View the full Brand Finance Denmark 50 report here

Lego is most valuable and strongest Danish brand, valued at DKK 38.7 billion

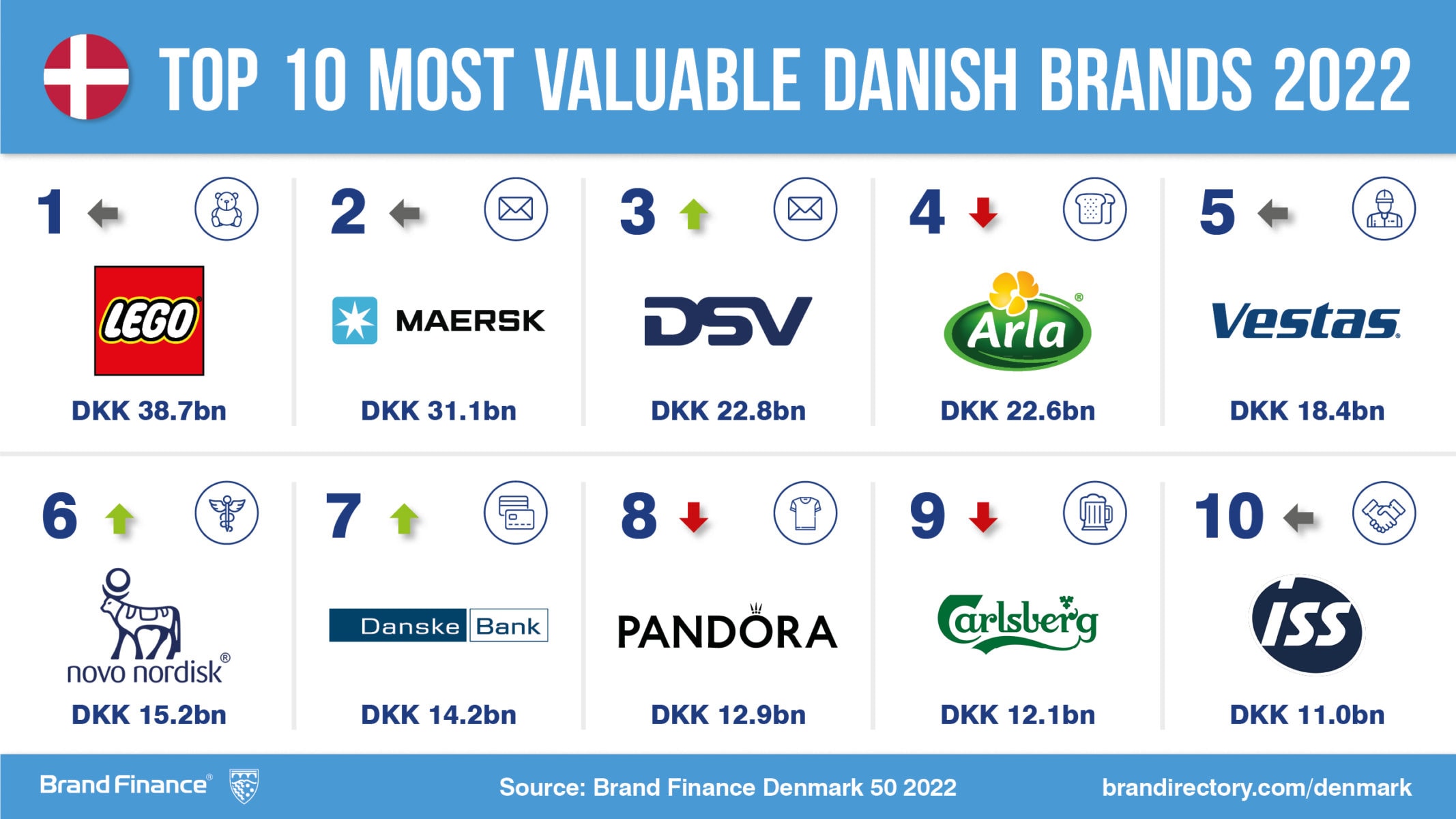

The iconic Danish toymaker Lego (brand value up 13% to DKK 38.7 billion) remains on top as the most valuable Danish brand for the seventh consecutive year, according to a new report from leading brand valuation and management consultancy Brand Finance. Lego leads a number of big Danish brands which are each returning to growth as the world looks beyond the COVID-19 pandemic such as 2nd ranked Maersk (brand value up 21% to DKK 31.1 billion), 3rd ranked DSV (brand value up 43% to DKK 22.8 billion) and 4th ranked Arla (brand value up 14% to DKK 22.6 billion).

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the world’s biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. Denmark’s top 50 most valuable and strongest brands are included in the annual Brand Finance Denmark 50 ranking.

