View the full Brand Finance Automotive Industry 2023 report here

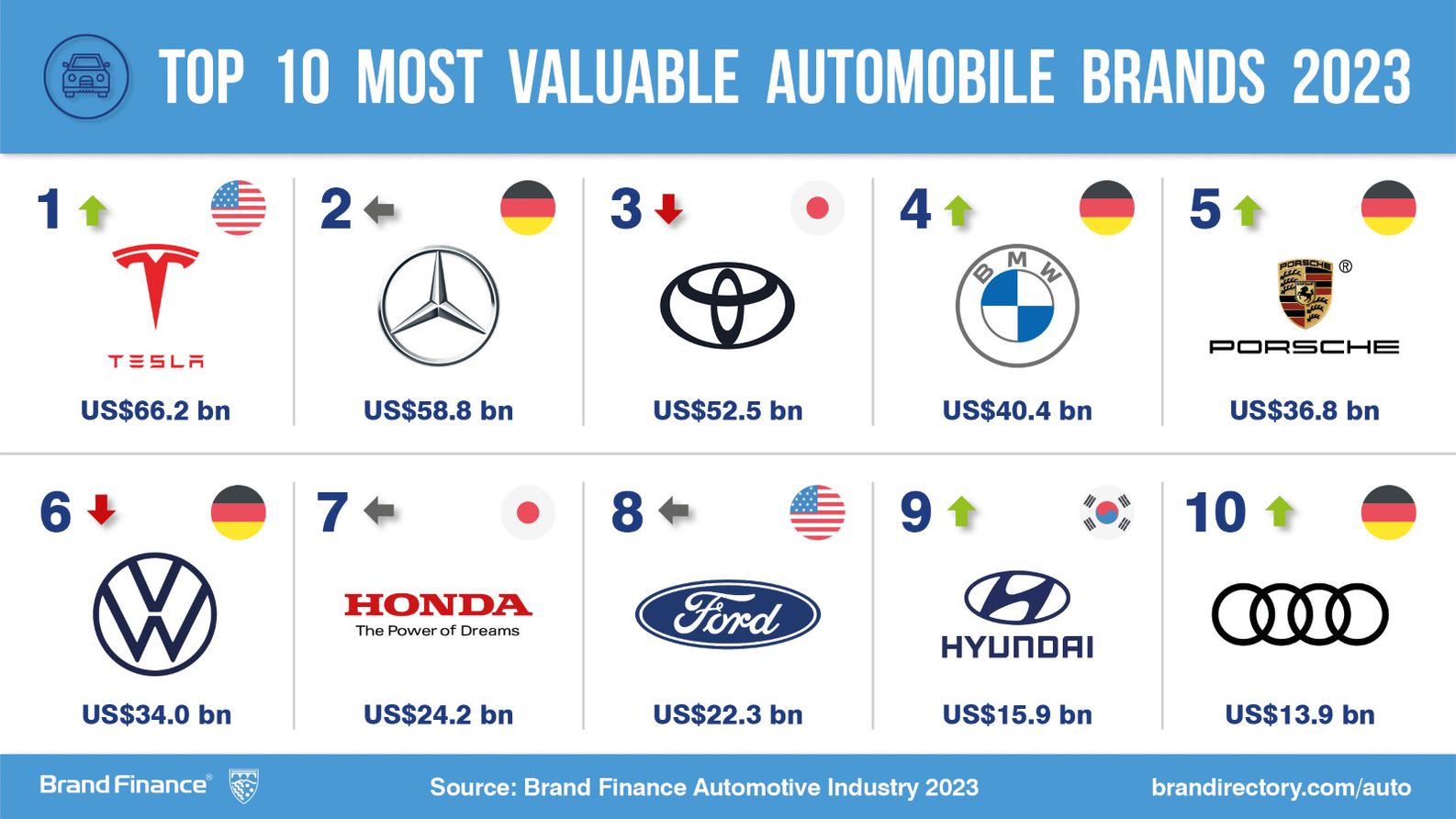

Tesla accelerated to the front of the pack, taking pole position as the world’s most valuable automotive brand, with its brand value surging by 44% to USD66.2 billion, according to a new report from leading brand valuation consultancy, Brand Finance. This makes it the world’s most valuable Automobiles brand for the first time, and the first time that a brand which does not manufacture internal combustion engines has topped the global rankings.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s most valuable and strongest Automotive Industry brands are included in the annual Brand Finance Automotive Industry 2023 ranking.

