Reprinted from the Hotel Business Review with permission from www.HotelExecutive.com. Read the article here .

Franchise agreements are a common strategy in the hotel industry, offering a pathway for rapid expansion without the need for significant capital investment. Under a franchise agreement, the franchisor (the hotel brand) allows the franchisee (the hotel owner) to operate a hotel under its brand name, following its standards and guidelines. In exchange, the franchisee pays fees to the franchisor, which may include initial franchise fees, ongoing royalties, and marketing contributions. In some cases, the franchisor also provides operational services through a management contract.

This model is particularly appealing to franchisees because it provides instant brand recognition, access to a proven business model, and the support of a larger network. For individual hotels, this can mean access to global distribution systems, loyalty programs, and marketing initiatives that would be challenging to achieve independently.

Some of the biggest names in the hotel industry, like Marriott International and Hilton Worldwide, rely heavily on franchise agreements. Marriott operates nearly 9,000 properties globally, spanning from luxury to budget segments, with over 6,500 of these being franchised. Similarly, Hilton boasts a global portfolio of nearly 7,800 hotels, with more than 6,600 of them operated as franchises, offering a wide range of brands across various market segments.

These major franchises leverage their global reach, strong brand recognition, and comprehensive support systems to drive growth and maintain consistency across their properties.

Growth of the franchise model

The popularity of franchising in the hotel industry has seen a significant rise in recent years. According to McKinsey, the proportion of franchised hotels increased from 66% in 2012 to 72% in 2023. This shift towards franchising allows hotel companies to focus on expanding their brand presence and generating consistent revenue streams, while minimising the liabilities associated with property ownership. The trend has been further accelerated by the COVID-19 pandemic, as hotel owners and investors increasingly value the structured support and established business models that franchise partnerships offer. However, this comes with trade-offs, including adherence to the franchisor's rules and regulations, which can limit creativity and operational flexibility. Despite these constraints, the evolving landscape has made franchising the preferred operating model for many global hotel chains.

Why do brands use franchise agreements?

