View the full Brand Finance Europe 500 2023 report here

Shell (brand value up 8% to EUR46.5 billion) earns title of fourth most-valuable European brand, according to a new report f/rom leading brand valuation consultancy, Brand Finance.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest European brands are included in the annual Brand Finance Europe 500 2023 ranking.

Shell has played a global leadership role in helping customers divest from Russian following the Russian invasion of Ukraine, helping to mitigate damage to Europe’s energy security. The economic fallout of the pandemic, leading to rising oil demand and increased hydrocarbon prices, has further benefitted Shell. With the appointment of a new CEO in 2023, the brand anticipates continued growth. However, concerns about high profits from increased energy prices and insufficient commitment to alternative energy sources could present a risk to brand perceptions.

Annie Brown, General Manager of Brand Finance UK commented:

“Throughout the past year, Shell has enjoyed the advantages of soaring hydrocarbon prices, driven by disruptions in gas supplies and a surge in oil demand as global economies began to return to normalcy in the aftermath of the Covid-19 pandemic. However, despite record profits off the back of this, Shell’s decline in brand equity has tempered the company's growth in brand value, casting a revealing light on the complex dynamics shaping Shell's overall performance.”

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

Dettol (brand value up 51% to EUR1.5 billion) has shot up an impressive 38 places to be named the third-strongest European brand. Consumers across Europe recognise Dettol for its effectiveness in killing germs and preventing infection spread. Post-pandemic, awareness around hygiene and health has risen and consumers appear to trust Dettol. This is reflected in the brand’s strong familiarity and consideration scores. As such, Dettol benefits from consumer willingness to pay more for its products compared to off-brand alternatives.

HSBC (brand value up 23% to EUR19.1 billion) and Barclays (brand value up 23% EUR11.9 billion) are this year’s first and third most valuable European banking brands. Improved economic forecasts in the post-pandemic era have hugely benefited UK banks, which have enjoyed significant profit increases. While expecting higher costs due to inflation and increased investments, rising interest rates have helped major UK banks to offset these effects and maintain their competitive edge in the European market.

William Hill (brand value up 20% to EUR1.3 billion) and bet365 (brand value up 10% to EUR3.9 billion) are the second and third biggest brand strength climbers in this year’s Europe 500 ranking. William Hill commands significant recognition in the UK and in Europe, earning a familiarity score of 71, well above the industry average. A much newer brand, bet365 has nonetheless solidified its position as a dominant player in the industry, renowned for its extensive array of sports markets, in-play betting options, and relatively user-friendly interface.

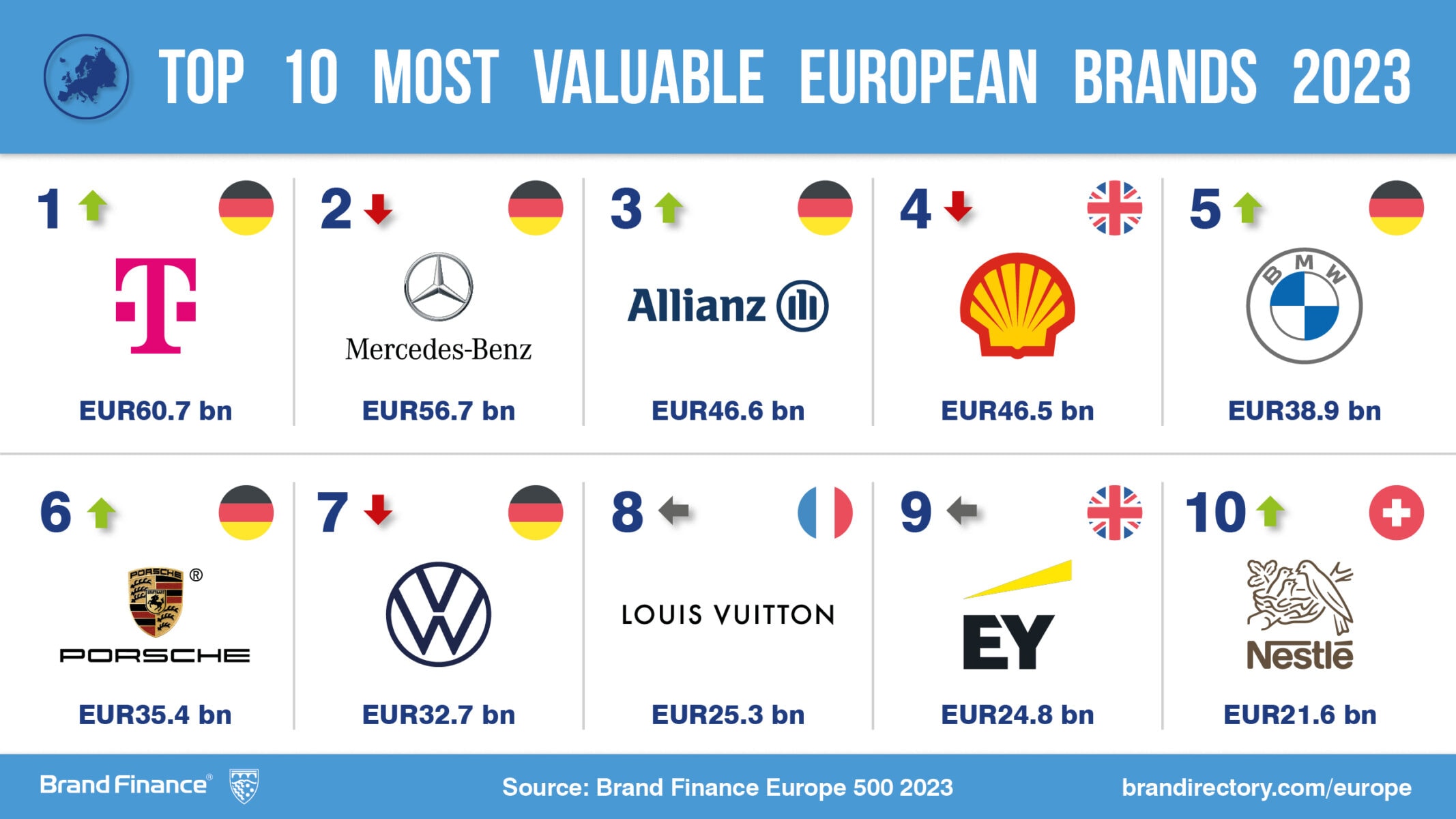

German telecoms provider Deutsche Telekom (brand value up 17% to EUR60.7 billion) has surpassed former champion Mercedes-Benz (brand value up 8% to EUR56.7 billion) to become the most valuable European brand. Building on its success as the second most valuable telecoms brand globally, Deutsche Telekom’s latest title as the most valuable European brand comes as a result of strong revenue growth across European markets and increasing customer numbers. The latter has also significantly propelled the brand’s growth in the US, which has seen record customer additions.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.