View the full Brand Finance Telecoms 150 2021 report here

MEA brands continue to innovate

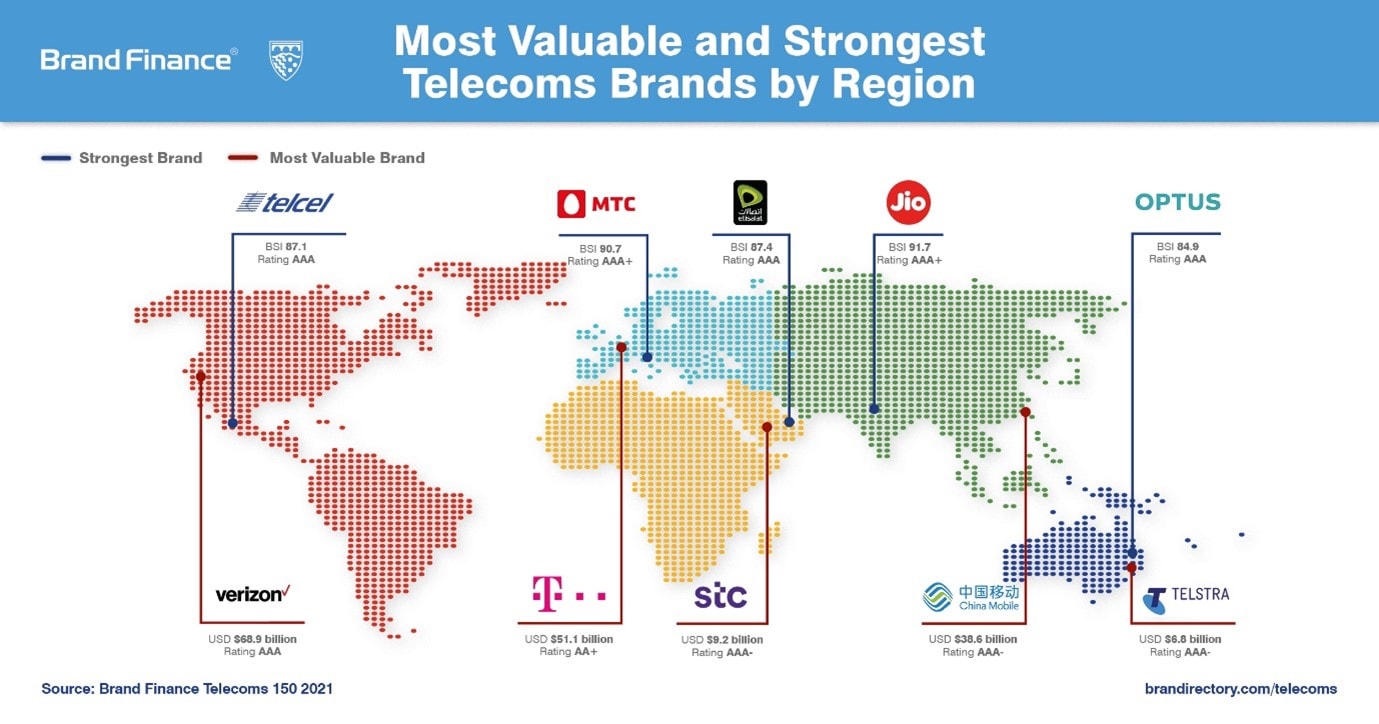

Etisalat and stc remain the frontrunners across the MEA region, claiming the title of the MEA’s strongest and most valuable telecoms brands, respectively.

stcis the region’s most valuable brand, its brand value up an impressive 14% to US$9.2 billion, simultaneously jumping 5 positions to 13th and becoming a AAA- brand. stc has recently doubled the capacity of its network, never compromising on customer service – something the brand prides itself on. stc is playing a crucial part in KSA’s Vision 2030 – a strategic framework to diversity the economy away from oil – through establishing a digital hub for the whole region, to accommodate future growth in the IT sector.

David Haigh, CEO, Brand Finance commented:

“stc’s brand has evolved and grown following its successful masterbrand refresh and extension into Kuwait and Bahrain at the beginning of last year. The company continues to execute its DARE strategy successfully and has strengthened its positioning as a company that enables digital life. Its commitment to digital transformation has been shown with stc pay, recognised as the first tech unicorn in Saudi Arabia.”

Brand Finance evaluates the relative strength of brands, based on factors such as marketing investment, customer perceptions, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. Etisalat has been crowned the MEA’s strongest telecoms brand, with a Brand Strength Index (BSI) score of 87.4 out of 100 and a corresponding AAA brand strength rating – the only brand in the region to achieve this rating.

