View the full Brand Finance Nation Brands 2022 report here

Following its invasion of Ukraine, Russia has recorded the largest fall in brand value among all the world’s nation brands this year, down US$144 billion or US$1,000 per person compared to 2021, according to the latest report by leading brand valuation consultancy Brand Finance. The decision to go to war appears to have undermined Russia’s economic standing, as evidenced by the stark nation brand value decline from US$786 billion last year to US$642 billion in 2022. This reflects the damage to commercial brands associated with Russia, to the country’s ability to access capital, as well as to its potential to influence perceptions across the world.

The widespread economic sanctions imposed on Russia have added to the health, social, and economic disruption caused by the COVID-19 crisis. Prior to the pandemic in 2019, Russia’s nation brand was valued at US$960 billion, but has since fallen by a third – placing it between much smaller Belgium (US$647 billion) and Austria (US$570 billion) at only 24th among the world’s top 100 most valuable brands.

Konrad Jagodzinski, Place Branding Director, Brand Finance, said:

“The Russian invasion has caused a humanitarian crisis, bringing destruction and suffering to the people of Ukraine. Russia is now paying a heavy economic price for its decision to start this war. This is demonstrated by the self-inflicted damage to Russia’s nation brand, which is now worth less than that of Belgium – a country with a population 12 times smaller.”

At the same time, although the war has wrought catastrophic humanitarian and economic devastation on Ukraine, causing its brand value to drop by US$22 billion from US$107 billion to US$85 billion, the nation has successfully defended its independence and won the support of allies internationally, resulting in a significant increase in its brand strength.

In addition to calculating brand value, Brand Finance also determines the relative strength of nation brands through a balanced scorecard of metrics evaluating brand investment, brand perceptions, and brand performance. Ukraine’s brand strength score has gone up by over 5 points year on year from 52.8 to 57.9 out of 100, driven mostly by a 15% increase in brand perceptions. Research carried out by Brand Finance in March 2022 saw Ukraine increase in familiarity, reputation, and influence, in addition to other metrics such as respected leaders, rule of law and human rights, and trustworthy media.

USA brand value still #1, ahead of China

At the top of the ranking, the United States (brand value up 7% to US$26.5 trillion) has retained its position as the world’s most valuable nation brand, maintaining the lead ahead of 2nd ranked China (up 8% to US$21.5 trillion). The USA and China are standout leaders in the Brand Finance Nation Brands 2022 ranking, with the combined brand value of the two equal to that of the remaining 98 nation brands in the top 100.

Forward-looking valuation of top 100 nation brands rises close to pre-pandemic levels

Across the world, the values of the world’s nation brands have substantially returned to their pre-pandemic levels. Nation brand valuations are based on forward-looking macroeconomic forecasts and the positive outlook on recovery from COVID-19 is driving this year’s increases. The total value of the world’s top 100 nation brands stands at US$97.2 trillion, up 7% year on year and only marginally behind the pre-pandemic value of US$98.0 trillion in 2019. While the combined value of the world’s top 100 nation brands has practically matched pre-pandemic levels, exactly 50 nation brands have increased in value over this period, while the other 50 remain below the valuation from before the COVID-19 crisis.

The United Kingdom is among the nation brands recording the best COVID-19 recovery, having seen the highest absolute brand value gain among all the nation brands bar China – up US$265 billion to US$4.1 trillion. Brand Britain has bounced back as a large share of the population was promptly vaccinated and restrictions on economic activity were progressively eased. This strong performance can also be explained by a recovery from the market uncertainty caused by Brexit in the years preceding the pandemic. Although brand perceptions are likely to increase following a period of unprecedented global attention as a result of Queen Elizabeth II’s passing, the looming recession and the drop in the value of sterling – if sustained – may undermine the UK’s brand value in future.

Vietnam has seen the third highest brand value gain over the course of the pandemic in absolute terms – up US$184 billion to US$431 billion in 2022 – but the world’s fastest growth in relative terms, up 74% compared to 2019. Vietnamhas gained momentum as an attractive destination for foreign investment thanks to successful fiscal and monetary policies and investments in human capital, but also amid trade disruptions from China’s lockdowns and continued tensions between Beijing and Washington.

