Analysing Brand Strength and why it matters

Every day at Brand Finance we are tasked with evaluating the strength of brands and marketing and valuing the impact of that strength. Within that task lies a requirement to answer different layers of questions including:

- What is a brand and what makes it strong?

- Why do brands and brand strength matter?

- What are the most popular brands?

- What can you do to build Brand Popularity and Strength? – The Brand Beta model

The following series of short articles is intended to explain how we do that and what that means for businesses.

2. Why do brands and brand strength matter?

Brand Strength is “in laymen’s terms how ‘good’ the brand is, and the impact it has on stakeholders’ actions: whether to buy the product, what price to pay, whether to work for an organisation, etc” and brands are the tool by which this strength is harnessed and exploited.

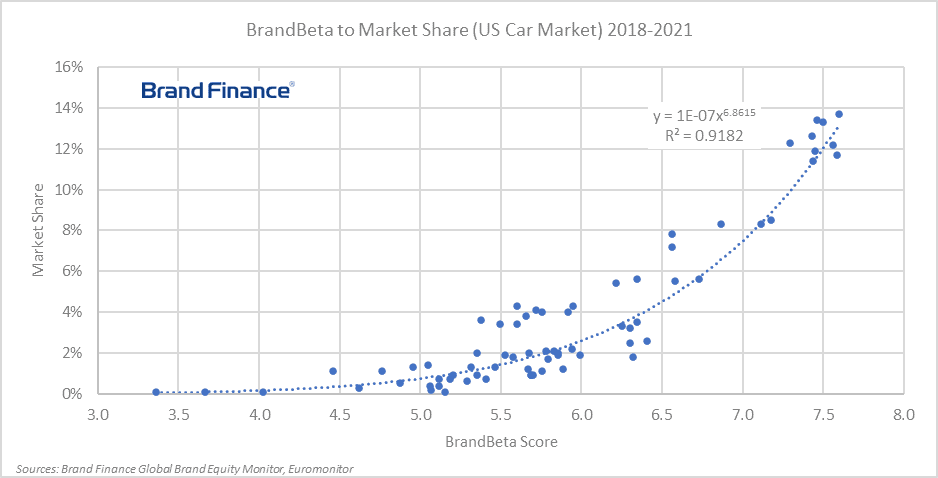

BrandBeta is a composite metric combining brand familiarity and consideration to purchase among those familiar. Together, the measure shows a strong relationship with usage and market share for brands in many markets.

BrandBeta’s more in-depth cousin the “Brand Strength Index” digs deeper into what is causing the BrandBeta results and also benchmarking its success in causing improved performance on the value drivers for the branded business/organisation.

Given that the intention of most marketers working for profit-seeking firms is to increase demand, BrandBeta and Brand Strength more generally can therefore be considered key concepts and useful to see how marketing’s activity changes the needle.

This relevance can be shown quite clearly by the use of two example industries.

BrandBeta in action: the US car industry

Over the last five years we have researched the car-buying public in around 20 countries per year, including in the United States of America.

The graph below shows the results of all automobile brands in the US car market according to our BrandBeta score compared against their market share in the relevant year.

The R2 figure shows the fit of the results to the trendline with a number closer to 1 indicating a perfect fit. The figure is above 0.9 indicating a very strong relationship as we have seen in virtually all sectors in all markets.

What is particularly interesting with this set of data is that there appears to be a double jeopardy rule. In other words, the higher a brand’s familiarity and consideration the more their market share will grow per additional unit of familiarity and consideration.

As others have recognised, this can be explained by a tendency for larger brands to have higher loyalty.

It also appears to us to be because consumers have a closer understanding and relationship with larger brands and are more able to positively differentiate their offer from others. In other words, not only are more people familiar with the brands but that the people who are familiar are each individually more familiar with the brands too.

The implications of this finding is that in many cases, a branded business which wants to make sure it is maximising its impact may want to focus itself on markets where it can dominate rather than spreading itself thinly across multiple markets where it is dominant in none.

BrandBeta in action: Banks in ASEAN

To highlight this effect in a different way, I have selected a data set relevant to my role as Managing Director of Brand Finance Asia Pacific – Banks in the countries of the Association of South East Asian Nations (ASEAN).

We regularly research bank brands in Indonesia, Thailand, Malaysia, Vietnam and Singapore and have this year started to do the same in the Philippines. The below graph shows results for the former 5 markets last year compared to the year before.

Rather than showing overall numbers for BrandBeta and market share, it shows the relationship between changes in each on the other. In other words, it shows whether you should expect usage increases if you have an increase in BrandBeta.

The results show that the short answer is that yes, you should. The R2 figure which shows the strength of the relationship is 0.53 meaning that usage can be expected to increase as BrandBeta increases and that can be expected the majority of the time. As you can see in the top left and bottom right quadrants there are some outliers but not many.

What this helps to show is that the relationship is not circumstantial but that as you improve brand beta, your market share is likely to move positively too.

What does this mean?

BrandBeta, and more importantly, the measures that underpin it are therefore key measures to track. What is useful about it too is that, by requiring a very small number of measures, it can drastically decrease a tracking budget.

As a result, you can track a brand regularly for a limited budget. This can free up budget to only invest in a larger diagnostic tracker, brand strength index and even brand valuation every year when the budgeting cycle comes up for review or if there is a big change in the measures within BrandBeta that needs explanation while also providing some core brand health KPIs that can be used for analytics like marketing mix modelling.

For more information about how we evaluate brands, visit Brand Valuation Methodology | Brandirectory