View the full Brand Finance Telecoms 150 2023 report here

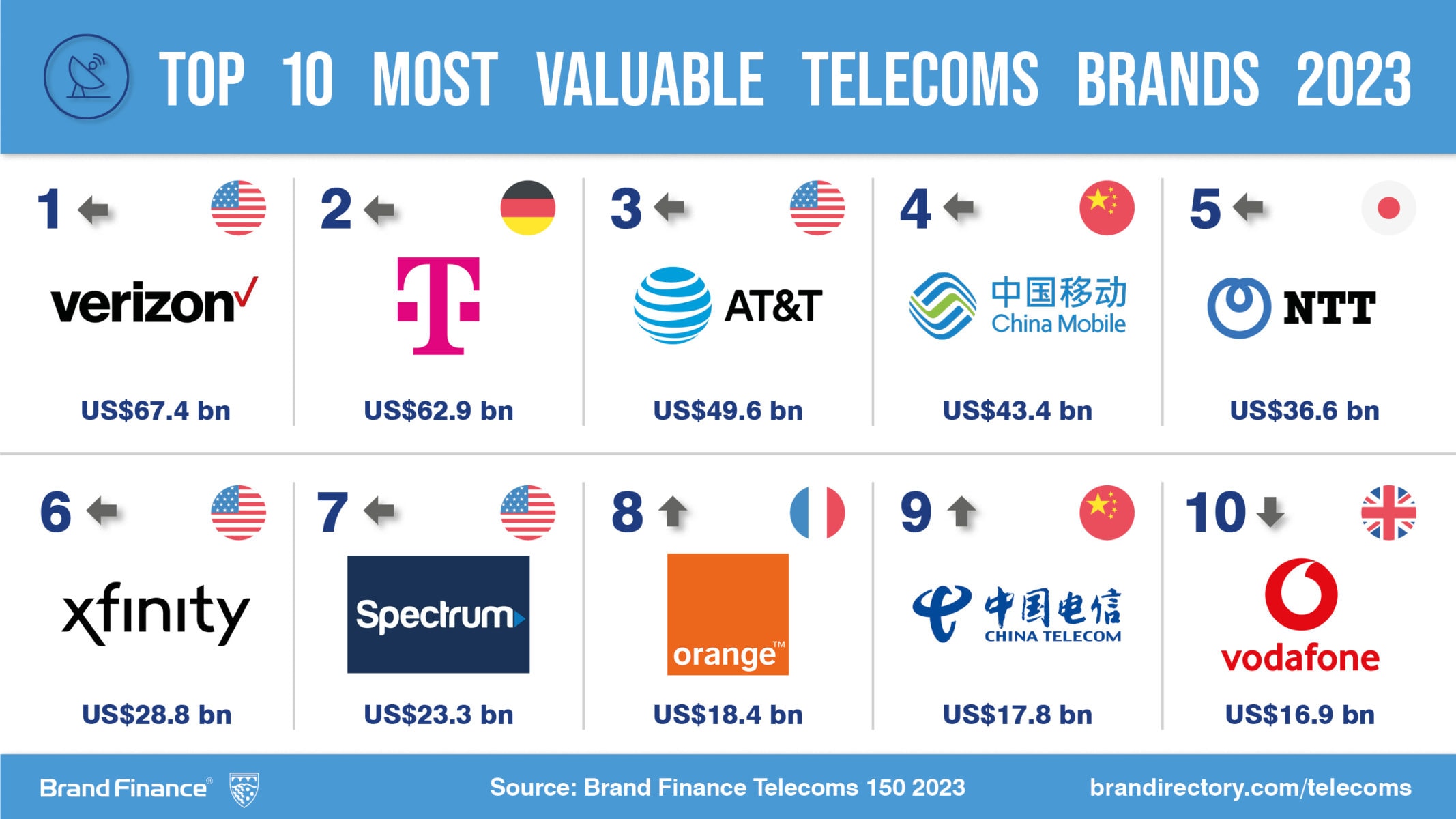

U.S. based brand Verizon remains the world’s most valuable telecoms brand for the 4th consecutive year despite a 3% year-on-year reduction taking its brand value to US$67.4 billion.

Every year, leading brand valuation consultancy Brand Finance puts thousands of the world’s biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 150 most valuable and strongest brands in the telecoms industry are included in the annual Brand Finance Telecoms 150 2023 ranking.

