View the full Brand Finance Media 50 2021 report here

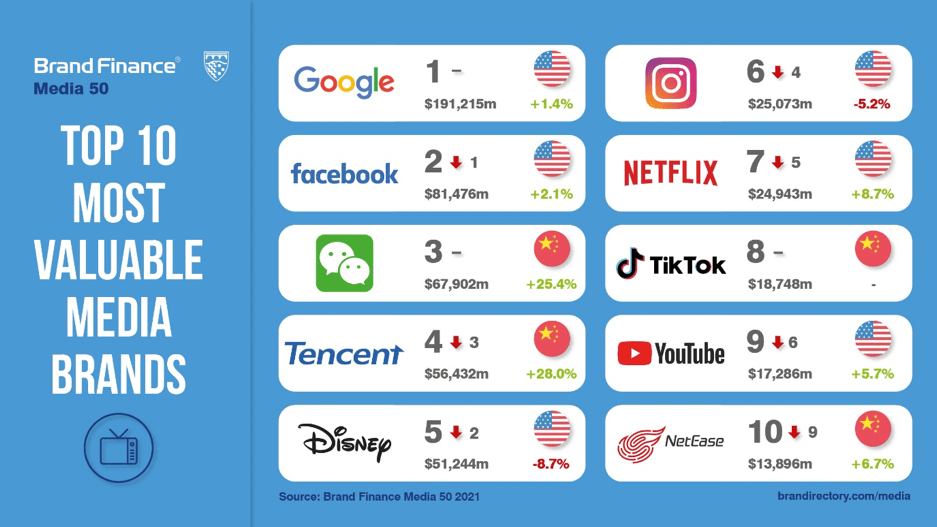

For the first time, search engines are included in Brand Finance’s annual ranking of the world’s most valuable and strongest media brands, with Google claiming the top spot, following a 1% increase in brand value to US$191.2 billion.

Technology has become an integral part of all businesses, so Brand Finance has reclassified brands into the industries they are revolutionising. As a search engine, most of Google’s revenue is derived from advertising, leading to its inclusion as a media brand and the extension of the Brand Finance Media ranking to include 50 brands this year.

Google also owns the majority of internet advertisement infrastructure – controlling about 90% of search ads, managing the main ad exchange and server, running popular browser Chrome, and dominating smart devices with its Android operating system. Moreover, it manages widespread data centres, as well as a large portion of the cloud, which is where most of the ad dynamics occur. In addition to capitalising on ad spend, Google has since expanded into a variety of fields such as hardware, entering the smartphone industry by releasing the Pixel, its first handset.

The addition of search engine brands to the Brand Finance Media 50 2021 ranking follows expansions in previous years including streaming platforms, gaming brands, and social media as they continue to grow and carve out their own place in the media market, shifting the balance away from the networks, film studios, and publishers before them. Five further search engines feature in the extended ranking this year, with Yahoo! placing second highest after Google in 13th position with a brand value of US$9.4 billion.

Richard Haigh, Managing Director, Brand Finance, commented:

“Significantly better at innovating than its rivals, Google changed the marketplace of search engines, spearheading the digital media revolution in a way that distinguishes the brand above all others. No better indicator of this is the fact that the name Google has become a verb - ‘I’ll Google it’ is quite arguably one of the most widely used phrases of the 21st century.”

TikTok wastes no time

A video sharing app that enjoyed a colossal boost in popularity during the pandemic, TikTok (known in China as Douyin), enters the Brand Finance Media 50 2021 ranking for the first time with a brand value of US$18.7 billion, launching into the top 10 most valuable media brands in 8th position. TikTok focuses on optimising the content you see, as opposed to other social networks that are simply built on relationships between people who know each other. The app gives preference to material that corresponds to the hottest topics, meaning consumers - to achieve more engagement - are likely to build content that aligns with those trends. This in turn encourages advertisers to join the app to promote their products.

Digital media stream on

While COVID restrictions and global lockdowns linger, social media and gaming platforms dominate among the ranking’s fastest-growing brands. Another Chinese video sharing platform Bilibili has gained more in brand value than any other brand in the Brand Finance Media 50 2021 ranking, with an impressive 106% increase to US$1.9 billion. Despite being known for its cache of video content, Bilibili draws a large portion of its sales from smartphone games, which accounted for 40% of its revenues in 2020 versus over 70% in 2018, indicating an attempt to diversify its revenue stream. In the first quarter of last year alone, Bilibili reached 172 million Monthly Active Users (MAUs), placing it in the same class as video services operated by Tencent (up 28% to US$56.4 billion).

