View the full Brand Finance Automotive Industry report here

Toyota dethrones Mercedes

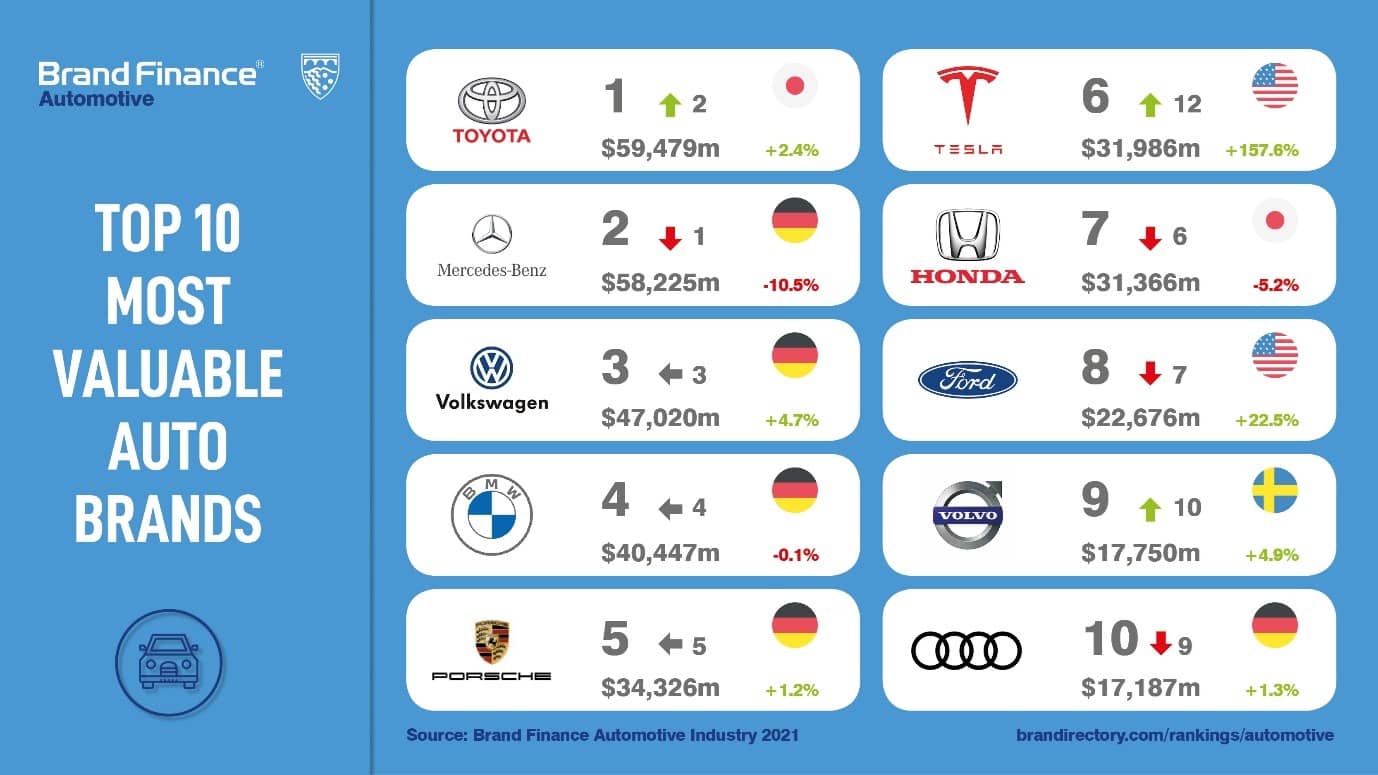

Toyota has overtaken Mercedes-Benz to claim pole position as the world’s most valuable automobile brand for the first time since 2017, following a modest 2% uplift in brand value to US$59.5 billion, according to the latest report by Brand Finance – the world’s leading brand valuation consultancy.

Toyota has not suffered the same output reduction experienced by rivals, and sales in Q3 2020 increased in Japan, North America, and Europe, with the car manufacturer upgrading its global sales forecast to 9.73 million units for the fiscal year. Additionally, net profit for the Japanese giant soared by 50% in Q3 2020. Toyota also benefited from a jump in sales in China – increasing by over 10% year-on-year – after improved ties with the Chinese government, which is interested in Toyota's green tech.

