View the full Brand Finance Rugby 10 2023 report here

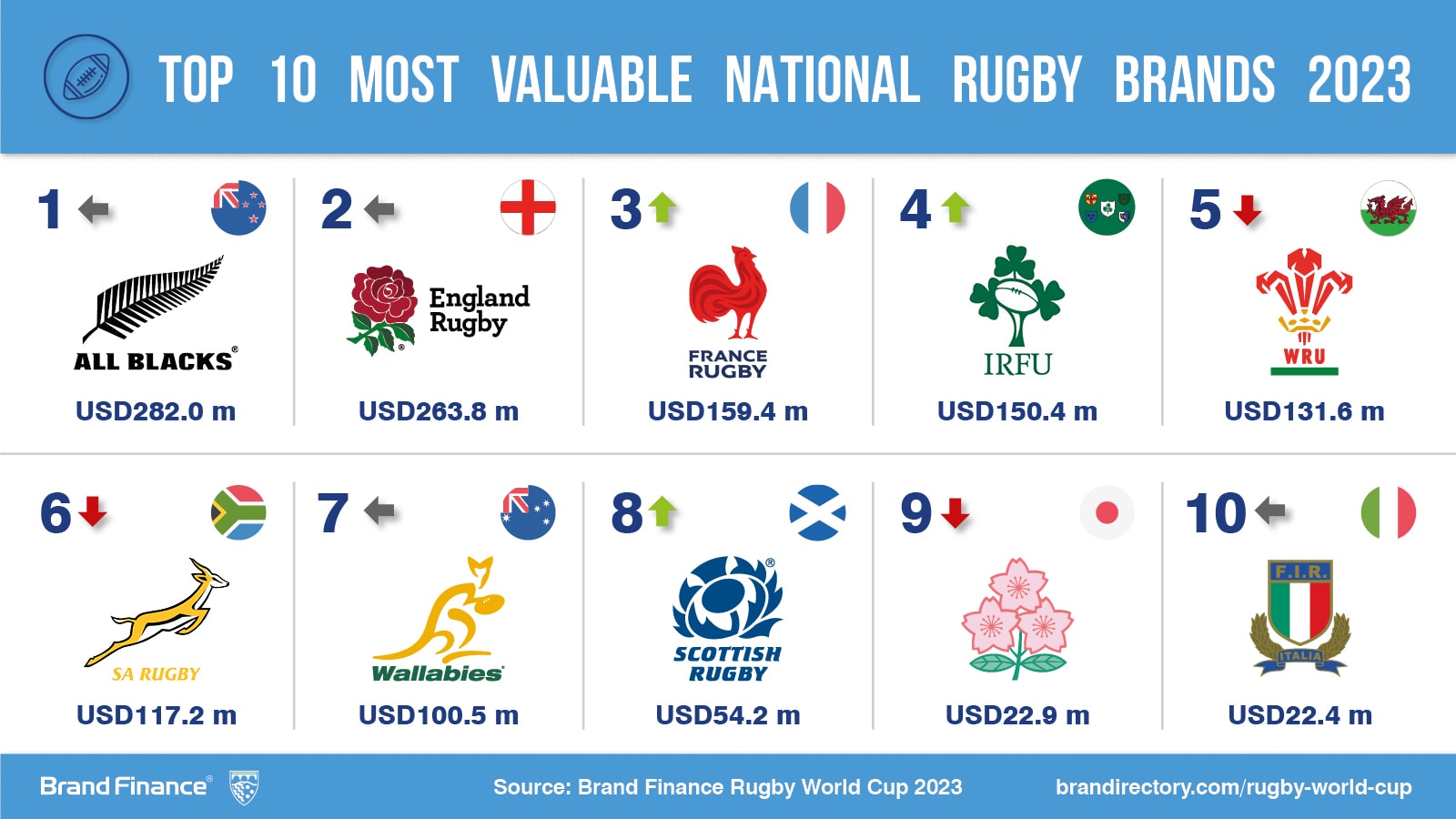

The New Zealand All Blacks (brand value up 52% to USD282 million, NZD 452 million) have continued to assert their dominance as the world’s most valuable rugby team brand, despite their on-pitch authority increasingly being challenged by other rugby nations. The All Blacks retained the top position for brand value, achieving a 52% increase since the last world cup. This growth is attributed to robust revenues, particularly in sponsorship and merchandising over the past four years.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 10 most valuable and strongest rugby team brands are included in the Brand Finance Rugby 10 2023 ranking.

