View the full Brand Finance China 500 report here

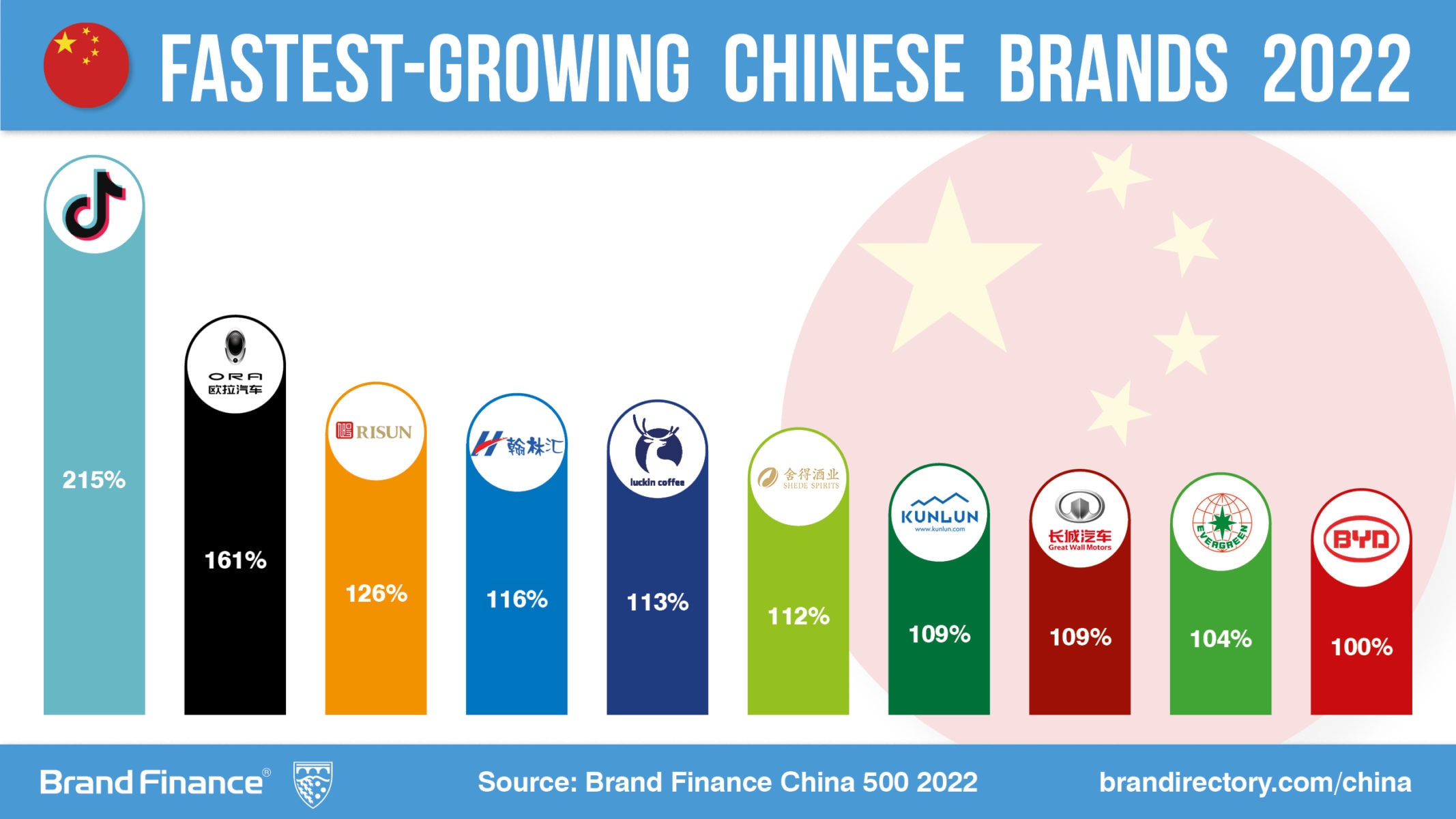

TikTok/Douyin achieves viral growth, while other big Chinese brands have more moderate growth

More than tripling in brand value over the past year, TikTok/Douyin (brand value up 215% to US$59.0 billion) is the world’s fastest-growing brand, according to a new report from leading brand valuation consultancy, Brand Finance. With an astounding 215% growth, the entertainment app’s brand value has increased from US$18.7 billion in 2021 to US$59.0 billion this year. Now the 7th most valuable Chinese brand, TikTok/Douyin has become a household name globally.

