This article was originally published in the Brand Finance Europe 500 2025 report.

Valuation Director,

Brand Finance

Tariffs could hurt American consumers more than their European counterparts.

Brand Finance research finds that U.S. consumers rate European brands as more reputable and admirable that American brands. As protectionist measures make it harder for European brands to compete in the U.S., Americans risk missing out on the brands they love most. In the current market environment, where brand perception is closely linked to values and identity, restricting access to popular international brands could have lasting consequences for nations’ economic influence, reputation and Soft Power.

Impact on different sectors

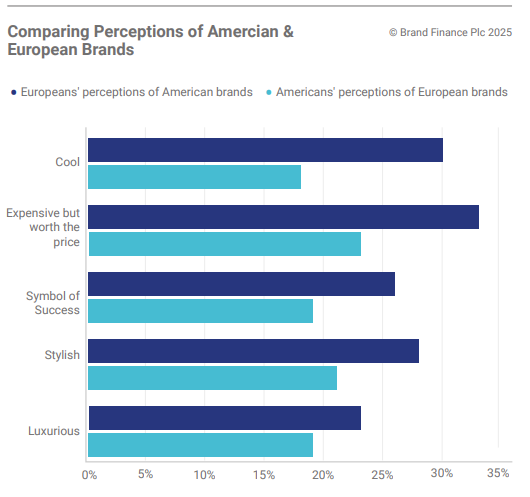

Brand Finance data reveals that U.S. respondents see European brands as more luxurious (30% vs. 18%), more stylish (33% vs. 23%), and a greater symbol of success (26% vs. 19%) compared to U.S. brands. These findings highlight the strength of consumer admiration, and what may be lost if access to these brands continues to narrow. The impact of these policies is especially pronounced in the luxury and premium sector, where U.S. tariffs - reaching up to 50% on European imports - are placing significant strain on iconic fashion houses such as Louis Vuitton, Chanel, Dior, and Hermès.

These brands are all ranked among the top 20 most valuable in Europe in 2025. Brand Finance data finds that Louis Vuitton earns perfect scores of 10 in the credibility metric – including for reputation and reliability - while Dior, the third-strongest brand in Europe, scores perfect 10s in reputation, selection, and price acceptance, underscoring U.S. consumers’ continued willingness to pay a premium for trusted European luxury.

In response to policy shifts, some luxury brands are considering relocating production to the U.S. to avoid tariffs. However, this move could come at a cost to brand equity. The ‘Made in Europe’ label is a core part of these brands’ appeal, tied closely to artisanal heritage and craftsmanship. Losing this could undermine the strength and iconic legacies of these luxury brands in the future.

According to Brand Finance data, European consumers are actually more aware of and more likely to use U.S. brands than vice versa, with brand awareness averaging 65% compared to 49% among American consumers for European brands. Usage follows a similar trend (26% vs.16%).

However, according to an assessment by the European Central Bank, U.S. trade tariffs on European products are prompting many European consumers to reconsider their purchases, with a significant number actively choosing to move away from U.S. products and services. This shift is described as decisive and potentially long-term, suggesting that the impact of tariffs extends beyond price to influence broader attitudes toward American brands.

Boycott movements are also gaining traction across Europe, and their impact is already visible. Tesla, one of the most prominent U.S. brands in Europe, is a notable example. As of April 2025, Tesla has seen its sales half in the EU, UK, and EFTA countries - a nearly 50% decline compared to the previous year. Data from Brand Finance shows that Tesla's brand value fell by 26% in 2025, decreasing to USD42.9 billion.

Even more concerning is Tesla’s drop in brand strength, which declined by over 19 points to 64.9 out of 100. Tesla has experienced notable declines in reputation scores across key European markets - including Germany, the UK, and the Nordic countries – as well as major drops in usage and recommendation, highlighting eroding consumer trust and the brand's weakening position in Europe.

The threat to Soft Power

Trade wars and escalating tariffs risk more than just economic disruption - they can also undermine a nation’s Soft Power. This is especially true in Europe, where brand reputation, cultural influence, and perceived quality are key pillars of global appeal, according to Brand Finance’s research.

The 2025 Global Soft Power Index shows that Europe still holds a strong position in global perceptions: several European countries, including Italy, France, Germany, Sweden, and the UK, rank highly among U.S. respondents for producing ‘products and brands the world loves.’

These brands – from BMW to Rolex and IKEA - carry deep cultural resonance and showcase European identity and prestige abroad. Additionally, the UK, Ireland, and Italy top the ranking for ‘rich heritage,’ among U.S. respondents, a further testament to Europe's broad cultural appeal.

Should tariffs and political tensions persist, Europe could find its most intangible but powerful assets – its reputation, culture and heritage, and brand equity - gradually weakened on the global stage, potentially weakening its Soft Power and international influence in future rankings.

The U.S. also faces significant risks to its Soft Power because of protectionist trade policies. Historically, America’s global influence has been rooted in both its economic strength and its advocacy for open markets and international cooperation.

Brand Finance data shows that the U.S. has ranked in the global top three for Business & Trade since 2021, including being among the top three for ‘products and brands the world loves.’

However, in 2025, it slipped two places to fifth for being ‘easy to do business’ with, and its overall Reputation dropped four ranks to 15th. The impact of current trade policies and their consequences on the U.S. Soft Power dominance remains to be seen.