View the full Brand Finance Automotive Industry report here

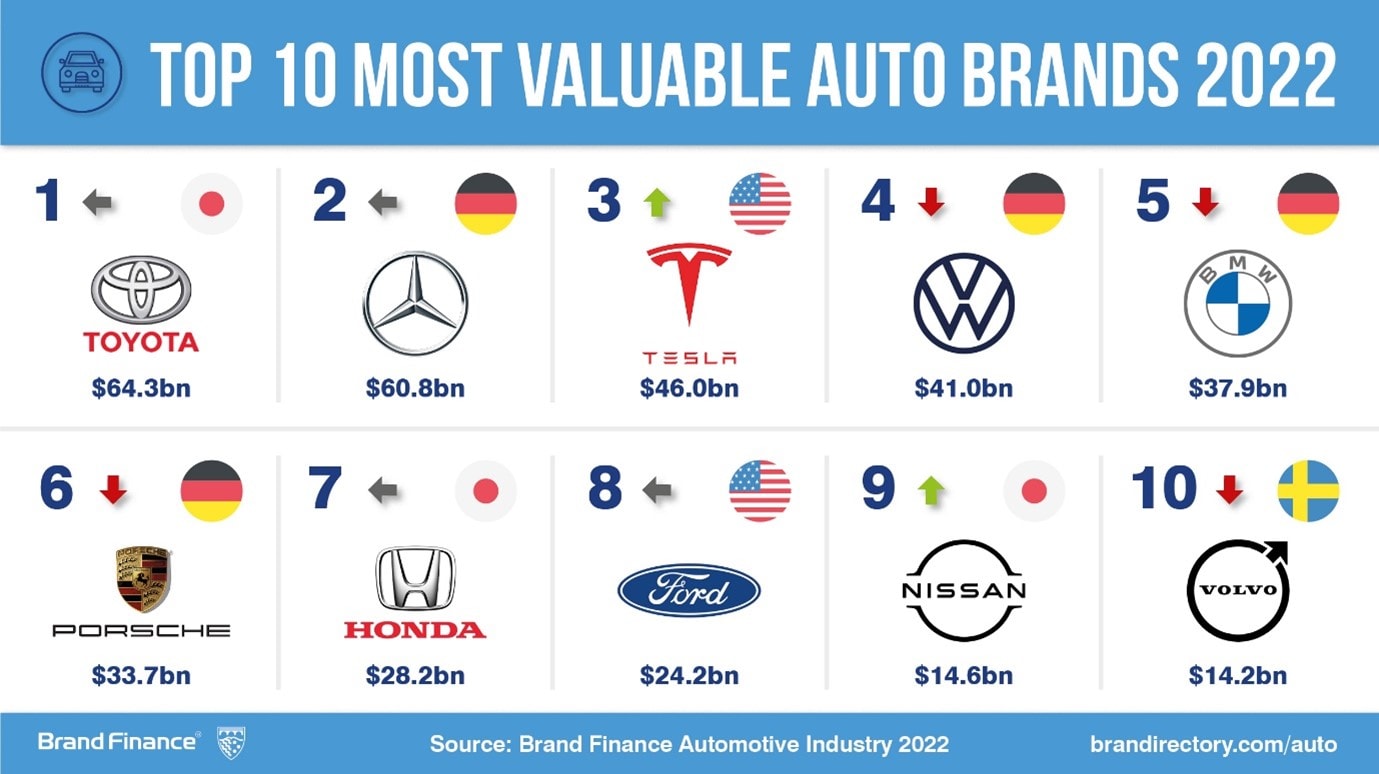

Tesla has been the fastest growing automobile brand over the course of the pandemic with astounding brand value growth of 271% in the last two years, according to the latest report by leading brand valuation consultancy Brand Finance. The brand’s impressive growth continued this year with its brand value up by 44% to US$46.0 billion, which saw it move from 6th to 3rd in the Brand Finance Automobile 100 2022 ranking. Tesla was the only brand in the Top 10 of the ranking to see significant growth this year.

Every year, Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The Brand Finance Automotive Industry 2022 report ranks the world’s top 100 most valuable and strongest automobile brands, the top 20 auto component brands, the top 15 tyre brands and the top 10 car rental service brands.

