This article was originally published in the Brand Finance Alcoholic Drinks 2025 report

Valuation Director,

Brand Finance

Perceptions of Guinness as a cool beer brand have tripled among young people since 2023. Traditionally, Guinness has held a strong association with older, male drinkers, particularly in its core markets like Ireland and the UK. Its image was rooted in ideas of masculinity and strength, reinforced by the perception that each pint was full of iron. While this identity helped define the brand, it also narrowed its broader appeal. In recent years, however, Guinness has worked to both challenge and reimagine those ideas to expand its consumer base. A key driver of its brand value growth has been rising global demand, reflected in late 2024 when Guinness breweries were operating at maximum capacity to grapple with supply shortages. This success even led to rumours surfacing in early 2025 about a potential sale of the brand by its parent company, Diageo, which it quickly dismissed.

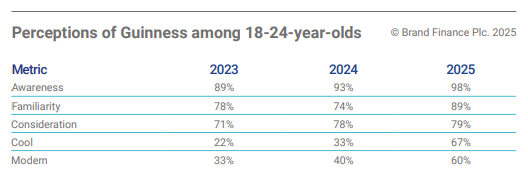

In line with rising demand, Brand Finance research reveals a notable shift in consumer perception and engagement between 2023 and 2025. Awareness, consideration, and perception have all seen significant gains. Further, Brand Finance research also shows that Guinness has gained significant traction among younger consumers (18-24), noting a marked shift in perceptions of the brand as ‘cool’ (22% in 2023 versus 67% in 2025) and ‘modern’ (33% in 2023 versus 60% in 2025), positioning it well for future brand growth (see table).

According to Brand Finance data, Guinness has also become increasingly popular with young women. Familiarity increased from 78% in 2023 to 86% in 2025, while consideration rose from 67% to 77%, reflecting the brand’s success in connecting a more diverse and engaged audience. Guinness’ brand value growth can also be attributed to its alignment with changing drinking habits. Guinness has successfully adapted to evolving consumer trends, particularly the rise of more mindful, health-conscious drinking. With fewer calories than many lagers and a considerable foothold in the non-alcoholic drinks sector since launching Guinness 0.0% in 2021, Guinness has confidently positioned itself as a future-proof brand. According to Brand Finance data, in 2025, 34% of UK non-alcoholic beer drinkers associate the Guinness brand with having a good alcohol-free alternative.

With little competition in the stout market and a well-established foothold in the non-alcoholic beer sector, this data shows that Guinness is building a future-proof, forward-thinking brand. In 2025, Guinness ranks as the 10th most valuable beer brand globally, with its brand value rising 32% to USD3.4 billion. It also remains the most valuable Irish brand in 2025 - a position it has held since 2022. In terms of brand strength, Guinness ranks 13th among global beer brands, with a Brand Strength Index (BSI) score of 79.4 out of 100.