View the full Brand Finance Football 50 2023 report here

Manchester City FC (brand value up 13% to €1.51 billion) has achieved a historic milestone by surpassing Real Madrid CF (brand value down 4% to €1.46 billion) as the world's most valuable football club brand. The club’s brand value has seen a positive increase of 34% growth since the COVID-19 pandemic and has now reached an all-time high. Manchester City FC also boasts the highest revenue in this year’s table, a key driver in its ascent to the top.

Hugo Hensley, Head of Sports Services at Brand Finance, commented:

“Manchester City FC has achieved an extraordinary feat by surpassing Real Madrid to become the champion of football club brands. For five years, the City team has exerted its dominance in English football, securing four Premier League titles in the past five seasons. However, the club’s performance in this year’s ranking highlights that Manchester City FC are performing off the pitch in terms of building a strong brand and attracting fans and sponsors, and setting the stage for what could be an iconic Champions League final against Inter Milan in June.”

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 10,000 football fans in Europe, Brazil, China, and the USA.

While beaten out of the top spot by Manchester City FC this year, Real Madrid CF strikes again as the strongest and second-most valuable football club brand. In 2022, Brand Finance research determined that the Spanish powerhouse were the most likely club to be rated ‘the best club in the world’ by fans. Brand strength is what attracts fans, players, investors, and sponsors to engage with the club –delivering commercial value through higher revenues, prices – especially for sponsorship, higher growth, and sponsors, reducing risks to profitability related to weak on pitch performance.

Following Real Madrid in 2nd, FC Barcelona (brand value up 4% to €1.4 billion) defends its 2022 rank in 3rd, as does Club Atletico de Madrid (brand value down 5% to €549.56 million) in 12th. Following a period of on-pitch setbacks and financial struggles, FC Barcelona appears to have resurged its reputation, winning the Spanish LaLiga ahead of historic rival Real Madrid in 2nd and Club Atletico de Madrid in 3rd.

Sevilla FC (brand value up 6% to €189.27 million) has also shot up five places to 25th, while Villareal CF (brand value up 5% to €137.38 million) has gone up four rankings to 36th position. After struggling in LaLiga and changing coaches multiple times, Sevilla FC found stability under the leadership of Jose Luis Mendilibar, who is credited with reviving the team’s success. Further solidifying its international reputation, the club has achieved remarkable results in Europe, defeating British and Italian powerhouses Manchester United FC and Juventus.