Tesla’s CEO, Elon Musk, has played a huge part in the growth of the brand with his charismatic, and at times controversial, behaviour keeping it firmly in the limelight. Tesla’s transformation into a household name has seen other brands try to connect themselves to the brand to benefit from the Tesla effect.

2021 saw Tesla increase its footprint in China, to ensure it continues to compete in the booming Chinese market. It opened a new research and development centre, its first outside of America, in addition to a data centre at its Gigafactory in Shanghai. The brand also built a second delivery centre in the city, which incorporates sales, test driving and delivery of Tesla vehicles. Looking to 2022, Tesla announced it would launch no new models this year due to the global chip shortage, as doing so would reduce its overall output. Instead, the brand will focus on its full self-driving software as well as scaling up its production capabilities.

Alex Haigh, Valuation Director at Brand Finance, commented:

“A trend we expect to see within the automotive industry in the future is the growth of add-on and subscription services. Tesla is one of the brands at the forefront of this shift with its full self-driving software, which the brand estimates could eventually be worth more than the value of the car itself.”

Electric revolution sees Chinese brands surge

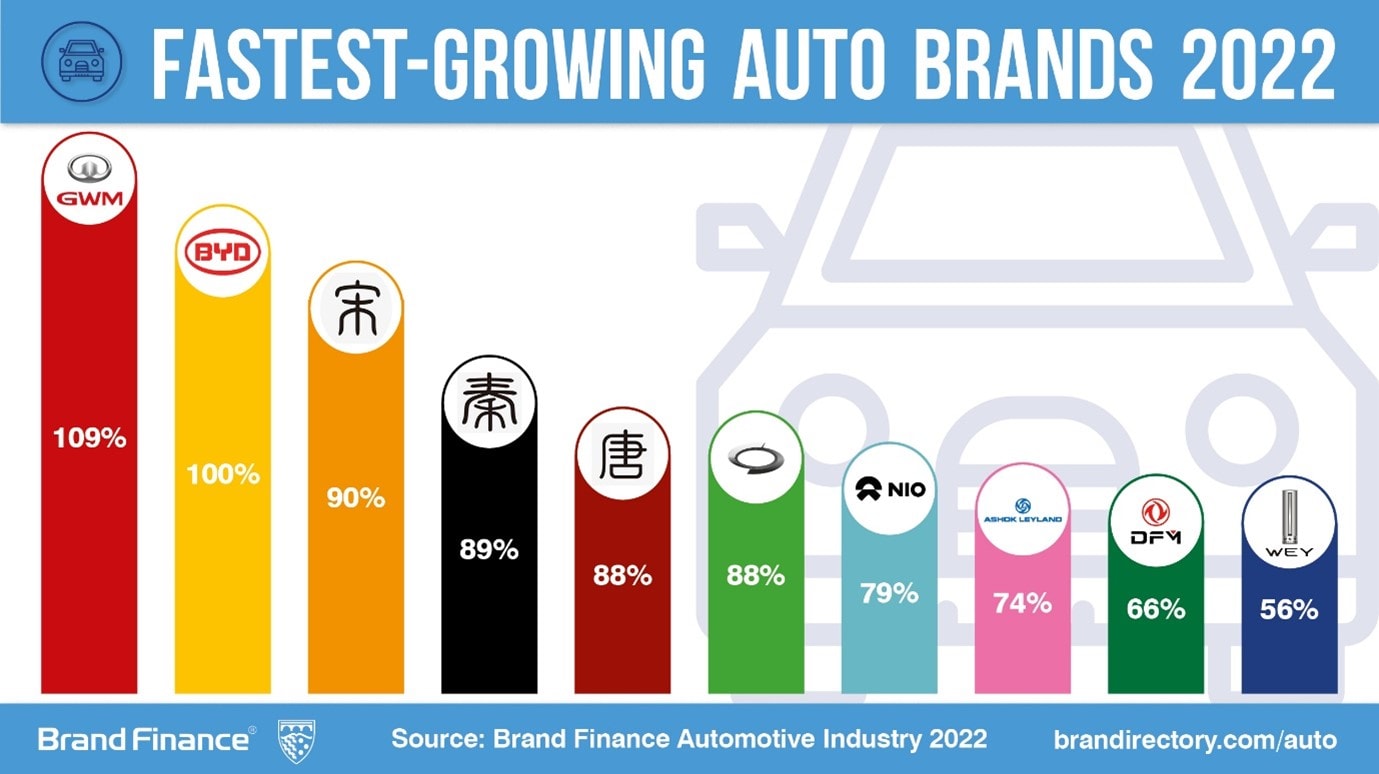

Chinese brands account for eight of the top 10 fastest-growing brands in the Brand Finance Automobile 100 2022 ranking. The increasing popularity and adoption of electric vehicles in China has been a key driver behind the impressive growth for these brands, with China accounting for most electric vehicles sold globally. Several Chinese brands are looking to capitalise on the momentum by expanding their global footprints, with several of these brands launching in Europe in 2021.

While Tesla has seen the fastest growth over the past two years of the COVID-19 pandemic, Great Wall is the fastest-growing brand in the ranking this year, with its brand value increasing by an impressive 109% to US$2.6 billion. As well as launching in Europe last year, Great Wall announced it will be launching nine electric vehicle models in Thailand over the next three years, where demand is expected to grow considerably. Great Wall plans to use Thailand as a base to launch its expansion into the ASEAN region. The auto marque’s CEO, Jianjun Wei, was also the top ranked automobile CEO in the Brand Finance Brand Guardianship Index 2022, which ranks the world’s top 250 Chief Executives according to how well they manage and grow their company’s brand, and placed 3rd overall across all industries.

BYD was the second fastest-growing brand in the automotive ranking with its brand value doubling to US$6.4 billion, an increase which saw it overtake Haval (brand value up 55% to US$6.1 billion) to become China’s most valuable car brand. BYD, which specialises in electric vehicles, saw sales accelerating 232% in 2021 with 603,783 models sold – making it the best-selling new energy vehicle manufacturer in China for the ninth year.

