Learn more about Brand Finance's Global Soft Power Index

or register interest for the Global Soft Power Summit here

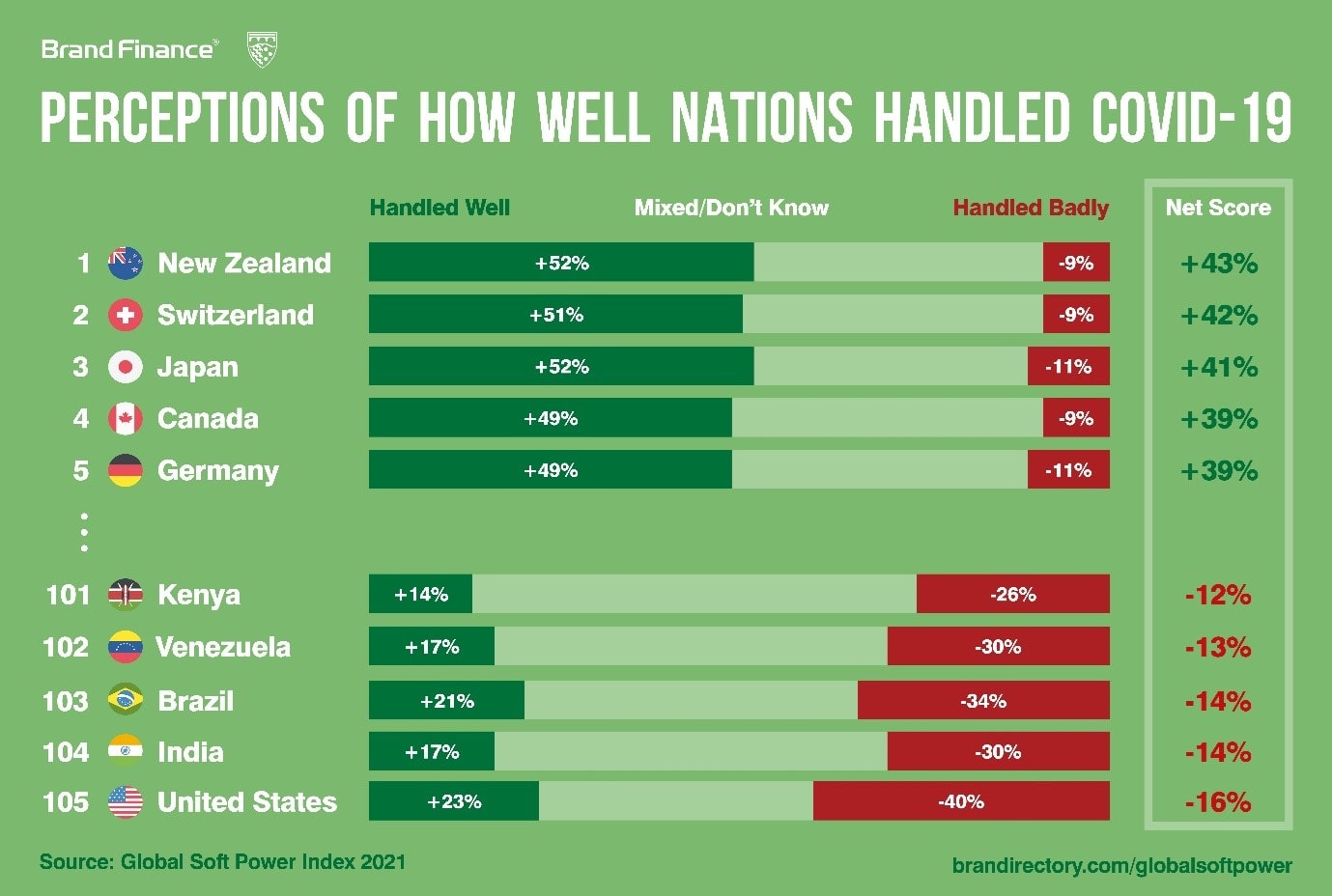

As part of the Global Soft Power Index – the world’s most comprehensive research study on perceptions of nation brands – Brand Finance asked 75,000 respondents from the general public and 750 from specialist audiences about the handling of COVID-19 by 105 nations worldwide. The respondents were asked to rate the nations’ efforts in terms of stimulating the economy, protecting the health and wellbeing of citizens, as well as cooperating on the international stage and providing aid. The full results of the Index will be revealed at the Global Soft Power Summit on 25th February 2021.

