View the full Brand Finance Cosmetics 50 2023 Ranking here

L'Oréal glows as the world’s most valuable cosmetics brand, valued at US$12 billion

L'Oréal (brand value up 7% to US$12 billion) reigns supreme as the overall winner in the Brand Finance Cosmetics 50 ranking. As one of the world’s most popular and well-known cosmetics brands, L’Oréal operates in over 150 countries and has a global portfolio of over 30 brands. In its analysis, Brand Finance has determined that the key measures of familiarity and consideration towards L’Oréal have increased. This increase may be attributed to the company’s digital marketing strategies and enhanced online presence. By leveraging its enormous social media following, (over 10 million followers on Instagram and 438k+ followers on TikTok) the brand has enhanced its familiarity amongst younger consumers, producing visually appealing content that is often led by popular influencers. Further, L’Oréal also boasts an innovative and continually expanding product range, a key attribute identified in the investment pillar of its brand strength.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest Cosmetics brands are included in the annual Brand Finance Cosmetics 50 2023 ranking.

Following the appointment of a new CEO in 2021, Nicolas Hieronimus, L’Oréal has also expanded its efforts in digital transformation and sustainability. In 2023, L'Oréal launched two new technology prototypes at CES 2023: HAPTA, a handheld computerised makeup applicator designed for people with limited hand and arm mobility, and L'Oréal Brow Magic, an electronic eyebrow makeup applicator that that enables users to achieve a personalised brow look within seconds.