Joining Great Wall and BYD in the Top 10 fastest-growing brands is Song (brand value up 90% to US$1.7 billion), Qin (up 89% to US$475 million), Tang (up 88% to US$630 million), NIO (up 79% to US$2.6 billion), Dongfeng (up 67% to US$1.4 billion), and WEY (up 56% to US$613 million).

Alex Haigh, Valuation Director at Brand Finance, commented:

“The shift to electric vehicles has benefitted Chinese brands hugely. With traditional internal combustion engine technology China was playing catchup, but in the electric vehicle space many Chinese brands are at the forefront. BYD’s newly unveiled Blade Battery is a prime example, and this will not only be used in BYD models, the brand has even been in talks to supply Tesla.”

Toyota holds on to pole position as most valuable automobile brand

Although Chinese auto brands have seen impressive growth, Japan’s Toyota has held on to the top spot in the Brand Finance Automobile 100 2022 ranking with a brand value of US$64.3 billion.

Whilst the Japanese brand wasn’t immune to the global chip shortage that ravaged the industry, Toyota was better placed than most to weather the storm thanks to its contingency stockpiling. The foresight allowed the brand to keep production levels high when others faltered and resulted in Toyota outselling General Motors in North America in Q1 2021 – the first time any brand has outsold General Motors in the region since 1998. Toyota remains the world’s top-selling automaker, the only manufacturer selling over 10 million vehicles globally.

Toyota was one of the early adopters of hybrid technology, with its Prius model dominating the hybrid segment for years, but it has fallen behind in the increasingly competitive electric vehicle arena in recent years. To regain ground, last year it announced it would be investing US$35 billion in electric vehicles, focusing on both battery technology and car development. The investment forms part of Toyota’s ambition to sell 3.5 million electric vehicles a year by 2030.

Fellow Japanese brands Honda (brand value US$28.2 billion)and Nissan (US$14.6 billion) join Toyota in the Top 10 of the ranking, though both brands saw a 10% decrease in brand value this year. Honda held onto its position in 7th, and despite the loss in brand value Nissan actually climbed two spots from 11th to 9th, as it fared better than Sweden’s Volvo (down 20% to US$14.2 billion) and Germany’s Audi (down 20% to US$13.8 billion).

Mercedes-Benz remains most valuable European brand

Sitting behind Toyota, Mercedes-Benz remains the second most valuable brand in the ranking, and the most valuable European brand, with a 4% increase in brand value year-on-year to US$60.7 billion. Amid challenging market conditions due to the pandemic and an industrywide semiconductor shortage, the brand prioritized electromobility and has seen great results from it. The German automobile giant confirmed that their electric vehicles sales saw a 90% increase this year.