Hailed as a global success story in the combat of COVID-19, New Zealand has been rated by the general public as the country that best handled the pandemic, with a net score of +43%. The net score is the difference between ‘handled it well’ and ‘handled it badly’ responses across the three measures (economy, health & wellbeing, and international aid & cooperation). Prime Minister Jacinda Ardern’s swift response and clarity of communication in handling the crisis has been widely praised by the media and recognised by people the world over.

At the other end of the spectrum, ranking bottom among 105 nations globally, the United States has a regretful net score of -16%, certainly a contrast to how strongly the US performed on other metrics in last year’s Global Soft Power Index 2020 survey. President Donald Trump’s response to the pandemic has been causing controversy both at home and abroad, with the president repeatedly refusing to acknowledge and act on the severity of the situation. With the most cases and COVID-19-related deaths globally, the world’s largest and strongest economy has encountered harsh criticism and questioning on the global stage.

David Haigh, CEO of Brand Finance, commented:

“The stark contrast between the public’s perceptions of how New Zealand and the US handled the pandemic, epitomises the two nations’ contrasting visions of the world, spearheaded by almost polar-opposite leaders. On the one hand, we have Ardern’s open, liberal, and compassionate policies versus Trump’s often combative, protectionist, and isolationist approach. With President-Elect Joe Biden getting ready to take the reins of power next year, all eyes will be on him to kickstart recovery across the nation.”

Other Western powerhouses’ weaknesses have also been displayed for the world to see during the pandemic, and their failings have not gone unnoticed by the general public respondents.

France (+15%), United Kingdom (+14%), Spain (+4%), and Italy (-1%), all record particularly low net scores. The UK in particular has struggled to negotiate the ongoing repercussions from the pandemic, including the fallout from the sharpest economic contraction on record – 20.4% in April this year, leaving the nation in a state of turmoil. The UK, Spain, and Italy are currently within the top 10 highest mortality rates per 100,000 in the world, with Italy recording the highest mortality rates per 100,000 among the three at 102.16.

Many affluent nations with a strong reputation of being well-run, have emerged as apparent role models in crisis management in the eyes of the public, often regardless of their approaches to handling the pandemic. Strong net scores above +35% were noted by nations such as Switzerland, Japan, Canada, Finland, Norway, Singapore, Denmark, South Korea, Australia, Austria, and Sweden.

Sweden – a nation that was particularly controversial in its COVID-19 response, snubbing the lockdown consensus and imposing comparatively relaxed restrictions and policies in pursuit of herd immunity – has a troubling 8th highest incidence of deaths per 100,000 in the European Economic Area. However, the general public and specialist audiences both rank Sweden a high 13th globally for its handling of the pandemic across all three measures.

Japan has defied the odds of many that expected the nation to be one of the worst hit at the beginning of the COVID-19 outbreak – due to its proximity to China, its densely populated cities, and burgeoning elderly population. But it has emerged as relatively successful, with lower Coronavirus cases and deaths and with its economy faring better.

At the same time, many other nations do not receive enough credit for their efforts where credit is clearly due. Vietnam’snet score is just +8%, despite recording staggeringly low COVID-19 cases and deaths. The story is the same for Slovakia with anet score of only +5%, but with far fewer cases than its European counterparts and a successful mass asymptomatic testing programme, which countries like the UK are hoping to replicate, the nation nonetheless falls far lower down the ranking than expected.

