View Brand Finance's Global Soft Power Index 2021 report here

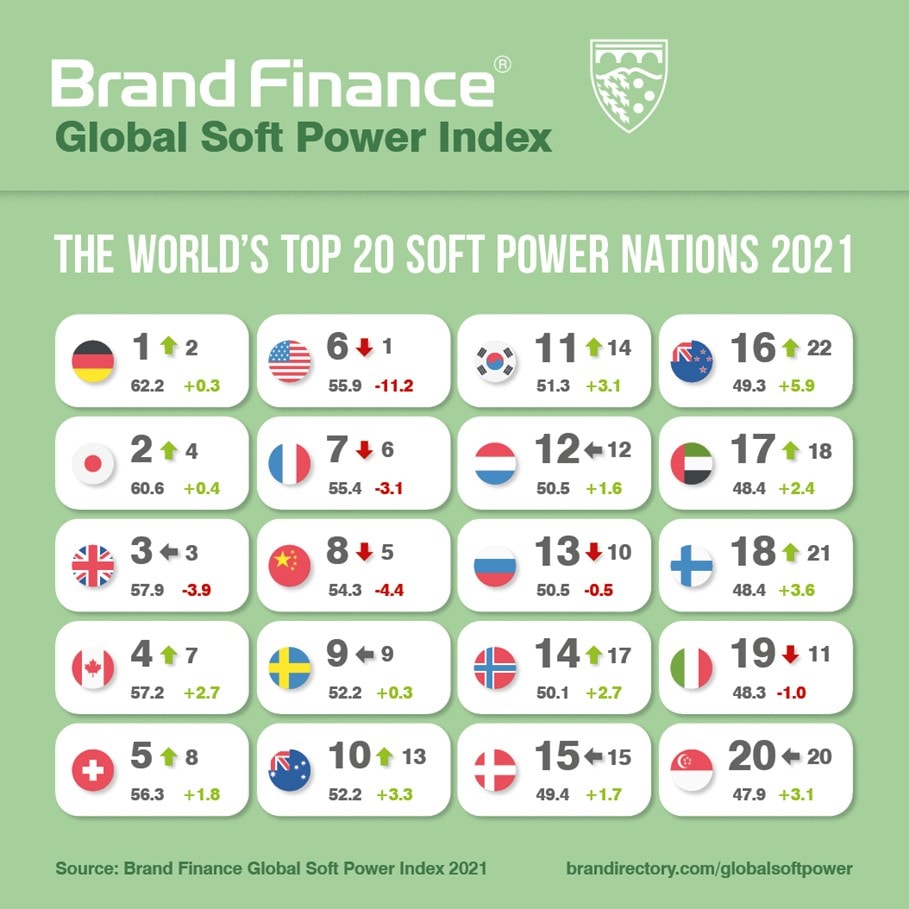

A beacon of stability in a turbulent year, Germany has usurped the United States to become the world’s leading soft power superpower, according to the Global Soft Power Index 2021 – the world’s most comprehensive research study on perceptions of nation brands, released today at the Global Soft Power Summit, hosted by Brand Finance – the world’s leading brand valuation consultancy.

With a Global Soft Power Index score of 62.2 out of 100, Germany has a clear 1.6-point lead over second-ranked Japan (60.6), and performs consistently across the Index’s 11 metrics, placing in the top five across nine of these, and ranking highest for statements in the International Relations, Governance, and Business & Trade pillars.

David Haigh, CEO of Brand Finance, commented:

“Angela Merkel has been commanding Germany and the continent since 2005, and despite mixed opinions of her leadership on home soil, she is hailed globally by the general public as the world’s most respected leader. Her long tenure at the helm of the nation has provided a strong and stable presence against the backdrop of unpredictable and erratic counterparts.

2021 marks the year that Europe and Germany will have to negotiate the significant void as Merkel prepares to step down as Chancellor, both her home nation and fellow-Europeans alike will be hoping Germany’s reliable leadership will continue as the world works towards a post-COVID recovery.”