Intense national pride in New Zealand’s rugby heritage and its globally recognised brand continues to drive revenue streams, such as merchandising and sponsorship agreements, including lucrative long-term kit partnerships with Adidas and Altrad. These brand-focused income streams contribute more significantly to the All Blacks' overall value than broadcasting and matchday earnings.

“The revenue from sponsorship and merchandising which is driving the All Blacks’ brand value, in many ways, defies expectations, considering New Zealand's comparatively small economy and rugby market size when contrasted with the second and third-ranked brands – England and France. This underscores the undeniable allure and universal appeal that the All Blacks’ brand has cultivated beyond its home turf.”

Mark Crowe, Managing Director, Australasia of Brand Finance

The All Blacks also remain strongest brand despite dip from 2019 peak

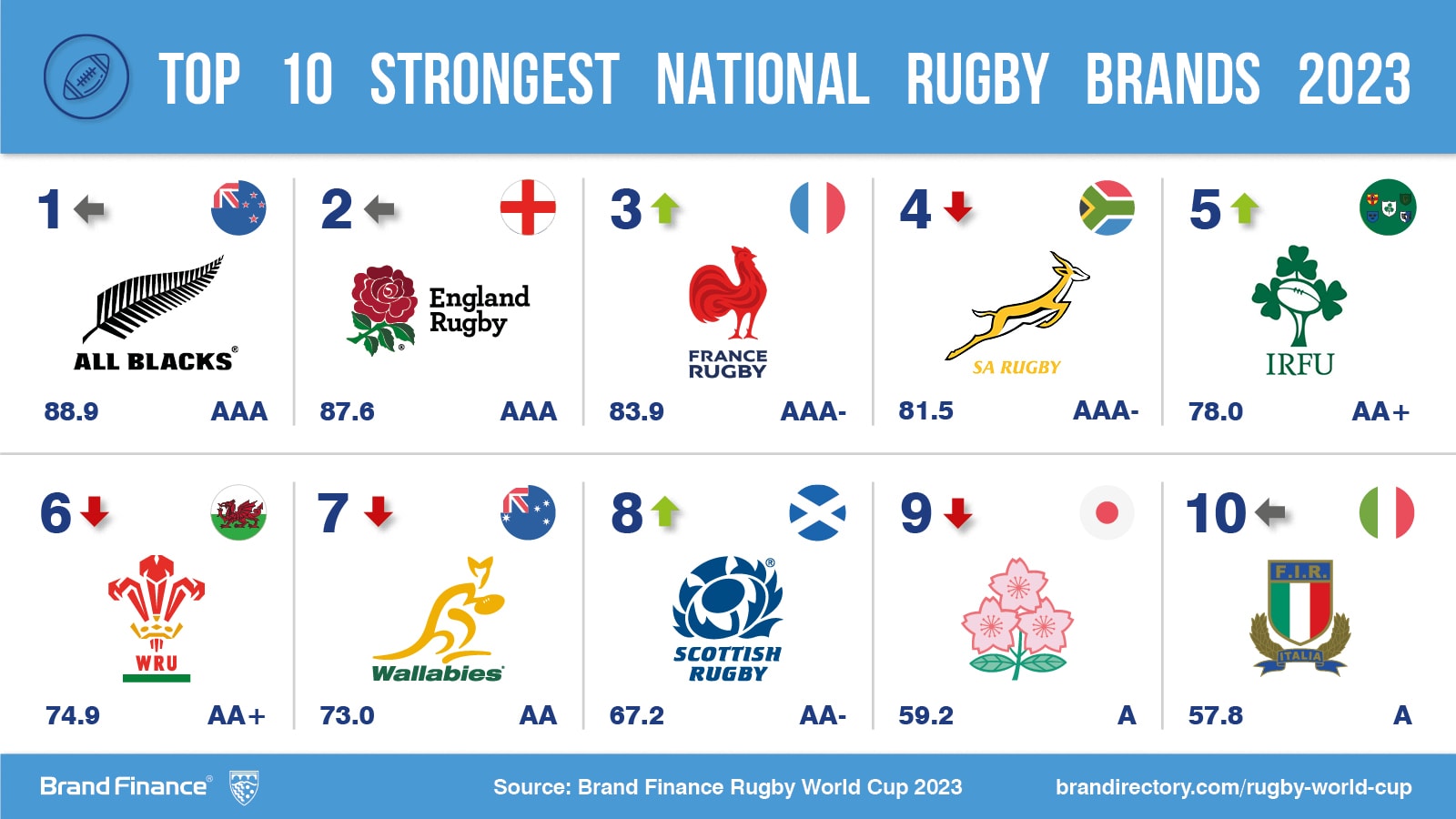

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics including marketing investment via social media, stakeholder equity such as heritage, and business performance through revenues from sponsorship, merchandising, and so on.

The All Blacks were also the strongest brand in the ranking with a Brand Strength Index (BSI) score of 88.9 out of 100 and a corresponding AAA rating. However, it is worth noting that the New Zealand All Blacks’ BSI has experienced a decline since its peak in 2019. The primary factor behind its 6-point decrease is the dip in on-pitch performance in recent years, seeing the team drop to 4th position in World Rugby’s rankings, behind Ireland, France, and South Africa.

Despite this, the resilience of the All Blacks brand is evident in its capacity to maintain its value and strength, despite variations in key performance metrics. This underscores the pivotal role that a robust sporting brand plays in shielding a business from the inherent fluctuations in on-field results.

The Wallabies’ brand strength declines and faces post-World Cup challenges

