View the full Brand Finance Media 50 2023 ranking here

Twitter’s brand value falls 32% to USD3.9 billion and brand strength sinks 11-points

Elon Musk’s tenure as CEO at Twitter (brand value down 32% to USD3.9 billion) sees the brand drop 8 positions in the Brand Finance Media 50 ranking this year. This is largely due to Brand Finance research finding a significantly weaker perception of the brand causing a very large 11-point drop in brand strength, and subsequent demotion to a brand strength rating of AA.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest Media brands are included in the annual Brand Finance Media 50 2023 ranking. This year’s ranking of the world’s most valuable media brands is again dominated by consumer-facing online tech companies, especially in social media.

Aggressive business approaches from Twitter CEO Elon Musk have contributed to Twitter’s brand value and brand equity erosion. Customers and stakeholders have perceived large redundancies negatively, which compound difficulties for the brand to retain advertisers and rld’s corresponding revenue. Brand Finance’s research reveals since Musk’s takeover, Twitter’s reputation has decreased substantially.

Richard Haigh, Managing Director of Brand Finance commented:

“The acquisition and privatisation of Twitter presented a strong and interesting investment case. However, the positive outcomes that some anticipated for the Twitter brand have not materialised. Brand valuation considers intangible and tangible assets, and Musk has overlooked one of brands’ most important resources: people. Twitter needs to address issues surrounding its reputation and brand equity to return to brand value growth.”

