We have been tracking the financial value of football brands for 15 years and the European Super League (ESL) project has probably caused the biggest shakeup to the game seen in that time. We have calculated that – had the league gone ahead – the 12 ESL Founding Clubs could have lost a combined brand value of €2.5bn.

Even though the ESL fancy was crushed almost as soon as it was announced, and our estimations – thankfully – will not be fully realised, the damage has been done and the football clubs behind the project have seen a €600m brand value loss from the fallout.

What could have happened?

In the most likely scenario, had the ESL gone ahead, we estimated that the annual loss for the Founding Clubs would have been €1.1bn in revenue a year and the brands would have all suffered significant reputational damage, leading to a drop in brand value of €2.5bn. This loss would have been a combination of lower broadcasting, commercial, and matchday revenue. The scenario assumed that the UEFA would not have allowed the teams to compete in the Champions League and the national leagues would also have removed the teams from their rosters.

For the ESL ‘Founding Clubs’ the prize seemed obvious – more money – but this ignored the huge risk that fans wouldn’t follow, and neither would the money. There was outrage in the home markets from fans and leagues alike, the effects of which will be felt for months to come.

Richard Haigh, Managing Director, Brand Finance

We value the top European football club brands each year, and at the 2020 measurement the top 50 were worth a total of €19.5bn. The twelve clubs behind the ESL project make up 56% of this – €10.8bn euros. This highlights the dominant commercial position they hold and is likely part of the reason they thought they could get away with the new scheme without sanctions from the domestic leagues and associations.

In addition, our analysis indicated that not only would the move have inflicted financial damage on the ESL Founding Clubs themselves, but also on the other clubs in their leagues, which may have lost up to 25% of their brand value.

Get in touch to discuss with our sports services team how the failed launch of the European Super League could affect your brand's finances in the coming months.

Living the American dream?