Leaders of nation brand value growth in 2022

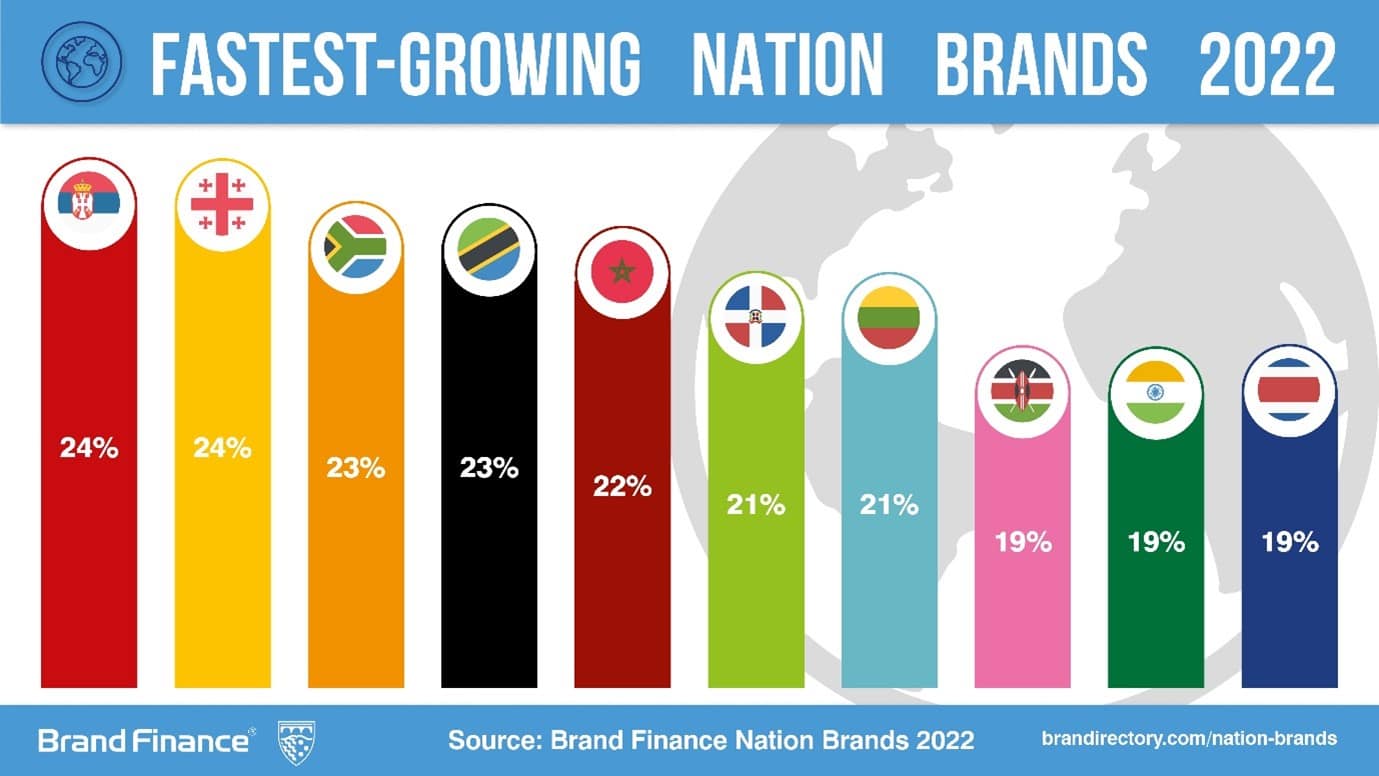

Looking at year-on-year nation brand value growth from 2021, Serbia (US$59 billion) and Georgia (US$18 billion) are the fastest growing in the Brand Finance Nation Brands 2022 ranking, each posting a 24% increase as they attract Russian businesses displaced by international sanctions.

Sub-Saharan Africa is strongly represented among the top 20 fastest-growing nation brands too, led by South Africa (up 23% to US$216 billion) and Tanzania (up 23% to US$41 billion) as the world’s 3rd and 4th fastest-growing this year, followed by Kenya (up 19% to US$80 billion) and Ghana (up 16% to US$57 billion).

Similarly, four North African nation brands feature among the top 20 fastest growing. They are led by Morocco (up 22% to US$80 billion), as the world’s 5th fastest-growing nation brand this year, closely followed by Egypt (up 19% to US$214 billion), both of which saw brand value increases due to the strength of their diversified economies, strong manufacturing sectors, and high tourism appeal. Algeria, a country largely dependent on its natural resources, also saw a growth in its brand value (up 16% to US$87 billion). As did Tunisia (up 16% to US$25 billion) which has seen a revitalisation of its tourism sector post-COVID.