In 2021, Mercedes-Benz launched the sixth generation of the C-class series with a new interior design and is planning to implement autonomous driving features. At the same time, an industry-wide trend to make a transition to electric vehicles and a sustainable approach to production and distribution is on the rise.

A key development to strengthen the Mercedes-Benz brand is the rebrand of Daimler AG to Mercedes-Benz Group AG. The focus of the rebrand is to enhance passenger cars and vans in the luxury segment. The strategic move to rebrand was to fulfil the brand’s objective to focus on financial and mobility services by offering insurance and rental subscriptions and digital fleet management systems.

Other German brands did not fare so well in the ranking this year, with Volkswagen (brand value down 13% to US$41.0 billion), BMW (brand value down 6% to US$37.9 billion), and Audi (brand value down 20% to US$13.8 billion) all seeing losses in brand value. With lockdowns, network contractions in production and the ongoing semiconductor shortage, the industry has been faced with many challenges. Apart from sector wide disruptions, the German automakers who were reliant on diesel-powered vehicles have had to deal with regulatory challenges and the transition to electric mobility and electric production methods, resulting in rolling back on production to meet industry trends.

Porsche most valuable among luxury and premium, but Ferrari strongest across the whole table

Porsche is the most valuable luxury and premium automobile brand in the world with a brand value of US$33.7 billion. The automobile giant celebrated the 50th anniversary of the iconic Porsche Design with a limited-edition sale of 750 cars to pay tribute to the iconic design by Ferdinand Alexander Porsche.

The brand’s aim to transform into an agile company has led to leveraging digital transformation by enhancing online sales. To adapt to new formats of sale in the automobile sector, Porsche has invested in e-commerce for 100 markets globally to adopt an omnichannel strategy to connect digital services and retail sales.

While Porsche is the most valuable brand in the luxury and premium segment, Ferrari was named the strongest automobile brand in the world with a Brand Strength Index (BSI) score of 90.9 out of 100 and a corresponding AAA+ rating. Apart from calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

2021 was Ferrari’s best-ever year in terms of sales, with the company paying bonuses to all employees as a result, and the projected growth for 2022 remains high. The automotive brand’s historic pursuit of controlled growth has helped to preserve its exclusivity within its sector, however, last year Ferrari expanded its target market to a younger demographic by launching a new high-end fashion line. The aim of creating a brand that can cater to Italian luxury lifestyle in the high-end category will help expand and strengthen its brand portfolio into new avenues, whilst enhancing brand awareness amongst the younger generation.

