View the full Brand Finance Finland 25 2021 report here

View the Brand Finance Nordic 150 2021 ranking here

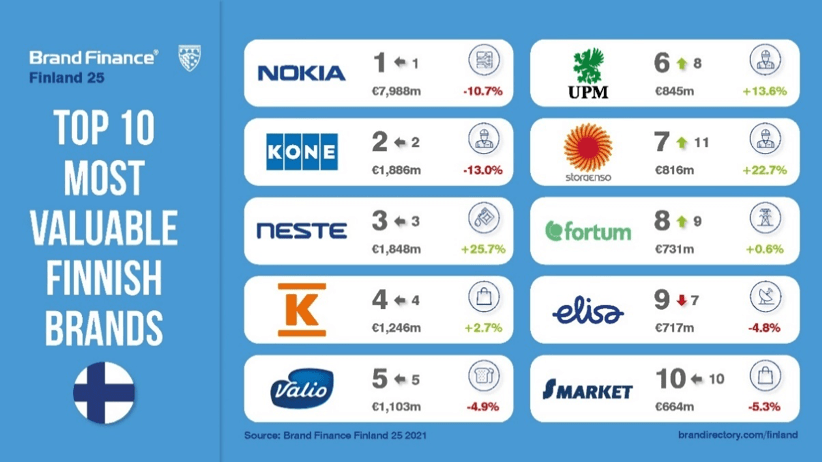

The overall brand value of Finland’s top 25 most valuable brands dropped 3% year-on-year from €25.2 billion in 2020 to €24.3 billion in 2021, according to the latest Brand Finance Finland 25 2021 report. While this translates to a decrease of €858 million in cumulative brand value, forecasts indicate that the nation’s GDP will grow by just over 2% in 2021 and is likely to return to 2019 levels by next year. Private consumption is one of the main drivers of Finland's economic growth, with e-commerce dominating trade, as it has in many other economies over the past year.

Nokia nabs #1

Despite recording a considerable drop in brand value, Nokia (down 11% to €8.0 billion) has retained the title of Finland’s most valuable brand for the 6th consecutive year and is also the 4th most valuable brand in the entire Nordic region. Nokia has a strong IP heritage and great opportunity to enhance its portfolio of brand and technology IP to deliver additional value across the business.

Savio D'Souza, Valuation Director, Brand Finance, commented:

“Finnish brands have held up incredibly well during the crisis. Finland has been very successful in building it is b2b brands; a noteworthy portion of the top 25 are b2b brands with significant regional and international presence. They have no doubt benefited from Finnish soft power which is now ranked 18th globally, as per the latest Brand Finance Global Soft Power Index.”

E&C dominates 22% of ranking brand value

Engineering & construction is the second most valuable sector, accounting for 22% of the total brand value in the ranking with seven brands featured, namely Kone (down 13% to €1.9 billion), UPM (up 14% to €845 million), Stora Enso (up 23% to €816 million), new entrant Metso Outotec (brand value €506 million), Wartsila (up 3% to €482 million), Konecranes (up 5% to €435 million) and YIT (up 19% to €419 million).

Kone remains the most valuable engineering & construction brand in the Brand Finance Finland 25 2021 ranking, as well as second most valuable Finnish brand overall. Despite a slight uptick in revenue over the last year, Kone has continued to grapple with slowing sales, causing a decline in brand value. However, the brand has seen sharp growth in the Chinese market, as well as improved momentum in other markets, as the world starts to return to normality, which should signal a positive change for brand value in the coming year.

Fortum reenergised

Fortum (up 1% to €731 million) maintains its spot in thetop 10 most valuable Finnish brands claiming 8th position, up one place from last year. The brand continues to establish itself as a key player in the transition to clean energy – supported by its acquisition and integration of Uniper – which will help synergise the brands’ three interrelated sustainability objectives: decarbonisation, customer centricity, and security of supply. Additionally, Fortum’s newly appointed CEO, Markus Rauramo, will provide refreshed leadership and support in further promoting Fortum and Uniper’s common goals, as he pledges to turn the two brands into European energy transition champions.

