View the full Brand Finance Nation Brands 2021 report here

The top 100 most valuable nation brands in the world have recorded a 7% increase in brand value since 2020, signalling that recovery is underway from the COVID-19 pandemic, according to the latest Brand Finance Nation Brands 2021 report.

Although this is a positive sign, uncertainty lingers and nation brand values have not reached pre-pandemic levels yet. At US$90.8 trillion, this year’s total brand value of the top 100 ranking is still 7% lower compared to 2019.

David Haigh, Chairman and CEO, Brand Finance, commented:

“Unlike previous economic crashes, recovery is uneven and is pinned on the combination of initial COVID-19 response strategies and a successful vaccination rollout. We are starting to turn a corner, as the world’s most valuable nation brands begin to return to pre-pandemic brand values. But results are varied, and it may take years for some to recoup lost brand value, creating even greater disparity between the most and least valuable nation brands.”

US & China lead the pack

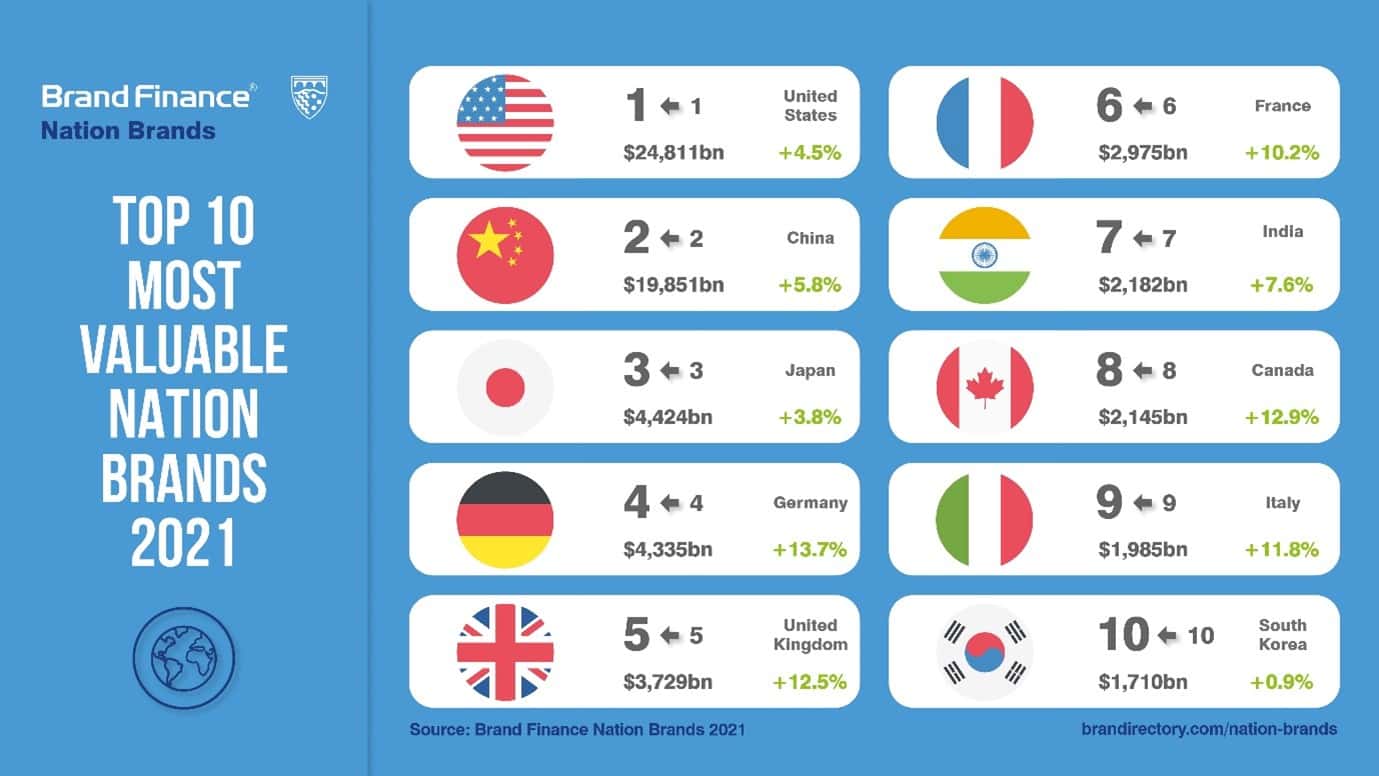

There has been no movement in the top 10 this year, with each nation retaining its rank from last year. All the top 10 have recorded a modest uplift in brand value, however, in line with the global trend across the ranking.