The Tesla brand is now worth more than five-times its pre-pandemic value, overtaking last year’s leader, Mercedes-Benz (brand value down 3% to USD58.8 billion), and last year’s runner-up, Toyota (brand value down 18% to USD52.5 billion).

Alex Haigh, Valuation Director of Brand Finance, said:

“This growth in brand value is a positive sign for Tesla as it indicates that consumers are recognising and valuing the brand more, which could potentially lead to increased sales and revenue in the future. The automotive industry is highly competitive, so for Tesla to achieve this level of growth in brand value is a noteworthy accomplishment and a testament to the value of the Tesla brand. Tesla must now work to protect this moving forward in order to build long-term brand strength.”

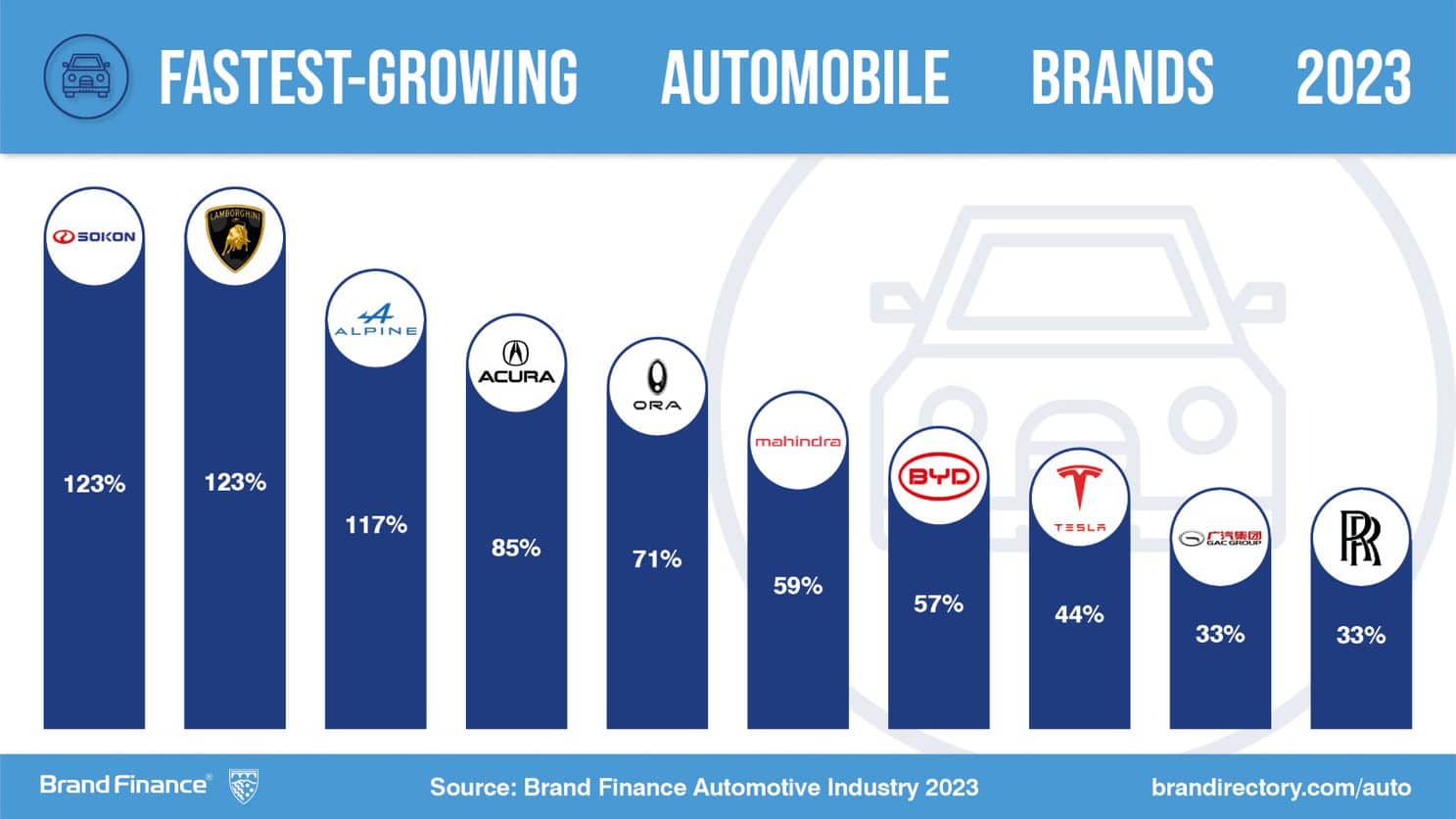

Chinese brand Sokon (brand value more than doubling to USD739 million) is the fastest growing Automobiles brand after a successful 2022 in which it sold 21% more vehicles year-on-year. The brand’s forecasts have also increased, helping further boost brand value.