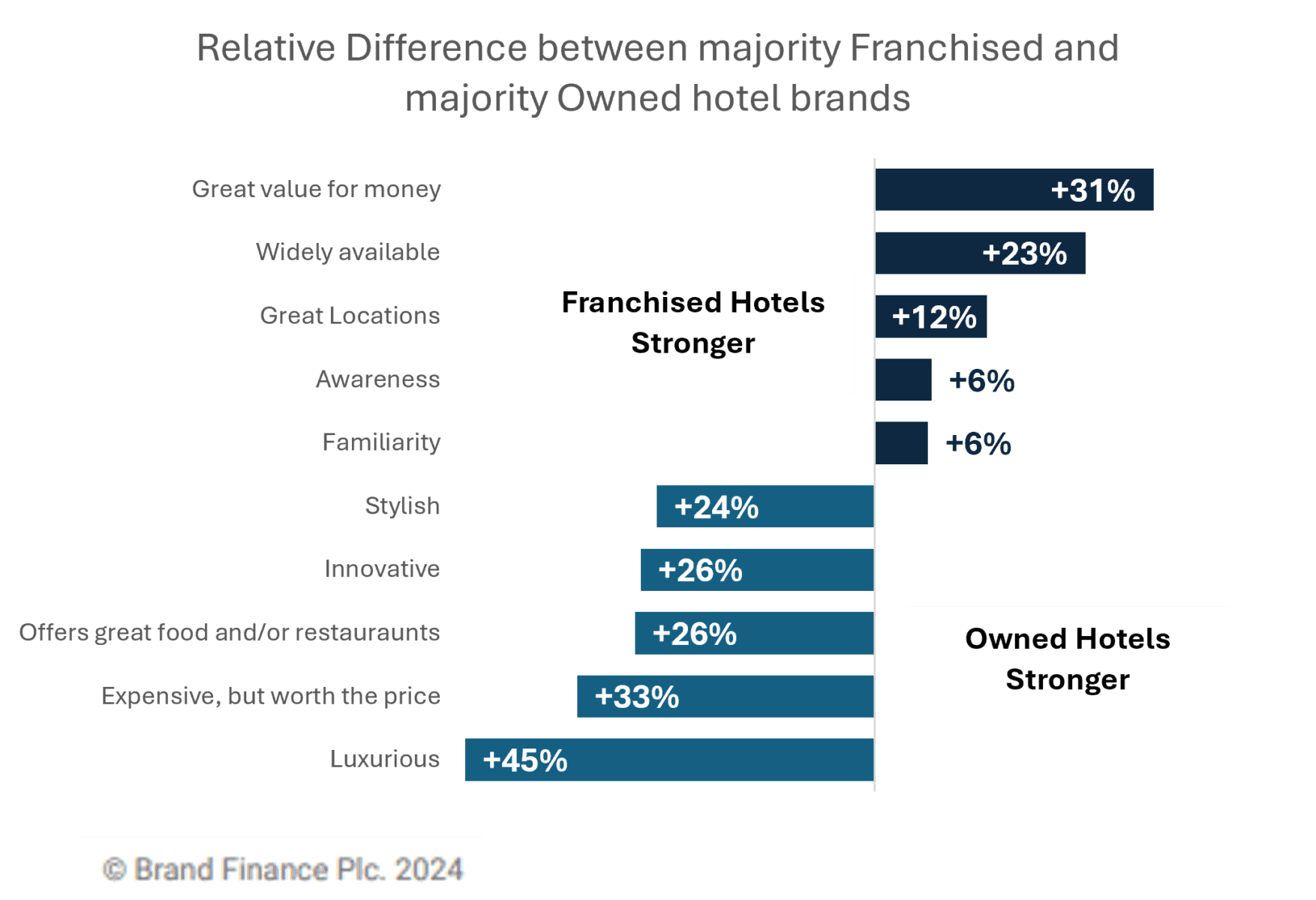

Quicker growth

A franchise model allows hotel brands to expand their physical presence more rapidly because they do not need to acquire or build the physical assets themselves. This asset-light approach is particularly beneficial for mass-market hotel brands aiming to build awareness quickly. Regular travellers often value the consistency of being able to stay in the same brand of hotel in different locations, which in turn helps the brand build loyalty. This growth strategy contributes to higher brand awareness and familiarity for franchised hotels, with Brand Finance’s research highlighting a significant advantage in both consumer awareness (73% vs. 69%) and familiarity (54% vs. 51%) compared to owned hotels. This approach also means that franchise hotels are perceived as being widely available (27% vs. 22%) and often in better locations (30% vs. 27%) than their owned counterparts.

Lower asset requirement

By not owning all the hotels in their portfolio, brands can maintain a leaner balance sheet, which requires less financial capital for growth. This reduction in capital needs leads to cost savings in both personnel and property-related expenses. Additionally, because property values can fluctuate with economic cycles, a franchise model mitigates some financial risk, allowing the hotel brand to concentrate on customer acquisition and retention efforts. These financial efficiencies also translate into better value for money for consumers, with franchised hotels often perceived as more cost-effective (32% vs. 24%) compared to their owned counterparts, making them particularly appealing to cost-conscious travellers.

Flexibility

Building new properties from the ground up can be time-consuming. The franchise model provides the flexibility to respond more quickly to changing consumer trends, whether by adjusting geographical locations or modifying the types of hotels offered. For example, the rise of remote work has changed traveller needs, and a franchise model allows hotels to adapt more swiftly to these trends. However, it's worth noting that hotel brands can also achieve similar flexibility by purchasing or adapting existing buildings, though this often involves negotiating additional costs and time.

Access to unique properties

Franchise agreements can provide hotel brands access to unique or historic properties, which might not be possible with new builds. While new properties can incorporate the latest amenities, franchises can leverage the charm and prestige of notable locations, making this model particularly attractive for upscale luxury brands.

Why some brands avoid the franchise model

Greater control over quality & consistency

One of the main risks of the franchise model is the potential loss of control over quality and consistency. Franchisees may not always maintain the brand's intended standards, whether in terms of hotel appearance or customer service. An owned hotel model allows for stricter oversight and often results in higher perceived quality and customer satisfaction. Additionally, weak franchise agreements can lead to disputes over responsibilities, affecting both customer engagement and the timely upgrading of hotel facilities. This is reflected in data showing that owned hotels are seen as more luxurious (28% vs. 19%), offering better food/restaurants (20% vs. 16%) and being more stylish (28% vs. 23%).

