View the full Brand Finance Singapore 100 2022 report here

DBS continues its decade-long run as the most valuable Singaporean brand, with its brand value up 11% to US$8.7 billion, according to a new report from the world’s leading brand valuation consultancy, Brand Finance. DBS leads a trio of bank brands at the top of the rankings, worth almost as much as second-placed UOB (brand value up 23% to US$4.9 billion) and third-placed OCBC Bank (brand value up 5% to US$4.8 billion) combined.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the world’s biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. Singapore’s top 100 most valuable and strongest brands are included in the annual Brand Finance Singapore 100 ranking.

The DBS brand has grown strongly this year in connection with its ongoing digital transformation, which has enabled it to continue expanding services during the COVID-19 pandemic of the last two-and-a-half years. This effort to harness new technology complements the brand’s prioritisation of climate change, with DBS joining global efforts to achieve net-zero carbon emissions by 2050. Mindful of broader ESG issues, DBS has begun to increase community support, particularly in light of the consequences of the pandemic.

Alex Haigh, Managing Director Asia-Pacific, Brand Finance commented:

“Singaporean brands are bouncing back from the pandemic, with most brand values returning to growth. The trio of Singaporean bank brands are at the top, led by DBS which is making a serious brand investment in improving its brand promise around issues of environmental, social and governance reforms. This is a key opportunity for a bank which sees investors increasingly concerns about such issues.”

UOB (up 23%) overtakes OCBC Bank (up 5%) to become second most valuable Singaporean brand

Very strong brand value growth by UOB (brand value up 23% to US$4.9 billion) has allowed it to overtake OCBC Bank (brand value up 5% to US$4.8 billion) in value this year, with the two banks switching 2nd and 3rd place in the Singaporean brand value rankings.

As UOB approaches its 90th anniversary in 2025, UOB is seeking to ensure that it delivers on its long-term commitment to honour and integrity, while ensuring that its product offering is attractive and relevant to modern customer needs. This year’s very strong brand growth at UOB has been correlated with the launch of UOB TMRW, a unified digital banking platform, and UOB Rewards+, Singapore’s largest cards rewards programme. These two customer and product-driven deployments have made – and will continue to make – a meaningful impact on customer brand perception. At the same time, UOB has set up a dedicated Corporate Sustainability Office and appointed their first Chief Sustainability Officer as both investors and customers express strong feelings about ESG-related issues.

Singtel retains AAA rating and is strongest Singaporean brand

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

According to these criteria, Singtel (brand value up 22% to US$3.9 billion) is the strongest brand in Singapore. With a score of 87.1 out of 100 and keeping the AAA rating, achieved the top ranking in the Brand Strength Index (BSI). DBS, Singapore’smost valuable brand, dropped to second position with a score of 85.8 out of 100.

Singtel continued to execute on their strategy of growing the 5G market share and developing growth engines in NCS and digital services.

Alex Haigh, Managing Director Asia-Pacific, Brand Finance commented:

“Since its independence, Singapore has grown from poverty to become one of the richest countries in the world. To do this, Singapore has nurtured the growth of both homegrown and international brands. We are entering into an era which is more focused on intangible assets, and if the pearl of Asia continues to support the growth of its brands, it will continue its miraculous growth story.”

