View the full Brand Finance Europe 500 2022 report here

Mercedes-Benz remains most valuable European brand

Mercedes-Benz (brand value up 6% to €52.4 billion) remains the most valuable European brand despite only moderate growth in a tough year for automotive brands. Amid challenging market conditions due to the pandemic and an industrywide semiconductor shortage, the brand prioritized electromobility and has seen great results from it. The German automobile giant confirmed that their electric vehicles sales saw a 90% increase this year.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. Europe’s top 500 most valuable and strongest brands are included in the annual Brand Finance Europe 500 2022 ranking.

This year, Mercedes-Benz launched the sixth generation of the C-class series with a new interior design and is planning to implement autonomous driving features. At the same time, an industry-wide trend to make a transition to electric vehicles and a sustainable approach to production and distribution is on the rise.

A key development to strengthen the Mercedes-Benz brand is the rebrand of Daimler AG to Mercedes-Benz Group AG. The focus of the rebrand is to enhance passenger cars and vans in the luxury segment. The strategic move to rebrand was to fulfil the brand’s objective to focus on financial and mobility services by offering insurance and rental subscriptions and digital fleet management systems.

Other German brands did not fare so well in the ranking this year, with Volkswagen (brand value down 12% to €35.4 billion), BMW (brand value down 5% to €32.7 billion), Porsche (brand value down 1% to €29.1 billion) and Audi (brand value down 18% to €11.9 billion) all seeing losses in brand value. With lockdowns, network contractions in production and the ongoing semiconductor shortage, the industry faces many challenges. Apart from sector wide disruptions, the German automakers who were reliant on diesel-powered vehicles have had to deal with regulatory challenges and the transition to electric mobility and electric production methods, resulting in rolling back on production to meet industry trends.

Deutsche Telekom is Europe’s second most valuable brand, up 44% in value since the start of the pandemic

Deutsche Telekom (brand value up 19% to €51.9 billion) has grown quickly in value to retain its position as the second-most valuable European brand, and to become the second-most valuable telecoms brand in the world. Deutsche Telekom is moving to consolidate its brands globally by introducing a new logo which has the potential to unify its “T” branding across both its T Mobile and Deutsche Telekom divisions internationally. Initially, the letter “T” will dominate digital channels and sponsorships, with the eventual deployment of “T” collateral into physical buildings and retail outlets.

Since 2020, Deutsche Telekom’s brand value has gone up by 44% in total. Successful business performance and high customer growth, especially in the United States, are the main contributors to this significant increase. In addition, the Group again scored points through sustained investments in network quality, digital technologies, and customer service.

David Haigh, Chairman & CEO of Brand Finance, commented:

“The unification of Deutsche Telekom’s branding internationally offers an opportunity to strengthen the brand amongst different consumer groups. This will allow the T brand to spread across various jurisdictions and benefit from globalized efficiencies – especially as it transitions from a challenger-brand in the US to become an established market leader as it is in Germany and some other European jurisdictions.”

Shell is Europe’s third most valuable brand, valued at €43.1 billion

Shell (brand value up 20% to €43.1 billion) has grown its brand value strongly this year, jumping from 4th place to become the 3rd most valuable European brand (and most valuable brand from the United Kingdom). Shell’s value is growing despite the challenges of COVID, the conflict in Ukraine, and perceptions of corporate sustainability practices in the oil and gas sector increasingly affecting consumer choice.

Shell has placed a large emphasis on their energy transition strategy, and it seems to be making a positive contribution to the strength of their brand. Shell aim to become a net-zero emissions energy business by 2050, in step with society’s progress towards the goals of the Paris Agreement on climate change. Shell’s efforts to develop new clean energy technologies, including electric vehicle charging, are likely to have a positive impact on the strength of their brand in future.

David Haigh, Chairman and CEO of Brand Finance, commented:

“The energy transformation is both the greatest challenge and the greatest opportunity facing Shell. Shell will be challenged to transform in coming years to simultaneously navigate the recovery from Covid, the conflict in Ukraine, and broader concerns about environmental sustainability in the future.”

STRENGTH: Ferrari remains strongest European brand with AAA+ brand rating, EY jumps up to second place

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

Ferrari (brand value down 12% to €6.9 billion) is the strongest brand in Europe, and the strongest automobile brand in the world with a Brand Strength Index (BSI) score of 90.9 out of 100 and a corresponding AAA+ rating.

2021 was Ferrari’s best-ever year in terms of sales, with the company paying bonuses to all employees as a result, and the projected growth for 2022 remains high. The automotive brand’s historic pursuit of controlled growth has helped to preserve its exclusivity within its sector, however, last year Ferrari expanded its target market to a younger demographic by launching a new high-end fashion line. The aim of creating a brand that can cater to Italian luxury lifestyle in the high-end category will help expand and strengthen its brand portfolio into new avenues, whilst enhancing brand awareness amongst the younger generation.

EY (brand value up 16% to €20.0 billion) is Europe’s second-strongest brand with a Brand Strength Index (BSI) score of 89.5 out of 100 and a corresponding brand rating of AAA+. The brand strength of EY is boosted by their client focus, with research showing improvements to their already strong customer consideration and satisfaction.