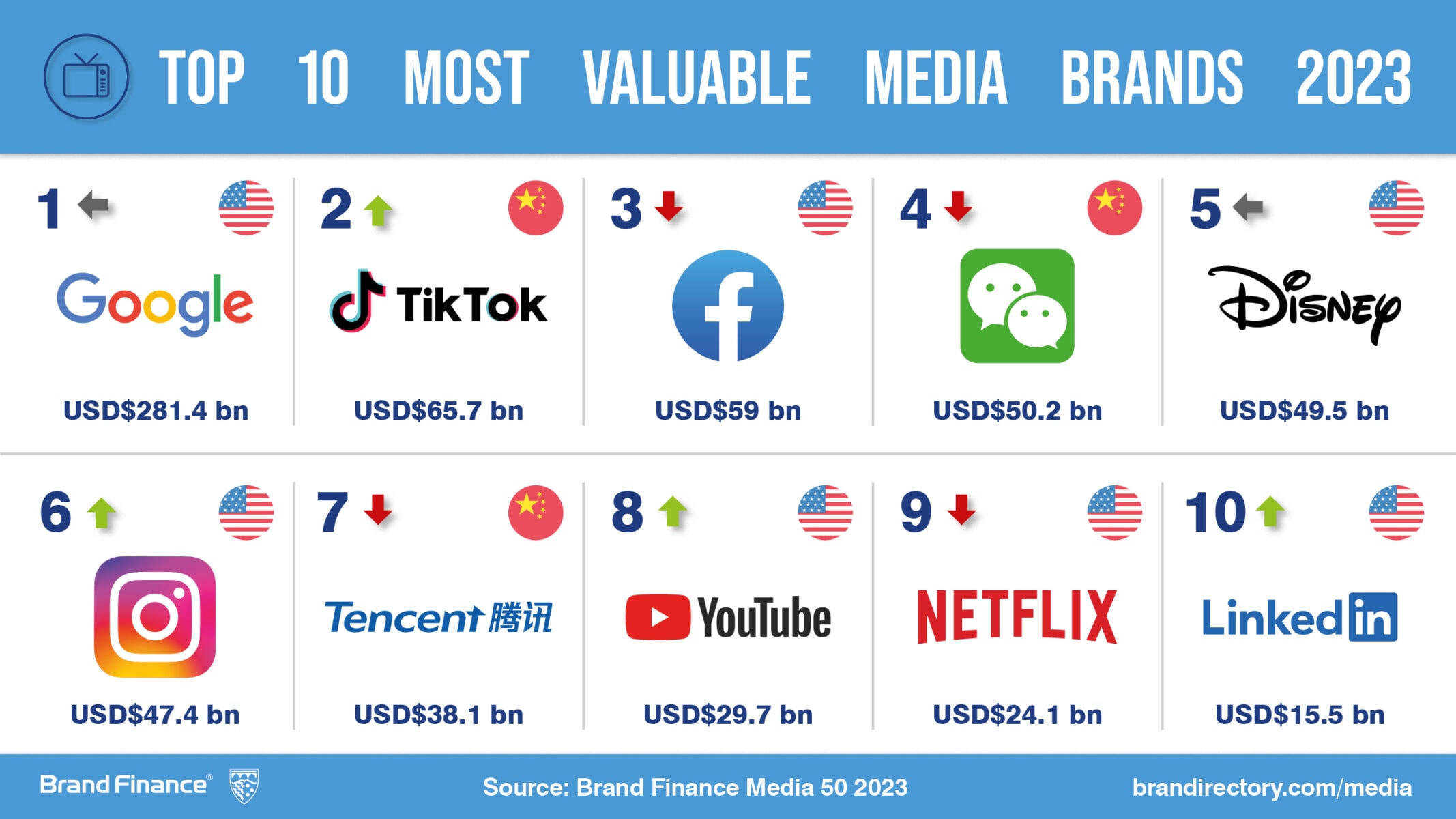

Google crowned most valuable and strongest Media brand, valued at USD281.4 billion

Google (brand value up 7% to USD281.4 billion) remains the world’s most valuable Media brand for the third consecutive year. The Californian tech giant continues to dominate the sector with a brand value more than four times that of its runner up, TikTok/Douyin (brand value up 11% to USD65.7 billion). Google’s healthy year-on-year brand value growth is the result of continued evolution and expansion of its services, including Google Wallet, Google Pixel and Google Cloud.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors. As well as being the strongest brand in the United States, and the world, Google tops the Media ranking, earning a brand strength index score of 93.2/100 and a prestigious AAA+ rating.

