View the full Brand Finance Ireland 25 2021 report here

Ireland has recorded mixed fortunes throughout the COVID-19 pandemic, with the lowest rates per capita in Europe in mid-December 2020, but by mid-January this year was in the grips of a rampant new wave. The nation first went into lockdown in March 2020 and has since then faced a patchwork of eased and then reintroduced restrictions. This uncertainty, interruption, and disruption to businesses has wrought economic and social impact across the nation.

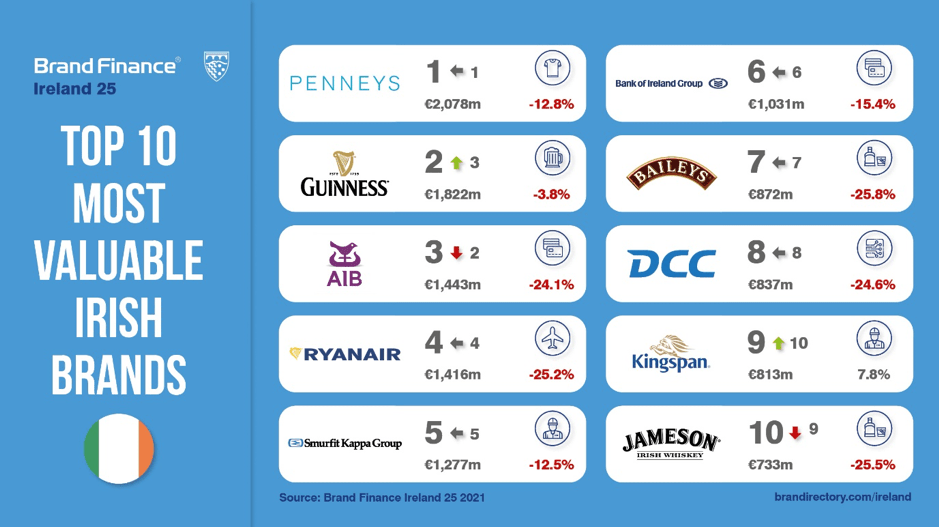

The total value of Ireland’s top 25 most valuable brands has dropped from €20.3 billion in 2020 to €17.5 billion in 2021 and, on average, the top 25 brands have lost 11% of brand value this year. With another lockdown in force and lacklustre vaccination rates compared to its neighbour, the UK, the future is looking uncertain.

Declan Ahern, Valuations Director, Brand Finance commented:

“The Irish and broader European Union’s response to the economic impact of the pandemic has been notably different to the response to the 2008 financial crisis, where lessons about job retention and support income seem to have been learnt. This bodes well for the longer term post-COVID-19 recovery and for brands across Ireland in the coming year.”

Penneys retains top spot

Penneys/ Primark has retained the title of Ireland’s most valuable brand, despite recording a 13% decrease in brand value to €2.1 billion. Much has been said about the decline of the high street - particularly in the years following the 2008 financial crisis - but Penneys has demonstrated a formidable resilience, with its distinct brand identity as the go-to spot for cheap and fashionable clothing, while bucking the trend among some consumers for more sustainable ‘slow’ fashion. Despite this, the brand has suffered amid the fallout from the pandemic. While many brands have a strong online presence and have shifted focus to e-commerce, Penneys has remained an in-store only retailer. With quick turnover times for its products and a reputation for large stores, the brand’s focus has been entirely on instore purchases and has not attempted a shift to online.

Declan Ahern, Valuations Director, Brand Finance, commented:

“As the vaccine rollout continues for the remainder of 2021, health and hygiene considerations will remain important factors in the shift to online retail. It remains to be seen what the longer-term effects will be for the high street, but Penneys will do well to consider a shift to an online presence going forward.”

Engineering & construction is nation’s most valuable sector

The engineering & construction sector is Ireland’s most valuable sector, with the four brands featuring in the ranking accounting for 16% of the total brand value.