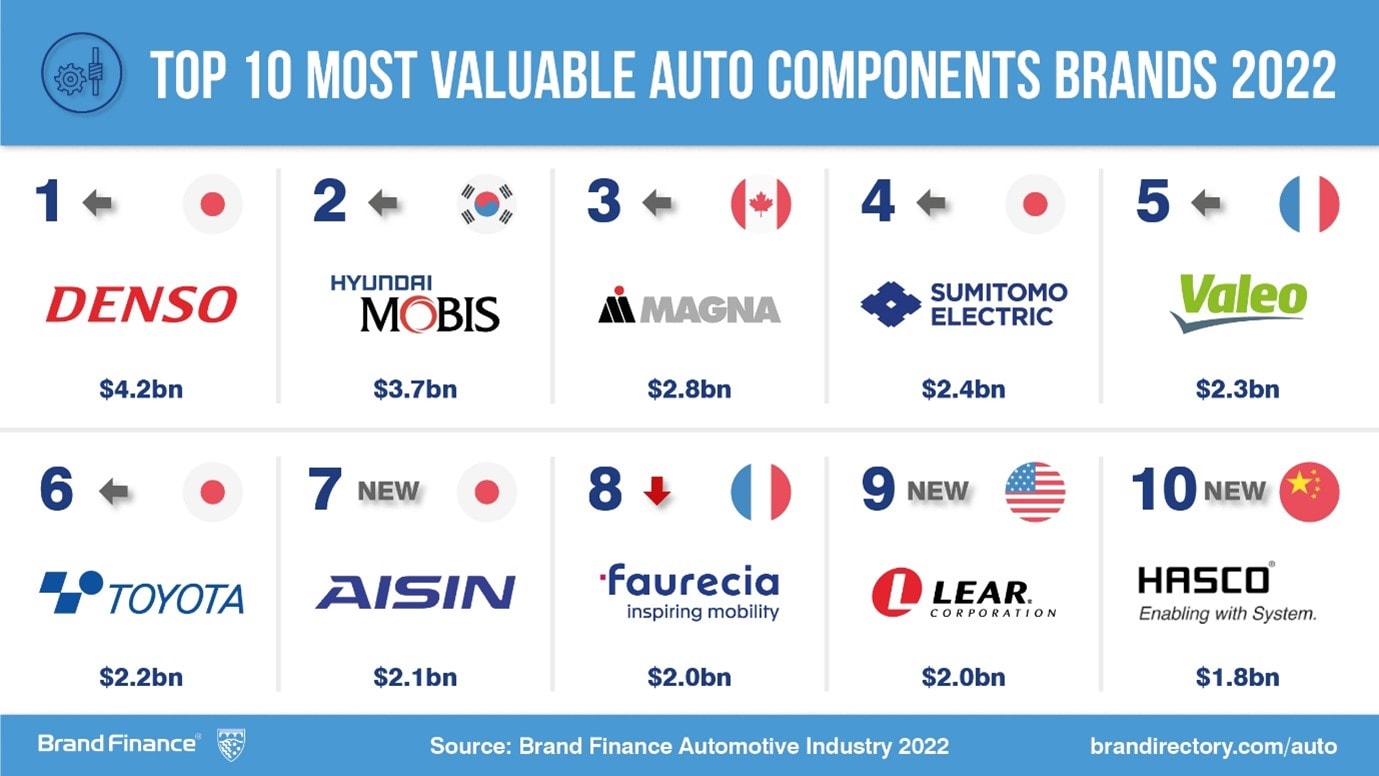

Denso most valuable auto components brand

Car sales picked up following the loosening of lockdown restrictions, and auto component brands saw demand rise in turn. It has been far from clear sailing for the industry with the global chip shortage disrupting production, but the overall outlook is positive, evidenced by the vast majority of brands in the Brand Finance Auto Components 20 2022 ranking seeing good growth.

Denso has retained the title of most valuable auto components brand in the world for the 5th consecutive year, with brand value up 12% to US$4.2 billion. The brand continued to play its part in combatting the COVID-19 pandemic, creating respirator components in collaboration with Ford, as well as hosting over 50 vaccination clinics for employees across North America. Looking forward, the ever-increasing adoption of hybrid and electric vehicles is good news for Denso, which has over two decades worth of experience in the manufacturing of hybrid car parts.

Alex Haigh, Valuation Director at Brand Finance, commented:

“The shift towards electric vehicles has presented the auto component sector with a big challenge, due to the different requirements for parts when compared to internal combustion engines. However, the components required for electric vehicles are more value-adding and will increase the overall value share of components in the manufacturing process, so those that make the proper investment will stand themselves in great stead to see growth over the coming years.”

