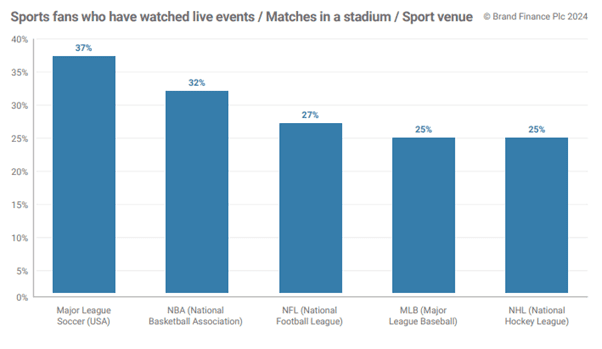

New data from Brand Finance reveals that US soccer fans are more likely to attend live matches in stadiums compared to American fans of all other major sports, highlighting the growing trend in the sport’s popularity

DALLAS, July 17, 2024 – Brand Finance, the world’s leading brand valuation consultancy, reveals that once again no US soccer brands feature in the latest ranking of the world’s top 50 most valuable and strongest soccer brands, despite growing popularity of the sport among Americans.

However, the 2026 FIFA World Cup, held across Mexico, the US, and Canada, is expected to deliver a significant uplift in the value of soccer brands across North America, as the world’s most popular sporting event takes center stage. Major League Soccer has been steadily building its presence throughout the nation, following some key player signings, including globally recognized sporting talent Lionel Messi.

Brand Finance's research shows that US soccer fans are more likely to attend live stadium matches compared to fans of NFL football, NBA basketball, MLB baseball, and NHL ice hockey. This contrasts with 2023 data that showed that football and the NFL were consistently identified as the nation's most popular sport, favored in nearly every state except five. Soccer, which displayed varying levels of interest last year ranging from 3% to 32% of individuals naming it as their favorite sport, has witnessed a rise in attendance and fan interest.

Technological advancements have significantly enhanced the fan experience in MLS stadiums, featuring augmented reality (AR) and virtual reality (VR) technologies, interactive apps, and intensifying social media engagement. These innovations foster deeper connections between fans, teams, and the sport itself, resulting in increased engagement and attendance levels.

Moreover, MLS is expanding its robust digital presence through strategic use of social media platforms to effectively reach younger audiences with exclusive content and interactive experiences. The league's social media following grew by 25% in 2023, accompanied by an 18% increase in engagement rates. While MLS broadcast deals remain smaller compared to the NBA and NFL, partnerships like the exclusive arrangement with Apple TV in 2023 have bolstered visibility globally, marking a pioneering move in sports streaming services.

“The forthcoming 2026 FIFA World Cup is set to amplify opportunities for soccer brands across North America, reflecting the sport's growing appeal and economic significance. With global football sponsorship forecasted to reach nearly USD 59 billion within the next decade, soccer clubs are increasingly focusing on enhancing their brand strength and value. This strategic investment aims to capitalize on the lucrative and expanding market. While no US soccer brands currently feature in the top 50 globally, the trajectory suggests promising potential on the horizon.”

Laurence Newell, Managing Director, Brand Finance North America

Inter Miami CF, Los Angeles FC and LA Galaxy are the country’s top three strongest soccer brands. Reaping the rewards of the Messi effect and outperforming all US clubs in Brand Finance’s research for having "a lot of star players”, Miami has the highest Brand Strength Index (BSI) score of all US soccer teams. The Florida team has been going from strength to strength since David Beckham – who is arguably more famous for his work off the pitch than on it now - founded the team in 2018 alongside others. The Vancouver Whitecaps and Toronto FC round off the top 5 for brand strength in the MLS.

Outside of the US, Real Madrid (brand value up 16%) is once again the world’s most valuable soccer club brand, surpassing 2023’s winner Manchester City FC, (brand value up 7%). Real Madrid is also the world’s strongest soccer club, The club’s exceptional brand strength derives from its perfect scores across several metrics in Brand Finance’s research, including squad investment, stadia, and sponsorships. Real Madrid’s strategic investments in star players like Kylian Mbappé and Jude Bellingham are expected to further boost record-breaking revenue through increased matchday and merchandise sales, while enhancing global visibility and fan engagement.

The English Premier League has the most clubs (17) featured in the Top 50 ranking, as well as by far the highest value of any league. Six of these clubs feature in the top 10, with Manchester United FC and Liverpool FC FC retaining 4th and 5th positions respectively. Arsenal FC, Tottenham Hotspur FC, and Chelsea FC retain 8th, 9th, and 10th ranks, respectively.

Note to Editors

Every year, leading brand valuation consultancy Brand Finance tests 5,000 of the biggest brands and publishes over 100 reports, ranking brands across all sectors and countries. The Brand Finance Football 50 2024 ranking includes the world’s top 50 most valuable and strongest football club brands.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The Brand Finance Football 50 2024 report includes the full ranking, additional insights, charts, more information about the methodology, and definitions of key terms.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.