View the view Brand Finance Ireland 25 2023 report here

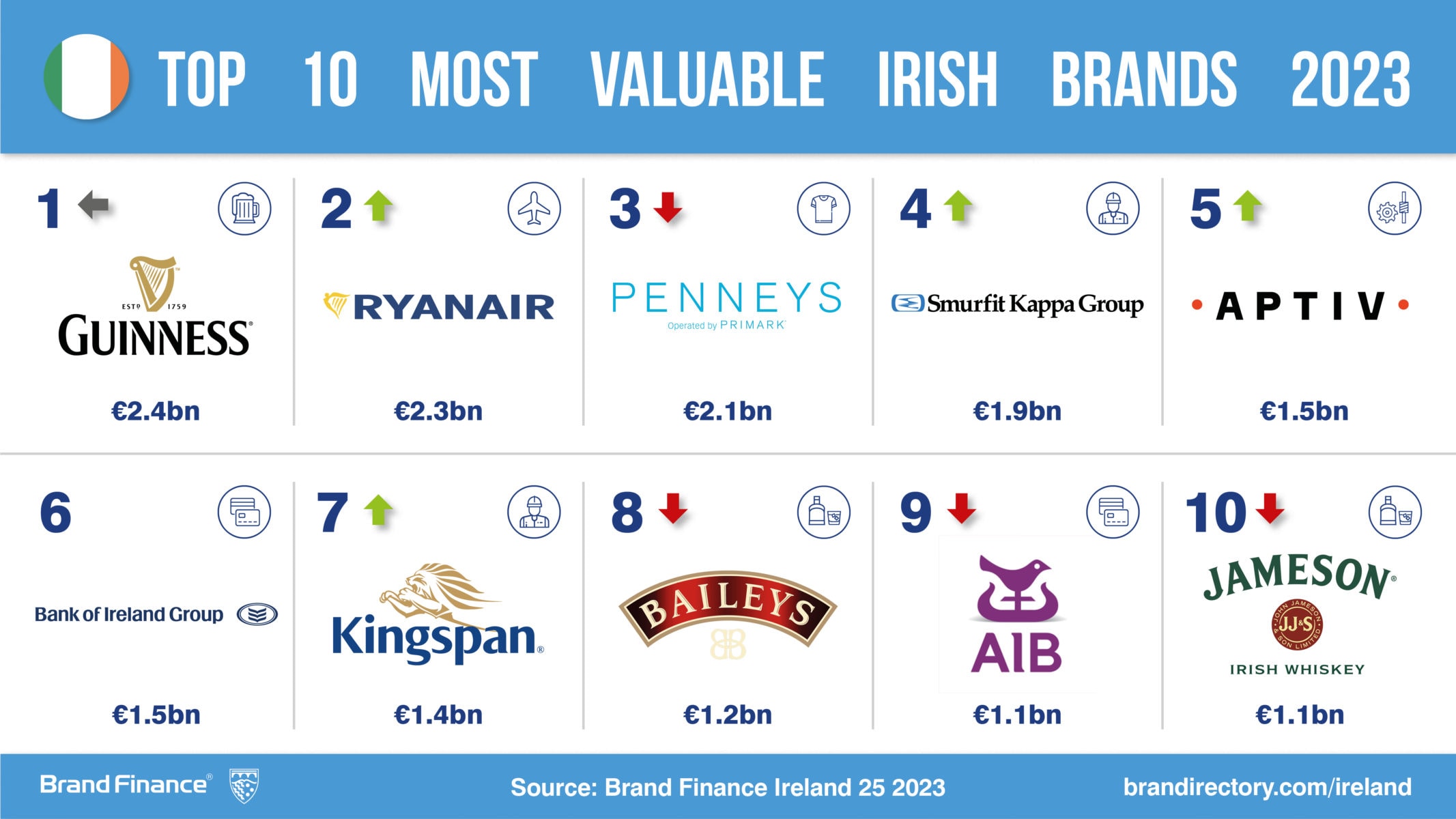

Guinness (brand value up 26% to €2.4 billion) has retained its position as the world’s most valuable Irish brand, according to a new report from leading brand valuation consultancy, Brand Finance. The brand value of Guinness has increased by a quarter this year, in connection with increased demand for the product in a post-pandemic world.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The top 25 most valuable and strongest Irish brands are included in the annual Brand Finance Ireland 25 2023 ranking.

The Guinness brand has shown significant growth this year, with organic net sales growing by 32%. The brand is increasingly being recognised as one of the most creative, innovative, and sustainable beers in the world, having launched several campaigns, including a pan-African campaign that attracted 1.5 million new Guinness drinkers. The brand is also investing in innovation and marketing, with recent award-winning dispense and liquid innovations, and new visitor experiences set to open in Chicago and London in 2023.

The brand is also committed to sustainability and has embarked on a three-year regenerative agriculture pilot in Ireland to reduce carbon emissions. Overall, Diageo and the Guinness brand are committed to building and nurturing one of the world's most iconic brands while being rooted in culture and local communities and ensuring that the brand helps these communities prosper.

Declan Ahern, Director of Brand Finance commented:

“With the world firmly facing a post-pandemic future, Irish brands are at the heart of celebrations across the world. Across the world, people celebrating events from the end of a work week, to the start of a marriage, raise glasses of Guinness or Baileys. These Irish brands are front-and-centre of people’s lives across the world, spreading a little Irish cheer and love globally.”

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakehol der equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

Over the past year, Baileys has seen growth in many markets outside North America: Northern-European communities are enjoying the drink as people socialise, and Southern Europe sales are recovering in connection to tourism re-opening after the pandemic. The brand produces its indulgent blend of aged Irish whiskey and Irish dairy cream in both the Republic of Ireland and Northern Ireland, and it is enjoyed all over the world.

Brand Finance research has found that Baileys has the highest familiarity rating at 75% of any spirit brand in the United Kingdom, with almost 90% of those consumers who report being familiar with Baileys considering it. Baileys is also developing a reputation as one of the world's leading brands that prioritizes responding to the needs of stakeholders and society, as they strive to build and nurture an iconic brand that is inclusive and sustainable.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.