This article was originally published in the Brand Finance NFL 32 2025 report.

Valuation Director,

Brand Finance

The no and low (NoLo) category continues to be a growth area within the alcoholic drinks sector. Increased health consciousness, a desire for more mindful drinking, and the lasting impact of the COVID-19 pandemic on drinking habits are driving consumers to opt for NoLo alternatives. NoLo beer has led the category for some time now. Data from Brand Finance reveals that non-alcoholic beer drinkers best associate Beck’s, Peroni, BrewDog, Corona Extra, and Heineken with good non-alcoholic lagers and ales, while Guinness is the leading brand overall in non-alcoholic beer.

So, who are these consumers and what draws them to NoLo alcoholic drinks? According to Brand Finance data, non-alcoholic beer drinkers over-index versus the general population across all interests and sporting activities. Most notably, drinkers of non-alcoholic beer are 68% more likely to be interested in sport and twice as likely (106%) to be interested in running, in particular. These beverages enable consumers to moderate their alcohol consumption, prioritise health, and reduce calorie consumption without giving up the social ritual of having a drink.

Brand Finance research also reveals that non-alcoholic beer drinkers have higher ad recall than the general population across the leading brands: Guinness, Peroni, BrewDog, Corona Extra, and Beck’s. A common thread among these brands is their strong presence in sports marketing, promoting alcohol-free versions as official partners of major events. Several beer brands leverage sporting event and club partnerships to promote their NoLo products, driving engagement with this rapidly growing consumer base.

For instance, since 2021, Heineken USA has served as the official import beer and hard seltzer partner of the Miami Dolphins and their home field, Hard Rock Stadium. The partnership highlights Heineken’s alcohol-free beer and is showcased through in-game promotions, branded bars, and sampling events.

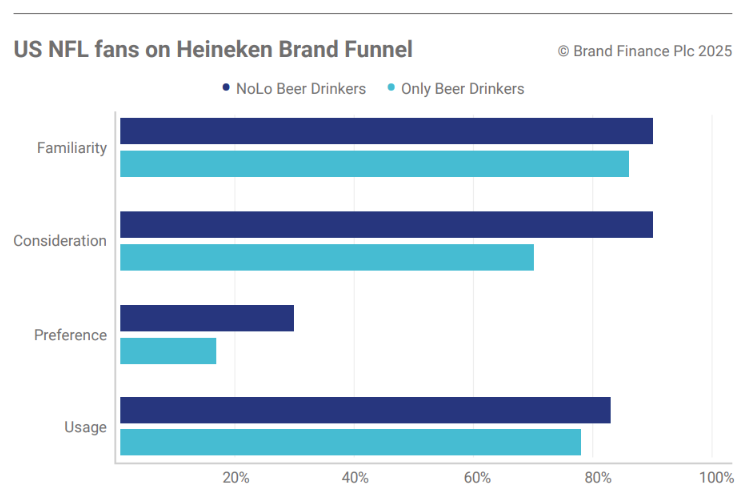

According to Brand Finance research, US NFL fans who drink non-alcoholic beer at least once a month are 5% more likely to be familiar with Heineken, 23% more likely to consider the brand, and 64% more likely for it to be their preferred brand. Usage of the brand in the past 12 months is also 6% greater amongst these NoLo beer drinkers.

Alongside its wider sport sponsorships, such as its partnership with the UEFA Champions League since 2020, it comes as no surprise that Heineken is one of the top beer brands that all beer drinkers globally, not just NoLo beer drinkers, associate with having a good non-alcoholic alternative, at 13%.

Partnerships like these underscore the rise of NoLo drinks among sports fans as brands become increasingly conscious of responsible drinking and marketing. At the same time, these alcohol-free products often carry the same brand names as their alcoholic counterparts – an intentional move that allows brands to promote both products simultaneously. Similarly, alcohol-free products often maintain the same visual identity, where logos and packaging are nearly identical to that of beer brands’ traditional products – another tool strategically used to preserve brand awareness and recall.

AB InBev’s Bud Light has been the Official Beer Sponsor of the NFL for almost three decades, a partnership secured through to at least 2027. While its sponsorship does not currently feature or emphasise alcohol-free beer, this level of brand exposure to NFL fans, bolstered by special team-branded cans for 27 teams across the league, positions Bud Light with a strong opportunity to expand into the NoLo category should this become part of its broader strategy in the future.

Beyond the NFL, Carlsberg and Liverpool FC hold one of the longest standing partnerships in the English Premier League, and in recent years, Carlsberg’s 0.0% product has become more central to its strategy. This strategy includes playfully positioning its alcohol-free product as “The Only 0.0 We Want” on matchdays.

Similarly, Guinness, the official beer of the English Premier League, heavily integrates its 0.0% alternative into its broader strategy. As of the 2024/25 Premier League season, Guinness entered into a four-year agreement with the league with a focus on promoting its non-alcoholic beer and responsible drinking.

Budweiser stands as a prime example of how sponsorship deals can remain viable even in markets or territories with strict advertising or alcohol consumption rules. By leveraging its 0.0% product, the brand can maintain a strong presence where traditional beer promotion is not permitted.

During the 2022 FIFA World Cup in Qatar, where the sale and public consumption of alcohol was tightly controlled, Budweiser 0.0% was the only beer made available to in-person fans at any of the eight World Cup stadiums, allowing the brand to stay visible on a global stage exclusive to them. All of this contributes to higher ad recall, as highlighted by Brand Finance data, underlining the effectiveness of NoLo branding among soccer and sport audiences more generally.

Beyond the non-alcoholic alternatives offered by major beer brands, a new wave of purely non-alcoholic beer companies has popped up, including Lucky Saint, Bero, and Athletic Brewing Company.

Athletic Brewing Company stands out with great potential as a segment leader. Like the NoLo lines of multinational giants, brands are beginning to capitalise on sports partnerships to drive brand awareness and growth, albeit on a smaller scale. Rather than aligning with high-profile professional events, like those sponsored by Heineken or Guinness, largely due to smaller budgets, these brands are looking towards tactical market sponsorships.

In June 2025, Athletic Brewing Company became the women’s professional soccer team San Diego Wave FC’s first Official Non-Alcoholic Beer Partner, involving brand activations from fan and community events to social content with players across the club’s digital platforms. Similarly, in July 2025, English Premier League club Arsenal FC announced a multi-year extension of its partnership with Athletic Brewing Company, also as the club’s first Official Non-Alcoholic Beer Partner. As part of its renewed partnership, the two have signalled towards plans to launch a limited-edition, co-branded brew for the 2025/26 season. This special release is designed to offer fans a unique and memorable experience.