View the full Brand Finance Hotels 50 2022 report here

Hilton brand value is up 58% to US$12.0 billion

Hilton (brand value up 58% to US$12.0 billion) has extended its reign as the world’s most valuable hotels brand, according to a new report from the leading brand valuation consultancy, Brand Finance. Hilton has grown its lead as the most valuable hotels brand in the world, with a brand value which is now greater than 2nd and 3rd combined: Hyatt (brand value up 26% to US$5.9 billion) and Holiday Inn (brand value up 10% to US$4.2 billion).

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest hotel brands are included in the annual Brand Finance Hotels 50 2022 ranking.

As we look to a post-pandemic world, Hilton’s brand value increase is driven by both an increase in forecast revenue and increased profitability expectations. At the same time, Brand Finance research discovered that customers improved their perception of Hilton, with the large brand’s perceived reliability and credibility on safety issues being a key factor. This contributed to a 7.2 point increase on its Brand Strength Index from 80.8 to 88.0, improving its Brand Rating from AAA- to AAA and becoming the third strongest hotel brand in the world this year.

Alex Haigh, Brand Finance Technical Director said:

“The global disruption to travel due to the COVID-19 pandemic caused significant disruption to brand values – but customers recognise that hotels are not to blame for the disruption. As a result, we see that successful brands have been able to bounce back quickly and re-earn customer trust in the post-pandemic world.”

Two-thirds of top 50 hotel brands remain below pre-pandemic values

Global travel restrictions over the last two years introduced in response to the spread of COVID-19 imposed significant and obvious costs on hotel brands, with many yet to recover: Of the 50 brands included in the Hotels 50 2022 ranking, two-thirds of the brands (34) remain below their pre-pandemic valuation of 2020, with just one-third (16) above their pre-pandemic valuation.

One brand to increase brand value sharply was NH Hotels (brand value up 47% to US$1.0 billion) which endured significant disruption from COVID-19 generally, and the Omicron variant more specifically. NH Hotels endured an occupancy rate of between 20% and 30% throughout the first half of 2021, growing throughout the year to 62% in October – before the Omicron variant played a key role in the occupancy rate falling back down to 26% in January 2022. However, with all NH Hotels properties now re-opened, occupancy rates have returned back over 60% more recently. These data are contributing to the NH Hotels brand value achieving a rate 33% higher than their pre-pandemic valuation on the back of increased revenue forecasts.

Elsewhere, the brand value of luxury hotel Intercontinental (brand value down 1% to US$1.5 billion) fell marginally, with significant concerns about potential delays to the reopening of services in Intercontinental’s key Chinese market. Despite enduring some of the toughest periods ever endured by the hospitality industry, Intercontinental remains focused on deliver its brand promise of deliver ‘True Hospitality for Good’. This brand promise seeks to benefit customers and staff, and to also positive difference to their local communities. Their strategy includes placing a sharper focus on their brand, and offers the potential of significant future brand value growth.

The Accor group, including brands Ibis (brand value up 24% to US$463 million) and Pullman (brand value up 20% to US$349 million) is having a strong year, with their brand values growing significantly this year. Average room rates across the Pullman and Ibis brands returned to their pre-COVID-19 levels, and some properties even exceeded pre-COVID-19 rates. While there are some lingering consequences of COVID-19 restrictions, their hotel brands maintained significant brand value and brand strength through the pandemic, a recognition that consumers did not blame hotels for the virus.

Taj Hotels is world’s strongest hotels brand with AAA rating

In addition to brand value, Brand Finance determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. Taj Hotels (brand value up 6% to US$314 million) is the strongest brand in the ranking with a Brand Strength Index (BSI) score of 88.9 out of 100 and a corresponding AAA brand rating.

The pandemic and subsequent national lockdowns hit Taj like other hotels across the world, and Taj was able to successfully adjust strategies to remain relevant to the need of tourists. Taj was at the forefront of this with agility and strategic initiatives such as offering support to the healthcare sector.