Retail claims third most valuable sector

With just three retail brands accounting for 10% of the overall brand value in this year’s ranking, retail is the third most valuable sector. The highest-ranking brand in this sector, Kesko (up 3% to €1.2 billion), defends its position in the top five most valuable Finnish brands at 4th place. Up slightly in brand value from last year, Finland’s top retailer saw better than expected sales in its building and technical trade, as well as in its groceries division, boosting the brand’s overall performance despite challenges posed by the COVID-19 pandemic.

Mandatum Life makes ranking debut as fastest-growing brand

One of three new entrants, Mandatum Life launches into the Brand Finance Finland 25 2021 ranking for the first time after an impressive brand value growth of 51% to €276 million, making it the fastest-growing brand in this year’s ranking. Other new entrants to the ranking include Metso Outotec in 13th position and Outokumpu (up 7% to €303 million) in 23rd.

Seen as the first challenger brand in the oil & gas sector, Neste snags a spot as Finland’s 3rd most valuable brand after an increase in brand value of 26% to €1.8 billion. The engineering services company is also the second fastest-growing brand and claimed a spot as the highest new entrant in the Brand Finance Oil & Gas 50 2021 ranking in 43rd position. The brand is the world’s largest producer of renewable diesel and jet fuel refined from waste and residues and continues to challenge the status quo through rolling out renewable solutions to the polymers and chemicals industries. Since “Neste Oil” became Neste in 2015, the company market cap has grown by over 800%, transforming the brand from a national oil company to an integrated player, paving the way for innovation.

Supercell lacks charge

In contrast, last year’s highest ranking new entrant and one to watch, Supercell, is the fastest falling brand in this year’s ranking. The mobile gaming brand saw its brand value decrease 34% to €655 million, also dropping five positions to place 11th overall, which can be attributed to an accumulative decline in revenues. While gaming companies enjoyed a general uptick during the pandemic, Clash of Clans maker Supercell recorded reduced earnings for a fifth consecutive year, grossing just €1.3 billion for the 2020 financial year – down from €1.3 billion in 2019 and 2018, and €1.7 billion in 2017.

It’s all in the name: Finlandia is nation’s strongest

In addition to measuring overall brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. According to these criteria, Finlandia – which celebrated its 50th anniversary in 2020 – is once again Finland’s strongest brand with a Brand Strength Index (BSI) score of 82 out of 100, and corresponding AAA- brand strength rating.

Finlandia has been taking important strides towards its sustainability drive, recently unveiling a strategic collaboration with the American non-profit Living Lands and Waters (LL&W), with a €25 million grant to fund LL&W's river clean-up projects throughout the United States. Finlandia's contribution is part of a larger initiative by the Finnish spirits brand to reduce its environmental footprint and establish carbon neutrality across its distillation operation by 2025. The introduction of a lighter-weight Finlandia Vodka bottle, as well as plans to minimise raw material intake and raise the percentage of scrap materials recycled or reused, are among some of the brand’s next moves.

Savio D'Souza, Valuation Director, Brand Finance, commented:

“As one of the world’s top ten selling vodka brands, Finlandia has cemented its position as a leader in key markets – most notably Poland, where the brand accounts for 50% of all vodka sales. Finlandia has celebrated strong CSR scores, a result of parent company Brown–Forman’s continued commitment to and support of the United Nations Global Compact and the Sustainable Development Goals.”

Brand Finance Nordic 150 2021: Standout Sweden

As was the case last year, Swedish brands dominate the Brand Finance Nordic 150 2021 ranking, with a combined brand value of €96.9 billion, equating to 54% of the ranking’s total brand value. IKEA (down 13% to €15.3 billion), Volvo (down 1% to €15.1 billion) and H&M (down 16% to €10.5 billion) have retained the top three positions in the ranking. Twenty-nine brands from Finland feature, compared with 65 from Sweden, 36 from Denmark and 20 from Norway.

ENDS

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.