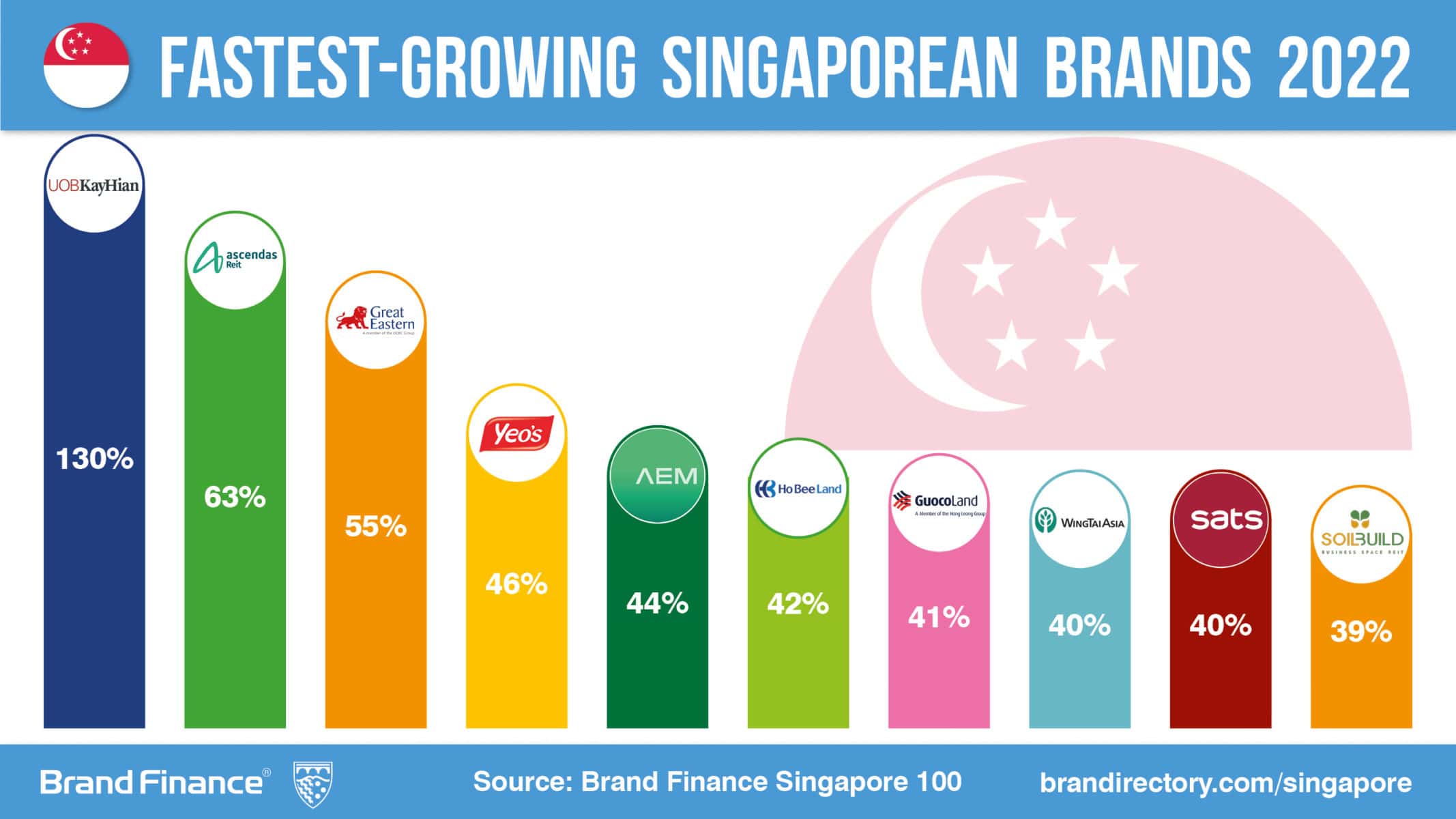

UOBKayHian more than doubles in brand value to be Singapore’s fastest growing brand

Backed by the UOB Group, UOBKayHian (brand value up 130% to US$155 million) is Singapore’s fastest-growing brand. This surge in brand value – to slightly more than its value two-and-a-half times ago – is correlated with an overall increase in trading volumes. With more people subjected to pandemic restrictions in recent years, more people have had time to consider investing in retail stockbrokers. The UOBKayHian brand has further benefited from the post-pandemic economic rebound and generally low interest rates which have applied globally until recent weeks.

Looking ahead, the brand value of UOBKayHian may continue to benefit from post-pandemic reopenings (especially if China reconnects more strongly with the world) but will also be tempered by the risk of higher interest rates, higher inflation and higher geo-political tensions. Further, the company has recently launched a joint venture with Goldhorse, a Hong Kong fintech company specializing in financial products, to provide a series of customized tools and financial services for the expansion of its structured product business.

Ascendas Reit (brand value up 63% to US$324 million)achieved rank 36th in Singapore this year. Ascendas Reit, Singapore's first and largest listed business space and industrial real estate investment trust, is planning to deepen its presence in the US and Europe markets. The REIT’s multi-asset portfolio in Singapore comprises properties in the business space and life sciences, logistics, and industrial and data centres segments. The third fastest growing brand is Great Eastern (brand value up 55% to US$3.1 billion), which retained its position as the fifth most valuable Singaporean brand.

FairPrice ranks 13th in the brand value ranking (US$908 million) and 12th in the Brand Strength Index (BSI), highest new entrant this year

There are five new entrants in the Brand Finance Singapore 100 ranking this year. FairPrice is the most valuable new entrant to the ranking in 13th place at US$908 million. In addition to its high ranking for value, the brand was also recognised for being amongst the strongest Singaporean brands, earning 12th position in the Brand Strength Index (BSI) ranking. FairPrice is helping vulnerable families to fight inflation by donating S$1.2 million to 600 families over three years. As part of its growth strategy, the brand has enhanced its product offering by expanding the Australian product portfolio on its shelves thanks to an agreement with Australian supermarket chain Coles.

View the full Brand Finance Singapore 100 2022 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. Singapore’s top 100 most valuable and strongest brands are included in the Brand Finance Singapore 100 2022 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Singapore 100 2022 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.