29 February 2024, LONDON – The United States and the United Kingdom are the most influential soft power nations in the world, according to the new iteration of the Global Soft Power Index by Brand Finance, the world's leading brand evaluation consultancy. China is ranked 3rd, surpassing Japan and Germany.

Brand Finance publishes the Global Soft Power Index based on a survey of more than 170,000 respondents from over 100 countries to gather data on global perceptions of all 193 member states of the United Nations. Thanks to the scope of the survey, the Index is the world’s most comprehensive study on perceptions of nation brands, providing an in-depth analysis of the evolving status of soft power as nations navigate significant global changes and challenges.

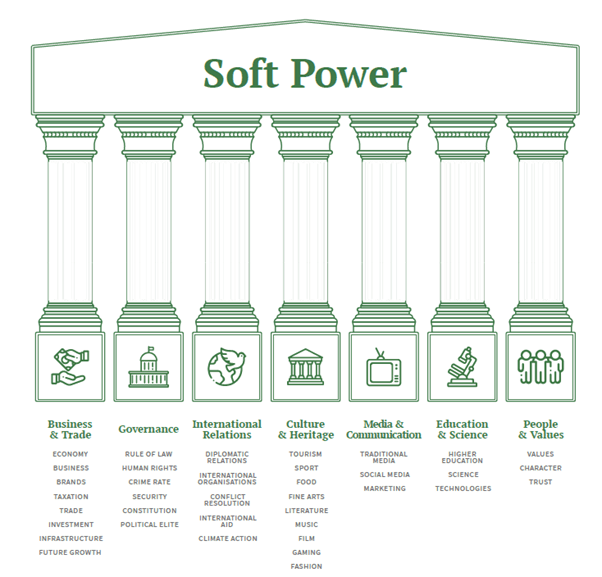

Soft power is defined as a nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics, etc.) through attraction and persuasion rather than coercion. Each nation is scored across 55 different metrics to arrive at an overall score out of 100 and ranked in order from 1st to 193rd.

The report has found that at a time of global uncertainty and instability, economic credentials are increasingly important contributors to a nation’s soft power. Nation brand attributes such as 'strong and stable economy' and 'products and brands the world loves' emerge as key drivers of influence and reputation on the global stage. This trend explains the continued dominance of the world’s largest economies like the USA and China as well as smaller developed economies like Switzerland and the United Arab Emirates at the top of the ranking. Dominant nation brands are recording faster soft power growth (average +3.1 points in the top 50) than the rest of the ranking (average -1.3 for those ranked 51-193).

David Haigh, Chairman & CEO of Brand Finance commented:

“The Global Soft Power Index 2024 underscores the complex interplay between global events and economic shifts in shaping soft power. As nations navigate these dynamics, the importance of a strategic approach to nation branding, supported by perceptions research and financial analysis, becomes increasingly evident.”

Key Findings of the Global Soft Power Index 2024:

The United States leads the rankings with an all-time highest Global Soft Power Index Score of 78.8, an increase from 74.8 in 2023, and earning the top spot for Familiarity and Influence, four out of the eight soft power pillars, and nine out of the 35 nation brand attributes, including ‘leader in science’, ‘influential in arts and entertainment’, ‘internationally admired leaders’, ‘helpful to countries in need’, and ‘supports global efforts to counter climate change’. However, internal security challenges around gun violence and police brutality as well as involvement in international conflicts seem to be undermining some of its nation brand perceptions, as evidenced by continued rank declines on ‘great place to visit’, ‘good relations with other countries’, ‘safe and secure’, and ‘friendly’ where the USA has dropped a further 9 places to 112th.

David Haigh, Chairman & CEO of Brand Finance commented:

“Donald Trump’s confrontational politics – both domestically and internationally – caused a serious erosion of the nation’s soft power in his final year in office, reflected in the United States temporarily losing its 1st rank in the 2021 Index, since recovered under the Biden administration. The upcoming presidential election in November 2024 will be momentous in terms of future direction for the USA and how the nation is perceived globally.”

The United Kingdom has overcome a soft power risk from temporary instability in late 2022 resulting from tumultuous government changes and the passing of Queen Elizabeth II. This year, the UK ranks 7th in ‘strong and stable economy’ compared to last year’s 12th and improves on ‘politically stable and well governed’ up to 12th from last year’s 16th. The nation’s Global Soft Power Index Score of 71.8 continues an upward trend from 67.3 in the previous year. Like the USA, as the UK is set for a general election this year, it will be interesting to see how the results impact its soft power.

China replaces Germany at the 3rd position in the soft power rankings, improving its overall score by +6.2, from 65.0 to 71.2 – faster than any other nation brand in the Global Soft Power Index this year. This rise is driven by a significant improvement in China’s perceptions across key Business & Trade and Education & Science metrics.

Germany fell to 5th position, after earning top ranking in 2021, and 3rd place in both 2022 and 2023. Germany has experienced stagnation and in many cases erosion in perceptions across the board this year, with a substantial drop of 14 positions in 'good relations with other countries' compared to 2023, along with decreases in helpful to countries in need' and measures of trustworthiness. Nevertheless, Germany achieved the top rank in Governance and, despite some score declines, remains among the leaders in the pursuit of a Sustainable Future.

