Brand Finance, the world’s leading independent brand valuation consultancy, has estimated the overall value per company size that could be disclosed in brand value due to the August Decree. Should trademark valuation be adopted by 100% of eligible Italian companies, it would increase the value of balance sheets by a total of €200 billion. To put this in context, the value of the top 50 most valuable Italian brands is around €125 billion, according to the Brand Finance Italy 50 2021 ranking.

For 90% of Italian companies, which employ up to 9 people, the average brand value added by the scheme would be just under €15,000, which is equivalent to a tax benefit of approximately €4,000 over 18 years of amortization with a payment of €450 as a substitute tax at 3%. For companies with 50 – 250 employees, the average brand value would be around €2.5 million, which would create a tax benefit of around €700,000 against a payment of only €75,000.

Despite the many benefits to the scheme if correctly executed, there is a danger that valuations conducted by people who are not professionally qualified to value brands could result in challenges, chaos, and legal actions.

Brand valuation is an exercise that is more complex than the valuation of other assets. It is precisely because of this that the ISO 10668 standard for monetary brand valuation has existed for several years, which has been supplemented by the ISO 20671 standard for determining the strength of the brands.

Lorenzo Coruzzi, Associate, Brand Finance, commented:

“The average undisclosed intangible value of listed companies in Italy is 12% of the market value as determined by investors. If non listed companies take advantage of this new opportunity it will result in a substantial strengthening of their balance sheets which will be helpful".

These valuations will also have a favourable tax impact for the companies. In order to qualify for the tax break Italian companies will have to pay in aggregate 3% of the €200 billion which comes to €6 billion payment over three years to the Italian Revenue Agency. In return, companies could receive a total tax reduction of €55 billion over the 18 years amortization period, which discounted would be worth around €27 billion in net present value terms.

David Haigh, CEO of Brand Finance, commented:

“We have been measuring the phenomenon of undisclosed intangibles on stock markets every year since 2002 through our Global Intangible Finance Tracker (GIFT). Under the IFRS or US GAAP, companies are not allowed to declare most of the intangible assets they generate internally. Brand Finance has been fighting for a more innovative approach to the regular evaluation of intangible assets, particularly brands, and their inclusion in the balance sheet for years.

This measure by the Italian government is a brilliant idea, not only in its efforts to restart businesses, but also because it touches on a couple of fundamental issues within intangible asset reporting. Among its various benefits, we observe a more informed management, potential increase in investments with the aim of increasing intangible value, more solid balance sheets, and a further defence against asset stripping”.

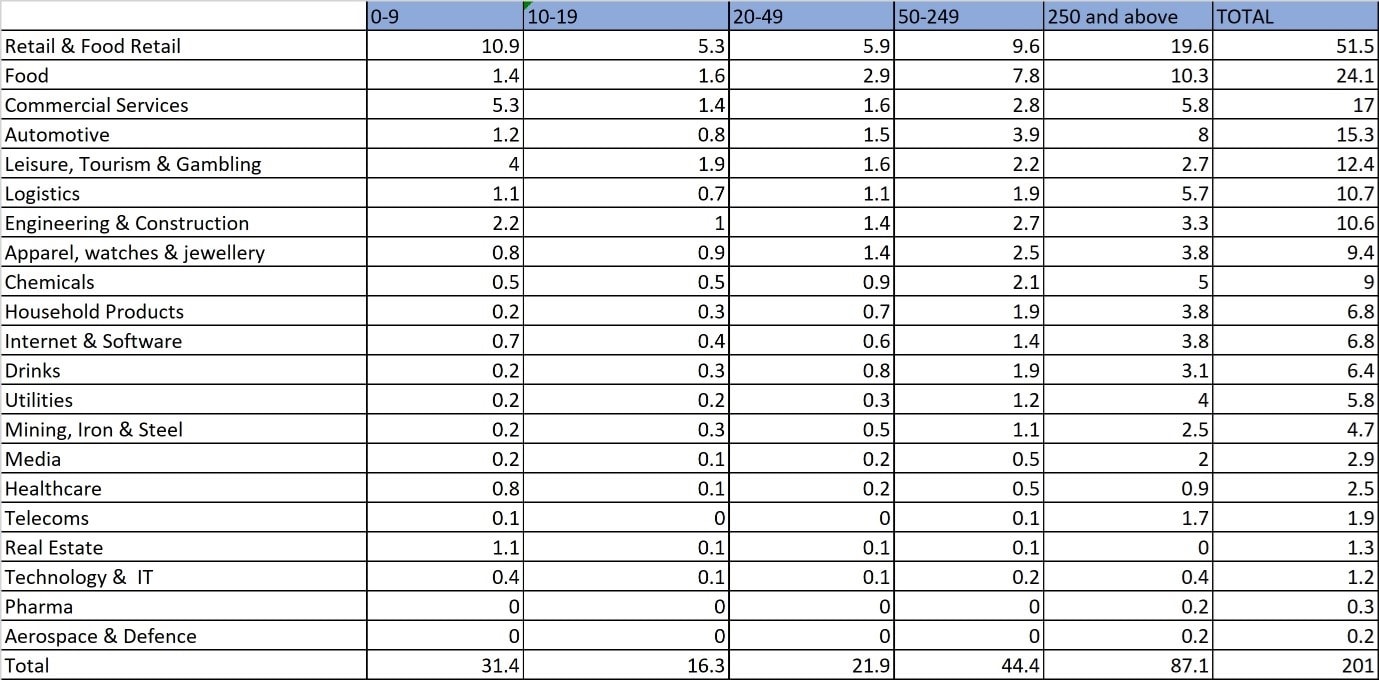

Table 1: Potential cumulative brand value per company size and industry (revenue data based on ISTAT) - Values in EUR billions

