Thai brands return to growth in challenging global environment as PTT remains #1

View the full Brand Finance Thailand 25 2022 report here

PTT is most valuable Thai brand valued at US$5.3 billion

As Thailand’s largest state-owned enterprise, the multinational energy brand has grown over time to benefit Thai society and the nation. PTT has not only identified that energy sustainability is crucial in response to climate change, but it has also recently announced its plans to make Thailand a liquified natural gas (LNG) hub with the brand aspiring to achieve carbon neutrality by 2050. PTT investments in renewable energy and energy storage indicates how important it is for the brand to assist in sustaining Thailand’s energy industry.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the world’s biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The top 25 most valuable and strongest Thai brands are included in the annual Brand Finance Thailand 25 2022 ranking.

Alex Haigh, Managing Director Asia Pacific commented:

“Multi-year high inflation and China's slowdown remain a drag on the nascent recovery of Thailand’s brands. While the Thai economy is projected to expand with domestic demand and exports. We expect that banking, oil, gas, and telecoms brands will be key to the country's recovery in the short-term.”

Kasikornbank is strongest Thai brand, with AAA rating

In addition to brand value, Brand Finance determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

According to this, Kasikornbank (brand value up 13% to US$1.9 billion) is the strongest brand in Thailand with its Brand Strength Index (BSI) score of 88.8 and corresponding AAA brand rating. An innovative and customer-centric banking brand, Kasikornbank has made digital transformation a priority. It has also been vocal of its intention to become the Regional Digital Bank of the post COVID-19 era, setting up service technologies that are more user responsive. Kasikornbank is committed to decarbonising its own operations and aims to become the leading sustainable bank in Thailand by pioneering green banking products. For Kasikornbank, sustainability is deeply ingrained in how it serves its customers and in how it manages its operations.

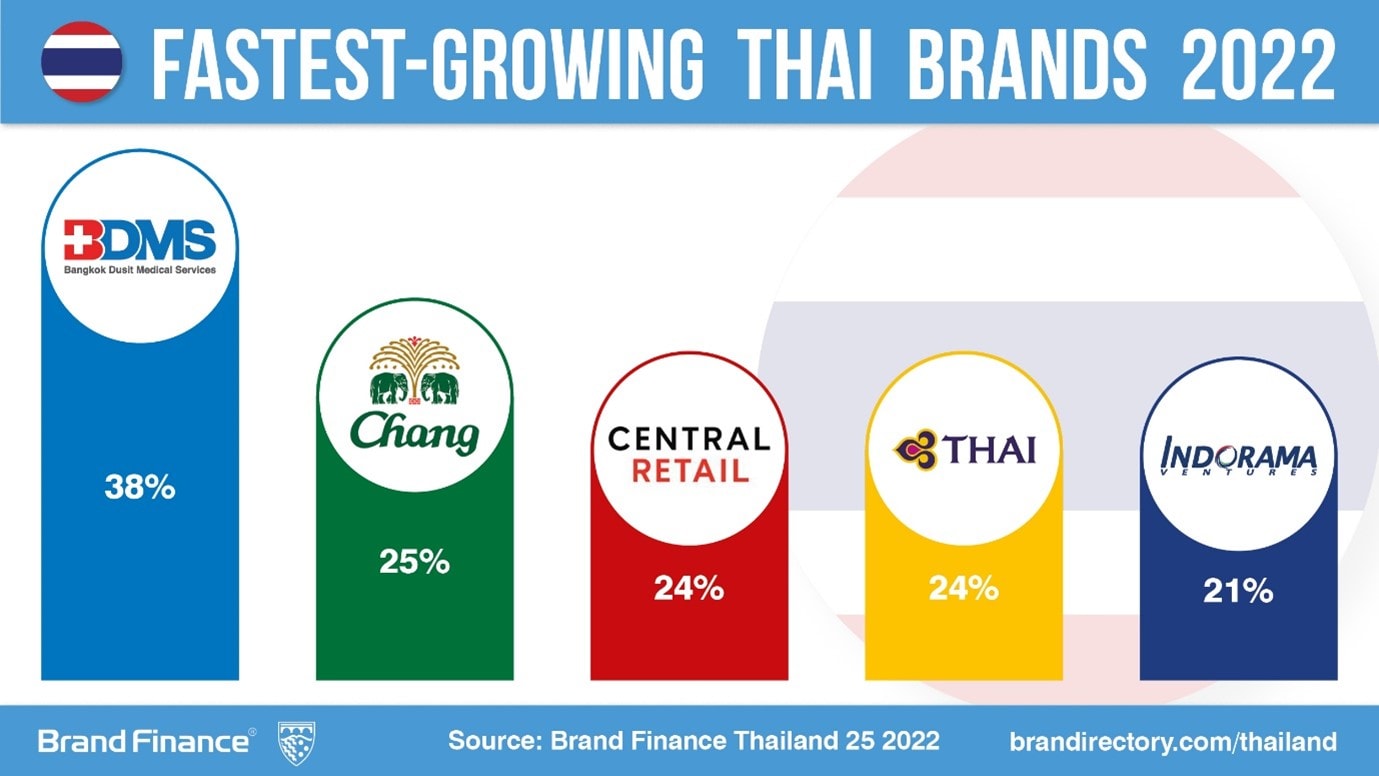

BDMS is fastest-growing Thai brand, up 38%

Bangkok Dusit Medical Services is the fastest growing Thai brand in the ranking up by 38% to US$656 million. In a world that has changed due to the global pandemic, it is no surprise that the demand for quality healthcare has become a top priority for many Thai people. As Thailand’s largest private healthcare network, BDMS has operated on the ‘prevention is better than cure’ philosophy and has pursued some exciting partnerships that support this notion. Their rapid brand growth this year has been correlated with their recent sponsorship campaign with CNN focused on healthy living and global health issues. BDMS has also recently entered into an agreement to lease an area of land earmarked to develop its BDMS Silver Wellness and Residence Project.

Top 25 most valuable Thai brands grew 4% this year

The total value of top 25 Thai brands (US$31.9 billion) is 4% higher than it was in 2021 (US$30.7 billion). According to our last Global Soft Power Index 2022, Thailand is one of 25 countries where recovery and response to Covid-19 pandemic was best, although currently the war in Ukraine and inflation are slowing growth. Banking (28%), Oil & Gas (20%) and Telecoms (16%) sectors performed well and has contributed the most to the nation’s growth.

View the full Brand Finance Thailand 25 2022 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Thailand ’s top 25 most valuable and strongest brands are included in the Brand Finance Thailand 25 2022 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Thailand 25 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.