Thanks to its strategy over the last few years and its recent achievement of becoming the fastest network on the planet, the brand was in a position to respond immediately to the 'new normal' of the pandemic, providing solutions and flexibility in a way that connected emotionally with consumers. Etisalat Group, the most valuable telecoms portfolio in the region which has recently broken the US$11 billion mark, is turning its sights on transforming into a truly global player.

David Haigh, CEO, Brand Finance commented:

“When COVID struck in 2020, Etisalat led from the front ensuring business continuity, robust e-governance, enablement of smart cities and remote learning, to help drive the digital future of the UAE. Staying relevant and enabling the nation with the fastest network on the planet, Etisalat has earned its place as the region’s Strongest Brand, ready deliver on its ethos of Together Matters as the UAE welcomes the world at Expo 2021.”

Out of the seven Middle Eastern brands Etisalat, Mobily, Ooredoo and stc have climbed the ranks this year. Mobily is the fastest growing telco brand in the region with a 17% brand value growth, jumping 10 places in the ranking to 75th position. Mobily (brand value US$1.3 billion), has strengthened its business and brand over the last three years by positioning the brand as the everyday hero. It has attained the highest Brand Strength Index score in its history at 75.4 out of 100 (brand strength rating AA+) and is in a strong position to capture the next wave of growth by seizing opportunities in the digital economy.

Telecoms brand guardians

Every year, Brand Finance releases the ranking of the world’s top brand guardians – the Brand Guardianship Index – which includes the top 100 CEOs globally. Brand Finance has researched and evaluated the brand guardianship score of over 200 CEOs this year.

stc’s Nasser Sulaiman Al Nasser topped the list of Brand Guardians from the telecoms sector this year. Al-Nasser announced his resignation in November of 2020, having presided over a successful rebrand and a period of growth for the stc brand.

The two most recently appointed Brand Guardians in the Telecom industry were Etisalat’s Hatem Dowidar, ranking 3rd and Telia’s Allison Kirkby, ranking 6th. Both had to deal with the COVID-19 pandemic in their first 12 months and have taken the challenge head on.