Merkel’s response to the COVID-19 pandemic epitomises her renowned credibility, with the specialist audiences surveyed perceiving Germany as the nation that handled the pandemic the best, and the general public ranking the nation 5th. A scientist by training, Merkel’s response was solely data-driven, and her methodical approach was viewed as a relative success on the global stage, proven by the nation recording consistently lower cases per 100,000 than its Western European counterparts.

Powerhouses suffer amid poor pandemic responses

Following a year defined by national lockdowns, travel restrictions, and social distancing measures, perceptions of soft power have been significantly influenced by nations’ approaches towards the COVID-19 pandemic. Those who reacted promptly and effectively –implementing early lockdowns and tight border restrictions – have performed well across many other metrics too, such as Australia which is the only nation to break into the top 10 this year.

Conversely, 13 nations have observed an overall drop in their Global Soft Power Index scores as media scrutiny of their handling of the virus caused negative trends across the Influence, Culture & Heritage, and People & Values metrics. Among these is the United Kingdom, dropping 3.9 points to an overall Index score of 57.9 out of 100, however still defending its 3rd place position in the Global Soft Power Index. This follows extensive criticism towards Boris Johnson’s government for an unclear approach to curbing the spread of the virus and reluctance towards implementing a lockdown, resulting in high death rates across the United Kingdom. Perceptions are likely to further improve in the coming year following the United Kingdom’s Brexit deal, as well as its vaccination programme, which currently races ahead of its European counterparts.

Across the Channel, France (55.4) has recorded depreciating scores across several metrics, most notably in Culture & Heritage and Influence, where it has dropped by 0.4 and 0.2 points, respectively. These metrics have likely been influenced by the lull in the hospitality and tourism industry following the COVID-19 pandemic, with fewer people able to experience France’s culture, heritage, and culinary delights. On the other hand, the nation has only experienced a marginal drop of 0.1 point in the Business & Trade pillar, as France is increasingly regarded as one of the top European nations for attracting foreign investment opportunities.

In the East, China (54.3) and Russia (50.5), have both observed a drop in their scores across the Reputation and International Relations pillars, though China has held on to its place in the top 10 while Russia has dropped to 13th position.

China’s performance in the Global Soft Power Index was likely impacted by the global media coverage of COVID-19 cases in the city of Wuhan, even though the authorities addressed the crisis very effectively and China is one of only a few countries around the world to have got the epidemic under control and to register positive GDP growth at the end of 2020. The nation has also seen a 0.5 drop in the Governance pillar, as Western perceptions of China’s political system hold it back from improving its overall score.

Notably, as both nations made the significant scientific strides of developing their own vaccines, China and Russia have observed improving scores of 1.1 and 0.8 respectively in the Education & Science pillar.

In the southern Mediterranean, both Italy (48.3) and Spain (47.5) have suffered a significant drop in the Index, with Italy sliding down 8 spots to 19th position and Spain slipping out of the top 20 – from 16th to 22nd. At the start of the pandemic, both nations made front-page news around the world due to the heavy death tolls brought about by the first wave, with the Italian health system nearing collapse in certain regions. In Spain, where mortality rates per 100,000 were among the highest in the world, a lapsing political consensus on how to handle the pandemic cost the government valuable time in curbing the spread of COVID-19.

The demise of US soft power?

A year of widespread turmoil has been starkly reflected in America’s steep drop in the Global Soft Power Index 2021, making it the fastest-falling nation globally. Between a turbulent election campaign and a haphazard COVID-19 response, the nation has lost its position as the world’s soft power superpower, falling to 6th position with an overall Index score of 55.9 out of 100.

With former President Trump’s hesitance to acknowledge the scale and severity of the crisis derided at home and abroad, the United States finds itself at the very bottom of the COVID metric – ranking an abysmal 105th.