The United States and China remain in a league of their own, claiming the first and second spot in the ranking, respectively. The US has recorded a 5% brand value increase to US$24.8 trillion in a year that has been marked by great political and economic change with President Joe Biden taking the helm. Similarly, China saw a 6% uptick in nation brand value to US$19.9 trillion. Both nations have celebrated economic recovery since the outbreak of the pandemic, contributing to their uplift in brand value. China’s economy was the first to recover – doing so at a meteoric pace - as the only nation to register positive GDP growth at the end of 2020 and growing at record pace in the first quarter of this year.

Many thought that relations would improve between the two superpowers under Biden’s leadership, following the turbulent Trump years, but this has not been the case thus far.

David Haigh, Chairman and CEO, Brand Finance, commented:

“The superpowers from the West and the East unsurprisingly dominate the Brand Finance Nation Brands ranking, with China remaining hot on the heels of long-standing leader, the US. With China’s recovery and economic rise showing no signs of slowing down, as growth hit a record high at the beginning of the year, no doubt the gap will continue to close in the coming years.”

Digital Estonia is world’s fastest-growing nation brand

Recording a 38% brand value growth from last year and outpacing modest increases across the ranking, Estonia is the world’s fastest-growing nation brand of 2021. The Baltic state had invested in digital infrastructure long before the COVID-19 pandemic hit the world. Anyone around the world can apply for e-residency in Estonia, which allows them to run an EU-based company online, and a staggering 99% of the country’s governmental services are offered online.

The advanced digitisation of the country put it on the front foot during the pandemic. On the same day the government announced a state of emergency, the Estonian Ministry of Economic Affairs and Communications launched an online hackathon to identify solutions to pandemic-induced problems, resulting in a chatbot to answer the public’s queries and the re-purposing of online platforms to match volunteers with those in need.

David Haigh, Chairman and CEO, Brand Finance, commented:

“Estonia is this year’s fastest-growing nation brand largely thanks to its world-class digital infrastructure. With some of the leading economies having their digital shortcomings highlighted during the pandemic, Estonia’s digital-first model should be one for others to follow.”

Myanmar and Ethiopia are fastest fallers

In stark contrast, Myanmar and Ethiopia are among the fastest-falling nation brands in the ranking. The unrest across the two countries has caused significant damage to their nation brand values, which have dropped 26% and 22%, respectively.

Brazil has also suffered a steep decline in brand value as the COVID-19 pandemic wreaks havoc on its society and economy. The South American continent’s largest economy, Brazil has lost 12% of its brand value this year and dropped out of the top 20 in the Brand Finance Nation Brands 2021. Famous for its vibrant culture, lifestyle, and sports, Brazil is the highest-ranked South American nation in the ranking, but the combination of high COVID-19 cases and damage to the agriculture sector from severe droughts have caused substantial damage to the economy.

