View the full Brand Finance Romania 50 report here

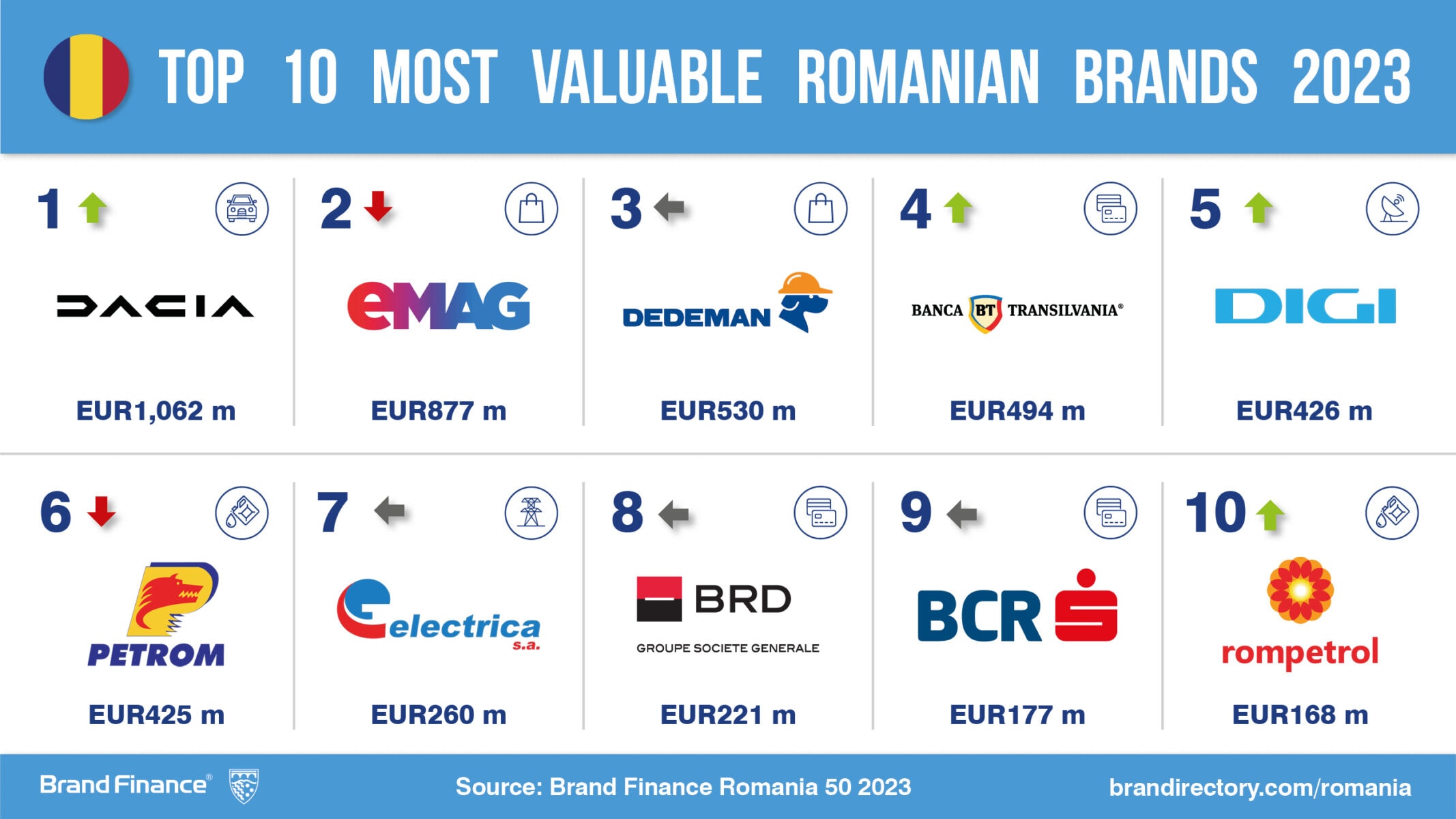

Dacia (brand value up 30% to €1,062 million)has recovered last year’s drop and overtaken eMAG (brand value down 15% to €877 million) to again become the most valuable Romanian brand according to a new analysis by Brand Finance, the leading brand valuation consultancy.

