This article was originally published in the Brand Finance Olympics Journal 2024

Valuation Director,

Brand Finance

The unofficial competition between apparel brands to win the hearts of Olympic fans with their team designs is almost as fierce as the competition between the athletes themselves. With the return on investment into brand sponsorships and partnerships at stake, the field has gotten more crowded, with smaller brands such as Lululemon, Asics, and Le Coq Sportif joining heavyweights Nike and Adidas in the battle for share of voice and association with the games.

When it comes to impactful brand sponsorships and partnerships, the winners and losers are determined by subject matter relevance and memorability.

The 2024 Paris Olympics served up a host of memorable moments for apparel sponsors and partners, and high fashion and independent designers seized opportunities to spotlight their creativity. As larger and more diverse mix of apparel brands buy in, it becomes increasingly challenging for individual brands to stand out.

THE ELUSIVE VIRAL MOMENT

Whether Olympics fans were dazzled by the show or disappointed by the drizzle, the opening ceremony and preluding photoshoots were a feast for the eyes thanks to creative team outfits. Local designer Michel & Amazonka designed and manufactured the kits for team Mongolia, grabbing headlines with a design inspired by the Mongolian Naadam Festival that seamlessly blended modern and traditional elements.

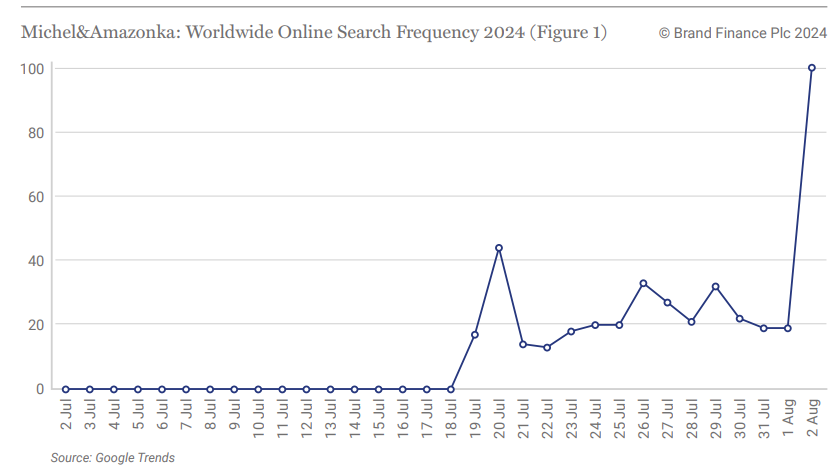

Although it was Michel & Amazonka’s third Olympics as the official designer of Team Mongolia, the Paris 2024 Summer Olympics games demonstrated that when brands produce the right mix of creativity and virality the international exposure of a platform like the Olympics can be an incredibly effective marketing tactic for rapid exposure. Michel & Amazonka experienced a surge in interest following the official image release and during the opening ceremony (Figure 1).

But for all its pomp and ceremony, the first night’s festivities are less likely to be the main commercial opportunity for global apparel brands. Instead, relevant supporting campaigns and team kit or product placement partnerships tend to yield a longer-term commercial gain, as evidenced by the running battle between Nike and Adidas to dominate the Olympics in terms of building their brands.

AN ONGOING ATHLETIC RIVALRY

In the Beijing 2008 Olympics, the combined opportunity for global brand building and host market growth led to an aggressive marketing battle between Adidas and Nike.

While Adidas was an official sponsor and launched a large “Impossible is Nothing” local campaign, Nike secured team China sponsorships in 22 of 28 sports. Targeting local fans, both brands invested significantly, Adidas was estimated to have spent $190m and Nike was estimated have invested $150m in sponsorship and associated marketing.