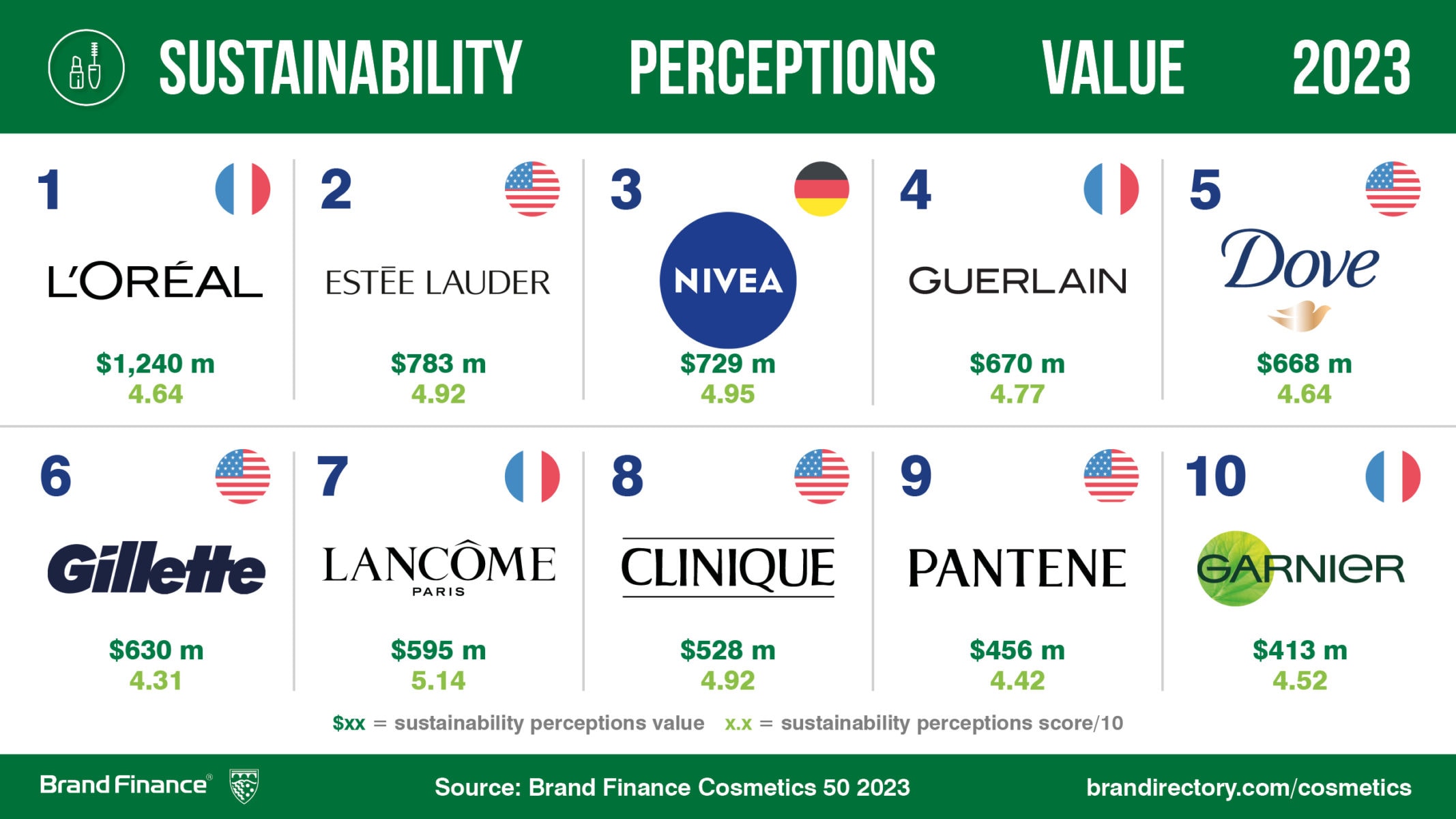

Brand Finance has also ranked L’Oréal as having the highest Sustainability Perceptions Value, with an SPV of US$1.24 billion. In addition, L'Oréal has been recognised by Ethisphere as one of the world's most ethical companies for the 14th time. In recognition of his efforts to promote environmental responsibility, diversity, equity, and inclusion in the fragrance industry, the Fragrance Foundation will award Hieronimus with the Hall of Fame award in June 2023.

Annie Brown, Director of Brand Finance, commented: “L'Oréal has once again come out on top, and Hieronimus has an ambitious and strategic vision for the giant’s future. The L'Oréal brand must continue to prioritise innovation, sustainability and digital transformation as it continues to expand its influence across the globe in the coming years.”

