View the full Brand Finance India 100 2023 report here

Top 100 Indian brands show resilience among global turmoil

Amidst the post-pandemic landscape and geopolitical uncertainties, India's top 100 most valuable brands have collectively exhibited growth, with their total value approaching USD2 trillion since the last valuation on January 1, 2022, according to leading brand valuation consultancy, Brand Finance.

Every year, Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. Using publicly available data and information, over 250 Indian brands have been assessed to produce the Brand Finance India 100 2023 report. This report ranks the world’s top 100 most valuable and strongest Indian brands and also features sectoral analytics and top sectoral brands.

Tata Group breaks US$25 billion mark

Tata Group has retained its title of India’s most valuable brand and is accelerating ahead with double digit brand value growth (10.3%) to US$26.4 billion – the first time any Indian brand has surpassed this impressive brand value marker.

Tata Group is the only Indian brand to feature in the top 100 of the Brand Finance Global 500 2023 (gaining 7 ranks in 2023) – The annual ranking of the world’s top 500 most valuable brands.

Savio D’Souza, Director, Brand Finance, commented:

“Over the last 2 years, the Tata Group has undergone a significant strategic transformation, embracing digitalisation and harnessing the power of technology across its diverse portfolio. The group has long been a trailblazer in promoting community welfare and sustainability, setting an example even before it became a global buzzword. Notably, the Tata Group has achieved the remarkable feat of being ranked 49th globally in Sustainability Perceptions Value, according to our inaugural global Sustainability Perceptions Index, conducted earlier this year.”

Mahindra group rising rapidly, now among India’s top 10 most valuable brands

Mahindra group has leaped into the position as India’s 7th most valuable brand (up 15% to a Brand Value US$7 Billion). The Group performed exceptionally well last fiscal year with record profits crossing Rs 10,000 crore for the first time on revenues of 1,21,269 crore. Remarkable growth in its Auto business and sustained growth in group companies like IT Services and Financial Services has ensured that the Mahindra brand is a force to reckoned with. The Group is a top performer across several global industry rankings and assessments in Environmental, Social, and Governance (ESG).

Taj is India’s strongest brand

In addition to measuring overall brand value, Brand Finance also evaluates the relative strength of brands, based on factors such as marketing investment, familiarity, loyalty, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. According to these criteria Taj (brand value US$374 million)is India’s strongest brand, With Brand Strength Index (BSI) score of 89.4 out of 100 and a corresponding elite AAA brand strength rating.

Auto, Metals, Building Materials and Hospitality sectors on the rise

Brands in the Metals sector, such as Tata Steel, Hindalco and Vedanta have displayed remarkable growth off the back of a revival in infrastructure & greenfield investments in India over the past year. Mahindra Auto, Tata Motors and Maruti Suzuki have all clocked double digit brand value growth, driven by the impetus towards an electric revolution in India and the emergence of pent-up demand following the pandemic. Taj Hotels has also posted significant financial growth through organic and inorganic expansion of footprint.

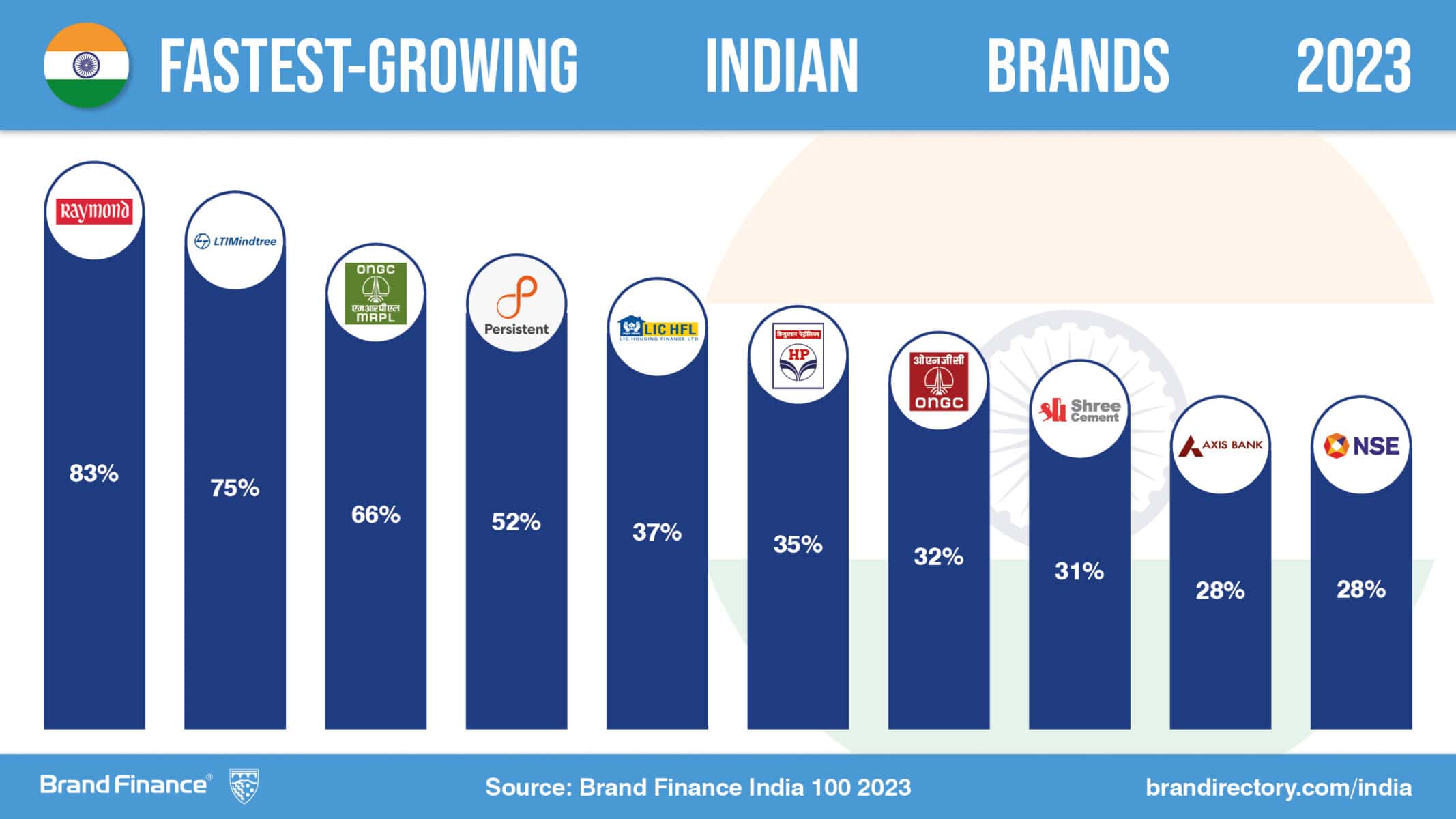

Some standout performances from Indian brand value analytics:

Ajimon Francis, Managing Director, Brand Finance India, commented:

“For the past decade, brands from India have embraced the ‘Made in India’ tag with pride, actively contributing to their own brand building while simultaneously nurturing the nation's brand identity. As a result, formidable brands such as Tata, Infosys, SBI, Airtel, Reliance, Mahindra, Taj Hotels, L&T, Bajaj Auto, Aditya Birla, Tech Mahindra, MRF all continue to punch well above their weight on the Global stage.”

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.