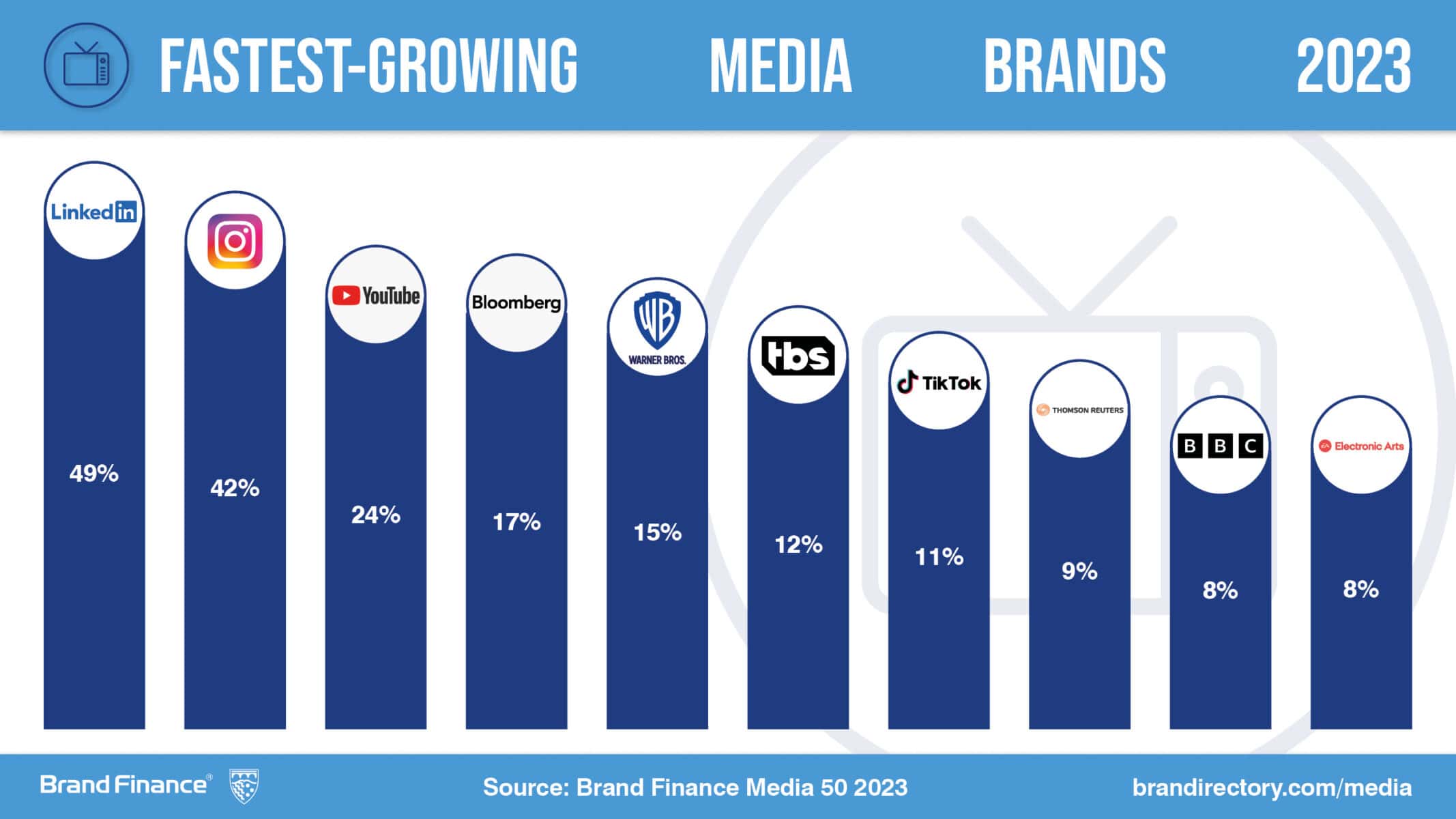

LinkedIn making connections as Media’s fastest-growing brand, up 49%

LinkedIn (brand value up 49% to USD15.5 billion) claims the title of Media’s fastest-growing brand. In connection with its improved standing as a recruitment and news advertising tool, LinkedIn grew significantly. Globally, LinkedIn is building a very strong position amongst professional white-collar users as a dominant tool in this sector. First launched in 2003, the brand is growing strongly in part due to its integration with other Microsoft services.

WhatsApp enters the chat as the highest new entrant in 17th, valued at USD8 billion

WhatsApp (brand value USD8.0 billion) joins the ranking in 17th as the best-performing new entrant. As one of the most popular instant messaging platforms, the brand boasts around 2 billion active users each month. This past year, the end-to-end encrypted messaging tool launched new features to its services including features such as view once images/videos and online visibility. WhatsApp’s sister brand, Facebook (brand value USD59 billion) sits in 3rd in the ranking. Both WhatsApp and Facebook are owned by the same corporate parent, Meta.