Every year, Brand Finance puts 5,000 of the world’s biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. China’s top 500 most valuable and strongest brands are included in the annual Brand Finance China 500 ranking.

TikTok/Douyin has been particularly successful in growing a valuable brand in a world affected by COVID-19 restrictions across the world, with the brand focused on entertaining users on their mobile devices. With different national policies on mitigating the risk of COVID-19 being timed differently in different jurisdictions, TikTok/Douyin has grown in popularity this year for entertainment as well as monetising user content with brand partnerships. A wide variety of consumer brands are including TikTok in their marketing spend, creating a new medium of advertising and selling via influencer marketing.

While traditional media companies produce or license content for distribution, modern social media outlets are benefitting from huge volumes of user-generated content. In recent years, social media channels such as Instagram have revised their product to encourage more content creation – and in doing so, building very strong brand attachments amongst users who are increasingly self-identifying as part of the social media brands.

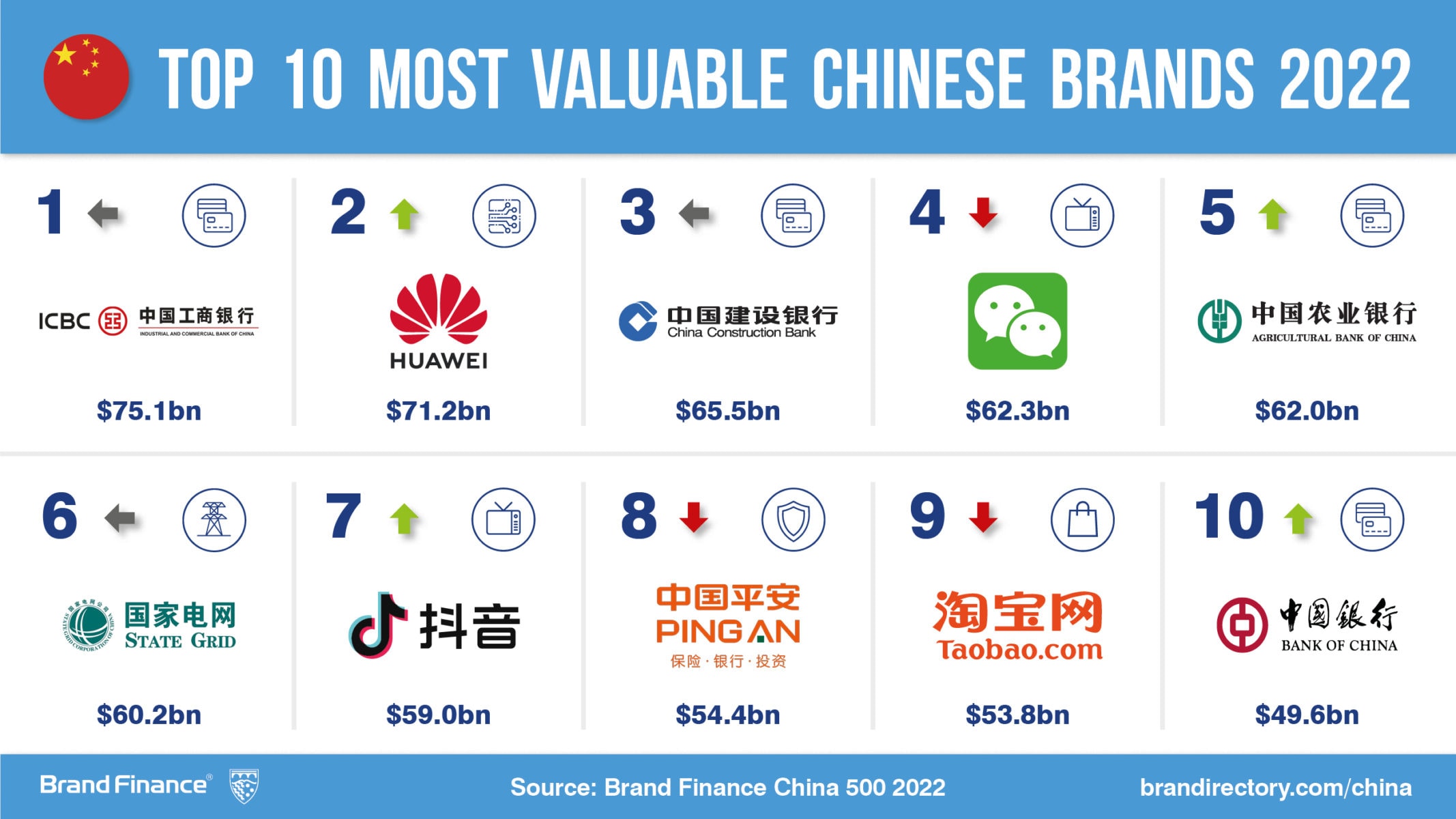

ICBC is China’s most valuable brand at over US$75 billion

Chinese bank brands have remained strong through the COVID-19 pandemic period, and a significant factor to this success was not only the nation’s timely response to the virus, but also the early and continued investment into digital development, allowing Chinese banks to continue engaging with their customers with relatively little disruption. Over the past year, China’s economy has continued to recover steadily despite a complex and ever-changing domestic and international environment.

This year, ICBC (brand value up 3% to US$75.1 billion) was the most valuable brand in China, and the most valuable banking brand globally. ICBC now has hundreds of subsidiaries in several dozens countries and regions, serving well over half a billion personal customers and several million corporate clients worldwide. ICBC continues to outshine its competitors, holding a healthy brand value lead ahead of China Construction Bank (up 10% to US$65.5 billion)and Agricultural Bank of China (up 17% to US$62.0 billion), which are the 3rd and 5th most valuable Chinese brands.

Increased investment is correlated with increased State Grid brand value growing past US$60 billion