Over the last two years, Lego has navigated the ongoing uncertainty of the COVID-19 pandemic and worked creatively to meet extraordinary demand for their products. Lego is continuing to deploy new sets in conjunction with various famous brands, and while much of the world has moved away from live, in-person, events, Lego is expanding a new retail format to create immersive, memorable brand experiences. This includes opening 165 Lego branded stores around the world in 2021, bringing the global total to 832.

Further, while much of the world is facing significant supply constraints, Lego’s five manufacturing sites on three continents make their supply chains relatively short, flexible, and able to meet shifting demand in our largest markets.

Anna Brolin, Managing Director, Brand Finance Nordics, commented:

“This is a good year for Danish brands, despite the recent return of market shivers. Given that markets have been in flux for years the ranking of top Danish brands can, with only a quick glance, come across as almost surprisingly stable. No newcomers on either of these two lists and mainly small individual rank movements. However, if scratching the surface lots of highly interesting undercurrents reveal that the Danish economy – which has a high concentration of export oriented multinational companies that tend to respond quickly to shifting global demands - is reinventing itself in a major way. In general companies which have scaled up e-commerce and ESG-investments have typically been rewarded with not only a higher brand value but also a stronger brand. Lego is leading from the front and is playing well in every way: they’re leading on the environment, they’re leading on creating immersive retail experiences, they’re leading on supply chain improvements and they’re leading in the eyes of their key stakeholder: children who love the Lego brand for what it represents.”

In addition to brand value, Brand Finance determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. In addition to being the most valuable brand, Lego is also the strongest brand in the ranking with a Brand Strength Index (BSI) score of 87.5 out of 100 and a corresponding elite AAA+ brand rating.

Lego’s brand strength is boosted by increasing awareness of Lego’s performance on environmental issues. This year, Lego announced its first operationally carbon neutral factory, which is due to open in 2024 in Vietnam. Further, after three years of research and development, Lego announced a breakthrough with their new prototype brick made from recycled PET bottles.