Following a pandemic-led boom in wireless internet demand, Verizon has lost subscribers to fast-growing rivals in the telecoms industry in 2022, contributing to its slight brand value decrease. Verizon’s 5G network will be the brand’s primary focus going forward. On top of this, wireless mobility and nationwide broadband are set to be two of the most significant contributors to its planned growth in 2023. It is focusing on innovation, continued investment, and the incorporation of advanced technology deployment to provide a better offering to consumers, businesses, and the public sector alike.

Deutsche Telekom (brand value up 5% to US$62.9 billion) is again both the 2nd most valuable telecoms brand globally and Europe’s most valuable brand. This impressive performance comes partly as a result of the brand’s strong organic revenue growth within European markets, with customer numbers growing at a steady rate across the board. However, the brand’s value has grown substantially in connection with its record customer additions in the United States.

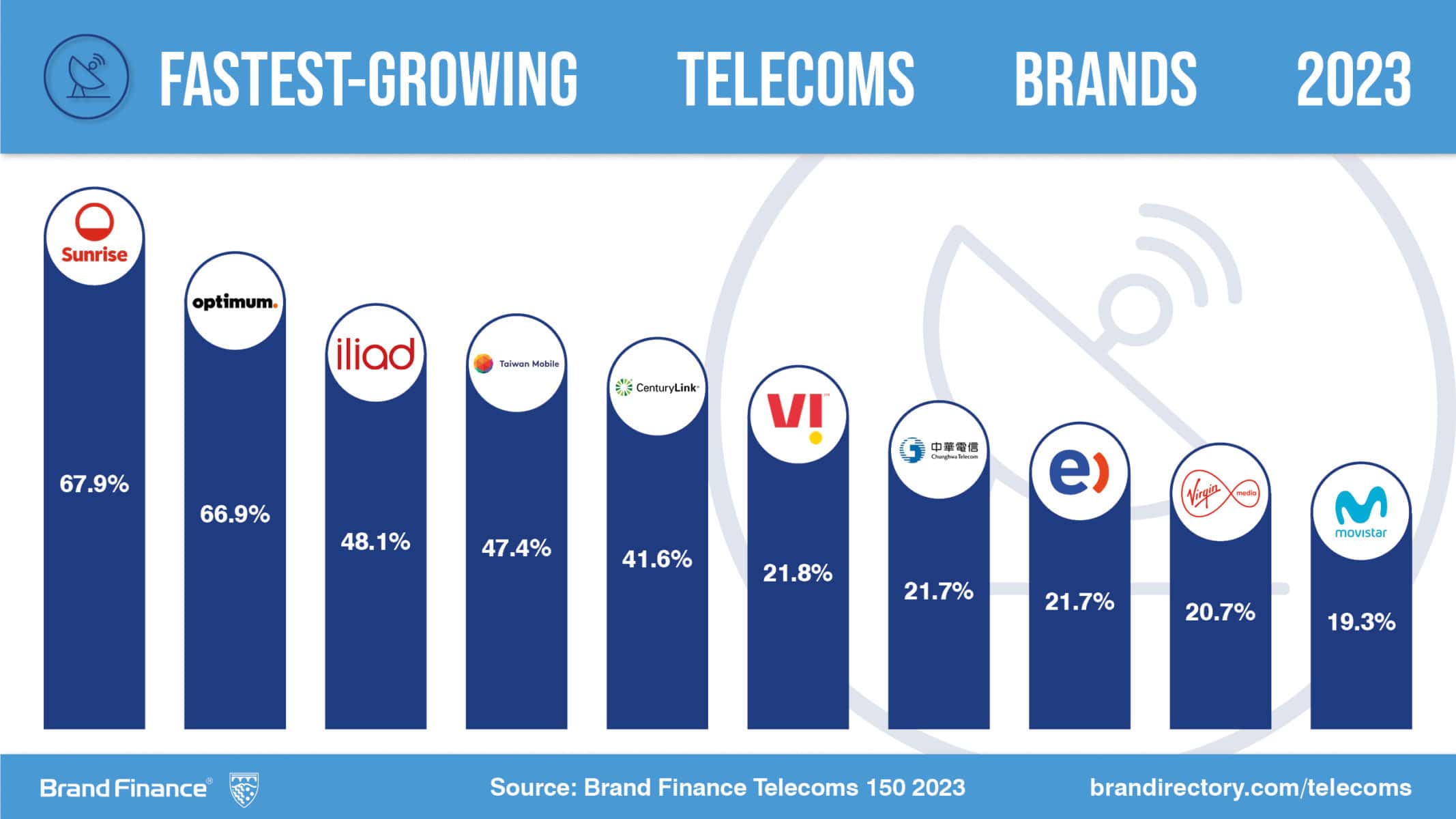

Swiss full-service provider, Sunrise, is the fastest growing telecoms brand in the ranking after a 68% brand value increase took it to US$1.8 billion. This comes off the back of a successful merger with Switzerland’s largest cable operator, UPC, in 2021. As part of a brand refresh, Sunrise has also introduced a new brand design and logo. It has also launched the Sunrise Business brand, strengthening its identification with and positioning within the business customer segment.