The brand has recently announced its foray into the EV market, with the launch of the SUV model planned in the coming year - this being the first of six-intended using the new e-TNGA platform that it has co-developed with Subaru (down 6% to US$8.2 billion).

Alex Haigh, Valuation Director, Brand Finance, commented:

“Toyota is outperforming competitors in a difficult business environment, while Japan's car industry has remained relatively stable as major markets rebound from the global impacts of the pandemic. Toyota has been around for over 75 years, evolving from a small subsidiary of a Japanese weaving firm to one of the most respected and trusted automobile brands in the world. Toyota's performance isn't a fluke... high-quality architecture, unyielding creativity, and innovative steps have all contributed to its growth.”

While the pandemic has taken a heavy toll on the global auto sector, demand recovered swiftly in the second half of last year, most notably in the US and China. However, a shortage of semiconductors is forcing carmakers to cut back production, with Honda (down 5% to US$31.3 billion) and Nissan (down 9% to US$16.2 billion) downgrading sales forecasts for the current fiscal year, citing in part the chip shortage. In fact, Nissan has seen some of the industry’s largest declines, with profits sinking by 33% – the lowest levels since 2009 – rendering the automobile brand practically unprofitable.

In addition to measuring overall brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, customer familiarity, staff satisfaction, and corporate reputation. According to these criteria, Maruti Suzuki (up 8% to US$3.0 billion) is the region’s strongest automobile brand with a Brand Strength Index score of 88.2 out of 100, while Toyota is the third strongest with a BSI score of 86.8 out of 100 and AAA rating.

As India’s largest auto manufacturer, Maruti Suzuki, has been driving the CNG side of its business heavily in recent years, with compressed natural gas engine options offered in eight models from its line-up of 14. With the rise in popularity for these types of vehicles ever-increasing – as concerns around the environment build, government regulations on emissions rise and from the need to reduce fuel costs – Maruti Suzuki is putting itself in a strong position for future growth too.

Tesla leaves traditional auto marques behind

The importance of technological innovation as a driving force behind brand value is best exemplified by Tesla (up 158% to US$32.0 billion), the fastest-growing brand in the world this year in the Brand Finance Auto 100 2021 ranking.

Emerging unscathed from the various controversies surrounding CEO, Elon Musk, Tesla’s market capitalisation has grown by an eyewatering US$500 billion over the last year, making it worth as much as the nine largest automobile manufacturers in the world combined. The California-headquartered auto brand has also celebrated record numbers of sales this year, ramping up production of its Model Y car and expanding into new markets by opening a plant in Shanghai. As the world’s best-selling plug-in and battery electric passenger car manufacturer as well as a pioneer in using artificial intelligence in the automobile industry, Tesla has continued to strive for innovation and sustainability, developing more efficient battery cells.

Mercedes lacks horsepower

German brands still command the autos industry, with the nation’s eight brands that feature in the ranking accounting for 34% of the total brand value, equating to an impressive US$201.8 billion. Germany is also home to four out of the top five in the ranking: Mercedes-Benz (down 11% to US$58.2 billion), Volkswagen (up 5% to US$47.0 billion), BMW (stagnant at US$40.4 billion) and Porsche (up 1% to US$34.3 billion).

While Teslaraces ahead of the crowd, it has been a difficult year for most traditional car manufacturers, with last year’s most valuable brand, Mercedes-Benz (down 11% to US$58.2 billion), seeing the largest brand value drop among this year’s top 10, resulting in losing its spot as most valuable automobile brand in the world. With sales impacted by COVID-19, the iconic German marque also struggled to formulate a coherent electric mobility strategy and communicate a clear vision for its electric car models, ultimately leading to its slip behind Toyota in the ranking.

Volkswagen has recorded healthy results this year, both for brand value and brand strength – its brand value up 5% to US$47.0 billion and its BSI score increasing 2.8 points to 81.3 out of 100. The brand has continued to focus on its ‘New Volkswagen’ strategy – described as a new era for the brand – as well as implementing its TOGETHER 2025+ strategy, which the ultimate aim of selling 50 different fully-electric vehicles and another 30 plug-in hybrid options, should the brand be successful it will overtake Tesla to become the world’s largest electric carmaker.

