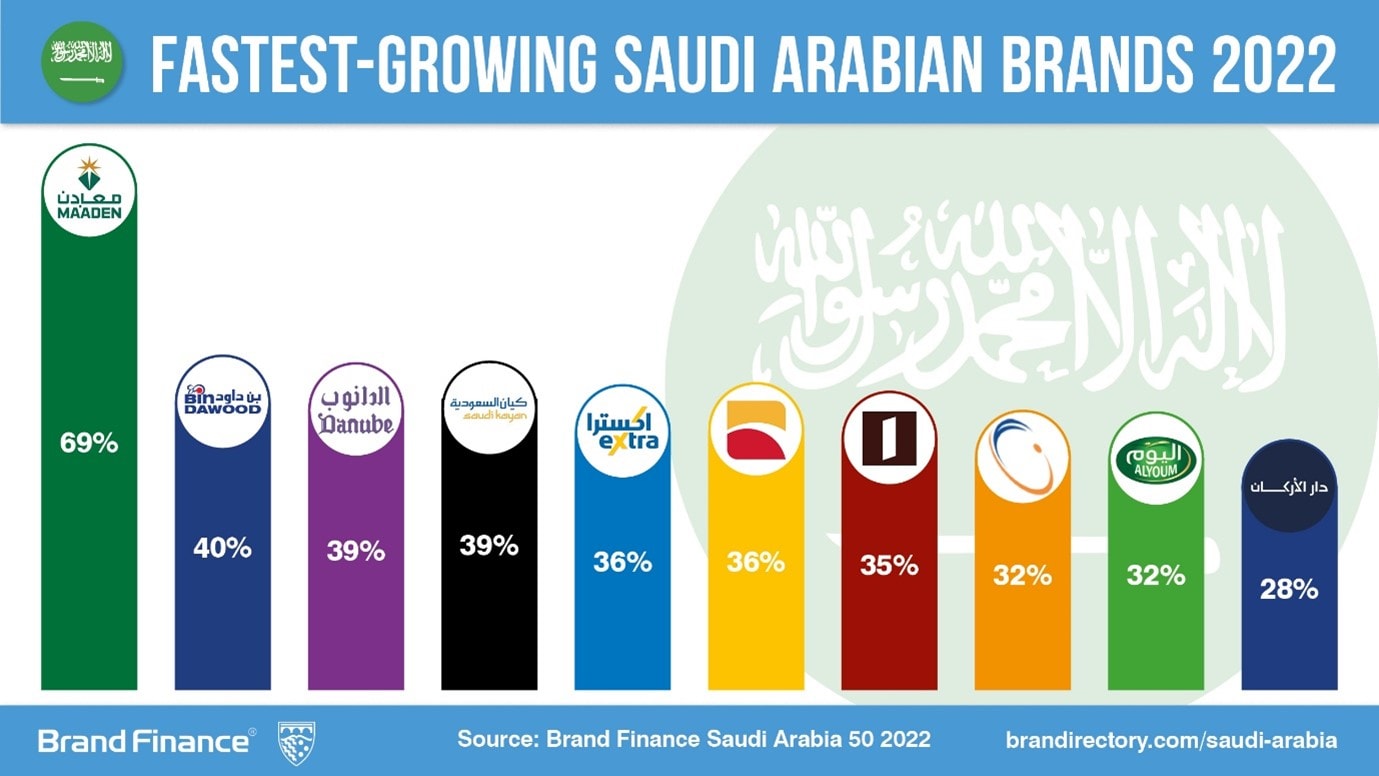

Ma’aden is fastest-growing brand

Ma’aden is the fastest-growing brand in the Brand Finance Saudi Arabia 50 2022 ranking, with its brand value increasing 69% to US$503 million over the course of 2021. The impressive growth has consolidated the brand’s position as the most valuable mining & metals brand in both Saudi Arabia and the wider MENA region.

The growth is the continuation of a positive trend for Ma’aden, which was also the second fastest-growing brand in the Brand Finance Saudi Arabia 50 ranking over the course of the COVID-19 pandemic, with its brand value up 91% in the last two years.

This year’s growth was driven by record sales, which saw a 44% year-on-year increase for Ma’aden. The company is the third pillar of Saudi industry, alongside oil and petrochemicals, and its growth has seen it named among the top 20 largest global mining companies by market capitalisation.