U.S based brand Optimum followed closely behind as the second fastest growing brand with a 67% increase to a brand value of US$2.5 billion after a similarly successful merger. The brand merged with Suddenlink in 2022 and has combined all of the company’s telecommunications goods under a single name. In combination with this, it also launched a new nationwide brand campaign, “Get Closer, Go Farther”. This emphasises its promise to bring customers closer together with Optimum products and services.

Lorenzo Coruzzi, Senior Consultant, Brand Finance, commented:

“Both outlined mergers and subsequent brand-refreshes highlight two examples of the benefit for brands of adjusting their brand architecture and combining two or more weaker brands under a more distinct and consolidated master-brand. This indicates significant brand value potential to be unlocked by other such brands operating under an unconsolidated brand architecture.”

AT&T (brand value up 6% to US$49.6 billion) saw brand value growth in 2023 following a redirection in business strategy in which it spun off its media arm in order to focus directly on its telecoms business. AT&T announced that it would spin off WarnerMedia into a new company in 2021. It completed the move in April 2022, to form a separate media company - Warner Bros. Discovery, Inc. AT&T has subsequently shown positive brand value growth of 6%. In 2022, the telecoms brand has focused on its go-to-market strategy, providing high-quality wireless and fibre services, while continuing to invest heavily in its 5G technologies.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 150,000 respondents in 38 countries and across 31 sectors.

