View the full Brand Finance Commercial Services 100 2021 report here

The world’s top commercial services brands have been grappling with the fallout from the COVID-19 pandemic, with brand values suffering, according to the latest Brand Finance Commercial Services 100 2021 report, extended to cover the industry’s top 100 brands for the first time.

COVID-19 has restricted and delayed the capacity of commercial services businesses to monetise their brands and global lockdowns have delayed the implementation - and so deferred the revenue - of many projects, while some clients have restricted spending altogether.

The past year’s disruption only partly explains the extensive brand value declines, however. The huge debts incurred by governments over the last year, and the continuing impact of COVID-19 in many parts of the world, cast a shadow over the global economy. In such an uncertain trading environment, a question mark remains over the ability of commercial services businesses to commercially leverage their brands.

Deloitte dominates

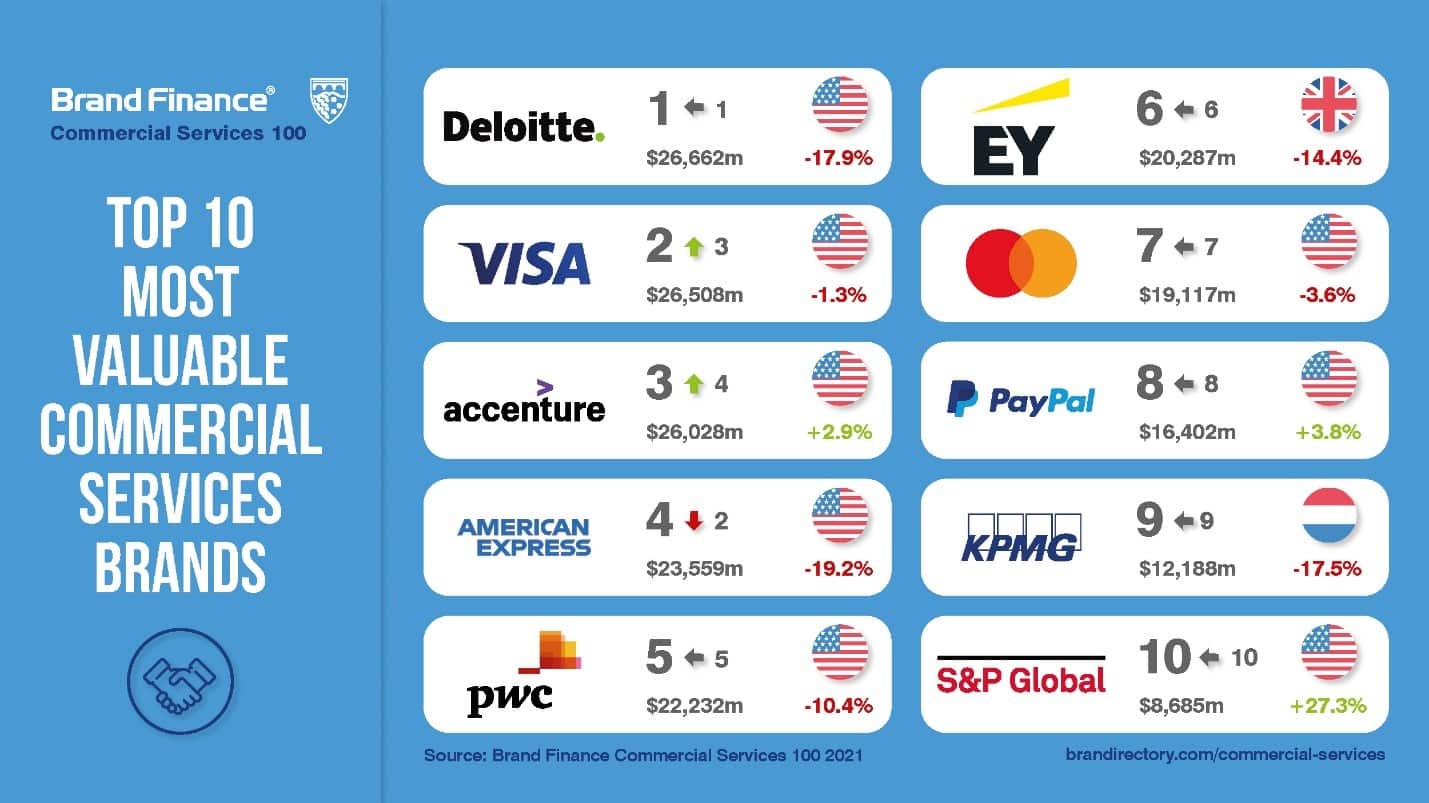

Deloitte is the world’s most valuable commercial services brand with a brand value of US$26.7 billion. Although it has held onto pole position, Deloitte’s performance reflects the declines seen across the commercial services sector, with 18% of brand value lost. The story is similar for the rest of the big 4: PwC (down 10% to US$22.2 billion) EY (down 14% to US$20.3 billion) and KPMG (down 18% to US$12.2 billion). A greater proportion of Deloitte’s revenue is derived from consulting as opposed to audit and assurance, which has left Deloitte more exposed to the impact of COVID-19 relative to the other big 4.

Parul Soni, Associate, Brand Finance, commented:

“Despite grappling with a challenging year, Deloitte continues to showcase its dominance in the sector claiming the titles of both the world’s most valuable and strongest commercial services brand. The combination of Deloitte’s focus on putting people first, paired with over 175 years of experience, makes for a truly resilient and world leading brand.”