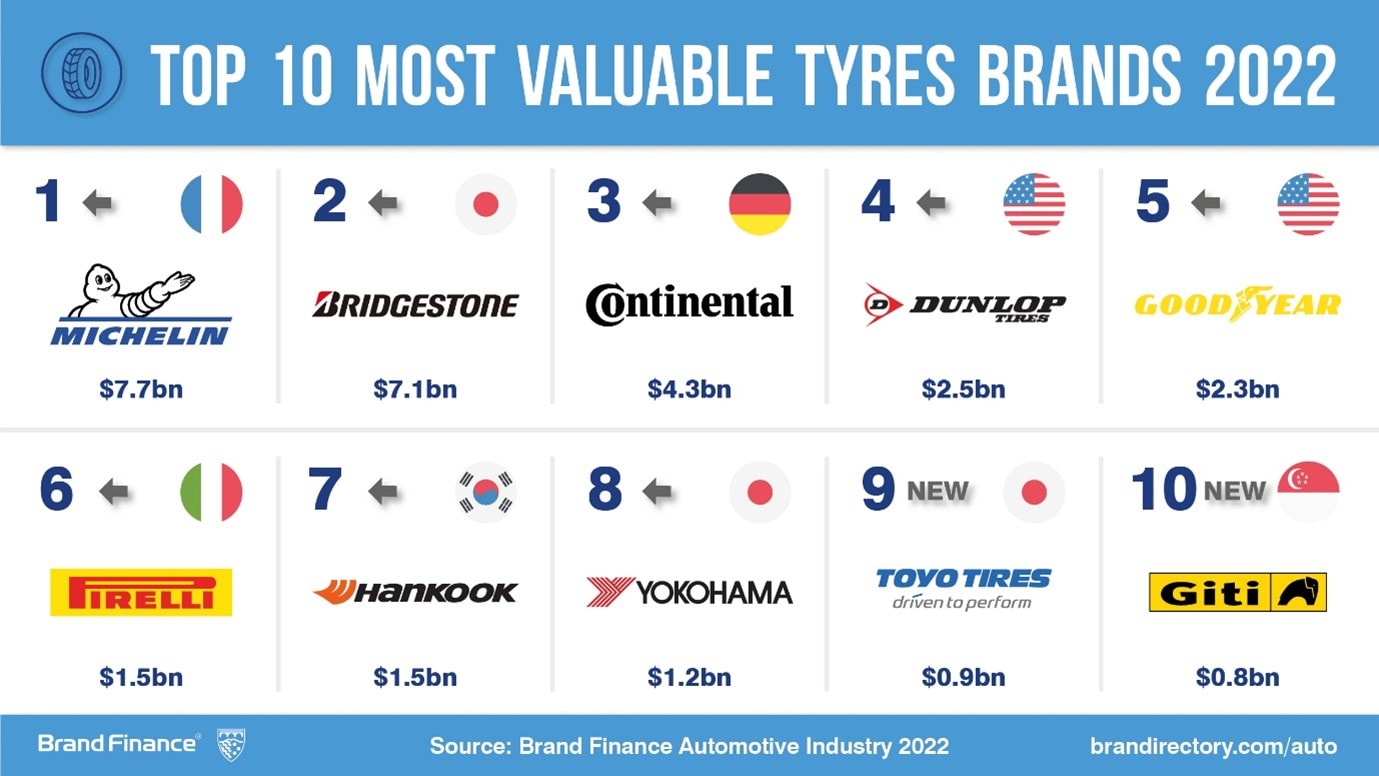

Michelin most valuable and strongest tyres brand

As the world opened back up and travel increased throughout 2021 the tyre sector regained traction, with almost every brand in the Brand Finance Tyres 15 2022 ranking now more valuable than they were pre-pandemic.

Michelin has retained the title of the world’s most valuable and strongest tyres brand, with a brand value of US$7.7 billion and a brand strength index score of 85.8 out of 100.

Despite continued disruption within the industry, Michelin saw a 15.6% year-on-year increase in consolidated sales in the first nine months of 2021 and exceeded expectations in the third quarter of the year thanks to a rebound in demand for tyres for agricultural machinery. The brand also announced an extension of its partnership with the MotoGP World Championship, remaining the exclusive tyre supplier for the competition until 2026.

Alex Haigh, Valuation Director at Brand Finance, commented:

“Michelin has performed well over the course of the pandemic and has put a little bit of distance between itself and 2nd placed Bridgestone. Michelin’s long history of innovation and reputation for quality has continued to pay dividends through one of the most disruptive economic periods on record.”