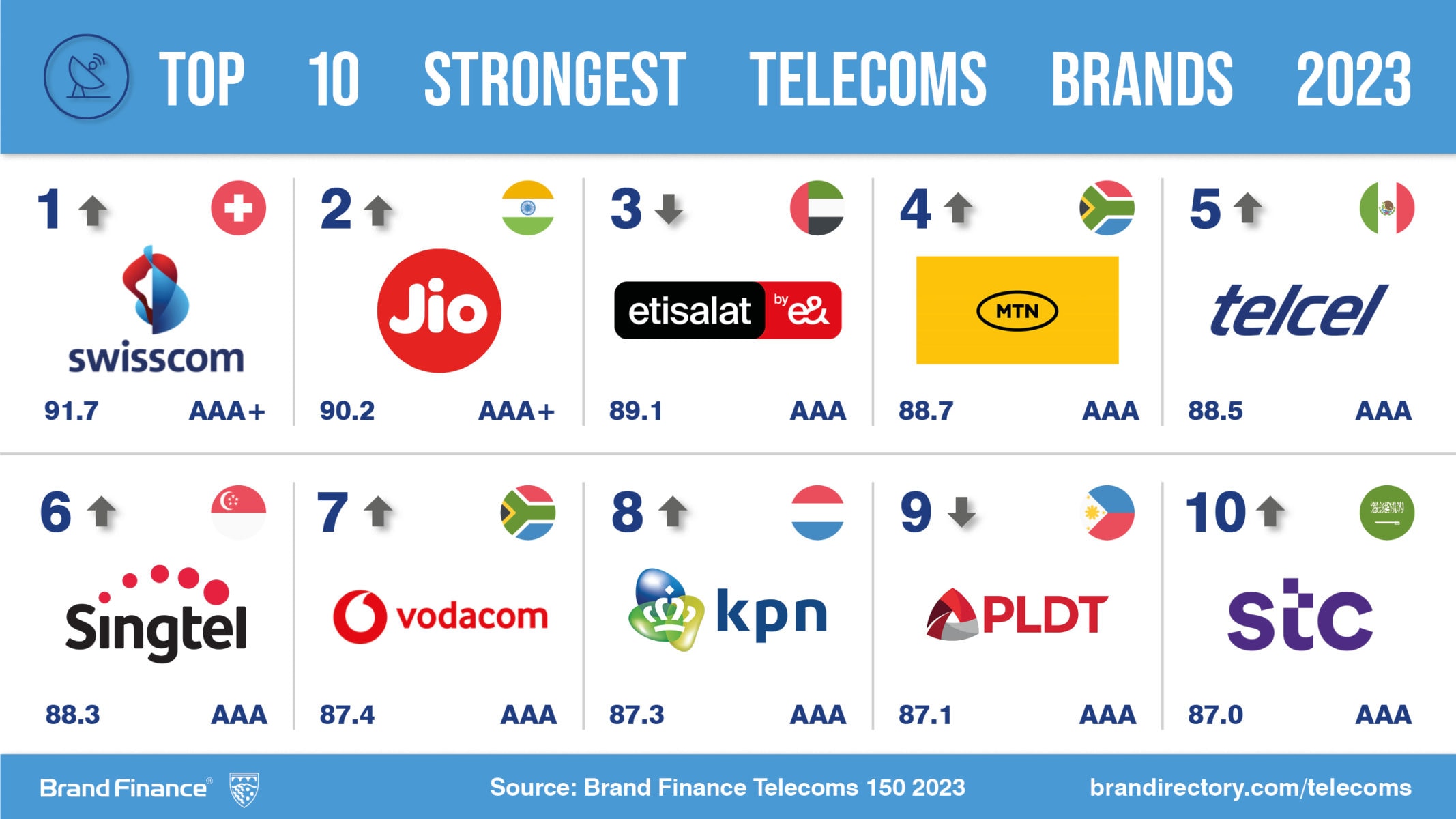

Swisscom (brand value up 5% to US$6.3 billion) is the strongest telecoms brand with a Brand Strength Index score of 92, making it the third strongest brand globally and earning it an elite AAA+ brand rating. Its recent announcement of its new Fixed Wireless Access 5G service for business customers is a continuation of its pioneering work in the European 5G market. Trust, coverage and network perceptions and its customer service are what sets Swisscom apart against competition and other telco brands and is clearly reflected in Swisscom’s extremely high brand strength index score.

Indian brand Jio (brand value up 6% to US$5.4 billion) is the second-strongest telecoms brand with a brand strength index score of 90/100, earning it an elite AAA+ rating. This was a two-point rise from last year. The brand has particularly focused on its roll-out of 5G in India, now extending coverage to 257 cities in the country and looking to further increase this at a rapid rate. 5G services have already created widespread benefits to Indian consumers, as well in sectors such as education, healthcare and agriculture. These benefits and the growth opportunities that Jio’s 5G network has presented have helped Jio build an extremely strong brand strength index score, one of only two AAA+ rated telecoms brands in the ranking.

Etisalat by e& (brand value up 4% to US$10.5 billion) is the third strongest telecoms brand globally with a Brand Strength Index (BSI) score of 89.1 out of 100. Etisalat by e& is a telecoms brand of the global technology group e&. Evolved through a brand identity change last year, Etisalat by e& reflects a tech-driven telecoms brand enabled by superior 5G connectivity; elevated NPS scores due to richer personalised customer interactions; and increased employee satisfaction on account of vigorous company culture making it an attractive employer.

Saudi Arabian brand stc (brand value up 17% to US$12.3 billion) is the most valuable Middle Eastern telecoms brand. It is also the second strongest telecoms brand in the Middle East with a brand strength index score of 87 out of 100 and a corresponding AAA rating. The brand’s value was positively affected by stc’s technological investments to keep delivering on its ambitious strategy and increased focus on the expansion of the brand in adjacent sectors such as ICT and IT.

Etisalat by e& (brand value up 4% to US$10.5 billion) is the second most valuable telecoms brand in the Middle East. The e& group operates in 16 countries and has the most valuable portfolio of telecom brands in the Middle East and Africa, valued at over US$14 billion.