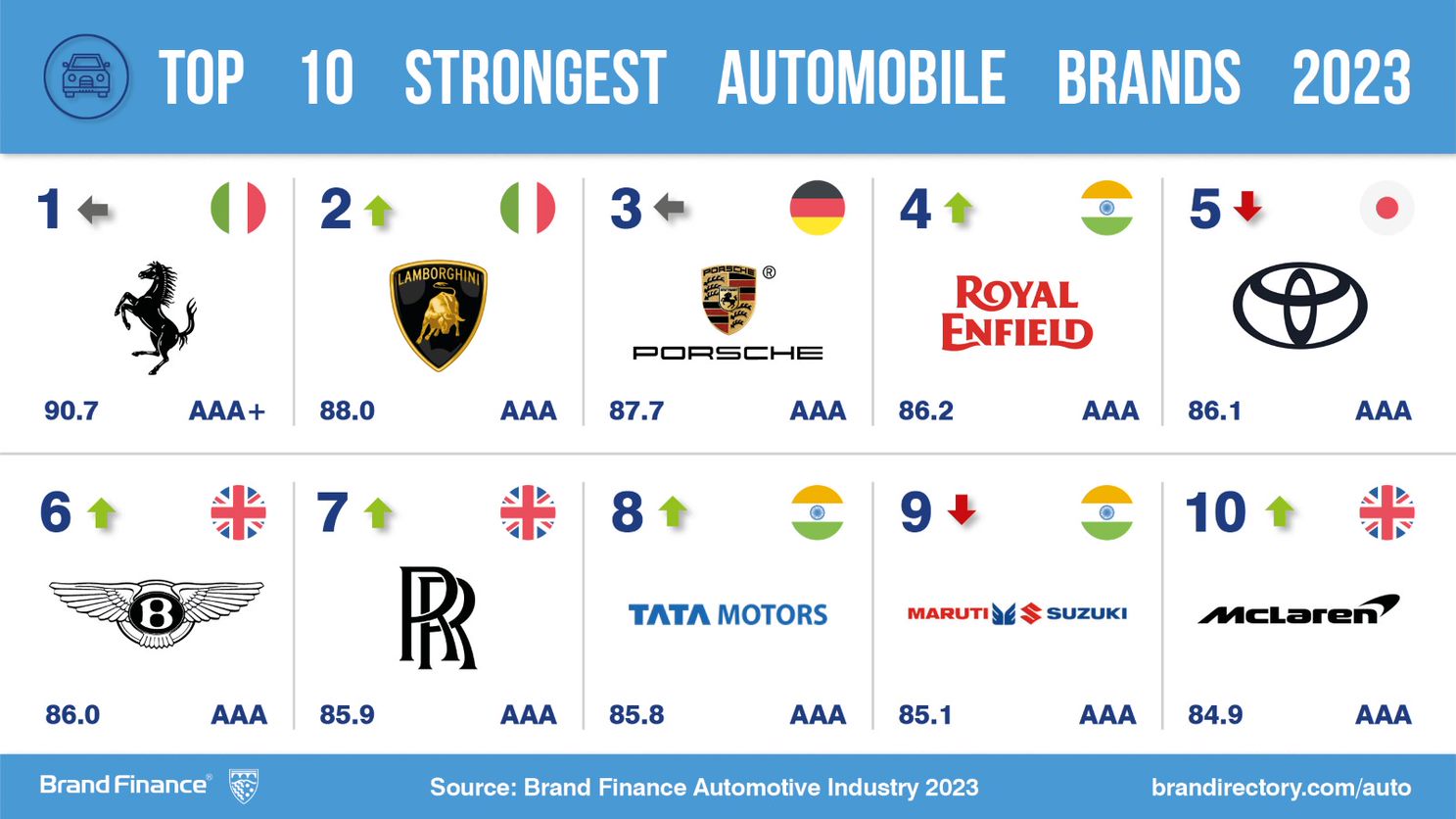

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

Ferrari (brand value down 8% to USD7.4 billion) is again the strongest Automobile brand with a Brand Strength Index score of 90.7, and AAA+ brand rating. Despite a brand value reduction, Ferrari in fact had a strong financial performance in 2022. Its brand reduction in USD was caused by adverse foreign exchange movements and concerns about future financing requirements.