Retail sector sees strong growth

Brands from the retail sector performed well in the Brand Finance Saudi Arabia 50 2022 ranking, with every brand featured seeing brand value growth. Jarir Bookstore remains the most valuable brand from the sector and moved up from 14th to 11th following a 23% brand value increase to US$742 million. Similarly, Panda (brand value up 16% to US$612 million) and Othaim Markets (up 25% to US$587 million) each moved up three places to 17th and 18th respectively.

BinDawood is the fastest-growing retail brand in the ranking this year, with a 40% growth in brand value growth to US$127 million. BinDawood saw sales return to a sense of normality in the second half of 2021, and in a sign of confidence announced plans to expand its domestic footprint by opening 10 new branches in Riyadh over the next five years. The brand also opened its first location outside of Saudi Arabia in 2021 in Bahrain, and also stands to benefit from its parent company, BinDawood Holding, moving to bolster its e-commerce capabilities.

SAUDIA cruises into top 20

New entrant to the ranking SAUDIA has broken straight into the top 20 of the ranking, with its brand value of US$572 million seeing it ranked 19th overall. SAUDIA’s brand value increase of 13% this year means it is also the fastest-growing airline brand across the Middle East. As part of Vision 2030, Saudi Arabia plans to increase the number of tourists to 100 million a year by 2030, and the number of religious visitors to 30 million by 2025. SAUDIA is due to play a key role to achieve these targets and has already announced plans to expand both the number of routes it serves, and the size of its fleet.

Healthcare sector sees fastest growth

The importance of healthcare has been highlighted throughout the COVID-19 pandemic, and it is reflected in the Brand Finance Saudi Arabia 50 2022 ranking. The healthcare sector was the fastest-growing in this year’s ranking, with its collective brand value up 108% year-on-year.

Dr. Sulaiman Al Habib Medical (brand value up 28% to US$499 million) continues to be the most valuable and strongest healthcare brand in both Saudi Arabia and the across the Middle East. The brand’s impressive growth can be attributed to its 23% year-on-year increase in sales in the hospital segment, and the higher rate of patient occupancy seen throughout the year. Looking forward, the brand plans to continue to expand its operations, announcing an US$8 million land lease investment in Al-Madinah, where it plans to build a new hospital to increase patient capacity in the future.

This year also saw two new entrants in the ranking from the sector, with Mouwasat (brand value US$178 million) and Saudi German Health (brand value US$134 million) entering in 41st and 47th respectively.

BUPA Arabia remains most valuable and strongest insurance brand

Bupa Arabia has once again been named the most valuable and strongest insurance brand in both Saudi Arabia and the entire MENA region. The brand has continued to see year-on-year growth in brand value, with an 8% increase to US$664 million this year, and retained its AA+ brand strength rating.

In addition to BUPA Arabia’s reported revenue increasing, Brand Finance market research also suggests that the brand has highly satisfied customers, with strong results in measures pertaining to both customer service and recommendation. The brand was also perceived to offer the best ‘value for money’ compared to any other insurance brand in the region. When asked about momentum of the brand, 60% of customers also believed it was ‘on the way up’ revealing they are expecting even more from Bupa Arabia in the future.

Although smaller than BUPA Arabia in terms of brand value, Tawuniya was the fastest-growing Saudi insurance brand this year with16% increase in brand value to US$496 million. The Saudi insurer also managed to improve its brand strength rating from AA- to AA following a 4.0-point increase in its BSI score to 71.6. The jump sees it join other reputable Saudi brands such as Aramco, Riyad Bank and SNB. Brand Finance market research revealed the brand improved customer consideration, overall reputation and various other perceptions around innovation and customer service over the 12-month period. Higher revenue forecasts also shows that the financial community expect an increasingly positive outlook for the brand over the next three years.

View the full Brand Finance Saudi Arabia 50 2022 report here

View the full Brand Finance Middle East 150 2022 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Saudi Arabia’s top 50 most valuable and strongest brands are included in the Brand Finance Saudi Arabia 50 2022 report, while the Middle East’s top 150 most valuable and strongest brands are included in the Brand Finance Middle East 150 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Saudi Arabia 50 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.