Video game publisher Huya is the ranking’s second fastest-growing brand with an impressive 74% increase in brand value to US$1.6 billion. The brand celebrated an uptick in MAUs at the end of last year - reaching a total of 178.5 million people - as well as a boost to advertising revenues, primarily driven by its expanding and diversifying advertiser base.

Other gaming platforms that performed well this year include South Korean NCSoft (up 68% to US$2.2 billion) and Kakao (up 49% to US$1.8 billion), as well as Activision Blizzard (up 20% to US$6.3 billion) and Electronic Arts (up 14% to US$4.4 billion).

TV and film suffer in wake of pandemic

COVID-19 has exacerbated the widening gap between traditional media brands, with TV networks and film studios facing an uphill battle against online competitors. This is best exemplified by CBS being thefastest-falling brand in this year’s ranking, with a 49% decrease in brand value to US$5.9 billion, following a dramatic drop in advertising revenue and a disastrous merger with Viacom. However, CBS is not alone in its struggles, with NBC (down 44% to US$8.4 billion), 20th Television (down 25% to US$6.1 billion), and Universal (down 21% to US$11.6 billion) all seeing considerable declines in brand value as film and television production was halted.

Comparatively, Netflix enjoyed a spike in usage, causing its brand value to increase by 9% to US$24.9 billion. Netflix has been a pioneering force in changing consumers’ viewing habits, taking over traditional television by providing a more appealing, flexible option in line with the modern fast-paced lifestyle. With 37 million new users by the end of 2020, Netflix’s success has driven improved revenue forecasts and brand equity scores. Despite this, the streaming platform’s growth was not as substantial as in previous years due to challenges posed by competitors such as Disney (down 9% to US$51.2 billion) and HBO (down 3% to US$4.0 billion), which recently started offering streaming services in a bid to remain competitive.

Riding the airwaves of media revolution to offer more personalised, online consumer experiences, Spotify enjoyed an impressive 39% boost in brand value to US$5.6 billion. The music streaming platform has seen a significant increase in new users over the past year after expanding operations into 13 new markets. Spotify is now primed for further success as it continues to develop its capabilities, signing exclusive podcast contracts with Archie Comics and Joe Rogan, and acquiring Megaphone from Graham Holdings to improve its own podcast technology.

Richard Haigh, Managing Director, Brand Finance, commented:

“Podcasts are one of the primary motivators for listeners to upgrade to paid subscriptions on music streaming platforms, with the global podcast industry expected to grow by nearly 30% over the next five years. With these forecasts, and rivals already showing market intent, Spotify's reign as the leading music streaming brand will be difficult to maintain.”

WeChat sector’s & world’s strongest

Apart from calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. According to these criteria, WeChat is the world’s strongest media brand with a Brand Strength Index (BSI) score of 95.4 out of 100. One of the world's most popular social media apps, WeChat is also the strongest brand globally, according to the Brand Finance Global 500 2021 report, and one of only two brands in the media ranking to have been awarded the elite AAA+ brand strength rating, the other being Disney with a BSI score of 89.7 out of 100.

Alongside revenue forecasts, brand strength is a crucial driver of brand value, and as WeChat’s brand strength grew, its brand value also enjoyed a rapid boost, increasing by 25% to US$67.9 billion. One of China’s home-grown tech successes with very strong equity, WeChat enjoyed high scores in reputation and consideration among Chinese consumers – according to Brand Finance’s original market research – successfully implementing a broad and all-encompassing proposition that offers services from messaging and banking, to taxi services and online shopping, becoming essential to many users’ daily lives.

Richard Haigh, Managing Director, Brand Finance, commented:

“A beacon of innovation, WeChat has shown the value of constantly striving for technical development, particularly in the face of adversity. Though the company has done exceptionally well this year, lower levels of enthusiasm among younger adults in China may be a warning flag. It will be essential for WeChat to keep up its momentum to achieve similar successes in the year ahead.”

In stark contrast, social networking site Facebook trails behind WeChat by almost 20 BSI points, scoring 77.0 out of 100. With 2.8 billion active monthly users, Facebook remains the most popular social media platform in the world. Despite recording a marginal increase in brand value and placing second overall in this year’s ranking, Facebook has battled widespread scrutiny over privacy issues and suffered significant reputational damage in the wake of several political and social scandals, ultimately damaging its brand strength.

With an even lower BSI score of 72.5 out of 100, Twitter’s brand strength is similarly dented by issues with consumer trust and reputation. In the past year, the platform faced intense scrutiny over its handling of Donald Trump’s account, sparking raucous debate surrounding freedom of speech and accusations against the former US President for allegedly using the platform to incite violence and spread fake news.

ENDS

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.