David Haigh, CEO of Brand Finance, commented:

“The raging of the virus across the US combined with former President Trump’s rebuke of medical expertise and touting of reckless home-remedies is the most likely culprit for the waning of America’s long-held role model status internationally, at a time where sensible global leadership has arguably been most needed.”

Well-governed nations climb ranks in the top 20

Europe and Asia command most of this year’s best performing nations, taking a cumulative 75% of the top 20 spots in the Global Soft Power Index 2021. Japan is the top performing Asian nation and second overall (60.6 out of 100), jumping up two spots from last year.

Japan continues to reap the rewards of its strong brands, solid consumer spend, and high levels of business investment, again ranking first in the Business & Trade pillar. Additionally, Japan has seen an improvement in its Education & Science score, now ranking first in this metric too.

Countries with a high overall Index score, such as Canada (4th – 57.2) and Switzerland (5th – 56.3), also scored within the top five nations in three key metrics: Reputation, Governance, and their COVID-19 response, suggesting a correlation between perceptions of how well-governed a country is and assessments of its handling of the pandemic.

On the flip side, ranking 47th in the overall Index, Vietnam (33.8) is a nation that objectively managed COVID-19 extremely well, but is not getting credit for it from the general public around the globe, most likely because of poor governance perceptions (68th) and a relatively low familiarity around the world. Vietnam was spared a year of lockdowns and besieged hospitals, and has one of the lowest COVID-19 infection and death rates in the world. Not only is the response to the pandemic impressive – given its shared border with China – but Vietnam also experienced one of the highest economic growth rates globally in 2020 – one of a handful of countries with positive growth in 2020.

New Zealand hailed as global success story

New Zealand is the fastest-improving nation in the Index, claiming 16th place in the ranking with an overall Global Soft Power Index score of 49.3 – up six places from 2020. Scoring 5.9 out of 10, the nation leads globally for its COVID-19 response, which has been praised and envied the world over. Swift and decisive action in shutting borders and enforcing mandatory quarantine left the nation free of COVID-19 for months, while others saw daily case rates in the thousands. The government has been so successful in suppressing the disease that social distancing is not required, with tens of thousands attending a music festival in December. Perceptions of New Zealand have no doubt been bolstered as nations such as the UK and the US cede their usual place as leaders in public health, with both battling repeated waves of the virus among loosened restrictions and ongoing debates about lockdowns.

David Haigh, CEO of Brand Finance, commented:

“Prime Minister Jacinda Ardern’s leadership has been widely credited as confident and decisive, hailed by some as key to the nation’s success in battling the pandemic – a view that is clearly reflected in her top 10 position among the world’s respected leaders. Her leadership is perhaps at the heart of New Zealand’s increased recognition in Influence, International Relations, and Governance in the Global Soft Power Index 2021.”

Middle Eastern nations dream big

Fifteen nations from the Middle East & North Africa (MENA) region feature in the Global Soft Power Index 2021, and those that featured in the Index last year have all seen their scores improve: the UAE (up 2.4 points); Saudi Arabia (up 2.3 points); Israel (up 1.1 points); Qatar (up 3.8 points); Egypt (up 3.5 points); Iran (up 0.4 points); Algeria (up 1.3 points); and Iraq (up 2.5 points).

The UAE is the region’s highest ranked nation with an overall Index score of 48.4 out of 100, simultaneously inching up the Index to 17th globally. The nation celebrates significantly improved scores across the Governance (18th), Education & Science (19th) and People & Values (24th) pillars – recording the greatest increase in the Governance pillar in the top 20 (up 0.8 points), as perceptions of its political stability improve. The UAE’s neighbours – Qatar and Saudi Arabia – have also celebrated marked improvements across the Governance pillar, with significant jumps in positive perceptions of their leaders, as well as views of being a safe and secure nation.