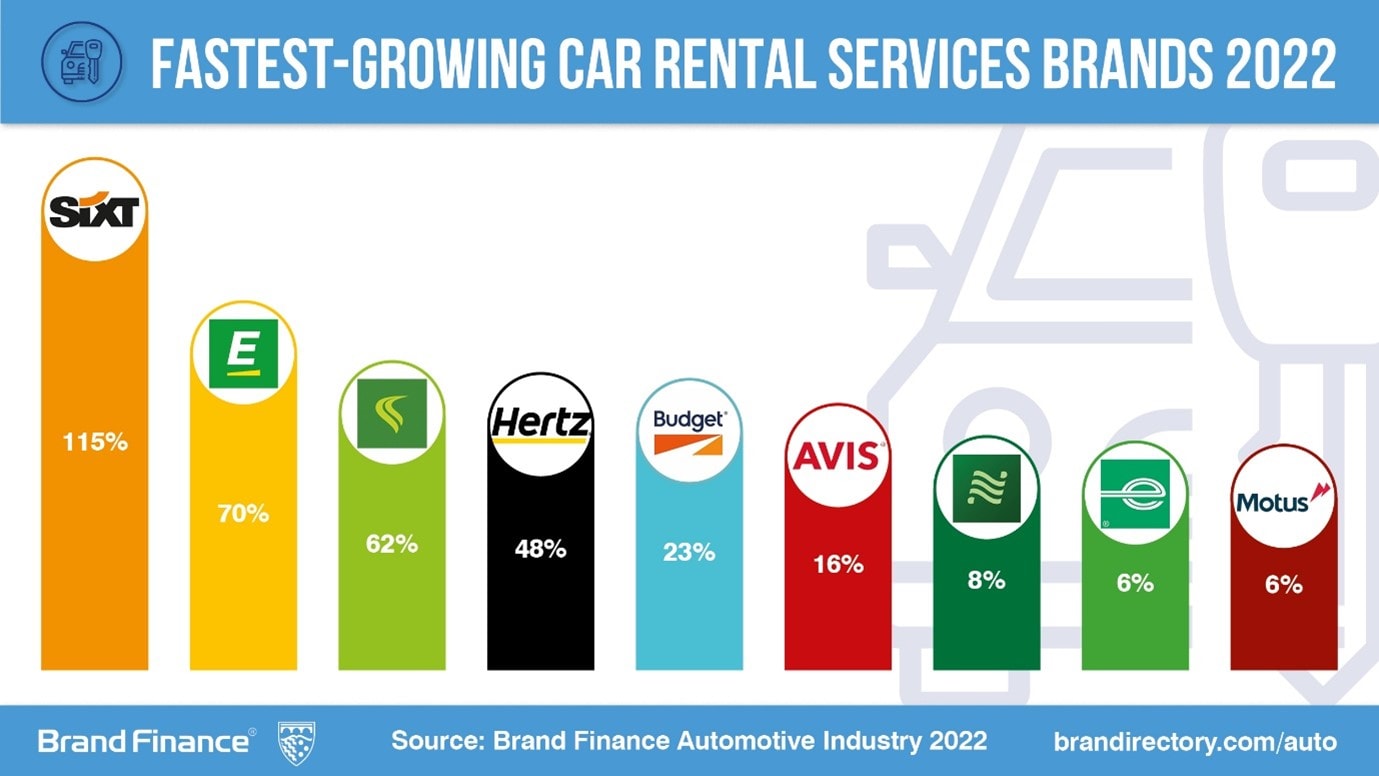

SIXT is fastest-growing car rental services brand

The car rental brands have gained momentum in 2021 after a steep decline in brand value at the start of the pandemic. As the demand for vehicle hires increases, brands in this industry are presented with the opportunity to innovate and capture a high market share.

SIXT is the world’s fastest-growing car rental brand of 2022 with a 115% increase in brand value over the year to US$1.3 billion, according to the Brand Finance Car Rental Services 10 2022 ranking. This year’s increase is the continuation of an impressive growth trend for SIXT, which has seen its brand value increase 265% over the past five years. The brand has built a strong international growth strategy, expanding rapidly in the United States and entering new markets, such as Australia.

David Haigh, CEO & Chairman of Brand Finance, commented:

“SIXT’s brand value has recorded an incredible rate of growth of 265% over the past 5 years, becoming one of the top brands in the Brand Finance Car Rental Services 10 2022 ranking. Its strategy of international expansion, coupled with fostering strategic partnerships across the automobile, technology, and hospitality sectors, as well as the introduction of new subscription models, is paying clear dividends.”

Enterprise has retained the position of the world’s most valuable car rental brand with a brand value of US$7.1 billion with a 6% increase in brand value over the year. Despite COVID-induced travel restrictions, the brand has performed well by launching new mobility hubs and undertaking fleet electrification, but it remains below its pre-pandemic brand value of US$7.4 billion.

View the full Brand Finance Automotive Industry report here

Note to Editors

Every year, Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The Brand Finance Automotive Industry 2022 report ranks the world’s top 100 most valuable and strongest automobile brands, the top 20 auto component brands, the top 15 tyre brands and the top 10 car rental service brands.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Automotive Industry 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.