Across the ditch the Wallabies face concerning challenges ahead. Australia Rugby’s teams Brand Strength Index (BSI) score has dropped significantly, falling 8 points since 2019, from 81 to 73 out of 100. This is the largest decline of all top 10 national rugby team brands. This decline is primarily driven by a weaker on-pitch performance which has reduced fan engagement and sentiment towards the Wallabies. The team’s early exit from the World Cup is likely to place further downward pressure on negative sentiment and the game’s popularity compared to other football codes and Australian sport in general. Looking ahead, this decline in brand strength is likely to also erode the Wallabies’ brand value, unless a significant effort made to restore perceptions and improve governance.

Mark Crowe, Managing Director, Australia of Brand Finance commented:

“The Wallabies brand faces immense pressure both on and off the pitch. Rugby Australia needs to balance the ability to compete against other rugby markets, like Europe and Japan, in providing competitive player remuneration while maintaining development programmes. The early exit from this year’s World Cup is going to intensify this pressure and now, more than ever, it is essential that Rugby Australia works to reform the game and improve participation.”

Mark Crowe, Managing Director, Australia of Brand Finance

England holds firm in second

England Rugby (brand value up 71% to USD264 million, GBP219 million) claim second spot once again, despite entering the World Cup on less-than-great form. England Rugby’s brand value growth is not without thanks to boasting the highest total revenue of all national rugby brands.

France surges to top 3 in terms of brand value and brand strength

France Rugby (brand value up 84% to USD159 million, EUR154 million) has emerged as one of the standout winners in this year’s ranking, surging into 3rd place both in terms of brand value and brand strength. This impressive growth can be attributed to the excitement surrounding the home World Cup and Les Blues’ outstanding team performance, currently ranked as the world’s number 2.

Ireland, the World Number 1 ranked team, overtakes Wales and South Africa

Propelled by its 15th Six Nations win in March 2023, Ireland Rugby (brand value up 94% to USD150 million, EUR145 million) is another rising brand as 2023’s fastest-grower. Ireland Rugby’s 94% increase in brand value has seen the current world’s number 1 overtake Wales Rugby (brand value up 23% to USD132 million, GBP109 million) and South Africa Rugby (brand value up 44% to USD117 million, ZAR1,989 million) to become the 4th most valuable national rugby team brand.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.