This can translate into strong financial returns for the hotel owner. These strong perceptions of quality and luxury mean that consumers are more likely to accept a price premium. Consumers were far more likely to view a majority owned hotel brand as “expensive, but worth the price” (33% vs 27%). This reflects that the extra costs required when the hotel is fully owned can be offset by higher prices.

Additionally, while franchising allows brands to expand rapidly, it also means they only receive a fee from the franchisee, rather than the full revenue generated by the hotel. This limits the potential profit compared to owning and operating the hotel directly.

No risk of partners switching to another franchise chain

A significant risk with the franchise model is that franchisees, as independent owners, may be tempted to switch to another franchise chain. This possibility can be used by the franchisee as leverage to negotiate more favourable terms, potentially reducing the franchisor's profit margins. Moreover, any consumer loyalty built up in a particular property might be transferred to another brand if the franchisee decides to switch affiliations.

A notable example of this occurred after Marriott's acquisition of Starwood Hotels & Resorts in 2016. Some Westin hotels, previously under Starwood, transitioned to other franchise brands like Hilton or Hyatt when their franchise agreements ended, as the franchisees sought better terms or brand alignment.

Easier to control fewer stakeholders

Brands that own and operate their hotels can maintain greater control over their employees and stakeholders. These employees receive direct training from the company and are more likely to adhere strictly to brand and operational guidelines. Unlike franchisees, who are partners rather than direct employees, staff at owned hotels are more aligned with the brand’s values and objectives. Centralised training and onboarding further ensure consistency across the brand’s operations.

Industry trends and future outlook

As the hotel industry continues to evolve, the franchise model is likely to remain a dominant strategy for expansion. Several factors contribute to this trend:

Emerging markets: Franchising is expected to see significant growth in emerging markets, where global hotel brands are expanding their presence to cater to the growing middle class. Countries in Asia, Africa, and Latin America present lucrative opportunities for hotel chains to establish their brands through franchising, leveraging local knowledge while maintaining brand standards.

Technology and consumer preferences: Advances in technology are also shaping the future of franchising. The rise of online booking platforms, mobile apps, and customer relationship management systems allows franchisors to maintain greater control over brand consistency and customer experience, even in franchised properties. Additionally, the growing trend towards personalised travel experiences may push franchisors to offer more flexible and customised franchise models that cater to niche markets, such as eco-tourism or wellness retreats.

Economic conditions: Economic downturns or shifts, like those triggered by the COVID-19 pandemic, often accelerate the adoption of asset-light models, including franchising. In uncertain economic environments, hotel brands may prefer the lower financial risk associated with franchising, while independent owners seek the security of a well-known brand to attract customers.

Comparing franchising across industries

The franchise model is not unique to the hotel industry, it is widely used in other sectors. However, the application and impact of franchising can vary significantly across industries.

In the fast-food industry, franchising is almost synonymous with business expansion. Brands like McDonald’s and Subway have built their empires largely through franchising, with strict controls over every aspect of the business, from menu offerings to restaurant layout. The hotel industry, while also focused on brand consistency, faces more complexity due to the larger scale of operations and the need to adapt to different geographic and cultural contexts.

In retail, franchising allows brands to expand rapidly without the need for significant capital investment, much like in the hotel industry. However, retail franchises often deal with more standardised products, whereas hotels must manage a broader range of variables, including service quality, customer experience, and property maintenance. This makes the franchise model in the hotel industry more challenging but also potentially more rewarding.

Balancing growth and control

Franchising is a powerful strategy for hotel brands aiming for rapid expansion with minimal capital investment. It offers significant advantages, including increased brand awareness, financial efficiency, and the ability to scale quickly. This is evident in Brand Finance’s annual ranking, where 8 of the top 10 most valuable hotel brands are franchised, highlighting its effectiveness in driving brand visibility and sales.

While owned hotels can deliver a more curated, luxurious experience, franchising often leads to greater brand value and higher returns for shareholders. Franchised hotels benefit from enhanced brand equity, which combines mental availability and financial value. Success in any model, however, requires careful tracking of consumer perceptions to ensure alignment with brand goals and market demands.

Ultimately, franchising excels in driving awareness—an essential factor in boosting sales and capturing market share. For brands focused on maximising shareholder value, a well-executed franchise model offers scalability and visibility that can translate into long-term growth and success.