Analysing Brand Strength and why it matters

Every day at Brand Finance we are tasked with evaluating the strength of brands and marketing and valuing the impact of that strength. Within that task lies a requirement to answer different layers of questions including:

- What is a brand and what makes it strong?

- Why do brands and brand strength matter?

- What are the most popular brands?

- What can you do to build Brand Popularity and Strength? – The Brand Beta model

The following series of short articles is intended to explain how we do that and what that means for businesses.

1. What is a brand and what makes it strong?

In order to talk about what makes a brand strong and set up for growth, it’s important to briefly define what we mean by “brand”.

When we speak about brands in the context of accounting or law, we consider brands to be “trademarks and their associate intellectual property” with this intellectual property being designs, domains, art works etc that are linked to the use of the trade marks.

Trademarks themselves are “any sign capable of being represented graphically and which is capable of distinguishing goods or services dealt with or provided in the course of trade by a person from goods or services so dealt with or provided by any other person” [1]. In other words, in legal terms, trademarks are simply a signpost distinguishing one company, product or service from another.

As a result of this, “distinctiveness” from the signposts of another legal ‘person’ is the key determinant of whether a mark can be trademarked. Differentiation or reputation don’t even get a look-in, an important fact given the discussion in our industry on the importance of distinctiveness over differentiation in driving brand strength and growth.

However, the ability to trademark a brand does not necessarily mean that that brand is “strong”.

As my colleague at Brand Finance and Insights Director, Steve Thomson, has pointed in an article in April 2019 Brand Strength is “in laymen’s terms how ‘good’ the brand is, and the impact it has on stakeholders’ actions: whether to buy the product, what price to pay, whether to work for an organisation, etc”.

What this means is that brands are more than signposts. In reality, they are a unit of storage for the cumulative familiarity, reputation and appeal among all stakeholders (customers, employees, suppliers, investors and the external public) and a method for exploiting that familiarity, reputation and appeal through the use of clear, distinctive signposting.

This is why at Brand Finance we use the rounded definition of “A bundle of trademarks and associated IP which can be used to take advantage of the perceptions of all stakeholders to provide a variety of economic benefits to the entity”, when identifying brands in order to evaluate and value them.

Importantly, this highlights the fact that brands are there to satisfy customer needs better than the competition and to make money. The way they make money is to influence people to make decisions that are favourable to person, business, nation, organisation etc that they wouldn’t make for the same entity if it had a less strong brand.

Each stakeholder is different but customers are generally the most important, so this article focusses on them and how their view of brands affects profit-seeking businesses.

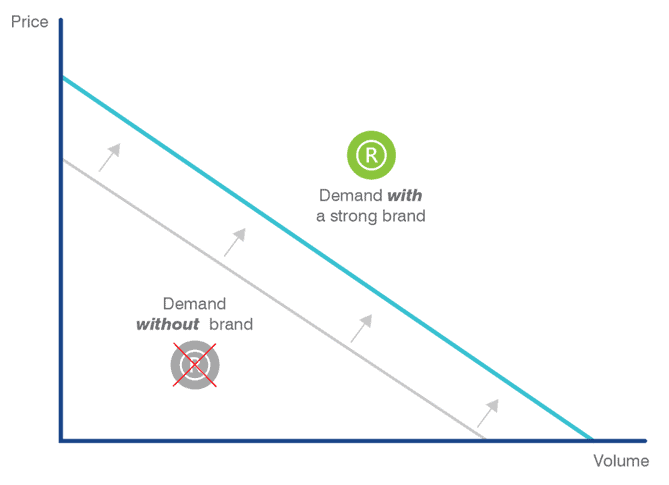

Among customers, the aim of brands is to make money and a strong brand will be one that stimulates the expansion of the demand curve when present compared to when not present. By stimulating additional demand, the brand has the effect of raising revenue and profit by either allowing for an increase in volume sold or price point or both.

Brands do this by having a higher level of penetration and awareness, and by stimulating a higher rate of conversion among non-customers (trial) and customers (loyalty) than other brands. In other words, they get more people to buy more (preferably at a higher price).

This effect is well summarised within the ‘marketing funnel’. The marketing funnel is a key construct when analysing the impact of brands on business performance. Customers and other stakeholders need to be aware of brands to consider them. Following this, the features of the product, service, price, availability, image etc as well as in some cases the nature of promotional activities lead people to consider and ultimately purchase branded products and services. The marketing funnel encompasses these effects into a simplified structure which provides an overview of strength.

That is not to say it is a panacea. Tom Roach’s article helpfully summarised why an overemphasis on the marketing funnel can be problematic [2]. In particular, it can create issues when used as a measure of marketing effectiveness or to guide media choices. This is because it overlooks the feedback loop that each level has on another (e.g. usage leads to familiarity) and does not directly recognise that marketing and the purchase process rarely work in such a linear way.

That being said, according to our own research and that of other agencies [3], consideration has a very close relationship with sales and sales growth.

At Brand Finance, we have therefore created a model derived from our research of over 4,000 brands in over 30 sectors in over 40 countries, which can be used to predict sales growth as a result of long-term brand equity and awareness.

