Read the full Global Soft Power Index 2023 report here

Access the agenda and livestream of the Global Soft Power Summit 2023 here

London, 2nd March 2023: Russia is the world’s only nation brand to lose soft power over the past year, while Ukraine has seen the strongest soft power improvement, according to the Global Soft Power Index 2023 released today. The Global Soft Power Index is a research study conducted annually by brand evaluation consultancy Brand Finance on a representative sample of 100,000+ respondents in 100+ markets worldwide, measuring perceptions of 121 nation brands.

While Russia’s Familiarity and Influence have gone up because of the impact that its decision to go to war has had on lives the world over, the nation’s Reputation has been severely damaged. Russia’s Reputation ranking in the study, one of the main determinants of soft power, has fallen from 23rd to an abysmal 105th resulting in a soft power score erosion of -1.3 points and causing it to drop out of the Index’s overall top 10 ranking, down to 13th.

Alongside the three key performance indicators of Familiarity, Reputation, and Influence, the Global Soft Power Index also measures perceptions of nation brands across 35 attributes grouped under 8 Soft Power Pillars. Russia has lost ground relative to others in the Index on all 35 attributes apart from “affairs I follow closely”. It now ranks 119th for the People & Values pillar and for the “good relations with other countries” attribute in International Relations. In addition, global sanctions have caused the nation’s perceptions as “easy to do business in and with" to fall by 61 places and having “future growth potential” by 74 places.

David Haigh, Chairman & CEO of Brand Finance, commented:

“While nations have turned to soft power to restore trade and tourism after a devastating health crisis, the world order has been disrupted by the hard power of the Russian invasion of Ukraine. An event that would be hard to believe were it not for the intensity of the images we have been seeing for months and the consequences the conflict is having on politics and the economy alike.”

At the same time, Ukraine gains +10.1 points (more than any other nation) driven by a steep increase in Familiarity and Influence, and jumps 14 ranks up to 37th from 51st the previous year. Ukraine now ranks 3rd in the world for “affairs I follow closely” and sees significant gains across attributes accentuated in official communications and media reports, such as “respects law and human rights” (up 69 to 29th), “tolerant and inclusive” (up 63 to 44th), and “leader in technology and innovation” (up 26 to 50th). The popularity of Ukraine’s President Volodymyr Zelenskyy, his ministers, and advisors, results in the nation going up 36 ranks to 12th on “internationally admired leaders”.

Nevertheless, many other attributes are affected negatively, from the obvious “safe and secure” (down 60 to 118th) or “great place to visit” (down 38 to 118th), to perceptions of Ukraine’s culture and people as the focus shifts to their suffering.