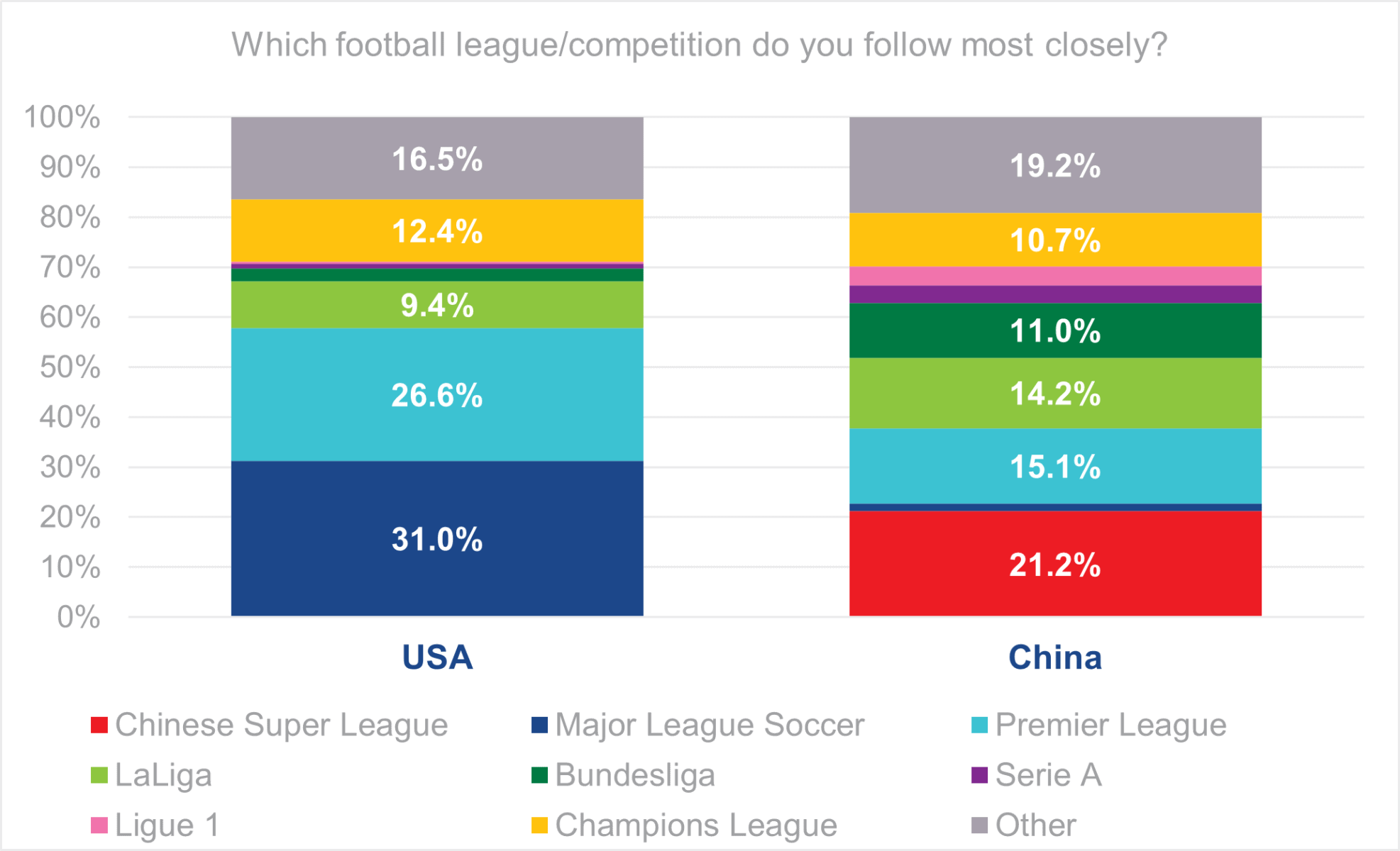

If not from the domestic markets, then the revenue would have had to come from the US or China, but an uplift in either of these geographies would have been unlikely. In both the US and China, the domestic leagues are by far the most popular as measured in Brand Finance’s Football Fan Survey. 31% of US fans prefer Major League Soccer and 21% of Chinese Fans prefer the Chinese Super League – and these numbers are already strengthening year by year. Both are countries that will more readily put their resources behind home grown team brands than foreign ones if the opportunity presents itself.

China is no longer an undeveloped market for European and North American football brands to grow. As we have seen in our studies of other industries, Chinese brands are growing fast. Many of these brands, like real estate giant Evergrande, are starting to become known beyond the domestic market and it is only a matter of time before we start hearing about Chinese football clubs more regularly.

In 2011, President Xi Jinping announced his dream to see China win the World Cup – a dream many thought impossible, but as a result, the game has received investment at all levels in the country. If the ESL Founding Clubs think that the Chinese market is a vacuum available for them to fill, they are in for a nasty shock as there’s only one true ‘super league’ in China.

Richard Haigh, Managing Director, Brand Finance

What's the damage?

Although the ESL Founding Clubs will not see the full €2.5bn brand value loss we forecast, their brand strength and therefore also brand value have undoubtedly been damaged. The club brands in question are unlikely to carry the same appeal to fans and sponsors, and the negative sentiment around the ESL has damaged emotional associations and affected attributes that sponsors value very highly, such as strong heritage, community engagement, and trustworthiness.

The sentiment of fans online towards the ESL project was overwhelmingly negative, with negative posts outweighing positive ones 3 to 1. The sour taste left by the ESL may lead to lower matchday spend and commercial revenue, which is still the lion’s share of any European club’s income.

Hugo Hensley, Head of Sports Services, Brand Finance

Rebuilding the brands will take different actions for the different stakeholders and relationships impacted. Loyal fans of the English clubs already see the U-turn as a win and can be proud that their voices were heard and that they have an influence on the club’s direction; but it will take more than a video statement to win back their faith in the owners. The clubs will need to show a specific commitment to the damaged attributes through actions not words – communicating with fan groups better on a regular basis and involving them in the decision-making process much more than it has been the case to date.

It is a different story for the national leagues and associations, governments, UEFA and FIFA – they will be weary of these clubs attempting to seize power again, but they should also recognise that they have contributed to the inequality in football that caused the 12 clubs to consider themselves untouchable.

The clubs will need to convince the regulating stakeholders of their loyalty, and that might mean conceding a greater proportion of domestic revenue distribution. The leagues, on the other hand, will need to take the fan reaction as a warning and make sure they also respect the issues raised. This could bring more scrutiny on the Champions League new format, which gives even more security to the continent’s ‘big clubs’.

What have we learned?

There are three key takeaways relevant to all brands, including clubs and sponsors, which come from the ESL’s poor communication, weak marketing, and misjudged positioning:

- There was a lack of communication with all stakeholders before the strategic decision, and this led to a defensive reaction to the announcement. Neither the fans nor the regulators seemed to have been properly consulted.

- The marketing of the new plans was uninspiring – it was announced as a legal agreement between businesses, and not an exciting opportunity to break out of a structure that most agree isn’t working perfectly. The clubs missed an opportunity to deliver global fans what they clearly have the appetite for.

- The positioning didn’t work for local markets, but our research also shows that football fans’ preferences in the key target market of China are much more driven by community attributes like passionate fans, strong heritage, and tradition – these were all damaged by the ESL reaction and show a misjudgement on the part of the clubs.