Similarly, Porsche (up 1% to US$34.3 billion) has also recorded healthy performances in brand value and BSI, which has jumped 1.7 points to 84.2 out of 100. Porsche celebrated strong sales of the Taycan which totalled over 20,000 units sold last year, despite a six week pause in production due to the pandemic. This impressive result means that over 10% of Porsche’s sales are now from its EV models.

No Gambler’s Fallacy for Ferrari

For the third year running, Italian luxury sports car manufacturer, Ferrari, has retained its position as the world’s strongest automobile brand with a Brand Strength Index (BSI) score of 93.9 out of 100. Ferrari is the only brand out of the ranking’s 100 to achieve the elite AAA+ rating.

Ferrari reacted proactively to the pandemic, initially shutting down production and then reopening with a focus on creating a safe working environment. This both minimised disruption and reinforced the brand’s reputation as a high-quality and responsible firm. In line with this, Ferrari ranks high for reputation in our Global Brand Equity Monitor study, particularly in Western Europe (in the top 3 of all brands researched in each of France, Italy, and the UK). Ferrari remains a highly desired brand, albeit aspirational rather than accessible for many.

Alongside revenue forecasts, brand strength is a crucial driver of brand value. As Ferrari’s brand strength maintained its rating, its brand value grew, improving 2% to US$9.2 billion. For years, Ferrari has utilised merchandise to support brand awareness and diversify revenue streams and is now taking steps to preserve the exclusivity of the brand, planning to reduce current licensing agreements by 50% and eliminate 30% of product categories.

Michelin most valuable and strongest tyres brand

The tyres sector has taken a hit over the last year and all brands in the Brand Finance Tyres 10 ranking have lost brand value. Owing to the lack of travel due to lockdowns, car sales are declining, which means tyre brands are selling less units, resulting in a drop in market equity across the industry. Furthermore, since the economy has been riskier in general over the past year, investor risk has increased, triggering a rise in the cost of capital.

Despite the sector woes, Michelin has maintained the title of the world’s most valuable and strongest tyres brand, with a brand value of US$6.8 billion and a BSI score of 84.8 out of 100.

While the sector may be struggling in the wake of the pandemic, Michelin still managed to push ahead with its innovation strategy, designing its first ever eco-tyre, the MICHELIN e.PRIMACY. Delivering high performance while reducing environmental impact, the MICHELIN e.PRIMACY is rated A for energy efficiency and B for wet grip. With fewer than 1% of tyres delivering a winning combination of A-rated rolling resistance and A or B-rated grip, this makes the MICHELIN e.PRIMACY one of the best tyres currently available on the market.

As with many industries globally, the tyre industry is not immune from the environmental spotlight and is a culprit within the climate crisis – from high levels of emissions in production to causing plastic pollution in the ocean. Michelin has committed to making its tyres 100% sustainable by 2050 as it continues to strive towards becoming the leader in sustainable mobility. The brand has entered strategic partnerships and collaborations to ensure this ambitious target is met and to realise its “All-Sustainable” vision. This drive is being mirrored by competitor Bridgestone establishing its Milestone 2030 last year, a new set of medium-term environmental targets.

In terms of brand value, Bridgestone is still only marginally behind Michelin, with a brand value of US$6.8 billion. Bridgestone posted a net loss last year for the first time in 69 years, with the pandemic denting sales in all its major markets.

Alex Haigh, Valuation Director, Brand Finance, commented:

"Bridgestone and Michelin are the world's two leading tyre manufacturers both with extensive experience on the track.

They have proven their merit on racetracks around the world, but it’s their consumer car tyres that people are most curious about.

Michelin is an elite tyre maker with an emphasis on creativity and technology, and you can bet that its ‘normal' tyres contain some of that racing experience.

Bridgestone places greater emphasis on the ‘everyday' driver, so although its tyre line isn't especially extensive, Bridgestone obviously understands its customers and what they want from their automobile tyres."

View the full Brand Finance Automotive Industry report here

ENDS

Note to Editors

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s 100 most valuable auto brands, 10 most valuable tyres brands, 20 most valuable auto components brands and 10 most valuable car rental services brands are included in the Brand Finance Automotive Industry 2021 report.

The full Brand Finance Auto 100 ranking, additional insights, charts, more information about the methodology, as well as definitions of key terms are available in the Brand Finance Automotive Industry 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.