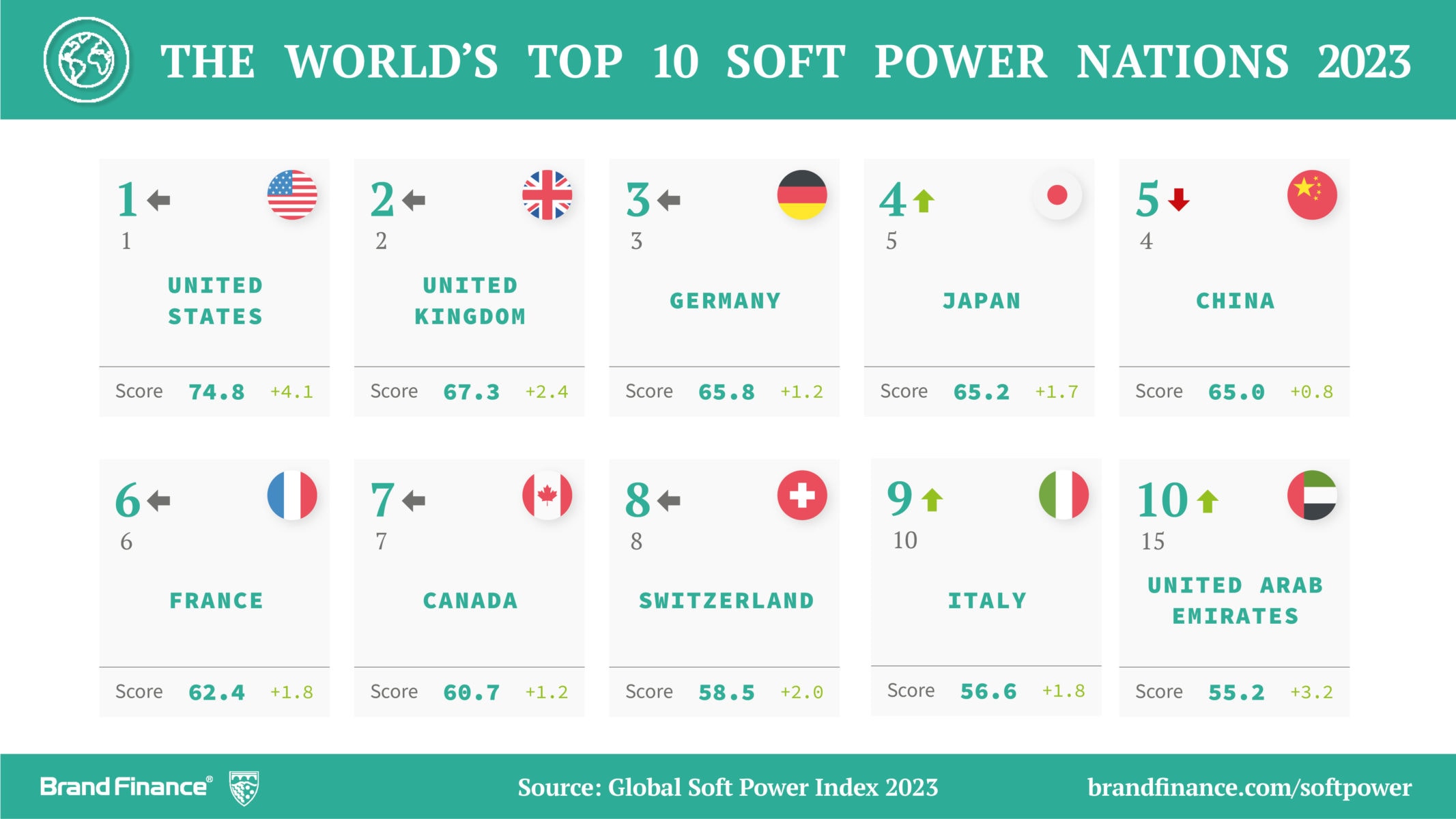

USA unrivalled as the soft power superpower

Under President Joe Biden, the United States reclaimed its top spot in the ranking in last year’s Index and has further increased the lead over other nation brands this year. The USA's overall score is up +4.1 points to an all-time high of 74.8. With the strengthening of the dollar and widely publicised large-scale investment projects by the federal government, perceptions of the US economy are on the up, resulting in America claiming the top spot for Business & Trade from China. The US also benefits from the introduction of a new “invests in space exploration” attribute in the Education & Science pillar, where it ranks 1st in the world. In fact, the US ranks 1st in twelve and among the top 3 in four more categories, bagging 16 soft power medals – more than any other nation brand in the Index.

The US records stable scores across most categories. However, mounting problems with shootings, gun crime, and police violence continue to erode perceptions of the country as “safe and secure” (down from 21st in 2020 to 62nd this year) and of its people as “friendly” (down from 5th in 2020 to 103rd this year).

The end of the Second Elizabethan Era

In the United Kingdom, 2022 will be remembered as the end of an era. The passing of Queen Elizabeth II at the age of 96, after 70 years on the throne, shook the nation. At the same time, intense media coverage of the period of mourning and the monarch’s spectacular funeral attended by the world’s leaders reminded the global public of Britain’s greatest soft power assets. The UK has defended its 2nd position in the Index this year, with an increase of +2.4 points to 65.8, recording increases across a number of attributes, from “good relations with other countries” (up 7 ranks) to “appealing lifestyle” (up 5 ranks).

Last year will also go down in British history for its three prime ministers. After the fall of Boris Johnson’s government, Liz Truss shot to power as quickly as she lost it to Rishi Sunak, becoming the country’s shortest-serving prime minister ever. While the nation’s overall Reputation has not been dented, perceptions of the UK as “politically stable and well-governed” declined relative to others (down 10 ranks).

Germany post-Merkel holds its own

Many worried about Germany losing its international standing after the departure of Angela Merkel. A year later, the nation has largely held its own, retaining 3rd position in the Index, with an increase of +1.2 points to 65.8. Olaf Scholz’s government has struggled with criticism of its hesitant response to Russia’s invasion of Ukraine, but this has had little impact on the nation’s perceptions among the global public. Germany’s nation brand strength transcends political crises, proving its resilience regardless of who is in charge.

China retains “future growth potential” despite COVID-19 restrictions

Although China has seen marginal growth of its Global Soft Power Index score (+0.8 to 65.0), it dropped in the ranking from 4th in 2022 to 5th in 2023, overtaken by Japan. While most nations accelerated their global engagement across trade, investment, tourism, and talent, China remained closed last year, maintaining a "zero COVID" policy. Reduced mental and physical availability of China’s nation brand among global audiences undermined its ability to improve perceptions at the same pace as competing economies, resulting in some relative declines, such as in the People & Values (down 57 to 95th) and Media & Communication (down 12 to 24th) pillars.