Among the top professional services brands, Accenture has bucked the trend, managing to increase brand value by 3% to US$26.0 billion. Accenture’s focus on technology consulting has meant that the pandemic has been a help as much as a hinderance - lockdowns and social distancing requirements have accelerated the imperative to transition to digital solutions for organisations of all kinds, leading to an increase in revenues over 2020.

In addition to measuring overall brand value, Brand Finance also evaluates the relative strength of brands, based on factors such as marketing investment, customer familiarity, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. According to these criteria, Deloitte is also the world’s strongest commercial services brand, with a Brand Strength Index (BSI) score of 91.0 out of 100 and a corresponding elite AAA+ brand strength rating.

Deloitte is closely followed by EY, with a BSI score of 89.6 out of 100 and also achieving the elite AAA+ brand strength rating. EY has committed to positioning itself as the most distinctive global professional services brand and has undertaken a series of activities to do so. An example is the launch of EY Ripples, a programme to positively impact one billion lives by 2030 by mobilising the EY network to unite in working towards the UN Sustainable Development Goals.

Payments – Visa overtakes American Express

Alongside professional services, the Brand Finance Commercial Services 100 ranks a number of other segments, including payments, human resources, business support, financial & investment information services, engineering & construction services, and credit agencies.

Visa is the second most valuable brand in the whole Commercial Services industry after Deloitte, with a brand value of US$26.5 billion. Rival Mastercard’s value is US$19.1 billion. The brand values of both have held up reasonably robustly, despite the pandemic, with only slight declines of 1% and 4%, respectively.

The same cannot be said for American Express, with its brand value falling by 19% to US$23.5 billion. Approximately 25% of revenues are derived from partnerships with hotels and airlines, leaving Amex much more exposed to the effects of the pandemic. Amex has also reduced merchant fees to increase acceptance, hitting revenue growth versus Mastercard and Visa.

In addition to suffering Covid-related revenue declines, Amex’s BSI score has also fallen significantly from 81 to 76 out of 100, which is primarily the result of reduced spend on Capex and research and development. Though perhaps a necessary measure in strained times, this reduction in investment is likely to limit the future potential of the brand, hence Brand Finance’s more pessimistic assessment of its strength.

While the restrictions on travel and physical retail have hit American Express, the reverse is true for Paypal (up 4% to US$16.4 billion). As spend has migrated online, new consumers have become more familiar with and willing to consider Paypal as a payments solution, while existing users have concentrated their spend via the brand. This has driven total payment volume close to one trillion dollars for in the 2020 financial year, with revenues topping US$21 billion.

Human resources take hit

The top three human resources brands have all seen significant brand value declines this year, thanks to a suffering job market, hiring freezes, and reduced demand for new hires in general. Randstad, the most valuable in the sub-sector, is down 8% to US$3.3 billion, Adecco is down 13% to US$3.1 billion while Manpower has fallen 28% to US$1.8 billion.

Business support - Willis Towers Watson tops sub-sector

In the business support sub-segment, Willis Towers Watson is the most valuable, with a value of US$2.6 billion. Here too, value is down, the brand has lost US$441 million in the last year. Cintas, which specialises in cleaning equipment and associated services might have been expected to perform more strongly given the need to make workplaces Covid-safe, but the shuttering of offices has seen it lose 12% of value to US$2.5 billion. The picture may be more positive for Cintas going forward however, as increase concern over health and hygiene, combined with a gradual return to office working leads to a recovery, or even elevation of demand.

Financial & investment information services – S&P gains 27%

Moody’s (brand value US$2.6 billion) and Bloomberg (brand value US$4.5 billion) have both seen the value of their brands fall by 2% and 10% respectively.

However, the leading brand in the information services sub-sector, S&P Global, has actually prospered during 2020 and is one of the fastest-growing brands, up 27% to US$8.7 billion. Significant demand for the brand’s products – namely its benchmarks, data, ratings, and research – as investors and companies globally sought to negotiate and understand the markets better amid the pandemic turmoil, has resulted in very solid financial results.

Engineering & construction services – mixed fortunes for brands

United Rentals is the most valuable in the sub-sector, despite recording a 25% brand value decline to US$2.1 billion. Fleet productivity took a hit last year, largely as a result of lower rental volumes.

In contrast, Jacobs Engineering (brand value US$1.9 billion), WSP Global (brand value US$563 million) and Arcadis (brand value US$459 million)have all recorded healthy brand value increases, up 15%, 9% and 28%, respectively. Arcadis was quick to implement cost cutting measures, including announcing a 30% reduction in the amount of office space the company leases.

Credit agency – Experian tops sub ranking

Experian tops the credit agencies sub-sector ranking with a brand value of US$1.8 billion. Recording a 13% loss in brand value this year, Experian suffered a major breach of customer information last year, which affected an estimated 800,000 businesses and 24 million South Africans.

Making up the podium in the sub sector are TransUnion (down 12% to US$1.5 billion)and Equifax (up 2% to US$1.4 billion). 2020 marked a record year for Equifax, which saw the brand deliver its 4th consecutive year of double-digit growth, largely thanks to strong performances in Workforce Solutions and U.S. Information Services.

View the full Brand Finance Commercial Services 100 2021 report here

ENDS

Note to Editors

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 100 most valuable commercial services brands are included in the Brand Finance Commercial Services 100 2021 report.

The full Brand Finance Commercial Services 100 2021 ranking, additional insights, charts, more information about the methodology, as well as definitions of key terms are available in the Brand Finance Commercial Services 100 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.