View the full Brand Finance Apparel 50 2021 report here

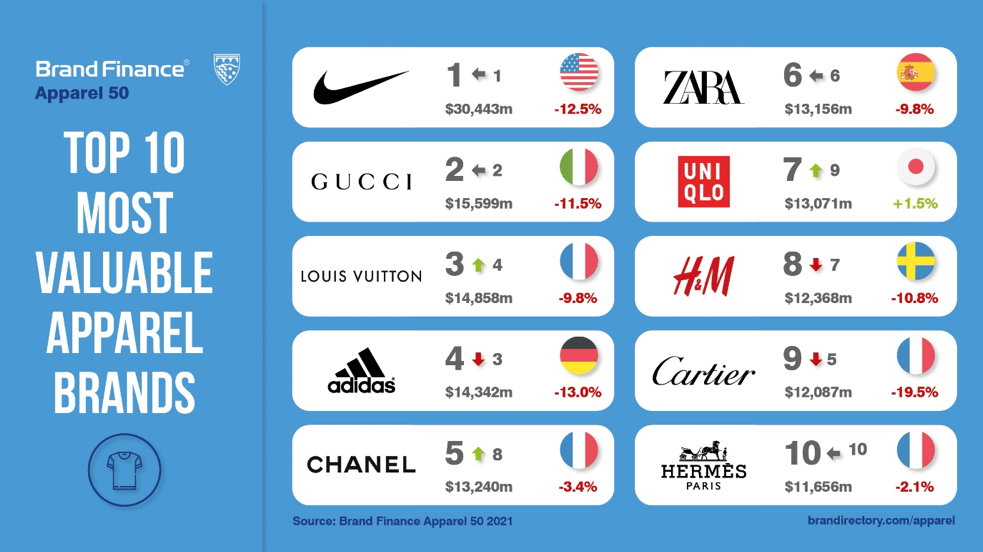

The total value of the world’s top 50 most valuable apparel brands has declined by 8%, decreasing from US$301.9 billion in 2020 to US$276.4 billion in 2021, according to the Brand Finance Apparel 50 2021 report. All brand values have a valuation date of 1st January 2021.

Richard Haigh, Managing Director, Brand Finance, commented:

“2020 was undoubtedly a tough year for the apparel sector. Global and widespread economic disruption caused a sharp decrease in demand and lockdown-induced store closures forced brands to digitalise quickly or face dire consequences to sales and profits. Despite the total brand value of the world’s top 50 most valuable apparel brands declining 8% year-on-year, on the whole we have witnessed remarkable agility and innovation across the sector, which will no doubt stand brands in good stead in the coming year.”

Nike does it again

Nike has retained the title of the world’s most apparel brand for the 7th consecutive year, despite recording a 13% brand value drop to US$30.4 billion. The brand still maintains a considerable lead over second-ranked Gucci, with a brand value of US$15.6 billion, down 12% from 2020.

Nike’s sales took a hit last year as the brand was forced to shut the majority of its stores across North America, EMEA and, Asia Pacific due to the pandemic. The brand saw an impressive uptick in online sales, however, which almost doubled in Europe, the Middle East and Africa.

Nike – a brand eminent in innovation – has continued to make leaps and bounds with new technology in its products, most significantly the controversial Nike Vaporflys, a shoe that has dominated the international athletics arena in recent years, with athletes wearing them claiming 31 of the 36 podium positions in the six world marathon majors in 2019. With the shoe surviving a ban for the now-postponed Tokyo Olympics, Nike can once again showcase itself as a brand that has helped to change the face of world athletics and sport.

Footwear brands stamp authority and record growth

The apparel ranking is divided into sub sectors: luxury; sportswear; fast fashion; watches, accessories & jewellery; high street designer; underwear; and footwear. Of these sub sectors footwear is the only one to record an increase in brand value year-on-year, posting a 9% increase in brand value on average. New entrants Timberland and Converse have performed particularly well this year, recording a 47% and 8% brand value increase, respectively. Nike-owned Conversesaw a modest uplift in sales last year, due to an increase in demand in Europe, as well has higher global digital sales.

In contrast, underwear brands have suffered the most significantly this year, with the two brands featured in the ranking losing an average of 19% of brand value. Victoria’s Secret (brand value down 22% to US$4.2 billion) is the third fastest falling brand in the ranking. The brand has been facing continued backlash for the lack of diversity in its marketing and in model line-up, an issue that has only been exacerbated as Gen Z consumers, in particular, are redefining the social norms around body image.

The other sub sectors also fare less favourably this year, all recording drops in average total brand value: luxury (down 10%); sportswear (down 7%); fast fashion (down 7%); watches, accessories & jewellery (down 4%); high street designer (down 13%).

Ones to watch

Fila is the fastest growing brand in this year’s Brand Finance Apparel 50 ranking following an impressive 68% brand value increase to US$2.7 billion. The brand, which operates in 70 countries through licensing deals, celebrated strong sales growth towards the end of last year, particularly within the Chinese market. Since Fila Korea purchased the global Fila brand in 2007, the brand has worked on strategically embracing the return of trends which helped it make its name across the sector originally, including 90s fashion making several comebacks.

New entrants Timberland and Bosideng are the second and third fastest growing brands, up 47% and 39% respectively. China’s Bosideng has entered the ranking in 50th position, with a brand value of US$1.5 billion. Bosideng announced a new clothing line launched with Jean Paul Gaultier, the former creative director of French luxury fashion house Hermès (down 2% to US$11.7 billion), which is being sold in stores and online on Chinese e-commerce giant Tmall’s platform.

Coach screeches to a halt

In contrast, Coach has recorded the biggest drop in brand value this year, falling 31% to US$4.7 billion. In line with sector trends, Coach’s sales and profits have taken a hit over the previous year. Coach’s parent company, Tapestry, has however cited that forecasts across its brands are looking more positive than anticipated thanks to triple digit e-commerce growth and a strong rebound across the Chinese market.

Coach has continued to embrace its strategy of celebrity-endorsed partnerships and collections, the latest of which, saw the appointment of superstar Jennifer Lopez as the global face of the brand.

Rolex: Timeless class

In addition to measuring overall brand value, Brand Finance also evaluates the relative strength of brands, based on factors such as marketing investment, customer familiarity, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. According to these criteria, Rolex (up 1% to US$7.9 billion) is once again the strongest apparel brand in the world, with a Brand Strength Index (BSI) score of 89.6 out of 100 and a corresponding elite AAA+ brand strength rating.

Synonymous with timeless class and luxury, Rolex is renowned for its world-leading quality and exclusivity, with the brand’s new releases known for setting the standard across the watch sector. Despite the challenges of the last year, the market for luxury watches has shown remarkable resilience to the pandemic turmoil, with demand remaining stable, demonstrated by Rolex’s website traffic experiencing a surge over the previous year.

View the full Brand Finance Apparel 50 2021 report here

ENDS

Note to Editors

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s 50 most valuable apparel brands are included in the Brand Finance Apparel 50 2021 report.

The full Brand Finance Apparel 50 2021 ranking, additional insights, charts, more information about the methodology, as well as definitions of key terms are available in the Brand Finance Apparel 50 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.