The largest utilities brands in the world are switching-on to a post-COVID future, led by China’s State Grid (brand value up 9% to US$60.2 billion), which is the 6th most valuable Chinese brand, and the world’s most valuable utilities brand. State Grid remains the world’s most valuable utilities brand for the fifth time in a row.

As the overwhelmingly dominant utilities company in China, State Grid is a powerful brand which considers environmental concerns with a commitment to green energy and achieved net zero carbon emissions for the Winter Olympics 2022.

BYD brand value doubles in value as electric vehicle market expands

Chinese automobile brands have made great strides and grown strongly this year. BYD (brand value US$6.4 billion) is one of the fastest-growing automobile brands in the world with a doubling of its brand value this year. The brand specialises in electric vehicles, a rapidly growing market in China, and saw sales accelerating 232% in 2021 with -more than 600,000 sold. Haval (brand value US$6.1 billion) is the global automobile sector’s second-fastest growing brand at 55%, but the faster growth of BYD allowed it to overtake Haval in brand value this year.

The increasing popularity and adoption of electric vehicles in China has been a key driver behind the impressive growth for these brands, with China accounting for most electric vehicles sold globally. Several Chinese brands are looking to capitalise on the momentum by expanding their global footprints, with several of these brands launching in Europe in 2021.

Wuliangye achieves 12% brand value growth

Wuliangye (brand value up 12% to US$28.7 billion) was the stand out performer inSpirit sector s, achieving very strong brand value growth. Wuliangye increased its ranking by two places to become the 16th most valuable Chinese brand, and with its brand value increase closely correlated with it continuing to become an iconic Chinese lifestyle brand alongside its competitor, Moutai (brand value down 5% to US$42.9 billion).

Wuliangye has been successful in achieving the largest brand value increase among the top tier baijiu brands in the while brand value of its competitor Moutai has decreased. The baijiu brand has been actively incorporating ‘Internationalise Baijiu’ into its corporate brand strategy as a part of China’s One Belt One Road initiatives by engaging in international events including trade expos, the World Economic Forum in Davos and Boao Forum for Asia to name a few. The involvement in such events is to promote Wuliangye’s baijiu culture and actively expand in the international markets.