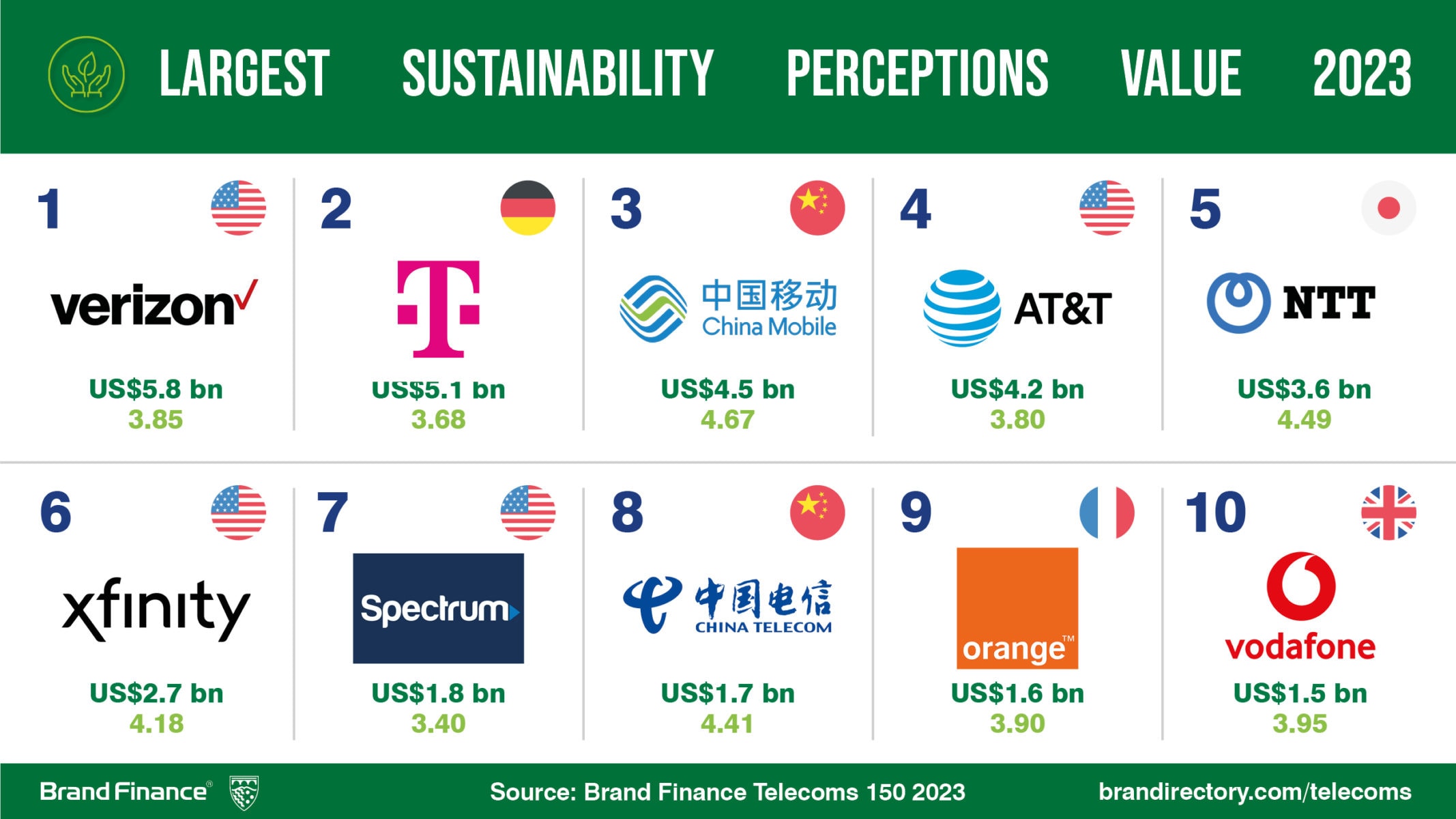

As part of Brand Finance’s analysis, research is conducted into the role of specific brand attributes in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand.

Kenyan telecoms brand, Safaricom (brand value up 3% to US$709 million) is perceived to be the world’s most sustainable telecoms brand, with an impressive Sustainability Perception Score of 6.46 out of 10.

As well as being the world’s most valuable telecoms brand, Verizon also has the highest Sustainability Perceptions Value, estimated at US$5.8 billion. While its position at the top of the table is not an assessment of its overall sustainability performance, it indicates how much brand value Verizon has tied up in sustainability perception. Brand Finance’s research finds that consumers around the world perceive that Verizon is minimising its negative impacts, reflected in Verizon’s top ranking in this area.