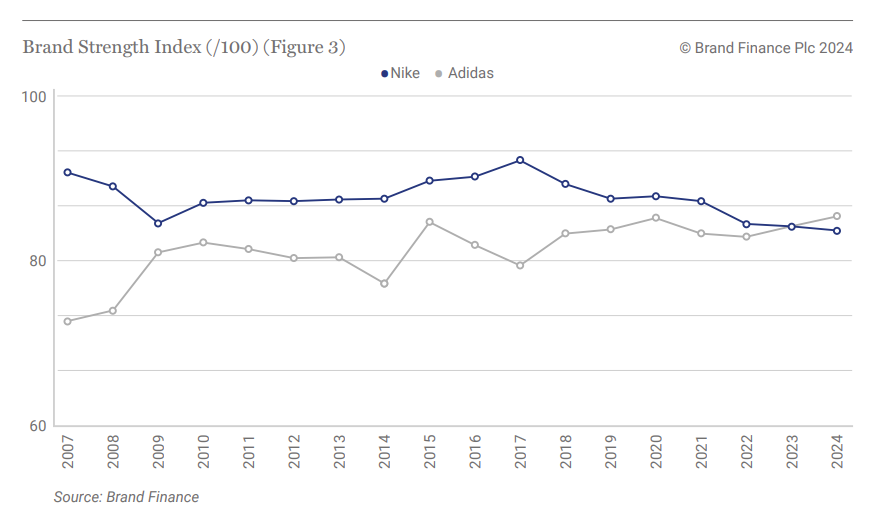

Brand Finance analysis suggests that Adidas was the overall winner, gaining an impressive 7 points in global brand strength (Figure 2), bringing it closer to the levels of Nike and marking the beginning of a turnaround which saw the Adidas brand value rise from $5bn in 2007 to a staggering $15bn this year.

Adidas entered an exclusive title sponsorship for The London 2012 Summer Olympics, as Nike infamously counteracted with guerrilla tactics.

The Adidas agreement prevented Nike from officially referencing the Olympic and London 2012, but Nike creatively swerved the restrictions by onboarding 400 athletes as ambassadors to compete in Nike shoes.

Nike also filmed their “find your greatness” campaign in creative locations like London, Ohio and Little London in Jamaica, and by continually focusing on individual athletes, closely competed with Adidas’s title sponsorship for brand visibility and impact.

Research during the games found that more consumers thought Nike was an official sponsor than Adidas. Had it not been for Nike’s campaign, Adidas would likely have seen significant gains following London 2012, but ultimately, the overall brand strength impact on both brands was minimal.

Rio 2016 was the Nike heyday. An online linguistics monitoring tool, GLM, recognised Nike as the top performing non-official sponsor brand in terms of association with the games. Nike’s brand strength hiked to its highest observed level ever since Brand Finance began tracking the brand in 2007 (Figure 3).

With a brand strength of 92/100 it was the 3rd strongest brand in the world in 2017, following the success of its various athlete endorsements and marketing activities throughout Rio 2016.

Both brands pulled back for the Tokyo 2020 Summer Olympics, held in 2021 due to the pandemic. Nike reportedly invested $39m in advertising, a quarter of what it spent for Beijing in 2008. This lower investment, coupled with general overshadowing of the games by COVID-19 led to a net loss in brand strength for both brands as Japanese Asics saw a positive impact with its gold partner status and role in supplying uniforms for team Japan as well as volunteers at the games.

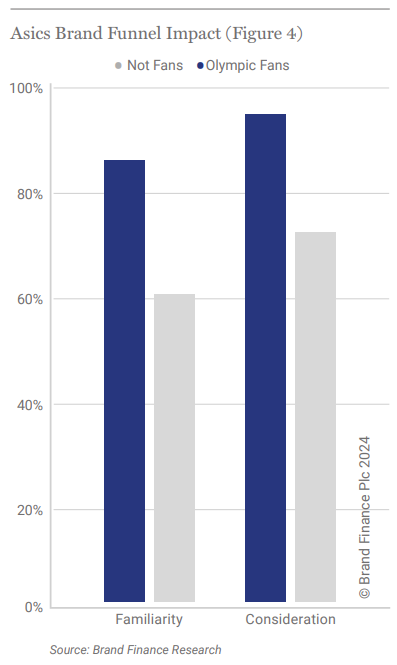

The lasting impact is evidenced in our latest brand research which found both familiarity and consideration for Asics to be significantly higher among fans of the Olympics than non-fans (Figure 4). Asics is likely to further cement its Olympics-generated brand building success following its recent agreement to be the first ever official supplier to the International Paralympic Committee.

LOCAL BRANDS, GLOBAL ARENA

Country of origin and soft power are undoubtedly a factor in emotional connection, relevance and effectiveness of sponsorship activities for apparel brands.

Lululemon appears to have hit the bullseye for relevance, memorability and impact with stylish designs and relevance given the brand’s premium activewear capability coupled with its Canadian origin. Since the opening ceremony, the brand has seen a 13% global rise in search frequency according to Google Trends.