Yili jumps 7 places as dairy brand value continues to grow

As China’s most valuable food brand, Yili ranking has improved 7 places from 44th to 37th in China 500. Yili’s brand value has benefited from its multi brand strategy’s success by creating multi sub brand in segmented markets under the umbrella of Yili Master brand. The strategy enabled Yili to map out consumer needs across product category with stratified brand category and brand positioning. Recently its close association with major events in China such as the Olympic Games and national Chinese priorities relating to nutritition have also contributed to the increase of its brand exposure . The brand value of Yili is continuing to increase as Chinese markets have improved accessibility to Yili (especially in secondary cities across China) and as Chinese consumers increasingly integrate dairy products to their lifestyle.

Huawei overcomes geo-political challenges to increase brand value by 29%

Huawei (brand value up 29% to US$71.2 billion) represents a significant achievement for a Chinese brand, with its brand value surging to become one of the top ten most valuable brands in the world despite antagonism from certain national governments. This global confrontation has limited Huawei’s global market opportunities, but the value of the Huawei brand has increased with an increased investment in both domestic technology companies and R&D, as well as turning its focus to cloud services.

Previously, Huawei primarily produced phones using the Android operating system developed by Google, and forthcoming development of a Chinese-based operating system for mobile devices may lead to significant brand value opportunities for Huawei. This has forced Huawei staff to focus on ensuring stable equipment supply and secure network operations, outside the Google-dominated Android ecosystem.

Beyond its consumer electronics products, Huawei has continued to develop its brand value in business infrastructure and associated markets. This investment is reflected in increased spending on research and development, which has now reached over 22% of total revenue and delivering one of the largest patent portfolios in the world. Huawei’s intellectual property portfolio includes well over 100,000 active patents, and was the largest recipient of new patents last year at both the China National Intellectual Property Administration and the European Patent Office.

Li Ning brand value is jumping high as sales increase

Li Ning (brand value up 68% to US$2.0 billion) continues to surge up the rankings of the most valuable Chinese brands, first entering the rankings in 2020 and jumping a further 50 places from 213rd last year to 163rd this year. Research by Brand Finance has found that the reputation of Li Ning is improving in both awareness and favourability, with an increasing number of consumers becoming familiar with the brand and having better perceptions of the brand. At the same time, Li Ning is leveraging this improved reputation into higher sales, which further improves brand value as more customers integrate Li Ning products into their lifestyle.

Pinduoduo brand value surges as brand saturates market

Similarly, Pinduoduo (brand value up 58% to US$9.9 billion) continues to grow strongly in brand value, improving 22 places from being the 63rd most valuable Chinese brand last year, to 41st overall this year. Pinduoduo is a mobile-only marketplace connecting agricultural producers with consumers and has become the default option in its current market. This creates great value for the brand, but as it is such a dominant operator which has reached saturation across the nation, the opportunity for future growth is constrained. Consequently, the company is seeking to invest in research and development opportunities to serve their users better.

Fast brand value growth for Guangzhou Pharmaceutical with new strategy

Guangzhou Pharmaceutical (brand value up 42% to US$2.1 billion) remain the largest pharmaceutical brand in China. The brand benefits from being part of the Guangzhou Pharmaceutical portfolio of brands, which includes twelve China time-honoured brands and ten century-old brands.

For a long time, Guangzhou Pharmaceutical has been deeply engaged in brand building, innovatively implementing the dual-brand strategy in the Chinese domestic market and combining the national well-known brand Baiyunshan with its time-honoured brands to create brands, such as Baiyunshan Chenliji, and Baiyunshan Jingxiutang etc., which in turn have promoted the rapid opening of the national market for branded products.

In the international market, Guangzhou Pharmaceutical has put forward the concept of modernisation and internationalisation of traditional Chinese medicine at the beginning of this century. In recent years, Guangzhou Pharmaceutical has strengthened its cooperation with Fortune 500 companies through the World Economic Forum, Boao Forum and other

international conferences.