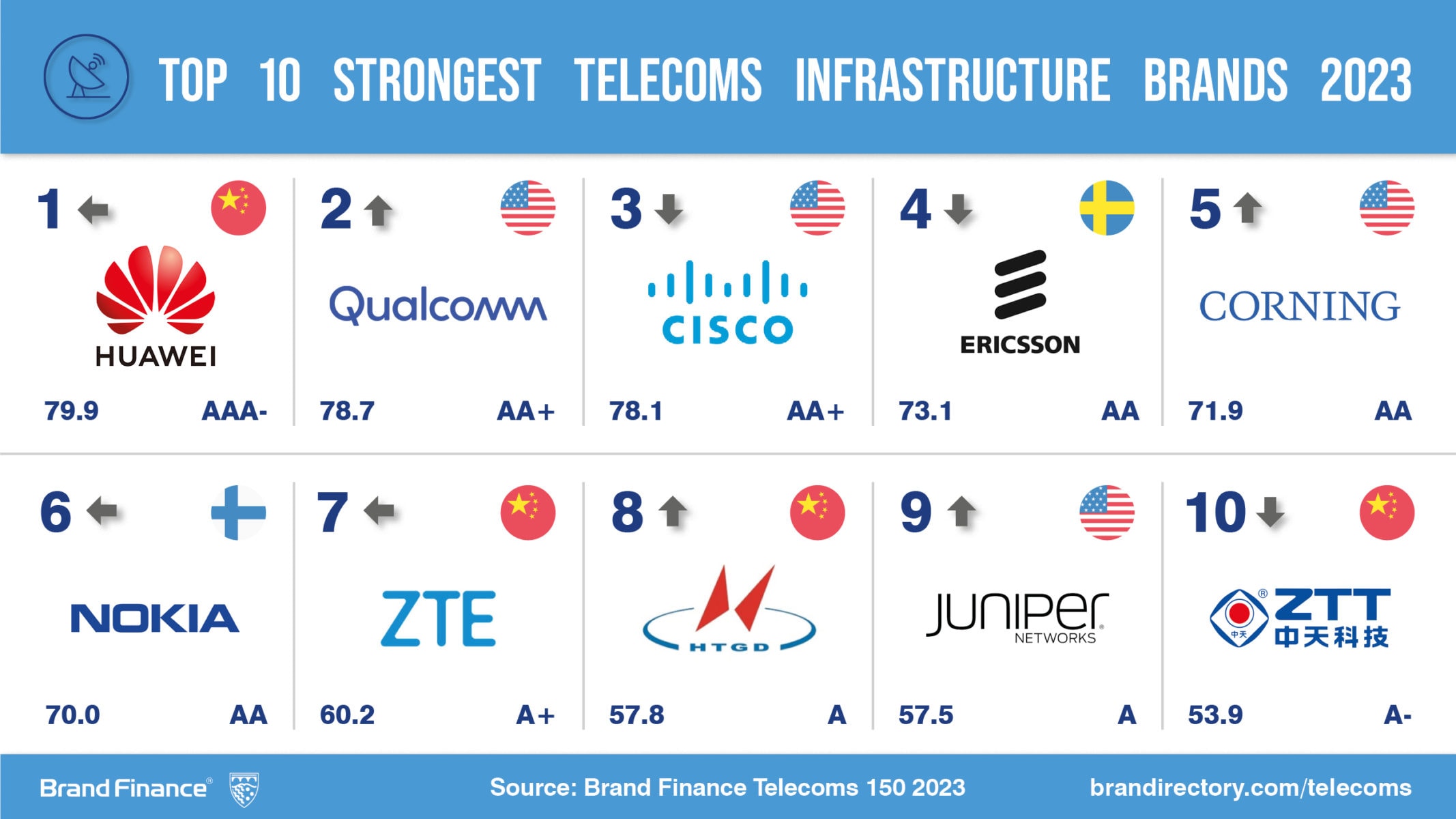

In addition to ranking the 150 most valuable and strongest telecoms operator brands, Brand Finance also ranks the top 10 most valuable and strongest telecoms infrastructure brands in the world in the Brand Finance Telecoms Infrastructure 10 2023 ranking.

Huawei (brand value down 38% to US$44.3 billion) continues its dominance at the top of the ranking. Huawei has lost significant brand value in connection to US sanctions, due to political and regulatory confrontations, that have caused a contraction in the geographies where it can operate. It has also suffered in relation to a global semiconductor shortage and a slump in demand for smartphones. Although it is losing brand value, the brand is still the strongest telecoms infrastructure brand with a Brand Strength Index Score of 79.9 out of 100 with a corresponding AAA- rating.

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.