View the full Brand Finance Food 100 2023 report here

Nestlé once again named world’s most valuable food brand, brand value USD22.4 billion

Nestlé (brand value up 8% to USD22.4 billion) once again earns the title of the world’s most valuable food brand, according to a new report from leading brand valuation consultancy, Brand Finance. Nestlé's brand value has steadily increased this year due to strong sales growth across its extensive and varied brand portfolio.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 100 most valuable and strongest Food brands are included in the annual Brand Finance Food 100 2023 ranking.

Nestlé’s ability to meet evolving consumer preferences, stay ahead of trends, and effectively launch new products has been a driving force behind its continued brand value growth. This year, Nestlé expanded its plant-based portfolio with the introduction of a new milk alternative, catering to an ever-increasing global demand for plant-based products. The brand also launched its first-ever Nescafé Ice Roast coffee, designed to satisfy rising consumer demand for iced coffee at home.

Savio D'Souza, Valuation Director at Brand Finance, commented:

“As an iconic global brand, Nestlé continues to raise the bar, setting new benchmarks for the industry and inspiring trust among consumers worldwide. With a rich heritage and a portfolio of trusted brands, Nestlé has built a legacy of success and an unmatched global reputation, enhanced by its enduring dedication to creating a healthier and more sustainable future for all."

Chinese dairy brand Yili is the second most-valuable food brand, valued at USD12.4 billion

Chinese dairy brand Yili (brand value up 17% to USD12.4 billion) retains its title as the world’s second-most valuable food brand. Yili has fostered strong customer loyalty in its local market by consistently delivering products of exceptional quality and perceived health benefits. This has contributed to strong domestic sales growth, while the brand’s global presence has also propelled its overseas revenue. Yili products are available in over 60 countries across five continents worldwide.