India, Brazil, and South Africa struggle to fulfil their soft power potential, as all three nations have relatively high Familiarity and Influence, especially in their home regions, but rank lower for Reputation. India fell to 29th place, the highest ranked Latin American nation brand Brazil stagnated in 31st, and Sub-Saharan Africa ranking leader South Africa dropped to an all-time low in 43rd place.

With the ranking extended to cover all 193 member states of the United Nations, Monaco is the highest-ranked new entrant at 42nd. The world’s lowest-ranked nations are small Pacific Island nations Vanuatu (191st) Nauru (192nd) and Kiribati (193rd) - each limited in influence by population, geography, and economic factors.

Hard power harms soft power. Russia, Ukraine, and Israel have all ranked lower this year as respondents appear to downgrade countries engaged in military action. Russia continues to fall in soft power rankings, down three places to an all-time low of 16th. While Ukraine is down seven places to 44th, the nation continues to be ranked higher than at any time before Russia invaded. Israel has fallen five ranks to an all-time low ranking of 32nd.

David Haigh, Chairman & CEO of Brand Finance commented:

“Our research shows that world opinion on individual countries and their actions differs widely, as demonstrated by the ongoing conflicts in Ukraine and Palestine. This fractured perception can be traced to a lack of free and fair media and communication, resulting in opinions that are formed based on biased or partial knowledge. The World Economic Forum identifies misinformation and disinformation as the biggest threat to world peace.

While global hard power expenditure was a record $2.2 trillion in 2023 and expected to rise in 2024, we estimate that the combined spending by nation brands on communications is less than $1 billion. Given the dramatic difference in investment, it is unsurprising that hard power has been dominating soft power.”

An intentional approach strengthens soft power. The greatest improvements in the ranking over the past five iterations of the Global Soft Power Index have been recorded by the United Arab Emirates (+13.8 points and 8 ranks to 10th), Saudi Arabia (+14.1 and 8 ranks to 18th), Qatar (+16.0 and 10 ranks to 21st), and Türkiye (+14.3 and 5 ranks to 25th). All are characterised by conscious efforts to grow their soft power through nation branding projects, diplomatic initiatives, and by hosting major events. The Gulf nations especially are seeing enhanced Influence and Reputation as well as strengthening International Relations and Business & Trade credentials, with the United Arab Emirates receiving 10/10 marks and top position globally on the key ‘strong and stable economy’ attribute this year.

The United Arab Emirates has successfully staged the high-profile EXPO 2020 and COP28. Qatar’s improvement follows the 2022 football world cup, which FIFA president Gianni Infantino called the best in history. Similarly, Saudi Arabia is seeing stronger perceptions following significant investments in tourism and football which have earned global media attention. Türkiye has during the same time officially changed its name and took on the role of a mediator leveraging soft power to facilitate diplomatic dialogue from Eastern Europe to the Middle East.

Note to Editors

Soft power is defined as a nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics etc.) through attraction or persuasion rather than coercion.

Full ranking, methodology, charts, commentary, expert contributions, and in-depth spotlights with interviews on many countries are available in the Global Soft Power Index report.

Data and materials prepared for Brand Finance’s reports and events are provided for the benefit of the media and are not to be used for any commercial or technical purpose without written permission from Brand Finance.

Follow Brand Finance on Twitter @BrandFinance, LinkedIn, Instagram, and Facebook.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 25 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

About the Global Soft Power Index by Brand Finance

For over 15 years, Brand Finance has been publishing the annual Nation Brands report – a study into the world’s 100 most valuable and strongest nation brands. Focusing on the financial value and strength of nation brands, the Brand Finance Nation Brands study is based on publicly available information, including data compiled by third parties for other indices and rankings.

Building on this experience, Brand Finance has now produced the Global Soft Power Index – the world’s most comprehensive research study on perceptions of 100 nation brands from around the world. The Global Soft Power Index is based on the most wide-ranging fieldwork of its kind, surveying the general public as well as specialist audiences, with responses gathered from over 100,000 people from across the world. The Global Soft Power Index report is the annual iteration of this study.

Global Soft Power Index Methodology

Two surveys are conducted, both global in scope:

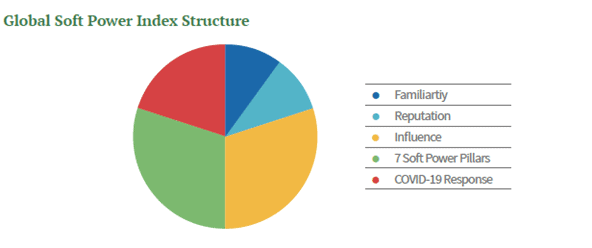

The Global Soft Power Index incorporates a broad range of measures, which in combination provide a balanced and holistic assessment of nations’ presence, reputation, and impact on the world stage.

The Index gives a 90% weighting to the views of the General Public and 10% to those of Specialist Audiences