Nevertheless, on many metrics China has largely defended its position from last year and it remains 2nd in the world for Influence, behind only the US, and 3rd in the Education & Science pillar, with particularly strong performance across “leader in technology and innovation” (2nd), “leader in science” (3rd), and the new attribute: “invests in space exploration” (3rd). The nation also maintains its global #1 positions for “easy to do business in and with” and “future growth potential”, pointing to the resilience of its Business & Trade credentials, despite an overall rank drop for the pillar to 3rd. Revised economic growth forecasts by the International Monetary Fund confirm that China is back in business in 2023, predicting 5.2% GDP growth, above the level of previous expectations as private consumption rebounds following the country’s opening post-COVID at the end of 2022.

UAE enters top 10 for the first time

With otherwise little change in the top 10, the performance of the United Arab Emirates is a standout. For the fourth year running, the Emirates achieved the highest score of any Middle Eastern nation brand, but this year’s increase of +3.2 to 55.2 has meant a jump of five ranks to allow it to claim 10th position in the global ranking for the first time. Both Reputation and Influence of the Gulf nation have seen notable increases this year.

David Haigh, Chairman & CEO of Brand Finance, commented:

“The UAE was one of the first economies to roll out mass vaccination and open during the COVID-19 pandemic, giving it a head start ahead of others and allowing it to maintain positive perceptions across the Business & Trade pillar with a particular improvement on the “future growth potential” attribute, where it ranks 3rd globally. The successful showcase of the Emirates as a global trade hub thanks to EXPO 2020 has also undoubtedly provided a significant boost. At the same time, the UAE is one of the largest donors of foreign aid as a percentage of GDP, which is recognised by the global general public counting it among the world’s most “generous” nations – 3rd.”

Perceptions of the UAE’s Governance and International Relations are on the up too and the nation’s salience is only expected to grow. The Emirates Mars Mission has landed the UAE at 8th for “invests in space exploration”, while hosting the world’s most high-profile climate conference, COP 28, will put the nation firmly in the spotlight in 2023. The historically oil-heavy economy continues to increase its commitment to diversification, innovation, and investment in a more Sustainable Future. The UAE already scores relatively high on the new soft power pillar of that name, placing 19th globally.

ENDS

Note to Editors

The Global Soft Power Index is a research study conducted annually by brand evaluation consultancy Brand Finance on a representative sample of 100,000+ respondents in 100+ markets worldwide, measuring perceptions of 121 nation brands.

Soft power is defined as a nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics etc.) through attraction or persuasion rather than coercion. It is inferred from a weighting of respondent data, taking into account nation brand perceptions across the three key performance indicators of Familiarity, Reputation, and Influence as well as 35 attributes grouped under 8 Soft Power Pillars.

The full ranking, methodology, charts, commentary, expert contributions, and in-depth articles with interviews on nation brands around the world are available in the Global Soft Power Index 2023 report.

Access the agenda and livestream of the Global Soft Power Summit 2023 taking place today, Thursday, 2nd March 2023 at 09:00-17:00 GMT at the Queen Elizabeth II Centre in London. The Summit will explore the findings of the Global Soft Power Index 2023 as well as bring together practitioners and researchers to explore and debate the role of soft power in international politics and business.

The Summit features a keynote speech by the former UK Prime Minister Boris Johnson as well as a virtual audience address by the First Lady of Ukraine Olena Zelenska and a live virtual discussion with the Minister of Foreign Affairs of Ukraine Dmytro Kuleba.

The full agenda of the Summit will include discussions on the role of sustainability, media, culture, business, sport, and development in driving soft power, featuring UAE Minister of State for Foreign Trade HE Dr Thani Al Zeyoudi, former Prime Minister of Sweden Fredrik Reinfeldt, Chinese-American environmentalist Peggy Liu, and British broadcaster and columnist Andrew Neil, among others. The day will conclude with a session on Australia’s Voice to Parliament exploring the impact of colonialism on perceptions of nation brands today, featuring Professor Megan Davis, and with a speech by Lord Ed Vaizey on the future of the British Monarchy and the Commonwealth.

Media Contacts

Ed Will

Group Marketing & Communications Director

M: +44 (0)7768 952 192

e.will@brandfinance.com

Michael Josem

Associate Communications Director

T: +44 (0)7624 488 557

For further information about Brand Finance’s soft power practice, please contact:

T: +44 (0)207 3899 400

softpower@brandfinance.com

Follow Brand Finance on Twitter @BrandFinance, LinkedIn, and YouTube.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.