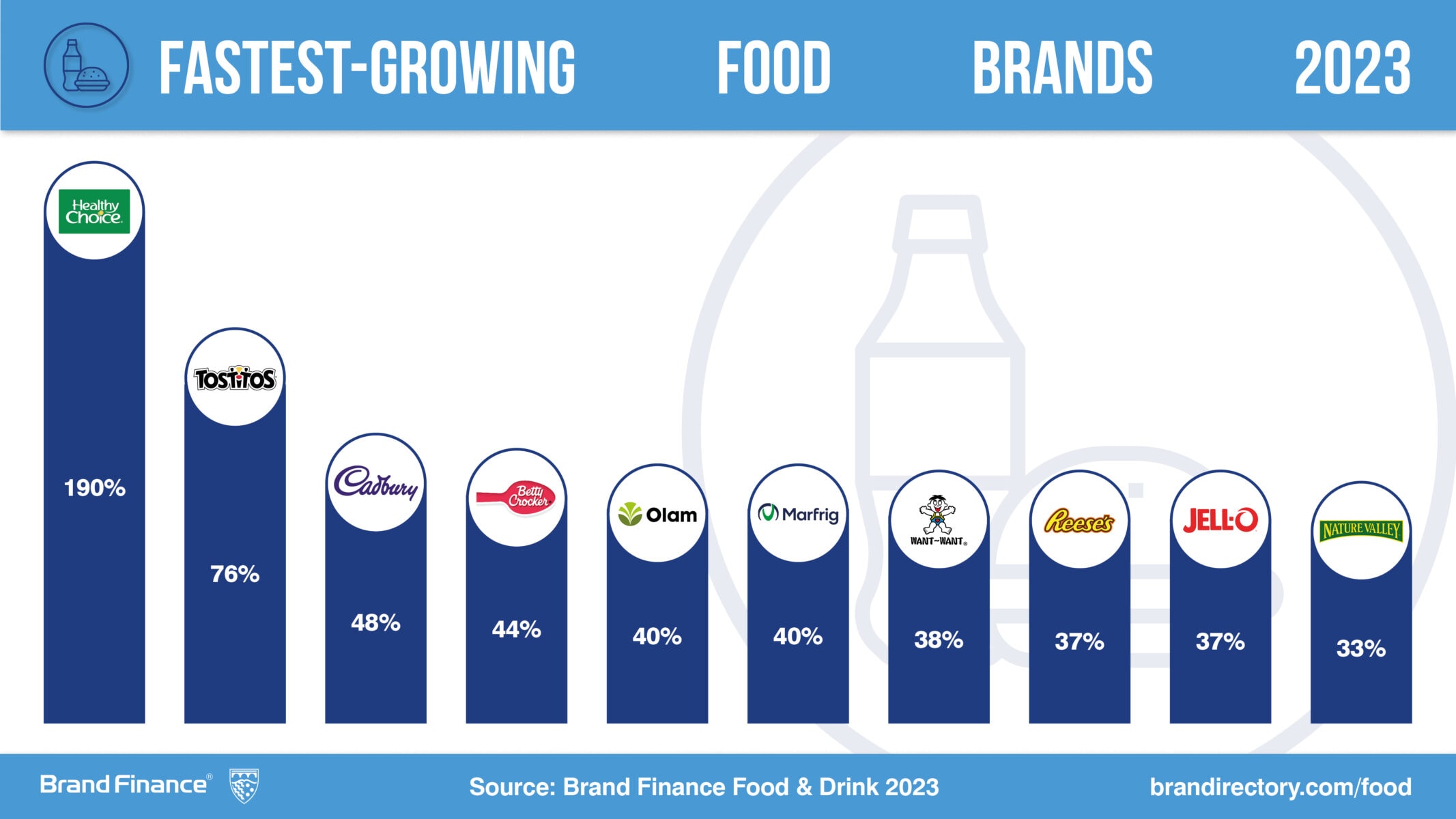

Snack brands see strong brand value growth

The snack industry has continued to grow in brand value in the post-pandemic world, with this year’s top five snack brands (Lay’s, Doritos, Want Want, Cheetos and Tostitos) increasing their brand values by an impressive average of 40%. A notable performer is Lay’s (brand value up 29% to USD11.1 billion), which also retains third place position in the Food 100 ranking overall. With its rich history and global presence, Lay’s’ strong performance can be attributed to its innovation and product developments, popular and far-reaching marketing campaigns, and enhanced e-commerce strategies since the pandemic.

Healthy Choice is a fresh new entrant as this year's fastest growing food brand

Healthy Choice, (brand value up 190% to USD1.2 billion) a frozen food brand owned by ConAgra Foods, is a new entrant in this year’s Food 100 ranking. As consumer demand for healthier options continues to increase following the pandemic, food brands are under increasing pressure to manufacture and promote more nutritious offerings. Coupled with resilient demand for frozen foods, this trend has enormously benefitted the Healthy Choice brand, which strategically markets its products as nutrition-packed and convenient, while also offering a range of modern and delicious recipes.

Hershey holds onto title as the world's strongest food brand, with an AAA+ rating

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

Hershey (brand value up 12% to USD3.9 billion) reigns supreme as the world’s strongest food brand, building on last year’s success with an AAA+ rating and an impressive Brand Strength Index (BSI) score of 91/100. Despite increased inflation rates, supply chain disruptions, and an extended period of global economic uncertainty, customer demand for Hershey products remains strong. As well as boosting its familiarity across the globe, the American confectionary giant continually seeks to adapt and extends its product portfolio and meet the needs of its enormous consumer base.