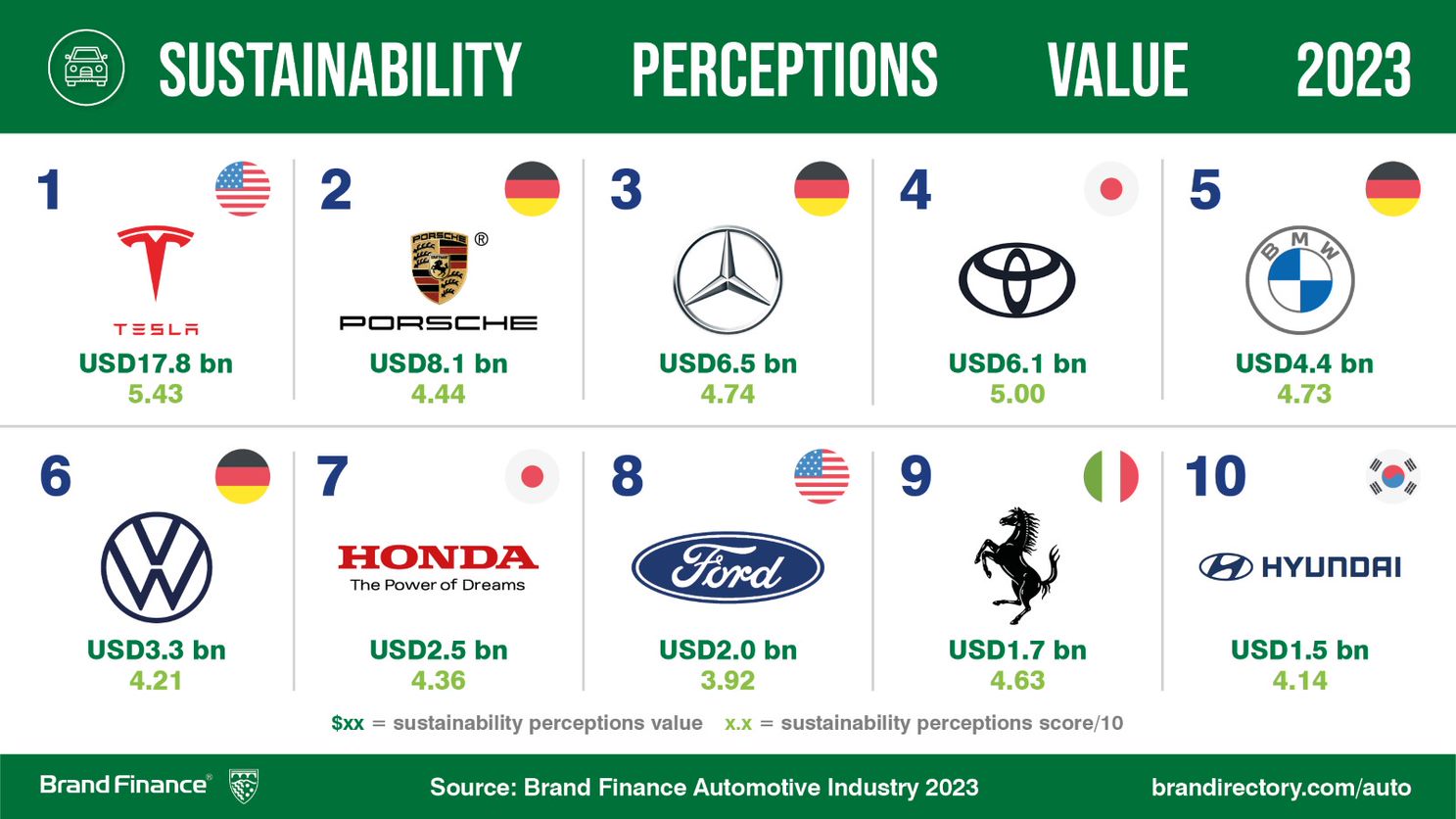

As part of its analysis, Brand Finance assesses the role that specific brand attributes play in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand.

Tesla has the highest Sustainability Perception Score (5.43 out of 10) and Value (USD17.8 billion). Tesla is well known as a pioneer of the EVs and battery technology that is aiding the transition to a lower carbon economy. This image has clearly carried across into the perceptions held by global consumers.