CPIC achieves marginal brand value growth in tough time for insurance

CPIC (brand value up 2% to US$15.8 billion) was able to increase its brand value marginally in a tough year for insurance. Affected by the COVID-19 resurgence, associated economic slow-downs, and mounting pressure on the insurance industry more generally, CPIC endured in the face of these competing pressures.

CPIC continues to pursue its brand transformation strategy, “3 Directions and 5 Mosts” as it seeks to improve its operations through staff development and productivity enhancement. The technology platform “Agency Force On-line” is already delivering benefits by improving the training system and improved metrics are flowing through the business – including a significant increate in policy persistence. This increase in policy persistence reveals that customers are reacting to the reforms with increased purchasing of CPIC products as they renew their policies at a higher frequency.

Newly ranked JD Logistics innovates in supply chain sector

Chinese supply chain and logistics provider JD Logistics (brand value up 15% to US$4.1 billion) is a new entrant into the Brand Finance China 500 ranking, making it the 90th most valuable brand in China. The brand recently acquired Deppon Express, a trucking and warehouse management service provider in the Chinese market to increase its logistical network and infrastructure.

Despite severe supply chain disruptions over the pandemic, JD Logistics grew considerably and announced its IPO in 2021 as a spin-off from the JD.com brand. The brand invested in cutting-edge technology and research to roll out an automated delivery service offering in selected cities in China. JD Logistics carry out deliveries in rural areas using new technology such as self-driving trucks and aerial drones.

Additionally, the brand is also focussing on ESG projects including establishing China’s first carbon-neutral logistics industrial park which aims to provide carbon-neutral operations by lowering energy consumption. A few segments of the industrial park will be powered by solar energy for lighting. JD Logistics is also making the supply chain more sustainable by employing green warehousing, reusable packaging and the usage of renewable energy.

CNBM achieves fast brand value growth as global demand for materials increases

CNBM (brand value up 17% to US$8.3 billion), the Chinese National Building Materials Group, has achieved fast brand value growth this year, improving their ranking nine places from 57th to become the 48th most valuable Chinese brand. The materials group has benefited from increased demand for its products despite the prospect of rising interest rates across the world. The huge fiscal transfers from various governments to citizens, at the same time as many areas of the service economy have been suppressed, has caused many people across the world to invest in improved living arrangements. As a huge material supplier brand, CNBM is very well positioned to benefit from this macro change, with the brand supplying very large volumes of cement, concrete, plasterboard and concrete.

Looking ahead, CNBM is also in a strong position to leverage its brand into the provision of material for construction of wind turbine blades, with 38,000 scientific researchers playing a key role in ensuring that CNBM is able to meet customer needs. The CNBM brand has also been enhanced by strong political support for its endeavours.

Beijing region is leading region for Chinese brand value

Regionally, Beijing is the home to the largest proportion of brand value in the China 500 rankings, accounting for 97 of the 500 brands, but 43% of the overall brand value, increasing by 13% from the previous year. This is caused by Beijing being the home of five of the top ten brands, including ICBC (brand value up 3% to US$75.1 billion), China Construction Bank (brand value up 10% to US$65.5 billion), Agricultural Bank Of China (brand value up 17% to US$62.0 billion), State Grid (brand value up 9% to US$60.2 billion), and TikTok/Douyin (brand value up 215% to US$59.0 billion) ), and Bank Of China (brand value up 2% to US$49.6 billion)..

Guangdong, Hong Kong and Macau regions form greater brand area with 125 top brands

The second-most valuable region is Guangdong, which is home to 72 of the top 500 brands. Greater Bay Area (GBA), consists of Guangdong, Hong Kong and Macau 3 regions in Southern China, it is envisioned as an integrated economic area aimed by taking a leading role domestically and globally by 2035. GBA accounts for a total of 125 brands in the China 500 ranking with 25% of brand value, of which 72(21% brand value), 44(4% brand value), 9 brands(1% brand value) from Guangdong, Hong Kong and Macau respectively. With three of the world’s top 10 ports in Shenzhen, Guangzhou and Hong Kong become connected, it is believed that synergies as the result will facilitate future growth for the economy.