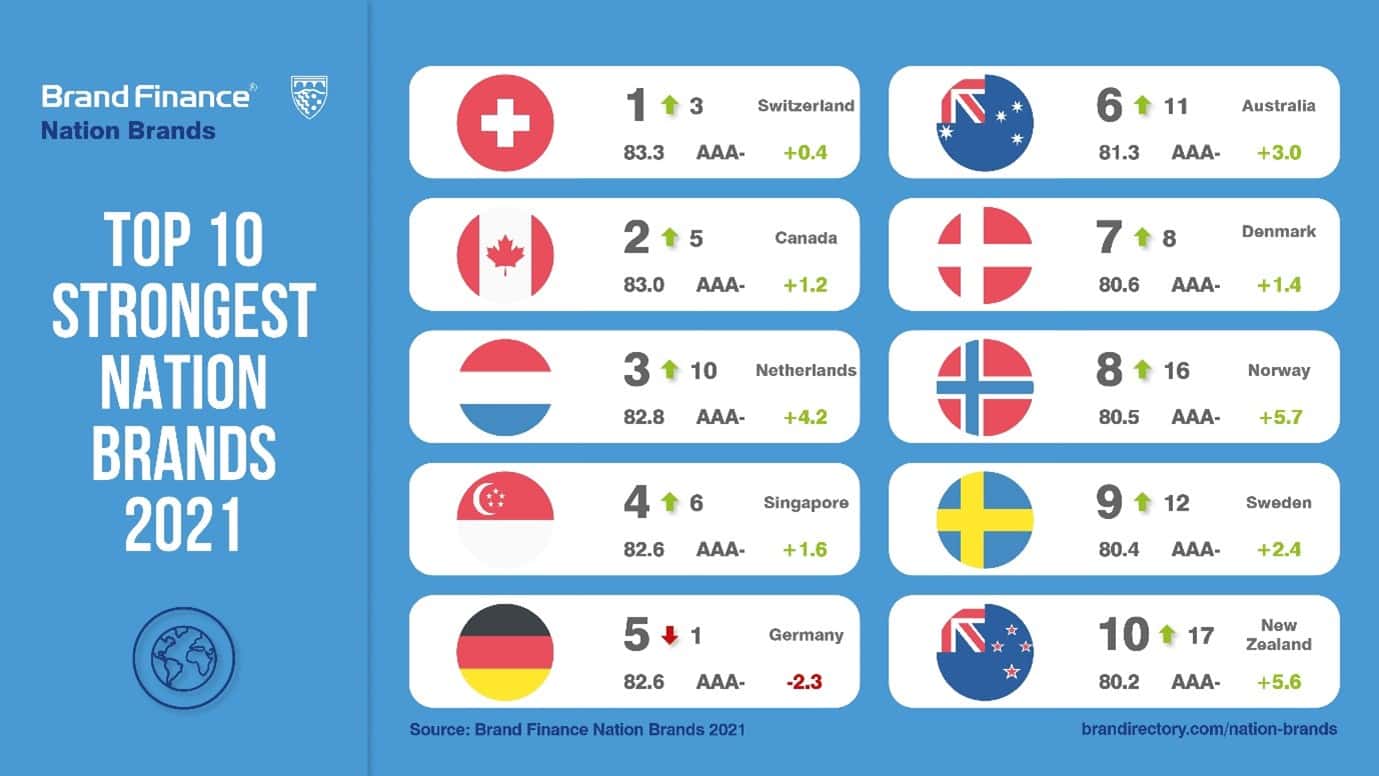

Switzerland is world’s strongest nation brand

In addition to measuring nation brand value, Brand Finance also determines the relative strength of nation brands through a balanced scorecard of metrics evaluating brand investment, brand equity, and brand performance. The nation brand strength methodology includes the results of the Global Soft Power Index – the world’s most comprehensive research study on nation brand perceptions, surveying opinions of over 75,000 people based in more than 100 countries. According to these criteria, Switzerland is the world’s strongest nation brand with a Brand Strength Index (BSI) score of 83.3 out of 100.

Switzerland’s BSI score has remained stable, while the nations around it saw theirs take a hit, resulting in Switzerland moving to the top spot for brand strength. According to Brand Finance’s research, the Alpine nation saw external perceptions slightly rise following its strong response to COVID-19. It used a mix of compulsory and non-compulsory measures during the pandemic to control the spread of the virus. For example, non-essential businesses had to close, but the government’s order to stay at home was only ever advisory – entrusting the people to make the decision for themselves.

This is reflective of Switzerland’s model of government, with the public allowed to voice their opinions on laws through frequent referenda – last year the population rejected a motion to end its freedom of movement agreement with the EU and voted to make discrimination on the basis of sexual orientation illegal.

David Haigh, Chairman and CEO, Brand Finance, commented:

“Small size is no barrier to occupying a solid position for nation brand strength and Switzerland securing the top spot this year is the perfect example. Switzerland has held firm whilst other nations have faltered over the course of the pandemic. The nation has recently been thrust under the spotlight, however, with the leak of the Pandora Papers, which could taint its reputation as Swiss financial advisers are scrutinised on the global stage.”

Germany slips to 5th

Last year’s strongest nation, Germany, has dropped down to 5th position in the brand strength ranking, following a 2.3 point drop in BSI to 82.6 out of 100. Despite garnering praise on the global stage for her strong and stable leadership spanning 16 years, Angela Merkel sees mixed results on home soil. Domestic perceptions are consistently less favourable across the metrics to their overseas counterparts, particularly in regard to the Global Soft Power Index Business & Trade and Influence pillars.

Australia and New Zealand move into top 10

Australia, up five places in the ranking to 6th, and New Zealand, up seven places to 10th, have both entered the top 10 for brand strength, with BSI scores of 81.3 and 80.2 respectively. The Australasian countries were deemed to have handled the early days of the pandemic extremely well. Both were lauded for their severe lockdowns and quick reaction to subsequent outbreaks, which resulted in minimal cases and allowed them to open back up internally considerably earlier than others.

At the time of our research, both scored well across our data points with internal and external perceptions of their handling of the pandemic. However, the vaccine rollout in both countries has lagged behind their global counterparts, which could hamper their BSI scores moving forward.

