This article was originally published in the Brand Finance UK 250 2025 report and the Brand Finance Europe 500 2025 report

It may sound warm and fuzzy, but brand love is not a soft metric.

Reputation and emotional response to brands are clear commercial drivers that influence consumer behaviour, and ultimately, brand success. In today’s crowded and competitive markets, being liked or trusted is vital for success.

In Brand Finance’s latest study of British consumer sentiment, we’ve identified the brands that Brits love and those that they do not, and how these perceptions translate into real commercial outcomes like consideration and market share.

Brand love matters – and pays

At the core of the research is a simple but telling question: how do people really feel about the brands they know? Brand Finance asked UK residents, “How would you describe your feelings about this brand?” regarding more than 1,000 brands, and respondents chose one of the following:

+ It’s a brand I hate

+ It’s a brand I dislike

+ It’s brand I’m fairly neutral on

+ It’s a brand I like

+ It’s a brand I love

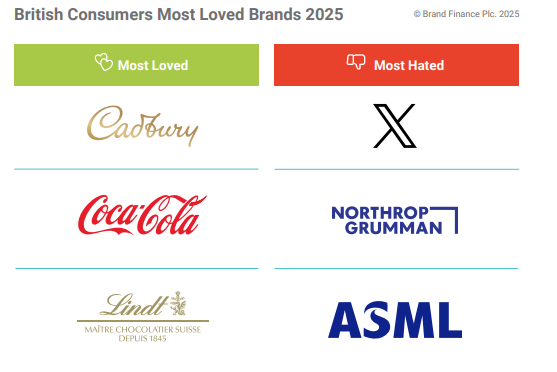

Fast-moving consumer goods (FMCG) brands dominate the top tier. UK residents are sweet on Cadbury, Coca-Cola, and Lindt, the top three most loved brands in the UK.

These long-standing favourites pair consistency with emotional resonance, indications that affection builds over time and pays off.

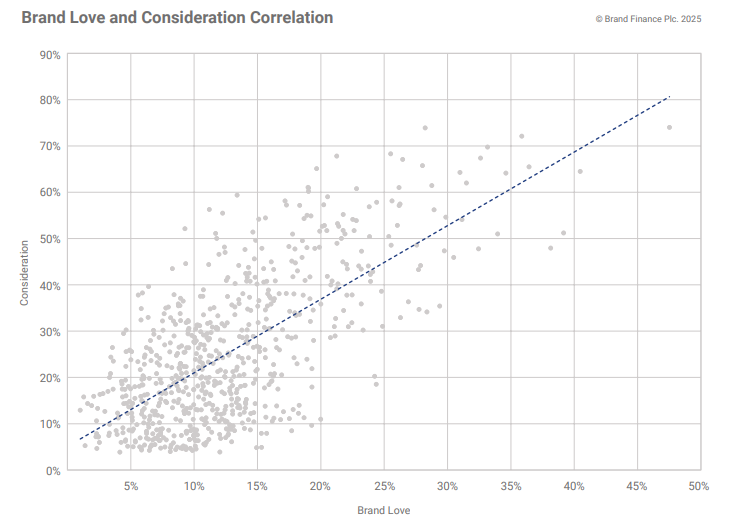

Beyond mere sentiment, Brand Finance data reveals a strong and consistent link between brand love and consideration. For every 1% increase in the proportion of people who say they “love” a brand, consideration rises by approximately 1.6%.

In short: love drives action.

At the other end of the spectrum, X (formerly Twitter), Northrop Grumman, and ASML were rated among the most disliked. The reasons vary — from lack of consumer relevance to reputational baggage — but the commercial consequences are consistent: low brand love equals low consideration. Incumbents hold trust, while challengers win hearts.

A deeper look at the data reveals a structural shift in how different types of brands are perceived. Challenger brands, often digital-first or tech-enabled, outperform legacy players on emotional appeal and are typically more loved than their incumbent competitors.

In the energy sector, for example, four of the top six most loved brands are challengers: Octopus Energy, Good Energy, Ovo, and Utility Warehouse. Their higher brand love scores are translating directly into greater consumer consideration, helping them eat into the market share of long-established legacy players.

However, brand love isn’t everything.

When it comes to reputation - a longer-term measure of trust and credibility - the incumbents still dominate. Legacy brands, with established histories and consistent performance, continue to be viewed as more reputable. Here too, perception links to performance. Brand Finance data shows that for every 1% increase in perceived reputation, consumer consideration rises by around 0.9%. So while brand love may be more powerful in triggering action, trust remains critical to sustaining it.

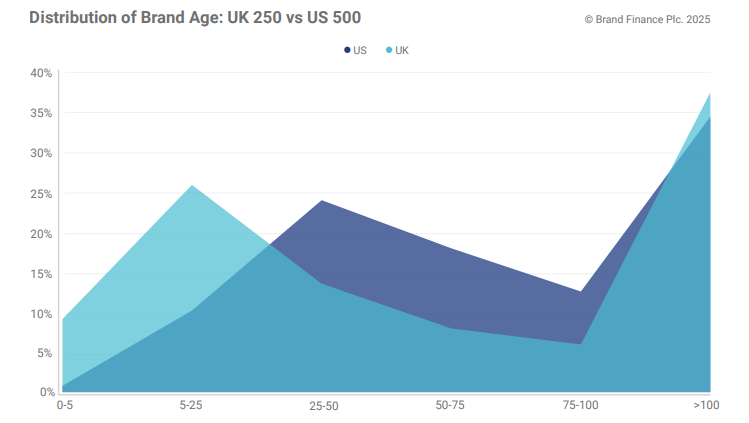

A surprise from the UK: A younger, more disruptive market

The UK brand landscape is more dynamic than often assumed. While the US is typically seen as the global hub of entrepreneurial disruption, our data suggests the UK has quietly outpaced it in brand innovation.

A larger share of the UK’s most valuable brands was founded in the last 25 years, particularly in sectors like financial services, telecoms, aerospace and defence, and utilities.

One of the clearest examples of this disruption is the UK banking sector. Just five years ago, the market was dominated by legacy high street institutions, with 67% of market share held by the top ten banks.

Today, that dominance has eroded. Challenger banks like Monzo and Revolut have broken into the top ten, and 48% of the market is now held by players outside that group. Digital-first banks have built consumer love rapidly and are now competing credibly on scale and influence.

Far from being a conservative marketplace, the UK is proving fertile ground for brand innovation. A younger, more energetic brand landscape is emerging, and the brands that understand the power of both emotion and trust are best placed to lead it.

Brand love drives growth but trust still matters. Challenger brands are winning emotional ground, but to turn affection into long-term success, they need to earn credibility. Meanwhile, incumbents must do more than rely on reputation; they must evolve, stay relevant, and connect emotionally to protect their position.