Zhejiang is third-most valuable region for top brands

The third-most valuable region is Zhejiang, with 35 brands and accounts 8% of China total brand value. Other regions, such as Shanghai (49 brands, 6% of value) and Taiwan (70 brands, 5% of value) are the home of a large number of smaller brands which made the China 500 ranking.

China is one of world’s leading nations for brand guardianship

The Brand Guardianship Index is the world’s leading ranking of CEOs who balance the needs of commercial success, long-term brand building and personal reputation management. Also published by Brand Finance, the Brand Finance Brand Guardianship Index has been expanded and now ranks the world’s top 250 CEOs.

Chinese CEOs represent 19 of the top 100 brand guardians, just under one-fifth of the global total. These chief executives today do more than simply grow a business and make money for their investors: they are good CEOs are those who nurture relations with all stakeholders, and enhance the reputation of their brands as a result. Investors increasingly care about corporate social responsibility about environmental, social and governance issues.

Jianjun Wei of Great Wall was the third-ranked brand guardian in the world, just ahead of Tencent’s Huateng Ma in fourth place. The two leaders are playing a key role in building strong corporate and personal brands in delivering important services to key stakeholders.

Chinese nation ranks third in 2022 Global Soft Power Index

This year, China's soft power performance has been exerted along several main lines including anti-COVID-19 efforts, innovation, the Winter Olympics, and its commercial brands.

Economic development in the pandemic in the second year of the pandemic, China's GDP increased by 8.1% and this rate was the best among the world's major economies, leading to China being rated 1st in the Global Soft Power Index’s Business & Trade pillar. China’s GDP reached US$17.7 trillion with the Index rating China 1st globally as ‘easy to do business in and with,’ and first at ‘future growth potential.’

A recent government work report puts China’s GDP growth target at around 5.5% in 2022 — at the top end of the forecast range given by many economists, and significantly higher than the IMF's forecast of 4.8%. Achieving such a high level of economic growth would justify the Index’s rating of China at 9.5 out of 10 on the measure of ‘a strong and stable economy.’ This will help China's "transition from Chinese products to Chinese brands", so it is possible that the next few decades will bring further growth of Chinese brands.

At the end of 2021, the Chinese Government stated that there were 2,886 confirmed cases of COVID-19 in China. Although China was the first major country to detect the epidemic, the global perception of China’s COVID-19 performance was very low in 2021. In 2022, China earned the 19th highest ranking of 5.4 on COVID-19 Response in the Index. This is a big and significant improvement from last year’s rating of 3.7. China’s rating is likely boosted by the distribution of Chinese-made vaccines to many non-Western nations for free – using economic hard power to leverage soft power benefits in some countries.

Since 2013, China’s ranking in the “Global Innovation Index” report released by the World Intellectual Property Organization has risen steadily for 9 consecutive years and is currently ranked 12th – a ranking in part based upon the value of the nation’s brands as assessed by Brand Finance. As a developing country, China ranks first in the world in nine indicators including patent applications, trademark applications, industrial designs, high-tech exports, creative product exports and domestic market size. This fully confirms the fact that China’s soft power in the field of technological innovation and intellectual property protection is constantly growing. This is reflected in the Index’s increased evaluation of China on ‘products and brands the world loves’ which increased by a remarkable +2.2 points from 5.7 in 2021 to 7.9 this year.

In cooperation with the international community, the Beijing Winter Olympics 2022 received notable praise from the International Olympic Committee and the participating athletes. The successful completion of the Winter Olympics has allowed the world to see a more confident, self-improving, and tolerant China. This helped to boost China’s rating on ‘leaders in sports’ from 2.7 to 3.0, an increase in ranking from 15th last year to 10th globally this year.

China's soft power is also reflected in many other things, from various types of cooperation in outer space technology to the increasing tendency of more Chinese people using domestic brands with more competitive quality and price in their daily lives. Over the past decade, Chinese brands have outperformed international peers in Brand Finance's brand value rankings, with their total value increasing nearly tenfold, and many brands have dominated certain industries for several years now. The picture of China's soft power changes will continue to unfold through more Chinese products becoming Chinese brands as global competitors and then global leaders in time.

View the full Brand Finance China 500 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. China’s top 500 most valuable and strongest brands are included in the Brand Finance China 500 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance China 500 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.