David Haigh, CEO of Brand Finance, commented:

“As the nation approaches its 50th birthday in December, the UAE continues to flourish and showcase its impressive growth trajectory, reflected in its 13th rank for future growth potential among the general public. The successful Emirates Mars Mission is a clear example of the nation punching above its weight, entering the race with global heavyweights China and the US, also forming an integral part of the nation’s journey to diversify its economy with sights set on long-term growth.”

Iceland and Luxembourg highest ranked new entrants

The Global Soft Power Index 2021 has been expanded to include 100 nations and therefore welcomes 40 new entrants to this year’s ranking. Out of these, Iceland (30th – 39.9) and Luxembourg (32nd – 39.0) are the highest-ranked nations. Both nations score well in Governance (Iceland – 19th; Luxembourg – 21st) and COVID-19 response (Iceland – 18th; Luxembourg – 26th) – two metrics with significant correlation in this year’s Index.

ENDS

Note to Editors

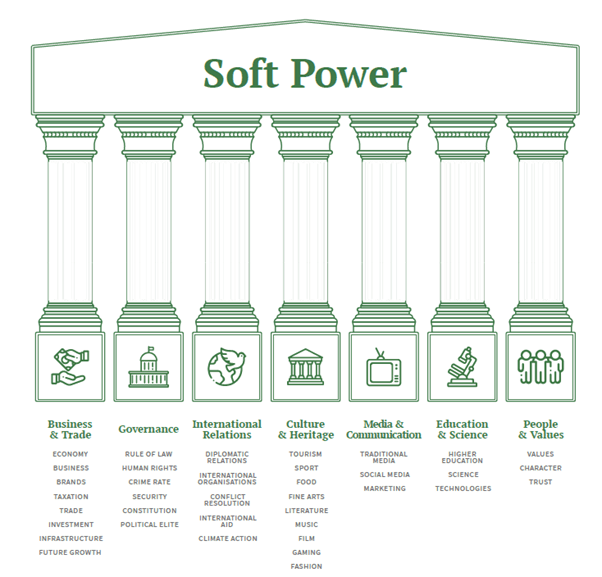

Soft power is defined as a nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics etc.) through attraction or persuasion rather than coercion.

Full ranking, methodology, charts, commentary, expert contributions, and in-depth spotlights with interviews on many countries are available in the Global Soft Power Index report.

Data and materials prepared for Brand Finance’s reports and events are provided for the benefit of the media and are not to be used for any commercial or technical purpose without written permission from Brand Finance.

Follow Brand Finance on Twitter @BrandFinance, LinkedIn, Instagram, and Facebook.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 25 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

About the Global Soft Power Index by Brand Finance

For over 15 years, Brand Finance has been publishing the annual Nation Brands report – a study into the world’s 100 most valuable and strongest nation brands. Focusing on the financial value and strength of nation brands, the Brand Finance Nation Brands study is based on publicly available information, including data compiled by third parties for other indices and rankings.

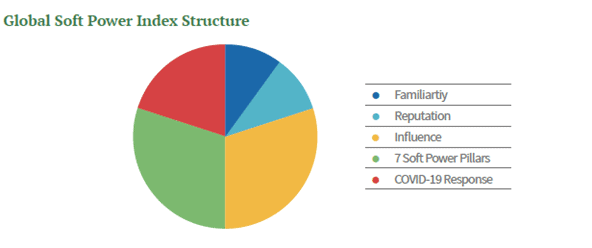

Building on this experience, Brand Finance has now produced the Global Soft Power Index – the world’s most comprehensive research study on perceptions of 100 nation brands from around the world. The Global Soft Power Index is based on the most wide-ranging fieldwork of its kind, surveying the general public as well as specialist audiences, with responses gathered from over 100,000 people from across the world. The Global Soft Power Index report is the annual iteration of this study.

Global Soft Power Index Methodology

Two surveys are conducted, both global in scope:

The Global Soft Power Index incorporates a broad range of measures, which in combination provide a balanced and holistic assessment of nations’ presence, reputation, and impact on the world stage.

The Index gives a 90% weighting to the views of the General Public and 10% to those of Specialist Audiences