Breaking the Western monopoly

Singapore and the United Arab Emirates have broken the Western monopoly in the brand strength ranking, claiming 4th and 11th position respectively. Scoring particularly high for Global Soft Power Index pillars of Business & Trade and Governance, Singapore continues to prosper both in the Southeast Asian region as well as globally. The city-state – renowned for its high-quality and economically efficient healthcare – has already fully vaccinated 82% of the total population. Singapore is on the right path to achieve the government’s aim of a “whole new normal”.

The UAE has climbed three spots in the brand strength ranking following a 2.5-point increase in its BSI score to 79.1 out of 100. Overseas perceptions of the nation’s prowess in the Education & Science pillar are high, and the successful Emirates Mars Mission is clearly a factor. The UAE also stands out for its COVID-19 response, and scores high for the Influence and Business & Trade pillars, both of which should see a further boost from Expo 2020 inaugurated in Dubai this month. The UAE’s continued increases in brand strength and value are testament to the nation’s strategy of diversifying its economy for long-term growth.

COVID-19 hurts perceptions of world’s largest economies

At the same time, the UK, US, Japan, and France have all fallen out of the top 10 strongest nation brands ranking due to the perception of how they handled COVID-19.

The UK, falling from 2nd to 14th with a BSI score of 77.4, and France, falling from 9th to 16th with a score of 75.4, recorded average Global Soft Power Index scores for overseas perceptions of their handling of the pandemic, but perceptions domestically were particularly low.

Japan, falling from 7th to 15th with a score of 76.7, saw a similar story with the perception at home that the pandemic was mishandled. However, this is polarised when compared to their perception abroad, where it achieved some of the highest scores in the Global Soft Power Index research.

The US, dropping from 4th to 17th with a score of 75.1, saw poor scores at home and abroad, and was also one of the lowest ranked nations by the specialists.

Despite their brand strength taking a hit, these nations all still feature in an unchanged top 10 when ranked by nation brand value.

David Haigh, Chairman and CEO, Brand Finance, commented:

“It will be important for the world’s largest economies to focus on making up the ground they have lost in brand strength, in order to protect their brand value. The UK, US, Japan, and France have all scored poorly domestically for their handling of COVID and they need to rebuild this trust with their respective populations.”

View the full Brand Finance Nation Brands 2021 report here

ENDS

Note to Editors

Every year, Brand Finance values 5,000 of the world’s biggest brands. The 100 most valuable and strongest nation brands are included in the Brand Finance Nation Brands 2021 ranking.

In a global marketplace, nation brand is one of the most important assets of any state, encouraging inward investment, adding value to exports, and attracting tourists and skilled migrants. In its 18th year, the Brand Finance Nation Brands study provides an all-round view of perceptions and value of nation brands – their presence, reputation, and impact on the world stage.

Understanding the strength and value of nation brands is key for governments and corporates alike to achieve success internationally, allowing to identify strengths and weaknesses and to improve growth strategies going forward.

Additional insights, charts, and more information about the methodology are available in the Brand Finance Nation Brands 2021 report.

Methodology

Brand Finance measures the strength and value of the nation brands of 100 leading countries using a method based on the royalty relief mechanism employed to value the world’s largest corporate brands.

Step 1 – Nation Brand Strength

Nation Brand Strength is the part of our analysis most directly and easily influenced by those responsible for their country’s nation brand campaigns. Nation Brand Strength is determined through a balanced scorecard of metrics evaluating brand investment, brand equity, and brand performance. The nation brand strength methodology includes the results of the Global Soft Power Index – the world’s most comprehensive research study on nation brand perceptions, surveying opinions of over 75,000 people based in more than 100 countries. Each metric is scored out of 100 and together they contribute to an overall Brand Strength Index (BSI) score for the nation brand, also out of 100. Based on the score, each Nation Brand is assigned a brand strength rating in a format similar to a credit rating.

Step 2 – Royalty Rate

The hypothetical royalty rate charged is determined by reference to average rates seen across sectors which are applied to the country based on the proportion of the country’s GDP generated from the primary, secondary, and tertiary sectors. The Brand Strength Index is relied upon to determine the appropriate royalty rate for the country.

Step 3 – Revenues

The nation brand valuation is based on forecasts of GDP in each country taken from the World Economic Outlook of the IMF. The applicable royalty rate calculated in Step 2 is applied to the country’s GDP to determine brand-related GDP streams.

Step 4 – Weighted Average Cost of Capital (WACC) or Discount Rate

In order to account for the risk across each national economy a discount rate is calculated. This represents the average cost of a brand’s sources of finance and the minimum return required on the brand asset. The discount rate is used to calculate the present value of future brand earnings (accounting for the time value of money and the associated risk).

Step 5 - Brand Valuation

The post-tax brand-related GDP streams identified in Step 3 are then discounted to a net present value using the discount rate, to determine the nation brand value.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.