The partnership is not without criticism due to greenwashing accusations particularly domestically and in France, but Brand Finance experts expect the overall global impact to be positive in terms of recognition and consideration for the brand in the coming year. In the latest study, Brand Finance estimated the Lululemon brand to be worth $6bn, with almost 10% growth since last year following the appointment of ex-Nike exec Nikki Neuberger as chief brand officer.

French apparel brands have come out in force for the Paris 2024 games. Louis Vuitton is likely to experience positive impact on brand value next year on the back of its “The Mission” campaign featuring iconic branded leather suitcases. A clip of this campaign was shown in the opening ceremony and the brand provided medal cases for the games.

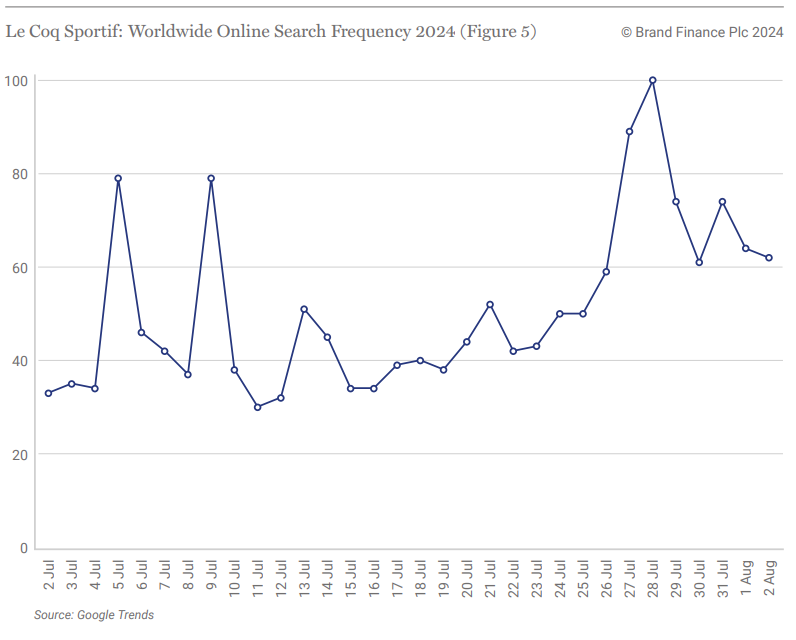

Compatriot Le Coq Sportif saw a notable 60% rise in google search rate following the opening ceremony (Figure 5). The traffic increase was mostly in France, where domestic origin brands typically perform well on preference versus international counterparts.

Nike is reportedly countering the competition with its highest investment in Olympics marketing to date, and a somewhat controversial campaign emphasizing individual pursuit of greatness in its “Winning: not for everyone” campaign. As shown in figure 3, Adidas overtook Nike in brand strength for the first time last year following success in top football team sponsorships and a resurged interest in its casual footwear such as Sambas.

However, Adidas’s Paris 2024 impact has been scuppered by the controversy surrounding its campaign featuring Bella Hadid, which has been criticized as antisemitic.

The campaign controversy for Adidas, coupled with Nike’s apparent Olympics push and renewed public interest in the brand’s ambush campaigns of 2012, might well lead to another year of roaring success for Nike. However, following a drop in brand value by 5% since last year, if the brand is going to reclaim its winning rank, Nike does need to just do it.

1 https://www.theguardian.com/sport/2008/aug/18/olympics2008.retail

2 https://www.campaignlive.co.uk/article/marketing-olympics-sponsors-leading-race-london-2012/1139142; https://www.kantar.com/inspiration/brands/paris-2024-offers-brands-an-olympic-sized-opportunity

3 https://www.insidethegames.biz/articles/1041052/exclusive-study-claims-nike-achieved-best-ambush-marketing-campaign-at-rio-2016

4 https://digiday.com/marketing/nike-eyes-marketing-moment-at-the-olympics-as-industry-execs-sound-off-on-the-brands-challenges/

5 https://www.globallegalpost.com/news/canada-olympic-kit-sponsor-lululemon-faces-greenwashing-action-in-france-1587667102

6 https://digiday.com/marketing/nike-eyes-marketing-moment-at-the-olympics-as-industry-execs-sound-off-on-the-brands-challenges/

7 https://www.ft.com/content/f5d620a5-6da0-4a5c-ab58-6deaf6b97a06