View the full Brand Finance Malaysia 100 2022 report here

Petronas remains Malaysia's most valuable brand for 12th consecutive year.

Petronas has retained its position as Malaysia's most valuable brand for the 12th consecutive year, with its brand value rising strongly by 13% to US$13.6 billion, according to a new report from leading brand valuation consultancy, Brand Finance. The brand value of Petronas is worth just over three times as much as the second-ranked Malaysian brand, Genting (brand value up 44% to US$4.5 billion).

The brand values of many big Malaysian brands have returned to growth as the nation looks beyond the pandemic, with Malaysia's 100 most valuable brands worth 21% (US$ 9.3 billion) more in 2022 (US$53.7 billion) than they were worth in 2021 (US$44.4 billion).

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the world’s biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. Indonesia’s top 100 most valuable and strongest brands are included in the annual Brand Finance Malaysia 100 2022 ranking.

Alex Haigh, Managing Director, Asia Pacific commented: “Top performing brands in the oil and gas, banking and telecommunications sector including Petronas, Maybank, and Affin Bank continue to innovate using digital transformation and are making up for losses incurred during the COVID-19 pandemic, gearing up and enhancing customer acquisition and engagement.”

Petronas brand value growth is correlated with their sustainability agenda and increased demand for their core products. The brand is fully committed to remain disciplined in its delivery of its Three-Pronged Growth Strategy, strengthening its core and growth portfolio while investing for the future and resolute in its efforts to achieve the goal of net zero carbon emissions by 2050. As the energy transition unfolds, Petronas continues to seize the attractive opportunities and recently introduced a new entity, Gentari Sdn Bhd which aims to accelerate the adoption and commercialisation of clean energy, by offering a suite of renewable energy, hydrogen and green mobility solutions that are safe, responsible, cost-optimised and emissions-abated via an integrated approach across the clean energy value chain for customers globally.

Genting rises to second place, overtaking Maybank.

The Genting brand (brand value 44% up to US$4.5 billion) has achieved strong growth following the removal of pandemic-related constraints. The brand is placing greater emphasis on maximising its overall operational efficiency by intensifying performance, optimising its databases, the quality of its services and its marketing strategy with the ultimate goal to elevate customer experience. Looking ahead, Genting has further opportunities for growth as its major operations in Singapore and Malaysia become more accessible to more tourists, especially from mainland Asia.

Airlines are bouncing back

AirAsia (brand value up 18% to US$1.4 billion) retains the 9th position in the 100 most valuable brands 2022 far away from the second and last airline company included in the ranking, Malaysia Airlines (brand value up 15% to US$200 million) which rank 44 this year, one position higher.

Revenues was significantly increased for AirAsia Aviation Group (AAAGL), a subsidiary of Capital A (formerly known as AirAsia Group), in Q1 attributed to improved demand and further easing travel restrictions across the key markets in the region. The brand has had a shake-up with new management and plans to diversify its business during 2022 especially since the recent launch of the AirAsia Super App.

Maybank is Malaysia's strongest brand with AAA ranking.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

According to these criteria, Maybank (brand value up 7% to US$3.9 billion) is Malaysia’s strongest brand, with a Brand Strength Index (BSI) of 89.1 out of 100 (up by 2.3 points) and a corresponding AAA brand strength rating. Maybank overtakes Petronas (87.7 out of 100) in the strength ranking in 2021 and DiGi (79.2 out of 100).

Maybank, aims to accelerate its growth post COVID-19 and entrench its position among the leading financial services groups in the region with specific focus on enhancing digital capabilities, discovering new value drivers for business growth besides championing sustainable practices.