The UAE is the highest ranked nation in the survey across the Middle East, and 14th globally, with a net score of +33%. The nation’s efforts, from international aid to vaccine development, have meant the UAE is perceived to have handled the pandemic better than its neighbours, Qatar and Saudi Arabia, with net scores of +29% and +24% respectively. The nation’s lower levels of familiarity, compared to nations like Switzerland, Denmark, and Austria seems to be a limiting factor, however.

Steven Thomson, Insight Director at Brand Finance, commented:

“The results demonstrate that in order for nations to establish positive perceptions of their actions, there are many more factors at play than successful implementation of their policies. As shown, reputation plays a vital role, as does familiarity. Nations with high reputations are often given extra credit by the general public, while those receiving low media attention have notably underperformed in the survey.”

According to the specialist audiences, in turn, it was Germany that has come out on top as the country that has handled COVID-19 best, with a net score of 71%. New Zealand was ranked 3rd by specialist audiences with a net positive score of 57%. Compared to the general public, the specialist audiences have understood and recognised the greater challenge that Germany has faced throughout the pandemic, as a nation with a much larger population and shared borders with several other nations, unlike New Zealand.

For the most part, the German government’s and Chancellor Angela Merkel’s response to the pandemic has been received positively both domestically and internationally and the numbers support this with the country recording consistently lower cases per 100,000 than its Western European counterparts.

One further question was added to the Global Soft Power Index survey asking how respondents perceived the World Health Organisation’s handling of the crisis. Overall, 31% of respondents believe WHO ‘handled it well’, compared to 20% who believed it was ‘handled badly’.

Chinese respondents were the most complimentary of WHO’s handling of the crisis, with a net positive response of +53% of respondents saying the organisation ‘handled it well’. At the other end of the spectrum, Japanese respondents were the least complimentary, with a net negative response of -51% of respondents saying the organisation ‘handled it badly’.

Interestingly, there were mixed reviews across the US, which notably withdrew from WHO this year. 35% of US respondents said WHO ‘handled it well’, 26% ‘handled it badly’ and 33% answered ‘mixed’.

ENDS

Note to Editors

The full results of the 2021 Global Soft Power Index will be revealed on 25th February 2021 at the Global Soft Power Summit. To register your interest for this event, sign up to our mailing list, or simply learn more about the Global Soft Power Index, email softpower@brandfinance.com.

The inaugural Global Soft Power Index 2020 report and the findings of last year's study are free to access online. Our interactive dashboard allows you to explore the full results from the survey in maps and charts, rank nations by metrics and statements, and choose data sets to create your own graphs.