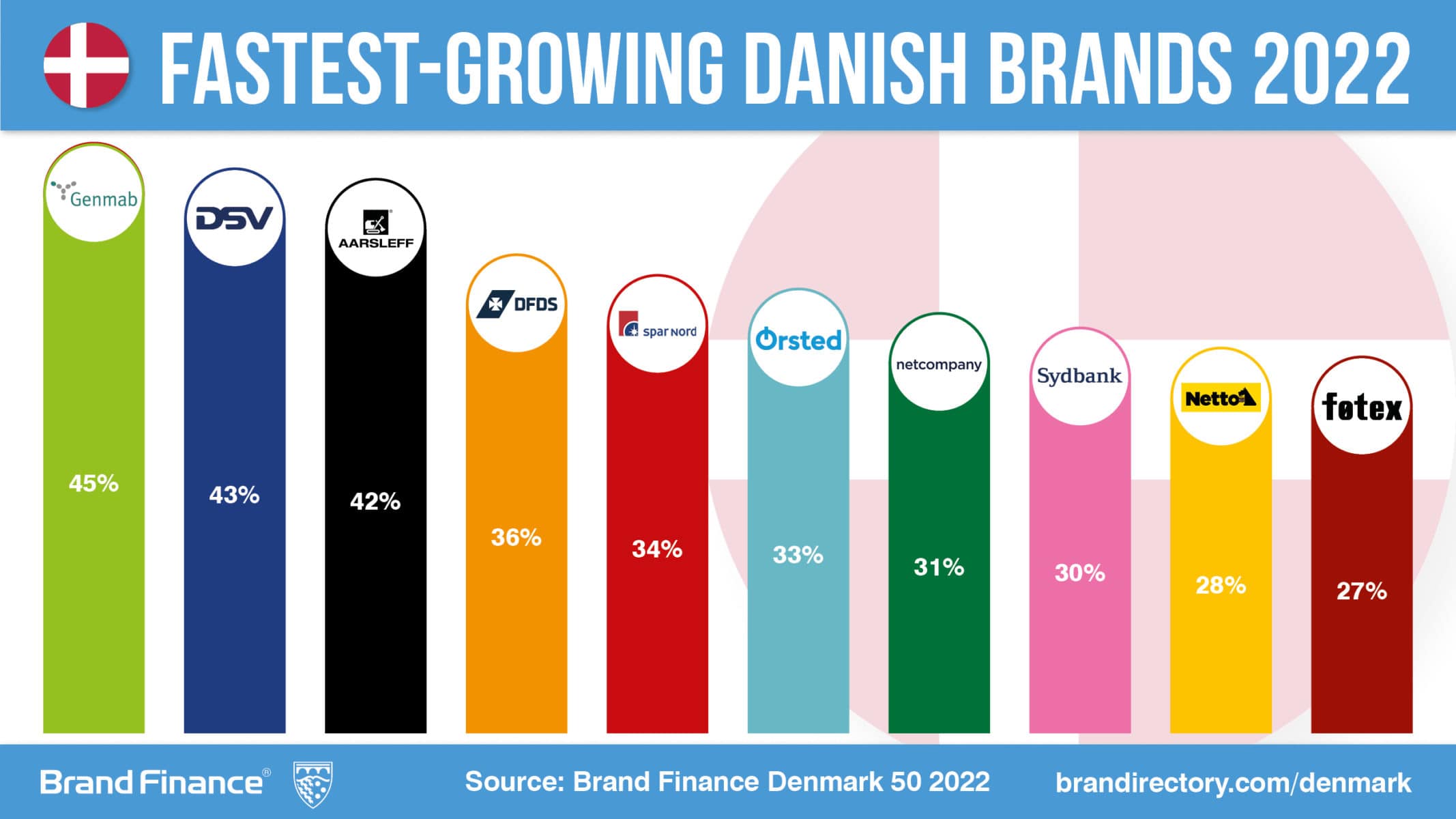

Genmab fastest-growing brands with over 40% brand value growth

This year’s fastest-growing brands are Genmab (brand value up 45% to DKK 1.8 billion) and DSV (brand value up 43% to DKK 22.8 billion). Genmab’s successful launch of Tivdak, a drug to fight cervical cancer this year, has resulted in very fast growth in brand value as the brand successfully deploys its first medicine. This milestone reflects the purpose-driven nature of Genmab to turn insights into medicine, and in doing so, deploy credible cures for some cancers.

Maersk grows quickly to retain 2nd place, now up more than a third compared to before pandemic

Maersk (brand value up 21% to DKK 31.1 billion) has retained its place as the second most valuable Danish brand this year, with its brand value now more than a third higher than its pre-pandemic levels. With large swathes of the global service economy placed under severe restrictions over the last two years, consumer spending has shifted from services to goods. As a result, Maersk has been called to ship many of these goods globally, with big increases in demand leading to price rises and a favourable business climate for Maersk.

The Maersk brand appears well positioned to take advantage of the changed global economy, investing in further capacity expansion to satisfy customer demand. In addition, Maersk is acquiring Senator, a leading German forwarding company, which offers further brand business growth opportunities.

Coop Danmark illustrates that not only export-oriented brands can do well

The second biggest retailer of consumer goods in Denmark, Coop Danmark (brand value up 13% to DKK 6.8 billion) is this year also the Brand Strength growth winner with its brand strength jumping 8.4 points, improving its Brand Strength Index from 63.4 to 71.8, and earning a brand rating of AA. The company illustrates that brands with an almost exclusively domestic audience can do well. The Work From Home trend as well as improved corporate social responsibility metrics contribute to the positive result for Coop Danmark. As an example, the brand has cut its CO2 emissions by 30% in the last eight years which has resulted in a Lean & Green Award for greener transport. This was achieved thanks to investments in production and logistics locations as well as its truck fleet, which uses domestically produced biodiesel and, increasingly, hydrogen technology.

Exciting transition period shifts going forward

Going forward it will be interesting to keep an eye on all sorts of analytically fascinating transition period developments. Including the interplay between brand value and brand strength. Will green energy company Ørsted (brand value up 33% to DKK 10.9 billion), presently ranked 11 on the brand value list, move into the top ten list despite some recent market setbacks? Danske Bank (brand value up 24% to DKK 14.2 billion) with brand value rank 7 this year, remains the most valuable brand within the banking sector by far. However, on the brand strength list Jyske Bank (brand value down 1% to DKK 3.1 billion)currently in the process of buying Handelsbanken Denmark,is not far behind. To what degree will the latter situation transform into an also boosted market value? Will the raised focus on green investments, within finance in general, continue to pay off as well as reshape also the banking industry? Following not least innovative ecommerce solutions Carlsberg (brand value up 4% to DKK 12.1 billion) and its associate Tuborg (brand value down 8% to DKK 6.2 billion) are now both on the top 10 brand strength index list? Will they be able to build even further on these positions of strength?

Denmark is punching above its weight and ranks number 18 in 2022 Global Soft Power Index

Denmark ranks 18 in the Global Soft Power Index 2022. This means Denmark drops three spots compared to the year before. However, the world continues to look highly favourable on most elements that build the Danish country brand. Meaning the drop is mainly due to a handful of other, bigger nations having improved more than Denmark during the recent recovery from COVID-19. Denmark also continues to stand out in relation to a number of metrics. A worldwide top 10 rank was achieved in relation to, for example, good governance, acts to protect the environment, trustworthy media, strong educational system, appealing lifestyle, trustworthy people and tolerant and inclusive people. As before, Denmark's high ranking, even during times of turbulence and even though a small nation, suggests that a strong brand helps build resilience. Including faith that existing troubles will be overcome.

Looking ahead, Denmark has good presence in Western Europe, but many smaller EU nations face a strategic challenge in building salience and relevance in places like Brazil, China, India, and Nigeria – markets of increasing importance in the global mix.

View the full Brand Finance Denmark 50 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Denmark’s top 50 most valuable and strongest brands are included in the Brand Finance Denmark 50 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Denmark 50 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.