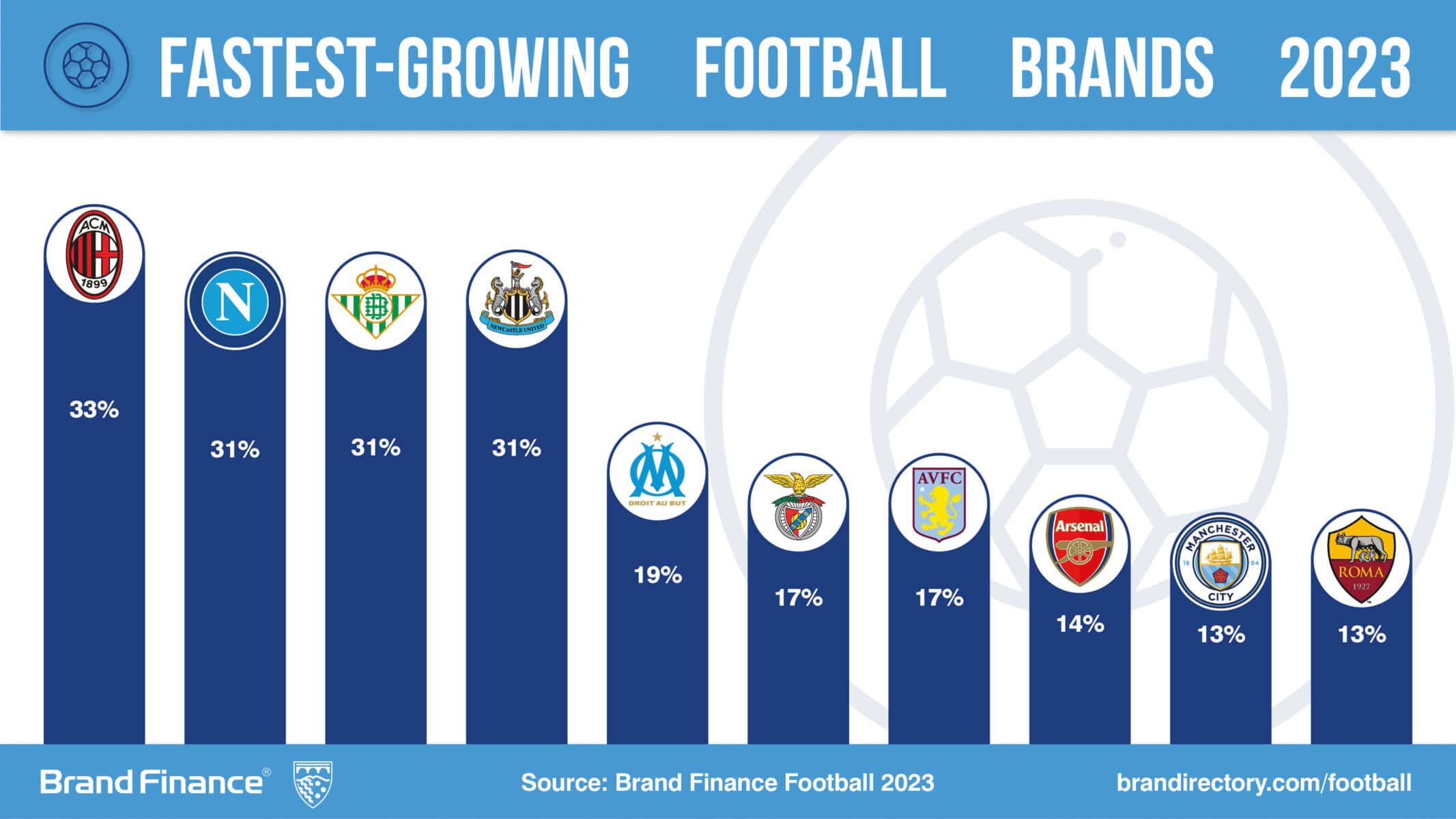

Spain adds two more achievements to its 2023 success, as Real Sociedad (brand value €133.63 million) is a new entrant in 37th place, while Real Betis (brand value up 31% to 153.1 million) shoots up nine positions to 34th to be named the third fastest-growing football club brand. Finishing 6th in LaLiga (ahead of Sevilla FC in 12th), Real Betis is hoping to further boost its brand strength and global recognition through a €70 million renovation of its home stadium. Further, Brand Finance also ranked Real Betis 2nd, one spot ahead of Real Madrid CF, in its Football Sustainability Index. The club’s commitment to raising awareness about climate change has further bolstered its positive reputation worldwide.

Manchester United FC (brand value up 9% to €1.4 billion) now sits one rank ahead of its historic rival Liverpool FC (brand value up 7% to €1.4 billion) in fourth and fifth position respectively. Both clubs have recorded positive brand value trajectories since 2022, finally surpassing their pre-pandemic values. After two Covid-hit seasons, 2022-2023 saw the continued return of live matches and fans to stadiums, resulting in increased ticket sales and revenues.

Jurgen Klopp's appointment as manager of Liverpool FC in 2015 has propelled the club to unparalleled success, establishing them as one of the country’s most formidable teams. As for its rival, Erik ten Hag’s arrival as Manchester United's leader in 2022 also seems to have resurged the club’s reputation. The Red Devils’ win against Newcastle United to win the League Cup this year saw them clinch their first trophy in six years.

Arsenal FC (brand value up 14% to €906.28 million) is up two positions from 2022 and now ranks 8th. Squad investments, (Arsenal FC signed Gabriel Jesus and Oleksandr Zinchenko from Manchester City FC in summer 2022) strengthened on-pitch tactics, and Mikel Arteta’s effective leadership have all contributed to The Gunners’ strong season, their 3-1 win over Chelsea FC (brand value up 1% to €860.5 million) on May 3rd propelling them to the top of the Premier League. Although eventually beaten into a respectable second by Manchester City FC, Arsenal FC set the record for the most days spent at the top of the league without winning it. Further, their status as the youngest squad in the league instils hope among key stakeholders for a promising future.

AC Milan represents Italy as the fastest-growing football club brand for second year running

AC Milan (brand value up 33% to €357.98 million) ranks 15th this year and is named the fastest-growing football club brand, closely followed by SSC Napoli, (brand value up 31% to €239.81 million) in 18th as the second-fastest growing. AC Milan had a successful season, reaching the Champions League semi-finals and holding a respectable 4th position in Serie A. The club's brand value has increased through royalties and sponsorships, totalling nearly €20 million in 2022. Also solidifying its growing success, SCC Napoli has stormed to the top of the Serie A league following continued on-pitch success. Revenues generated from the Serie A and the Champions League qualifiers, in addition to broadcasting and sponsorship opportunities, have further propelled the club’s growth.

Paris Saint-Germain (brand value up 10% to €1.1 billion) has moved up one rank into 6th, overtaking 2022 rival FC Bayern Munich (brand value down 1% to €1.1 billion) who drops to 7th. PSG, the current top-ranked team in the French Ligue 1, gained global recognition and popularity following the 2022 World Cup, which saw young talent Kylian Mbappé, and footballing legend Lionel Messi go head-to-head in a historic final. The club’s formidable and widely recognised powerhouse trio of Messi, Mbappé, and Neymar, has solidified PSG’s iconic status, in the footballing world and beyond.

Germany has 10 clubs in the 2023 ranking, with its strongest and most valuable club brand, FC Bayern Munich holding its top 10 rank in 7th. Although the team made a record start to the season, they are facing increasing competition from other German clubs. They sit in 2nd place behind Borussia Dortmund (brand value up 5% to €541.92 million, ranked 13th) in the Bundesliga, while Bayern also recently suffered their first-ever defeat by RB Leipzig (brand value down 9% to €222.46 million, ranked 19th). That said, Bayern’s exceptional talent pool, global reputation and popularity remains undisputed; the club have secured more victories than all remaining Bundesliga teams combined and boast an enormous global fan base.

Brand Finance research finds that the Bundesliga’s brand value has decreased by a further 8% since 2022. The perception likely persists that the Bundesliga is less competitive compared to the Premier League and Serie A, as major British and Spanish clubs continue to dominate the brand value and strength rankings, while Bayern Munich remains the sole German club in the top 10.

Flamengo (brand value up 2% to €97.85 million) have dropped from 49th in 2022 to 50th position in 2023. Despite Brazilian hopes for their success, the team were knocked out of the 2023 FIFA Club World Cup in February after a disappointing defeat to Saudi Arabian team, Al-Hilal. That said, the Brazilian club still performs respectively in the BSI ranking, dropping only one place to 16th. This strong result indicates that the club maintains a favourable global reputation, attributed to the successful legacy and rich heritage of its nation’s football culture. Flamengo also achieves the second-highest score globally for its passionate fan base.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.