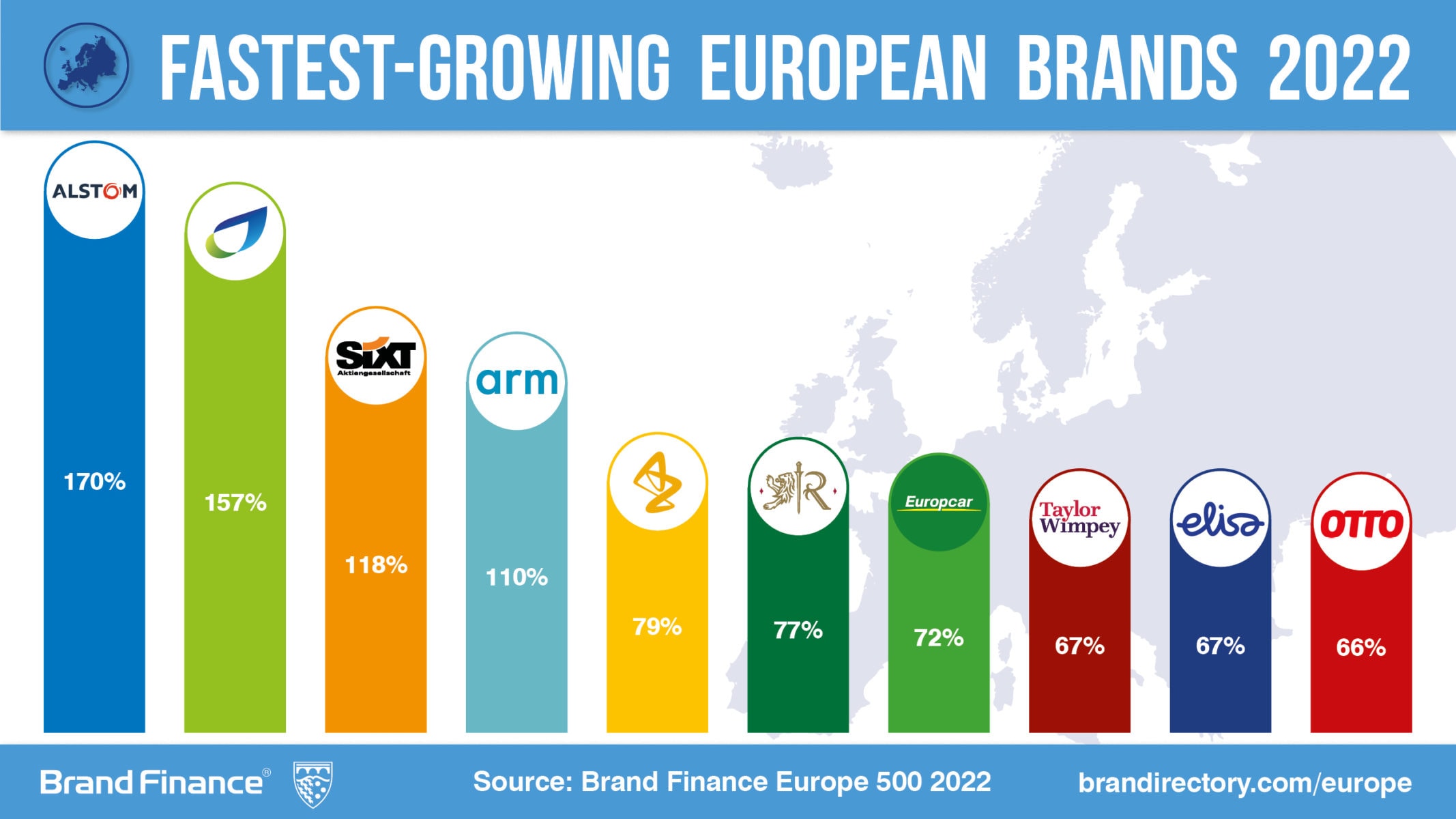

GROWTH: Alstom is Europe’s fastest-growing brand as brand value almost triples, British Gas is second with 157% increase, Sixt third with 118% value growth

Alstom (brand value up 170% to €1.0 billion) is Europe’s fastest-growing brand this year, with the French engineering brand completing the acquisition of Bombardier Transportation this year. The combined brand now has extensive, and complementary, reach globally, with Bombadier’s key customers in northern Europe and North America complementing the customers of Alstom. As a result, the combined brand now has the world’s largest installed base of rail vehicles worldwide, from light-rail and monorail vehicles through to high-speed trains.

British Gas (brand value up 157% to €1.1 billion) is Europe’s second fastest-growing brand this year. Much of the value increase is derived from the addition of over 500,000 new residential energy customers via M&A activity. The switch is likely to affect the way those customers perceive British Gas and may impact future brand strength performance.

Sixt (brand value up 118% to €1.2 billion) is Europe’s third fastest-growing brand, and the world’s fastest-growing car rental brand this year. This year’s increase is the continuation of an impressive growth trend for SIXT, which has seen its brand value more than triple in value over the past five years. The brand has built a strong international growth strategy, expanding rapidly in the United States and entering new markets, such as Australia.

David Haigh, CEO & Chairman of Brand Finance, commented:

“SIXT’s brand value has recorded incredible growth over the past 5 years. Its strategy of international expansion, coupled with fostering strategic partnerships across the automobile, technology, and hospitality sectors, as well as the introduction of new subscription models, is paying clear dividends.”

View the full Brand Finance Europe 500 2022 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Europe’s top 500 most valuable and strongest brands are included in the Brand Finance Europe 500 2022 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Europe 500 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.