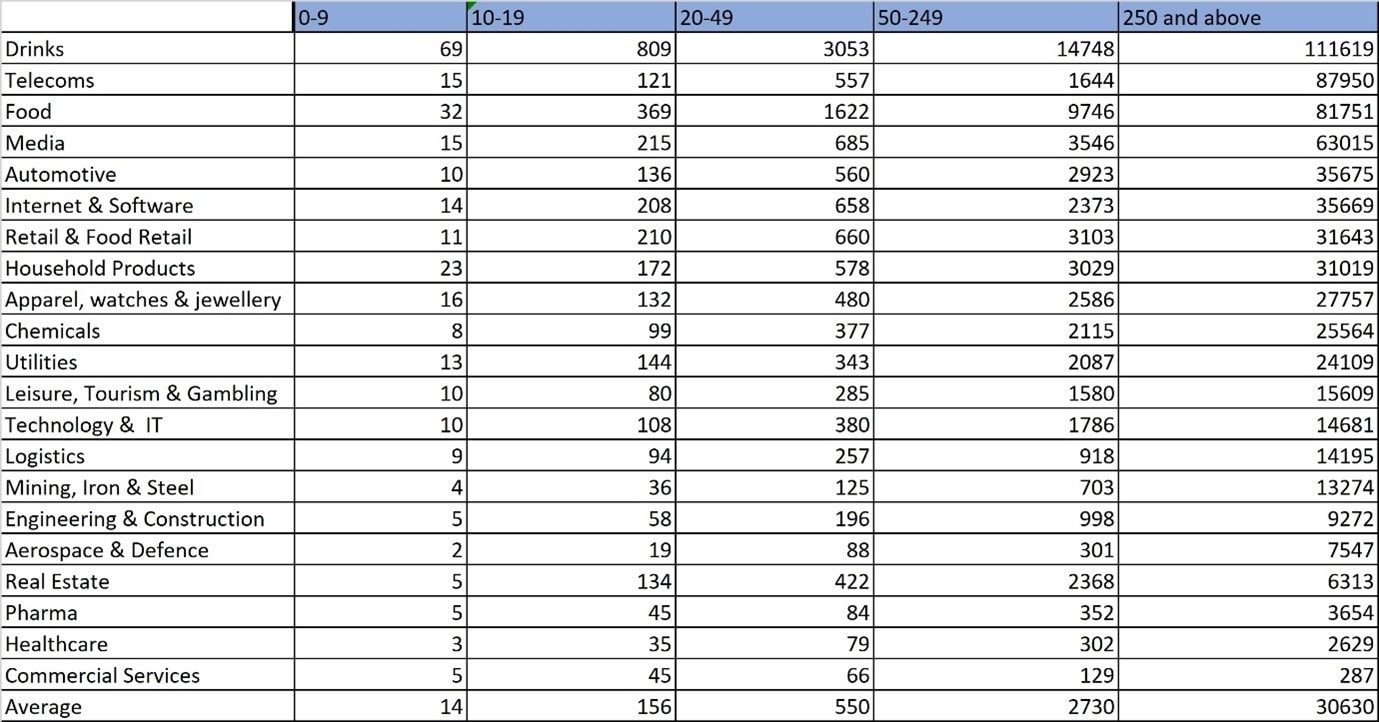

Table 2: Average brand value for individual company based on industry and company size. (Revenue data based on ISTAT) - Values in EUR thousands.

Background

Five hundred years ago, Fra Luca Pacioli, is reputed to have invented the “Double Entry Bookkeeping” system which has transformed financial reporting ever since.

500 years later, Italy is once again revolutionizing financial reporting practices. The “Decreto Agosto”- August Decree, now authorises Italian companies for the first time to put their homegrown brands on the balance sheet. This will strengthen their balance sheets and revive the nation’s economy following the devastating COVID-19 pandemic. Currently, conservative International Financial Reporting Standards (IFRS) prevent companies putting internally generated brands in financial statements except in the case of acquisition.

This new measure could revolutionise accounting and financial reporting for years to come, improve transparency for investors, make it easier to compare companies pursuing organic vs inorganic growth, and assist boards in understanding and financially supporting their brands. Companies which disclose brand value under the August Decree could benefit from tax breaks, improved bank ratings, lower cost of capital, and reduced risk of takeover. This exciting development in the world of intangible asset valuation offers a trial run which could influence IFRS in the future. We hope that it is on step closer to closing the gap between the balance sheet and reality.

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.