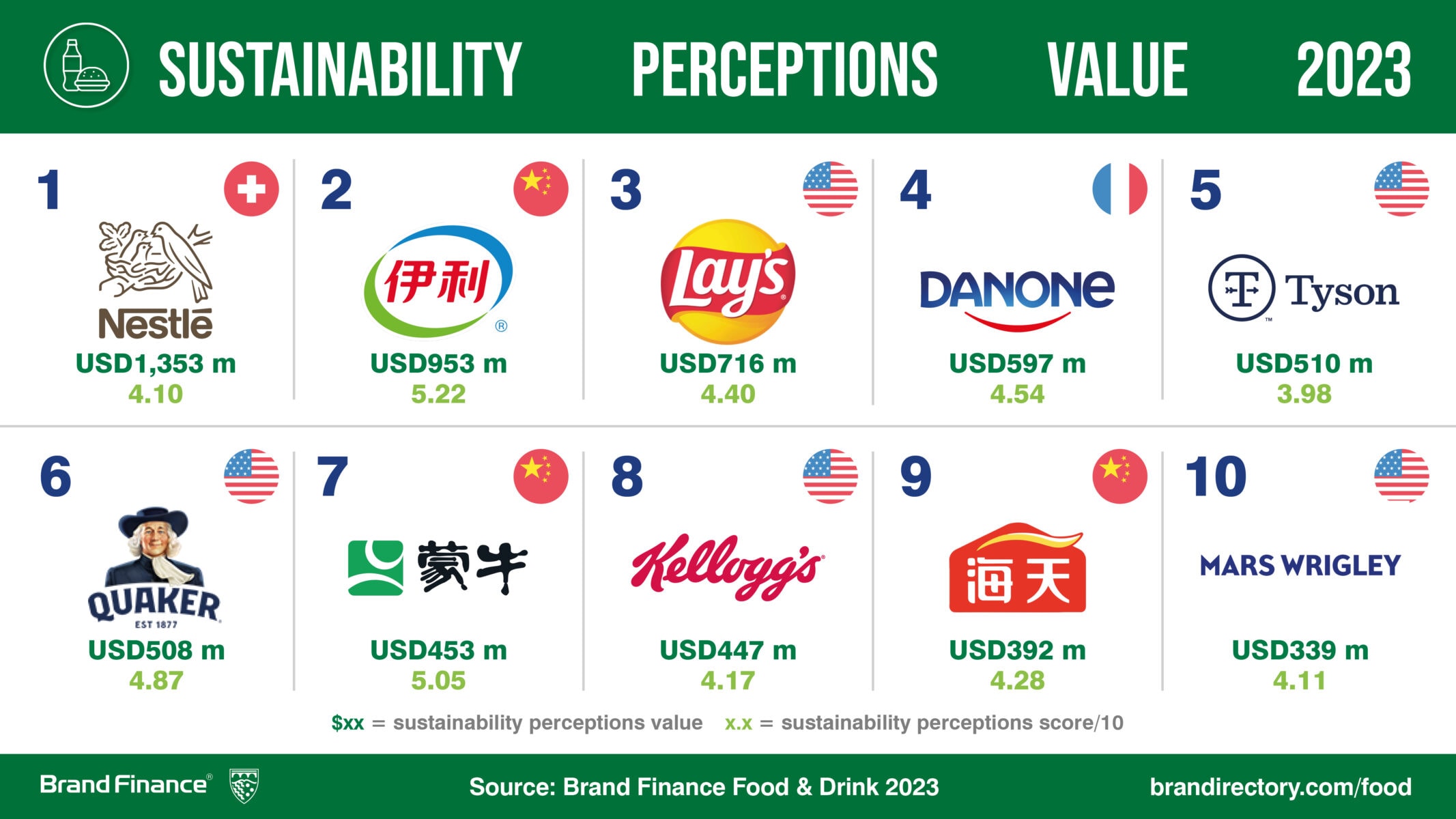

Nestlé has the highest Sustainability Perceptions Value at USD1.35 billion

This year’s most valuable food brand Nestlé also has the highest Sustainability Perceptions Value in the Food 100 2023 ranking, valued at USD1.35 billion. The Swiss giant’s ongoing commitment to environmental and social responsibility, responsible sourcing, and nutrition has contributed to its global perception as a sustainable company.

Nestlé’s position at the top of the SPV table is not an assessment of its overall sustainability performance, but rather indicates how much brand value it has tied up in sustainability perceptions. That said, the brand has made significant progress in its sustainability objectives. For example, Nestlé is the first company to disclose the nutritional value of its entire global product portfolio, benchmarking against the Health Star Rating system. The brand aims to lead the industry in providing delicious and balanced meals worldwide as part of it "Good for You" focus. The brand has also significantly reduced its greenhouse gas emissions and is reportedly on track to achieve 100% renewable electricity by 2025.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.