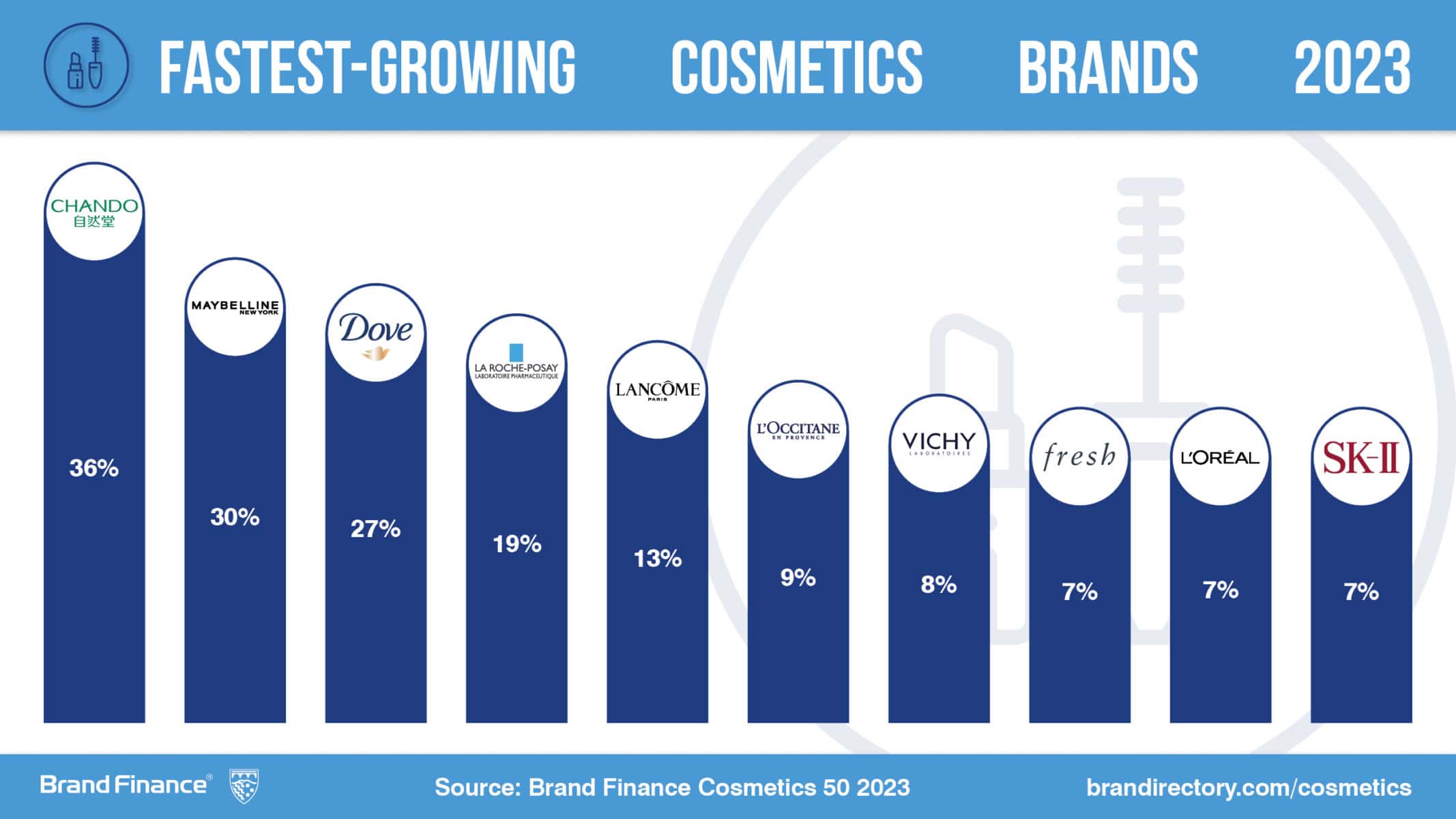

Chinese beauty giant CHANDO is the fastest growing cosmetics brand of 2023

CHANDO (brand value up 36% to US$1.3 billion) has taken the beauty world by storm with its innovative branding and unique products. This increase may be attributed to growing Chinese and global demand for luxury products at affordable prices. The company establishes a unique brand identity by offering a diverse range of products including skincare, fragrances, and home goods. Its Himalayan-inspired branding also holds significant appeal in its local market. As a result, Brand Finance research finds that familiarity and consideration for the brand have improved in China, contributing to its increased brand value and overall ranking, at 38th in 2022 and 32nd in 2023.

CHANDO is also perceived as a leading brand in sustainable and ethical business practices. Through measures such as endorsing renewable energy sources and promoting eco-friendly packaging, CHANDO is attracting a rapidly growing crowd of ethically conscious consumers.

Maybelline New York (brand value up 30% to US$4 billion) is the second fastest growing cosmetics brand of the year. Owned by L'Oréal, Maybelline launched its global sustainability programme in 2022, ‘Conscious Together,’ to promote sustainability and reduce its environmental footprint. The initiative also aims to empower women by supporting organisations committed to their advancement. Maybelline's brand image is also associated with empowering women promoting self-expression through makeup, and the company continues to leverage social media and influencer marketing to engage with its vast audience in the digital age.

Skincare giant Vichy makes a comeback, increasing its brand value by 8% to US$677.62 million, and ranking 7th for fastest growing cosmetics brand

Also part of the L’Oréal family, Vichy (brand value up 8% to US$677.62 million) specialises in a range of high quality and innovative skincare solutions. In recent years, Vichy has also been recognised for developing a more sustainable business strategy, and for promoting eco-friendly formulae in its products.

Considering the growing importance of environmental and ethical responsibility in the market, it will be crucial for Vichy to continue prioritising sustainability efforts. This will not only enhance its Brand Value in future rankings, but also enable it to maintain a distinct identity in comparison to its competitors. Notably, La Roche-Posay (brand value up 19% to US$1 billion) shines eight spots ahead of Vichy in 39th spot, and its products continue to be perceived as innovative, high-quality, affordable, and eco-friendly.

Natura is sitting pretty as the world’s strongest cosmetics brand, with a Brand Strength Index (BSI) of 89.1.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

As Brazil's top cosmetics company, Natura (brand value down 18% to US$2 billion) is renowned for its commitment to ethical and sustainable practices. Brazilian consumers have a strong connection to the company's South American heritage and appreciate its efforts to preserve the Amazon Rainforest. In addition to its sustainability focus, Natura has positioned itself as a cruelty-free brand. This endeavour has further solidified the company's reputation as an industry leader in sustainability. As per Brand Finance's research, sustainability and transparency play a crucial role in shaping the reputation of cosmetics brands. Natura's unwavering commitment to these values is a driving force behind its continued success and popularity among consumers.