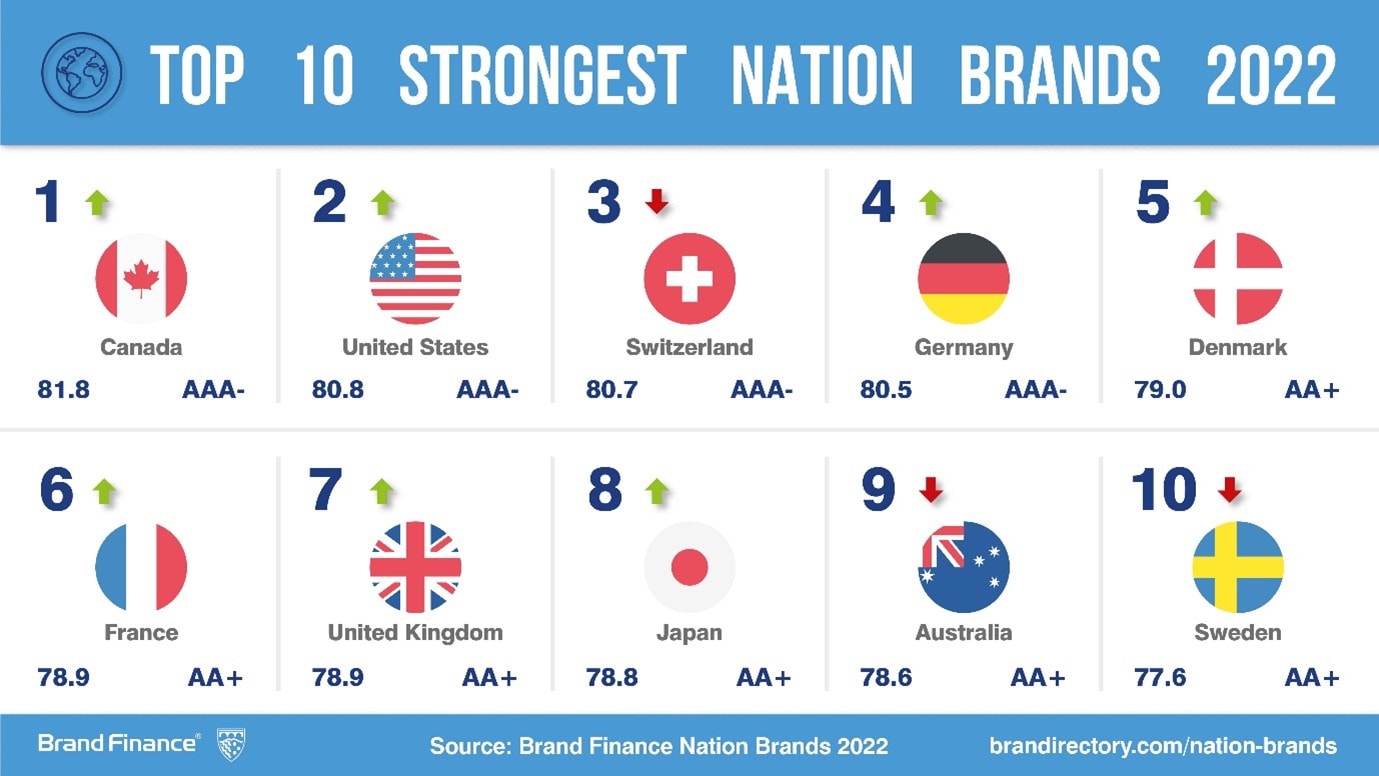

Large economies return to top of brand strength ranking, with Canada claiming #1

Canada has claimed the title of this year’s strongest nation brand with an overall brand strength score of 81.8 out of 100, supplanting last year’s leader Switzerland (80.7). Alongside GDP forecasts, nation brand strength is an important driver of nation brand value.

Canada boasts one of the highest brand perceptions scores, with excellent marks across both international and domestic audiences. With a stable economy and one of the highest standards of living in the world, Canada has a strong advantage in brand investment, and its brand performance has remained relatively high thanks to flexible COVID-19 policies.

Brand Finance’s brand perceptions research, originally published in the Global Soft Power Index 2022, has evidenced a recovery of the reputations of the world’s largest economies over the past year, compared to the first year of the pandemic. While in 2020 leading nation brands including China, Italy, and the USA were seen to have suffered significantly from the first wave of COVID-19 infections, in 2021 they were seen to have successfully rolled out vaccinations and managed the virus.

In this way, the USA, France, UK, and Japan all make a comeback to the top 10 brand strength ranking after the extraordinary one-year decline in their international perceptions caused by the COVID-19 pandemic. Similarly, China enters the top 20 for the first time, claiming 15th place, and Italy and Spain return to the top 25.

Brand performance held back by COVID-19, with UAE positive exception

While nation brand perceptions have largely recovered over the course of the past year, brand performance has not yet returned to its pre-pandemic levels for most nation brands in the ranking. With global interactions in the crucial areas of trade, investment, tourism, and talent attraction down across the board throughout 2021, most brand strength scores remain held back by the legacy of the COVID-19 pandemic.

A positive exception, the United Arab Emirates, ranks highest globally in brand performance, with a score of 80.5 out of 100. The UAE has attracted a higher volume of trade, investment, tourism, and talent than other nation brands. A successful COVID-19 response, which allowed the UAE to open for business sooner than many other destinations, is one of the key drivers of the UAE’s impressive results this year. Thanks to maintaining a higher brand performance score and improving its brand perceptions, the UAE has defended its position as the strongest (76.7 out of 100) as well as most valuable (US$773 billion) nation brand in the Middle East and Africa.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.