Full General Public results for COVID-19 question

| Rank | Nation | Net Index Score | Rank | Nation | Net Index Score | |

| 1 | New Zealand | 43% | 53 | Morocco | 9% | |

| 2 | Switzerland | 42% | 54 | Poland | 9% | |

| 3 | Japan | 41% | 55 | Hungary | 9% | |

| 4 | Canada | 39% | 56 | Bangladesh | 9% | |

| 5 | Germany | 39% | 57 | Angola | 9% | |

| 6 | Finland | 38% | 58 | Uganda | 8% | |

| 7 | Norway | 38% | 59 | Vietnam | 8% | |

| 8 | Singapore | 37% | 60 | Indonesia | 8% | |

| 9 | Denmark | 37% | 61 | Egypt | 7% | |

| 10 | South Korea | 37% | 62 | Chile | 7% | |

| 11 | Australia | 37% | 63 | Pakistan | 7% | |

| 12 | Austria | 36% | 64 | Ethiopia | 7% | |

| 13 | Sweden | 35% | 65 | Croatia | 6% | |

| 14 | United Arab Emirates | 33% | 66 | South Africa | 6% | |

| 15 | Netherlands | 32% | 67 | Uzbekistan | 6% | |

| 16 | Qatar | 29% | 68 | Cambodia | 6% | |

| 17 | Belgium | 28% | 69 | Peru | 6% | |

| 18 | Iceland | 24% | 70 | Lithuania | 5% | |

| 19 | Estonia | 24% | 71 | Slovakia | 5% | |

| 20 | Saudi Arabia | 24% | 72 | Trinidad & Tobago | 4% | |

| 21 | Russia | 21% | 73 | Bolivia | 4% | |

| 22 | Slovenia | 20% | 74 | Myanmar | 4% | |

| 23 | Portugal | 19% | 75 | Senegal | 4% | |

| 24 | Azerbaijan | 19% | 76 | Algeria | 4% | |

| 25 | Jordan | 18% | 77 | Lebanon | 4% | |

| 26 | Luxembourg | 18% | 78 | Spain | 4% | |

| 27 | Czech Republic | 18% | 79 | Ghana | 3% | |

| 28 | Oman | 17% | 80 | Tanzania | 2% | |

| 29 | Israel | 16% | 81 | Nepal | 2% | |

| 30 | France | 15% | 82 | Dominican Republic | 1% | |

| 31 | Malaysia | 15% | 83 | Iraq | 1% | |

| 32 | Kuwait | 15% | 84 | Nigeria | 0% | |

| 33 | United Kingdom | 14% | 85 | Tunisia | 0% | |

| 34 | Greece | 14% | 86 | Bulgaria | 0% | |

| 35 | Turkmenistan | 13% | 87 | Argentina | 0% | |

| 36 | China | 13% | 88 | Ukraine | 0% | |

| 37 | Turkey | 13% | 89 | Ecuador | 0% | |

| 38 | Bahrain | 13% | 90 | Colombia | -1% | |

| 39 | Uruguay | 13% | 91 | Jamaica | -1% | |

| 40 | Latvia | 12% | 92 | Cuba | -1% | |

| 41 | Kazakhstan | 12% | 93 | Italy | -1% | |

| 42 | Sri Lanka | 12% | 94 | Honduras | -1% | |

| 43 | Serbia | 10% | 95 | Romania | -3% | |

| 44 | Costa Rica | 10% | 96 | Guatemala | -4% | |

| 45 | Panama | 10% | 97 | Congo | -4% | |

| 46 | Coted'Ivoire | 10% | 98 | Mozambique | -5% | |

| 47 | Ireland | 10% | 99 | Iran | -5% | |

| 48 | Zambia | 10% | 100 | Mexico | -9% | |

| 49 | Cameroon | 10% | 101 | Kenya | -11% | |

| 50 | Thailand | 10% | 102 | Venezuela | -13% | |

| 51 | Philippines | 9% | 103 | Brazil | -14% | |

| 52 | Paraguay | 9% | 104 | India | -14% | |

| 105 | United States | -16% |

About the Global Soft Power Index by Brand Finance

For over 15 years, Brand Finance has been publishing the annual Nation Brands report – a study into the world’s 100 most valuable and strongest nation brands. Focusing on the financial value and strength of nation brands, the Brand Finance Nation Brands study is based on publicly available information, including data compiled by third parties for other indices and rankings.

Building on this experience, Brand Finance has now produced the Global Soft Power Index – the world’s most comprehensive research study on perceptions of soft power of 100 nations from around the world. The Global Soft Power Index is based on the most wide-ranging fieldwork of its kind, surveying the general public as well as specialist audiences, with responses gathered from over 75,000 people across more than 100 countries.

Brand Finance has created the Global Soft Power Index to provide an all-round view of perceptions of nation brands – their presence, reputation, and impact on the world stage. Understanding those perceptions is key for governments and corporates alike to achieve success internationally, allowing them to identify strengths and weaknesses, and to improve growth strategies going forward. The stronger the nation’s soft power, the greater its ability to attract investments and market its products and services.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.