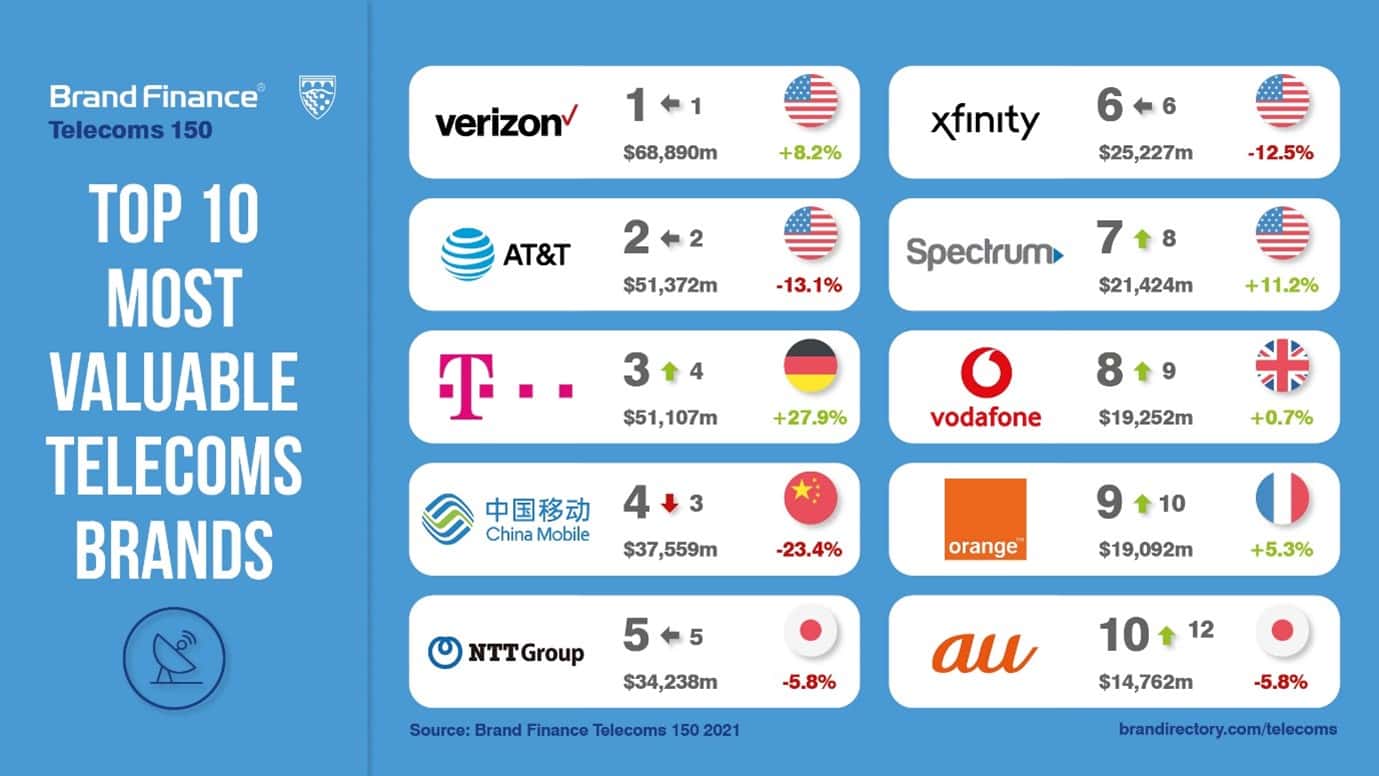

Verizon retains top spot globally

For the second year in a row Verizon has claimed the title of the world’s most valuable telecoms brand following an 8% increase in brand value to US$68.9 billion. This brand value growth has not only propelled it back into the top 10 most valuable brands globally in the Brand Finance Global 500 2021 ranking, but has meant the brand has continued to widen the lead over second placed AT&T (brand value down 13% to US$51.4 billion). 15 further US brands feature in the Brand Finance Telecoms 150 2021 ranking, with a combined brand value of US$182.8 billion.

Two years since the beginning of Verizon’s business transformation program, Verizon 2.0 - focusing on the transformation of the network, the go-to-market, the brand, and the culture of the business – the brand continues to make leaps and bounds across the industry. The giant is widely recognised to have the best-in-class network and the widest coverage in the US, with the network’s usage surging during the pandemic, handling a staggering 800 million phone calls and 8 billion texts per day. Verizon is making significant strides in its 5G expansion programme, which now spans over 2700 cities and 230 million people.

Savio D’Souza, Valuation Director, Brand Finance commented:

“While 2020 was the year for Verizon to optimise its existing assets, we expect 2021 to be the year where Verizon strengthens its network leadership through acquisitions of a broader spectrum and a wider launch of its 5G. Supported by an increased focus on gaming, the company is also leveraging its superior brand strength to increase customer differentiation by migrating customers to unlimited plans and increasing stickiness with content and partnerships such as Disney+, Apple and Discovery plus.”

Deutsche Telecom reigns as most valuable in Europe

With a brand value of US$51.1 billion, Deutsche Telekom has retained its position as the most valuable telecoms brand in Europe, climbing one spot in the Brand Finance Telecoms 150 2021 ranking to 3rd place. Following an impressive 28% brand value growth, the brand is the fastest growing in the top 10 by far, outperforming the second fastest growing brand, Spectrum, which has increased by 11% to US$21.4 billion.

As the largest telecoms provider by revenue in Europe, Deutsche Telekom has reaped the rewards of its expansion into superfast internet connections and a boost in popularity for its MagentaENIS service package. Last year, the German telecoms brand also completed the T-Mobile and Sprint merger in the United States, which has significantly bolstered its total revenue, even despite the COVID-19 pandemic. With one successful merger under its belt, the telecoms giant is now turning its sights back to Europe to continue its expansion – an endeavour that will more than likely lead to further success in the coming year.

Jio is shining star as sector’s strongest and fastest growing

Taking the sector by storm as the world’s strongest telecoms brand is Indian telecoms giant, Jio, with a BSI score of 91.7 out of 100 and an elite AAA+ brand strength rating.

Despite only being founded in 2016, Jio has quickly become the largest mobile network operator in India and the third largest mobile network operator in the world, with almost 400 million subscribers. Renowned for its incredibly affordable plans, Jio took India by storm through offering 4G to millions of users for free, simultaneously transforming how Indians consume the internet – known as the ‘Jio effect’.

The dominance of the brand across the nation is evident from the results from Brand Finance’s original market research. Jio scores highest in all metrics – consideration conversion, reputation, recommendation, word of mouth, innovation, customer service and value for money - compared to its telecom competitors in India. The brand has no major weaknesses within the sector, and unlike other telecoms brands globally, Jio has shown that it has broken the mould, and enjoys genuine affection from consumers.

As well as being a standout brand for brand strength, Jio is the fastest-growing brand in the ranking in terms of brand value, bucking the negative trend across the industry, with a 50% increase to US$4.8 billion.

Fellow Indian brand Airtel has also celebrated a strong year, jumping 12 spots in the ranking to 23rd following 36% brand value increase to US$6.1 billion.

View the full Brand Finance Telecoms 150 2021 report here

ENDS

Note to Editors

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s 150 most valuable telecoms brands are included in the Brand Finance Telecoms 150 2021 report.

The full Brand Finance Global Oil & Gas 50 2021 ranking, additional insights, charts, more information about the methodology, as well as definitions of key terms are available in the Brand Finance Telecoms 150 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.