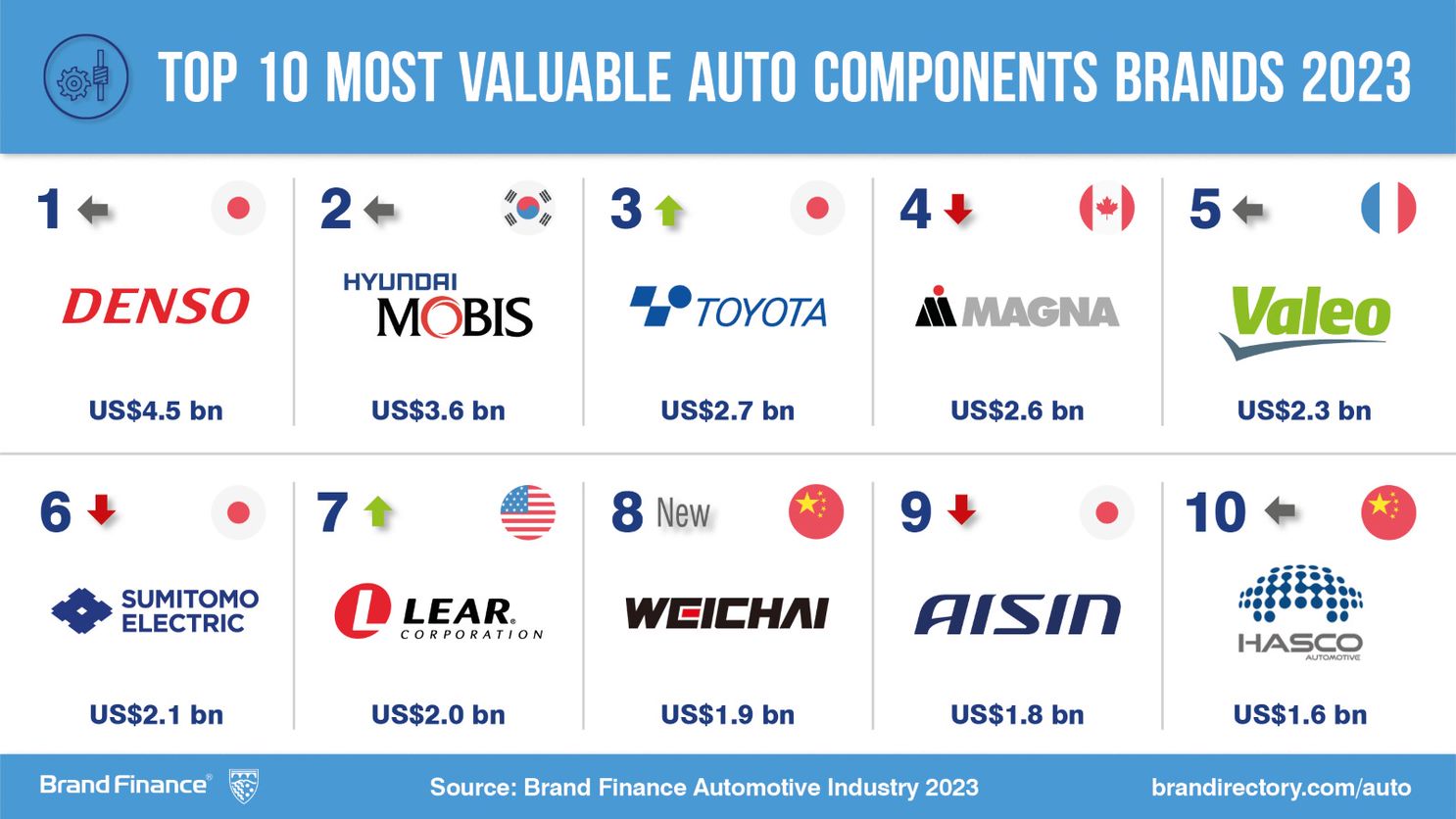

Japanese brand Denso (brand value up 6% to USD4.5 billion) retains its title as the world’s most valuable Auto Components brand for the 6th consecutive year. Denso has invested heavily in electrification as it looks towards a more electric focuses future for the automotive industry.

Aptiv (brand value up 30% to USD1.6 billion) is the fastest growing brand in the Auto Component ranking. As well as recent acquisitions of Wind River Systems, Inc and Intercable Automotive, the brand saw revenues increase in 2022 after a second year of record new business bookings. French brand Valeo (brand value up 1% to USD2.3 billion) is the strongest Automotive Component brand with a Brand Strength Index score of 69 out of 100, with AA- rating.

There was no movement in the top three of ranking of the world’s most valuable tyre brands in 2023, with Michelin (brand value up 2% to USD7.9 billion) remaining in the top spot for the 6th consecutive year. It is followed by Bridgestone (brand value down 1% to USD7 billion) in second place, and Continental (brand value down 3% to USD4.1 billion) in third.

As well as being the most valuable Tyre brand, Michelin is also the strongest, with a Brand Strength Index score of 88.1 out of 100, with a corresponding AAA rating. Michelin’s high brand equity has partly enabled it to remain resilient to difficult macroeconomic challenges

Chinese brand Sailun is the fastest growing Tyres brand (brand value up 6% to USD7 million). In 2022 the brand released its EcoPoint3 tyres, a more sustainable and affordable solution to car manufacturers, after ten years of development. This innovation created widespread media-coverage within the industry, contributing to Sailun’s brand value growth.

As well as being the most valuable and strongest Tyres brand, Michelin also has the highest Sustainability Perception Value of any Tyres brand in the ranking at USD255 million.