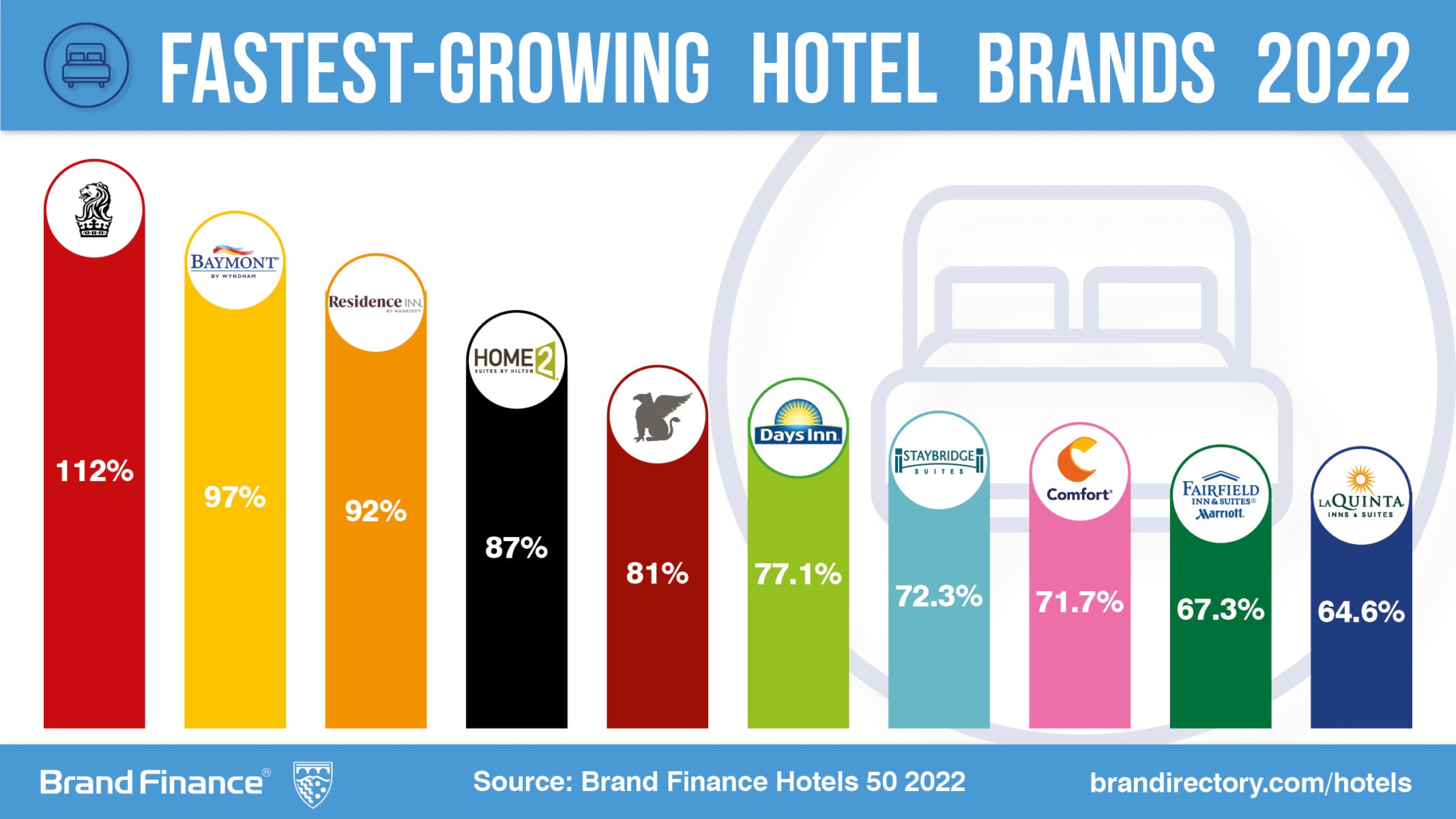

The Ritz-Carton is world’s fastest growing hotel brand, more than doubling in value this year

The Ritz-Carlton (brand value up 112% to US$1.1 billion) is the world’s fastest growing hotel brand this year, with its brand value now 67% above its pre-pandemic value of US$632 million. This brand value has increased based on its impressively high revenue per available room and large number of rooms. Part of the Marriott Group, the Ritz-Carlton has built an extremely strong brand, with its Brand Strength Index increasing from 79.6 to 83.2, with its brand rating now firmly in the AAA- band.

Other quickly growing brands include Baymont (brand value up 97% to US$382 million) which has re-entered these rankings as it bounces back quickly from COVID. This bounce back in brand value is associated with strong trading conditions forecast for its key markets, and improved customer perception. Similarly, Residence Inn (brand value up 92% to US$760 million) is the third fastest growing hotel brand, which has achieved a significant improvement in customer perception, which is leveraging a very large number of rooms and revenue per room relative to other brands.

View the full Brand Finance Hotels 50 2022 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest hotel brands are included in the Brand Finance Hotels 50 2022 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Hotels 50 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.