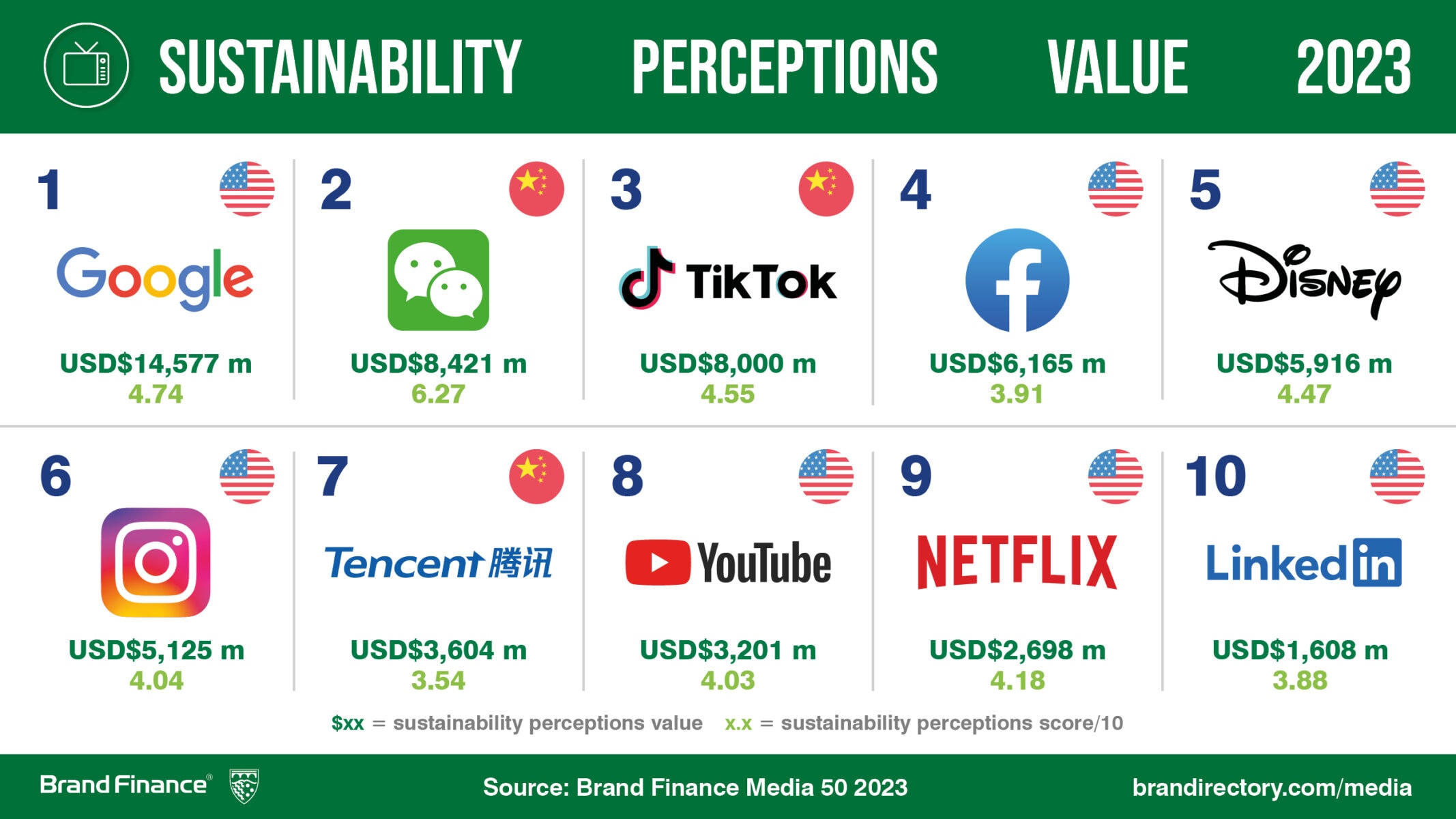

WeChat has highest Sustainability Perceptions Score, rated 6.27 out of 10

As part of its analysis, Brand Finance assesses the role that specific brand attributes play in driving overall brand value. One such attribute is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand.

WeChat (brand value USD50.2 billion), the Chinese multi-service super-app, is best-rated for perceived sustainability with a Sustainability Perceptions Score of 6.27 out of 10. This, in part, can be attributed to Chinese society’s prioritisation of ESG factors, deeming them crucial for economic growth and social stability. Additionally, as part of the Tencent (brand value USD38.1 billion) family, WeChat operates under the same ESG model. For example, in 2022, the parent company pledged carbon neutrality by 2030, as well as its commitment towards China’s overall carbon transformation goals.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.