Every year, leading brand valuation consultancy Brand Finance puts thousands of the world’s biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The top 50 most valuable and strongest Romanian brands are included in the annual Brand Finance Romania 50 ranking.

The change at the top, between Dacia and eMAG, reflects the two respective industries’ opposite pre- and post-pandemic evolution: the automotive market has recovered as people started to move again, while the online shopping slowed down, despite a switch of consumers’ buying patterns towards online. Dacia’s recovery is even more interesting when compared to the evolution of the parent company’s brand (Renault) which has been losing brand value constantly over the past 5 years.

"The recent changes in the top brands ranking – illustrated also by the intense competition for the top position – show that traditional brands are losing ground to new, digital, brands. More than 60% of the brands in the ranking were created in the last few decades, and some of them even created in new industries, like eMAG did with online retail."

Mihai Bogdan, Managing Director, Brand Finance Romania

Brick-and-mortar retail continues its post-pandemic recovery

Dedeman remains the most valuable brand held entirely by Romanian shareholders, defending the 3rd position in the ranking (brand value up 5% to €530 million), with the preponderantly brick-and-mortar retail sector continuing its post-pandemic recovery. Thus, Altex brand value is up 13% to €139 million, and Mobexpert is up 17% to €22 million; the same trend is visible in the pharma retail, with Farmacia Tei going up 24% to €30 million, and Help Net up 14% to €27 million.

Banca Transilvania remains the strongest Romanian brand, rated AAA+

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 150,000 respondents in more than 38 countries and across over 30 sectors. By this measure, Banca Transilvania is the strongest Romanian brand, achieving an elite AAA+ brand ranking – with brand value going up 25% to €494 million, up one place to the 4th position). The banking brand is, for the second year in a row, ranking amongst the top ten strongest banks globally.

Overall, the combined value of Romania’s top 50 brands is up 13% from previous year, to over €6.6. billion, above the whole Romanian economy’s rebound of 4.7% in 2022.

Although the Romanian economy has not had significant connections with Russia and Ukraine, the war shockwaves caused by the Russian invasion of Ukraine, which is expected to continue for the near future, may still cause unpredictable disruptions.

Over 60% of brands and brand value in the top 50 ranking come from brands created by the private sector over the past 30 years

New brands – created and developed by entrepreneurs and private companies over the past 30 years – account for over 60% of the Brand Finance Romania 50 2022 – both in number of brands and in brand value.

The high value ranking list has recorded a low churn rate over the years, with only a couple of brands moving in and out of top 50 every year. Thus, two brands from last year’s ranking didn’t make the cut for this year’s: the respectable water brand Borsec, and the pharma retail brand Sensiblu - which was discontinued by the new owners of the business in favour of their international brand.

The new entrants are the local rising real estate brand One United Properties, which makes a remarkable entry in 24th place with a brand value of €49 million, and the industrial brand ALRO (brand value €40 million, in 29th place).

“Globalisation brings about greater exposure, even for businesses that do not stray outside their home country – hence no shortage of challenges and trials for the local brands nowadays. However, it is this combination and alternance of opportunities and threats that stimulate brands to continuously evolve and build upon their equity”.

Mihai Bogdan, Managing Director, Brand Finance Romania

In addition to analysing individual brands, the Brand Finance Romania 50 report also ranks the 10 most valuable brand portfolios, calculated for those businesses that deploy more than one brand into the market. These portfolios encompass over 40 well-known local brands, the most valuable of which are also featured individually in the main top 50 ranking. The top 10 portfolios list has been stable since 2017, with smaller contenders not growing fast enough to overtake the incumbents.

View the full Brand Finance Romania 50 report here

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.