View the Brand Finance Romania 50 2021 report here

The fifth annual report by Brand Finance on the most valuable and strongest Romanian brands coincides with a time of great uncertainty induced by the global Covid pandemic. The economic turbulence is reflected inevitably in the Brand Finance Romania 50 2021 ranking, with the combined value of Romania’s top 50 brands dropping by 3.7%, to EUR 5.6 bn, while the Romanian economy declined 3.9% as a whole in 2020.

However, the top 50 brands’ combined value is almost 50% higher than in 2017 – when the first Brand Finance Romania ranking was published. Also, remarkably, 45 brands of the initial 2017 ranking are still present in the top 50 in 2021, while two missing - Bancpost and AKTA - were acquired by bigger competitors in the meantime, which demonstrates the resilient characteristic of solid brands.

Mihai Bogdan, Managing Director, Brand Finance Romania, commented:

“Brands are still sailing in uncharted waters, but we have reasons to believe that the stronger the brand, the better it will weather the storm. So far, riskier market conditions as a result of the pandemic have translated to higher risk rates this year, across most sectors, which have affected the brand valuations.”

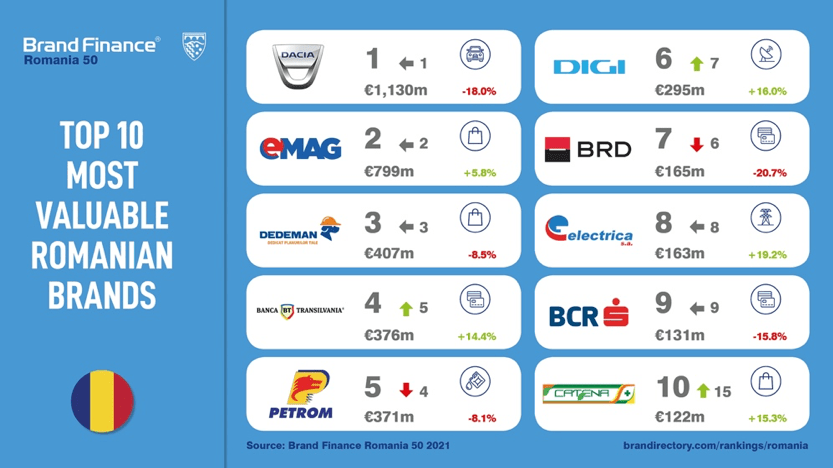

The automotive brand Dacia keeps the pole position in the Brand Finance Romania 50 ranking for the fifth year in a row, even after a severe 18% decrease in brand value to EUR 1,130m. However, with second placed eMAG’s brand value up to EUR 799m, the difference between the two has halved compared to 2020 – so the race for the top position is getting heated.

Operating in a sector severely hit by the pandemic restrictions, Dedeman remains the most valuable brand held entirely by Romanian shareholders, defending the 3rd position in the ranking despite a loss of 9%, with a brand value of EUR 407m. Banca Transilvania is up one place and nearing the podium, with an increase in brand value up to EUR 376m.

Only one change among the upper echelon this year – with Catena climbing for the first time into the top 10, after an increase of 15% in brand value, up to EUR 122m; consequently, Bitdefender is sliding for now to 11th place.

Movers and shakers

New brands – created and developed by entrepreneurs and private companies over the past 30 years – account for 7 out of every 10 brands in the ranking, and with a combined brand value of EUR 3.1 billion generate 56% of brand value in the Brand Finance Romania 50 2021. Moreover, the number of brands created by the private sector over the past 30 years has increased from 30 to 34 in the ranking.

This year has seen only two new entrants in the top 50, both of them re-entrants from previous years. After a couple of turbulent years, the energy brand Tinmar is back with a brand value of EUR 22m, while Cocorico qualifies for 50th place with EUR 15m brand value. The two brands sliding out of the ranking this year are Bilka and Bog’art.

The economic climate wasn’t equal for all, and brands reacted differently – with 50% of the brands decreasing in value while the other half gaining. As a result, 30 brands kept their place or climbed in the ranking, and 20 brands dropped places.

The fastest climber this year is the pharma retail brand Farmacia Tei, going up 11 places to the 37th place, with a notable increase in brand value of 30%, to EUR 23m.

Portfolio steadiness

Next to analysing individual brands, the Brand Finance Romania 50 study also ranks the 10 most valuable brand portfolios, calculated for those businesses that deploy more than one brand into the market. These portfolios encompass over 40 well-known local brands, the most valuable of which are also featured individually in the main top 50 ranking.

The top 10 portfolios have remained virtually the same since 2017, with smaller contenders not growing fast enough to overtake the incumbents. What’s new this year is the remarkable 22% jump in value for Ursus Breweries, up to EUR 213m – which consolidates its leading position, fuelled by brand value increases for its main brands Timisoreana and Ursus. Conversely, Cris-Tim’s brands portfolio registered the highest drop in value (24%) down to EUR 52m.

David Haigh, CEO, Brand Finance, commented:

“While the road to recovery and hopes are pinned on the speedy and successful rollout of the vaccines to open borders and kick-start the global economy once again, brands which have pushed the boundaries of technological innovation and were able to pivot their business to adapt to consumers’ changing needs have remained a cut above the rest, across sectors. 2021 is the final call to get on board for all brands still stuck in the 20th century.”

View the Brand Finance Romania 50 2021 report here

ENDS

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.