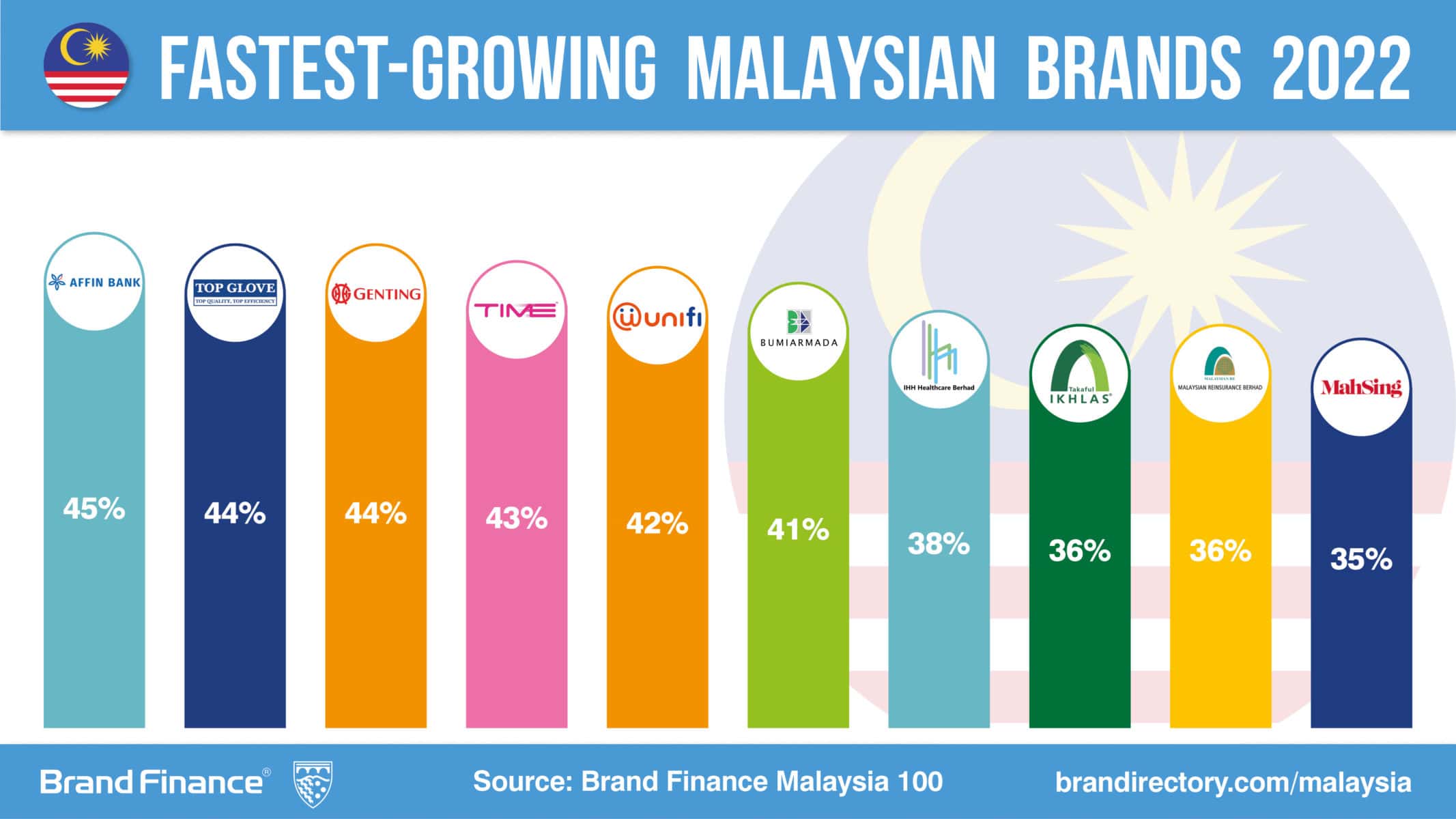

Affin Bank, Top Glove and Genting are the fastest growing brands in Malaysia

Affin Bank is the fastest growing brand in Malaysia (brand value up 45% to US$232 million) followed closely by Top Glove (brand value up 44% to US$499 million) and Genting (brand value up 44% to US$4.5 billion).

Affin Bank doubled their net profit this year, the bank has achieved growth as it increased its issuance of loans because of consumer spending in the region. The brand’s Brand Strength Index (BSI) also jumped 7.8 points this year, owing to an improvement in consumer perceptions such as ‘value for money’ according to research conducted by Brand Finance coupled with the company’s commitment to ESG resulting in an improvement in BSI scores.

The bank has also invested in technological innovation to grow and has therefore won two awards under the Cloud and Mobile-Banking categories in the Malaysia Technology Excellence Awards 2022, a strong reflection that customers and industry stakeholders are aware of their ongoing strategic focus.

The brand value of Top Glove has grown strongly in connection with the very obvious increase in demand for gloves globally. Top Glove has developed a strong reputation amongst stakeholders for their glove products and is now producing up to a quarter of gloves in the world.

Mah Sing and IHH jump 10 places in rankings

Mah Sing (brand value up 35% to US$130 million)and IHH (brand value up 38% to US$87 million) both jumped ten places in the ranking, to 56th and 67th place respectively. Mah Sing’s projects continued to record a rebound in sales momentum as the reopening of the country’s borders and the transition to the COVID-19 endemic phase spurred a recovery in economic activities. The group plans to hive off its rubber glove business which contributed to accelerate its growth, after venturing into the segment only 19 months ago under the Mah Sing Healthcare Sdn Bhd banner as the demand for rubber gloves has decelerated sharply.

On its part, IHH is working to align itself with three major trends that have begun to shape the healthcare industry: healthcare being delivered digitally, growing consumer demand for greater transparency and improved public-private collaboration. The hospital operator said that Covid-19 accelerated the group's efforts to innovate, leverage synergies and build platforms for growth.

View the full Brand Finance Malaysia 100 2022 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Malaysia’s top 100 most valuable and strongest brands are included in the Brand Finance Malaysia 100 2022 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Malaysia 100 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.