Smurfit Kappa is the sector’s highest ranked brand, maintaining 5th place in the ranking with a brand value of €1.3 billion, down 13% year-on-year. The brand benefitted from increased e-commerce sales in Europe spurred by lockdowns across the continent. Despite this boost, however, Smurfit Kappa still suffered a drop in its core earnings, and thus its brand value.

Of surprisingly good fortunes is Kingspan, its brand value up 8% to €813 million. The brand, and specifically its cladding materials, are at the heart of the ongoing Grenfell Tower Inquiry, which is investigating the use of the brand’s flammable cladding in the 2017 tower block tragedy. Despite this, Kingspan has successfully managed to continue the operation of almost all construction during the pandemic - a stark contrast to most other industries.

Airline brand value grounded

After a year in which the travel industry was battered by lockdowns and uncertainty, it is unsurprising that Aer Lingus is Ireland’s fastest falling brand, its brand value dropping by 29% to €256 million. Irish airline giant Ryanair also suffered, with a 25% drop in brand value to €1.4 billion.

Airlines have had to contend with a stark drop in passenger numbers, closed borders, and new safety procedures on flights. Some airlines have been forthright in their criticism of government responses, with Ryanair accusing the UK and Irish governments of taking ‘draconian measures’ following the reintroduction of lockdowns at the start of 2021.

Trouble for Irish banks

Across the world, governments, central banks, and regional and local financial institutions have taken extraordinary measures to support local consumers and businesses through economic uncertainty and ongoing lockdowns. While this has largely led to improved brand equity perceptions for high street banks, it has meant that they are facing significant provisions for future loan losses as government support is lifted. It is for this reason that we have seen significant brand value declines for the Irish banking sector.

All three Irish banks in this year’s ranking have seen declines in brand value year-on-year with Allied Irish Banks down 24% to €1.4 billion, Bank of Ireland down 15% to €1.0 billion and Ulster Bank down 24% to €176 million.

The banking sector is the second most valuable across the nation, with the three brands accounting for 15% of the total brand value in the ranking.

Think! rebrand pays off

Think! - the US-founded protein bar brand acquired by Glanbia in 2015 - is Ireland’s fastest growing brand, its brand value up 19% year-on-year to €392 million. The brand has undertaken a complete overhaul over the last year, with a name and brand change from ‘ThinkThin’ marking a shift in its offering and focus on general wellness rather than weight loss, reflecting broader cultural trends.

eir faces mixed reception

eir has seen the second greatest brand value jump in this year’s Brand Finance Ireland 25 ranking, up 16% to €608 million. As with other telecoms brands globally, eir’s operations have seen a significant increase in demand since the onset of the pandemic, with customers following stay-at-home and working from home orders. This has not come without its difficulties, however, with the brand facing a barrage of customer care complaints. The brand was already in the midst of undertaking changes to its operations when the pandemic hit, and this, combined with increased demand on the network, created what eir bosses described as a ‘perfect storm’ for the business.

Cheers to Baileys as nation’s strongest brand

In addition to measuring overall brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, customer familiarity, staff satisfaction, and corporate reputation. According to these criteria, Baileys (down 26% to €872 million) retains the title of Ireland’s strongest brand, with a Brand Strength Index (BSI) score of 83.5 out of 100 and a corresponding AAA- brand strength rating.

Baileys has continued to invest in diversifying its product range, with dairy-free, low sugar and chocolate flavour varieties of the liqueur now available, as well as recently launching its easter egg range - all while maintaining its strong brand identity.

Fellow brand under the mighty Diego portfolio, Guinness (down 4% to €1.8 billion), is the nation’s second strongest brand (BSI 81.6) and second most valuable brand. The drink, synonymous with the nation and its beverage industry, has an extremely strong identity, only supplemented by its successful advertising and sponsorship campaigns, most notably as the title sponsor of the Six Nations Rugby Championship.

View the full Brand Finance Ireland 25 2021 report here

ENDS

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.