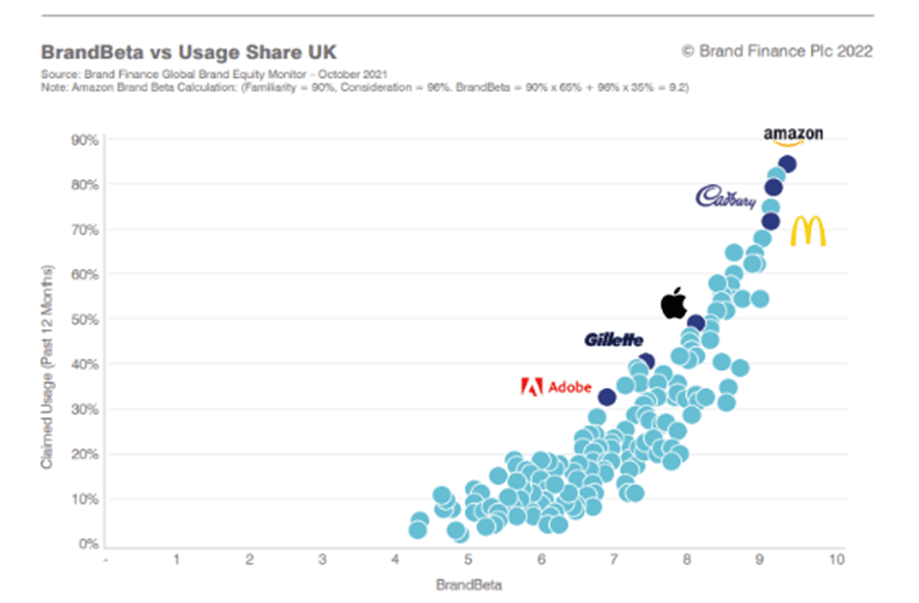

This model is called the BrandBeta® and is calculated as a combination of brand familiarity and consideration conversion, being the proportion of people familiar with a brand who are willing to consider it. The BrandBeta® model is highly predictive of share.

In fact, our analysis shows that, when combined, familiarity and consideration conversion explain over 80% of the variance in market share within the categories covered.

Analysing the impact of familiarity and consideration conversion, we noted that familiarity explains approximately 65% of the variance in share, while consideration conversion explains approximately 35%. BrandBeta® is therefore a combination of the two measures in the ratio (65:35).

This combination creates a score out of 10 which our additional analysis shows can be used to predict market share growth.

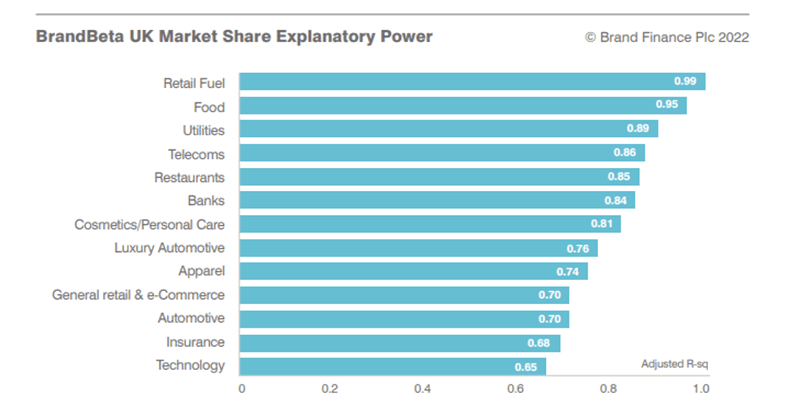

This relationship is across all countries and sectors although there are some small differences in the effects between them. The results for the UK can be seen below:

However, as well as this prediction of share we also need to understand the factors which drive consideration conversion and familiarity.

Marketing activities and past experiences influence familiarity while Brand attributes - such as quality, coolness, availability and trust – influence the likelihood to consider and should be researched. Within Brand Finance’s syndicated research we separate sectors in to in-depth (Tier 1) research sectors and high-level (Tier 2) research sectors.

Within “Tier 1” sectors, these explanatory brand attribute measures are researched. In the “Tier 2” sectors, additional research can be performed as necessary in order to give diagnostic detail on how to improve brand positioning and messaging to influence likelihood to consider and therefore purchase.

Even without these detailed metrics, however, brand strength in the minds of consumers can be summed up by this BrandBeta® figure and later explained more thoroughly through the use of more in-depth research.

BrandBeta® refers to the position of brands within customers minds – awareness and perceptions. This is how the brand is currently perceived by customers and as I have stated, this is an essential part of any brand evaluation.

That being said, a full understanding of a brand’s strength requires an understanding of all stakeholders. It also requires an understanding of the ‘inputs’ (in the form of marketing activities and brand/product attributes) that will influence perceptions in to the future as well as an understanding of whether perceptions are having the desired effect on outcomes (i.e. the demand curve mentioned above). This is neatly summarised in a “Brand Strength Index” about which I talk in a separate article [4].

For more information about how we evaluate brands, visit Brand Valuation Methodology | Brandirectory

[1] Section 2 of the Singapore Trade Marks Act

[2] Tom Roach, 01/09/2021, The sales funnel is wrong but it’s here to stay, so let’s fix it., https://thetomroach.com/2021/09/01/the-sales-funnel-is-wrong-but-its-here-to-stay-lets-fix-it/

[3] Gain Theory, 2018, The Long Term Impact of Media Investment, https://www.gaintheory.com/the-long-term-impact-of-media-investment/

[4] Alex Haigh, 02 December 2021, Brand Strength Index: Creating a scorecard for your brand, https://brandfinance.com/insights/brand-strength-index-creating-a-scorecard-for-your-brand