Behind the glam: M.A.C Cosmetics is struggling to keep up

M.A.C Cosmetics (brand value down 19% to US$2.7 billion) has dropped 5 places in the ranking since 2022 and is now ranked 17th. More alarmingly, its brand value has dropped by a total of 39% from US$4.4 billion since the beginning of the pandemic period.

Fierce competition and shifting consumer preferences may have diminished M.A.C’s brand value. The company is a subsidiary of Estée Lauder (brand value down 10% to US$7.2 billion), ranked 2nd this year. The giant has several other high-end brands under its umbrella, including Smashbox, Clinique, and Bobbi Brown, the latter two competing with M.A.C in this year’s table. Notably, Clinique (brand value down 20% to US$4.8 billion) is ranked 9 spots ahead of MAC in 8th position.

While M.A.C has built a brand of vibrant and daring makeup options, Brand Finance research finds that consumers are choosing what they perceive to be as more natural alternatives. Clinique's branding highlights simplicity and gentleness, and its vast range of skincare and makeup products are also perceived as gentle and high-quality. This more subdued aesthetic endorsed by Clinique could potentially appeal to a wider range of consumers than the bolder aesthetic favoured by M.A.C.

Innisfree drops out of the game, and other South Korean beauty brands face uphill battle to maintain brand value

The South Korean cosmetics industry is facing a setback as Innisfree has dropped out of the 2023 ranking entirely. Ranked 41st in both the 2021 and 2022 rankings, Innisfree has witnessed a decline in its brand value by almost half. The other two South Korean brands in this year's ranking, Sulwhasoo and The History of Whoo, have also struggled. Sulwhasoo's brand value has decreased by 11% to US$1.3 billion, while The History of Whoo has seen a considerable drop in brand value of 18% to US$1.2 billion.

Research suggests that the Covid-19 pandemic significantly affected the nation’s cosmetics industry. Further, in 2022, Innisfree reportedly planned to close 80% of its physical stores in mainland China. As the world’s second-largest beauty market, Chinese consumers have a growing interest in locally made products, as well as having more access to global brands. As the Chinese cosmetics industry continues to grow, it will be crucial for foreign brands to understand and adapt to these changes in order to remain competitive.

Beauty meets sustainability: L'Oréal claims the throne with a Sustainability Perceptions Value of US$1.24 billion.

As part of its analysis, Brand Finance assesses the role that specific brand attributes play in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance research suggests that the importance of sustainability is extremely high in Cosmetics relative to other sectors. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value,’ is then calculated for each brand.

Given the increasing importance of sustainability in the perception of cosmetics companies, it is unsurprising that the world's largest cosmetics company has once again topped the rankings. Steps taken by the French giant towards sustainable innovation include promoting sustainable formulae in its products, producing environmentally friendly packaging, and reducing waste and carbon emissions across its operations.

It should be emphasised that the brand’s position at the top of the SPV table is not an assessment of its overall sustainability performance, but rather indicates how much brand value it has tied up in sustainability perceptions. L'Oréal’s Sustainability Perception Score was also relatively high, at 4.64/5. While L’Oréal may not be perceived as the most sustainable brand compared to those with sustainability embedded in their core mission, (e.g., Botanical cosmetics company, Yves Rocher, scoring 5.87/10, and Natura, scoring 5.29/10) the company has made, and is perceived as making, significant strides towards a greener future.

Yves Rocher has the highest Sustainability Perceptions Score, at 5.87/10

Yves Rocher (Brand value down 9% to US$2.3 billion) has achieved the highest Sustainability Perceptions Score in the Cosmetics 50 2023 report, at 5.87/10. Since its founding, Yves Rocher has remained committed to its sustainability mission. Its efforts were solidified by the establishment of the Yves Rocher Foundation in 1991, which has successfully planted more than 100 million trees worldwide in 2023.

Yves Rocher also champions a sustainable vision for the future, aiming to reduce its plastic consumption by 30% and use 100% recyclable plastics by 2030. More generally, Groupe Rocher is making strides towards a more sustainable future, aiming to reduce its greenhouse gas emissions by 75% in La Gacilly, its region of origin, by 2025. Since 2011, this process has been underway at five production sites. Thanks to a new heating system, Les Villes Geffs has been using 45% renewable energy since 2023.

Today, the botanical brand continues to use natural and organic products and promote eco-friendly packaging, leading the industry in sustainable business practices. As it does so, it also sends a message to consumers that sustainability is not just a buzzword, but an essential practice for the future.

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.