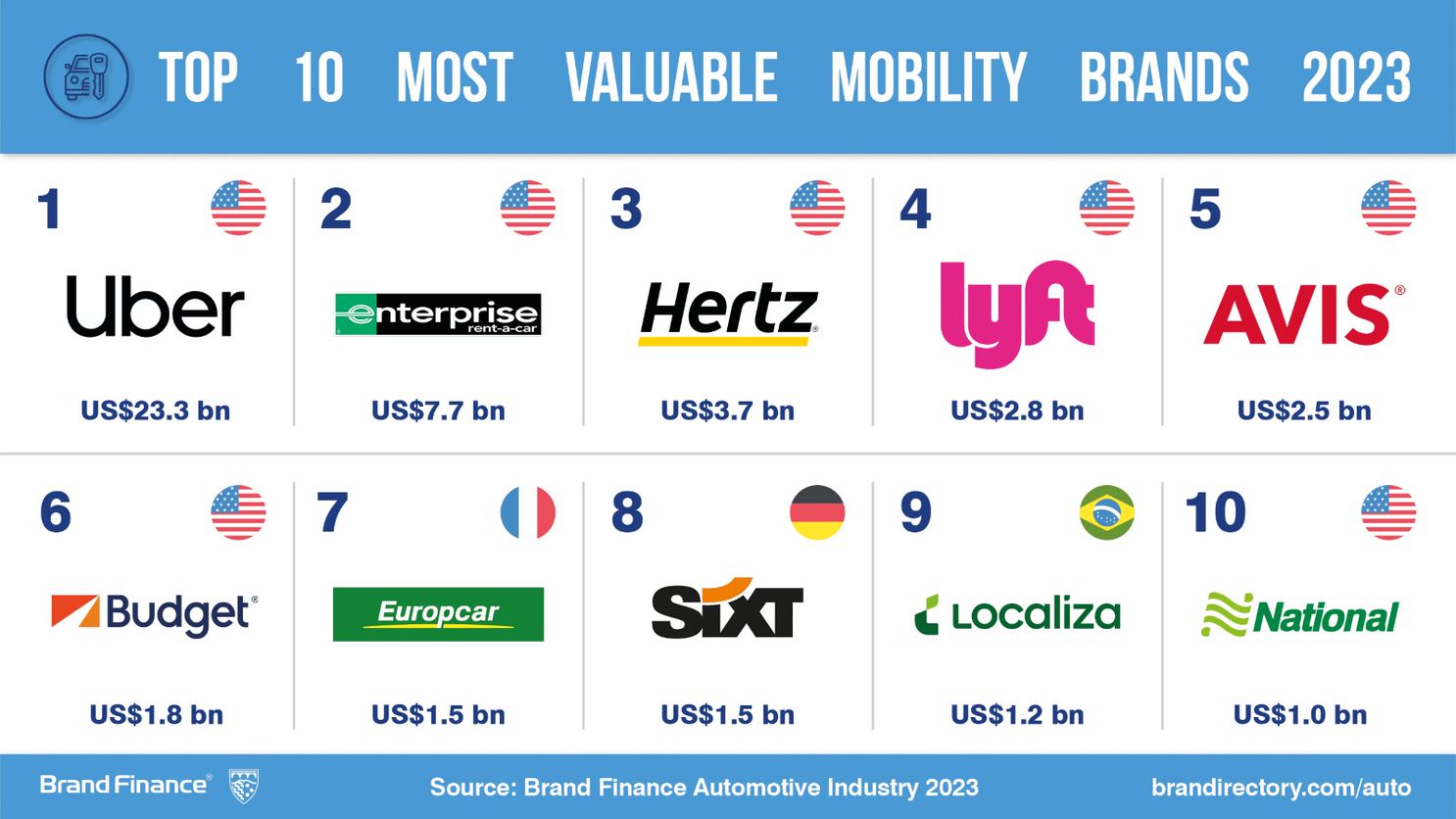

Uber is the most valuable Mobility brand in 2023, up 2% year-on-year to USD23.3 billion. Uber’s dominance in the sector is highlighted by the fact that its brand value is mor than three times the value of the second most valuable Mobility brand, Enterprise (brand value up 9% to USD7.7 billion).

As well as being the most valuable Mobility brand, Uber also has the highest Sustainability Perception Value in the ranking – USD2.4 billion. Enterprise is the strongest Mobility brand, with a Brand Strength Index score of 76.7 out of 100 and corresponding AA+ brand rating.

View the full Brand Finance Automotive Industry 2023 report here

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.