Reprinted from the Hotel Business Review with permission from www.HotelExecutive.com. Read the article here .

Four years after facing unprecedented challenges due to the pandemic, the hotel industry continues to struggle with lingering effects on brand value and strength.

As of 2024, according to Brand Finance, the total brand value of the world's top 50 most valuable hotel brands stands at USD 56.8 billion, a significant drop from the pre-pandemic figure of USD 70.2 billion in 2020. It’s a stark lesson for sector-marketing decision-makers about the long-term and costly effects of scaling back marketing investment to cut expenses in the short term.

Cost-cutting and consequences

In times of economic crisis, marketing budgets are often among the first reductions as organizations seek to conserve cash and mitigate financial strain, which is precisely what unfolded during the pandemic, as many hotels slashed their marketing spend because tourism and corporate travel ground to a halt. While these budget cuts provided immediate fiscal relief, they have had more significant long-term repercussions for brand health and market positioning.

Reduced marketing investments can impair a brand’s visibility, making it challenging for hotels to attract and retain new customers. Meanwhile, brands that maintain or only slightly reduce marketing efforts can sustain higher levels of brand awareness, a significant advantage when competing for business against brands that dramatically scale back.

Furthermore, as consumer interactions increasingly migrated online during the pandemic, hotels that neglected digital marketing and customer engagement tools were at a disadvantage. Diminished focus led to missed opportunities to communicate safety measures and reassure guests.

Notably, budget reductions and staffing cuts in marketing departments made it more difficult for hotels to recover swiftly and effectively once the market rebounded. This talent drain highlights the broader implications of cutting marketing budgets, underscoring the critical role sustained marketing efforts play in a brand’s resilience and recovery.

Impact of marketing cuts

Brand Finance conducts extensive market research annually across the hotel sector, examining 155 hotel brands in 21 countries. This research involves surveying consumers on various aspects of brand perception, including Familiarity, Awareness, Consideration, and Reputation. To understand the pandemic's impact on consumer perceptions, we cross-analyzed this data with financial reports from over 120 global hotels, revealing insightful trends.

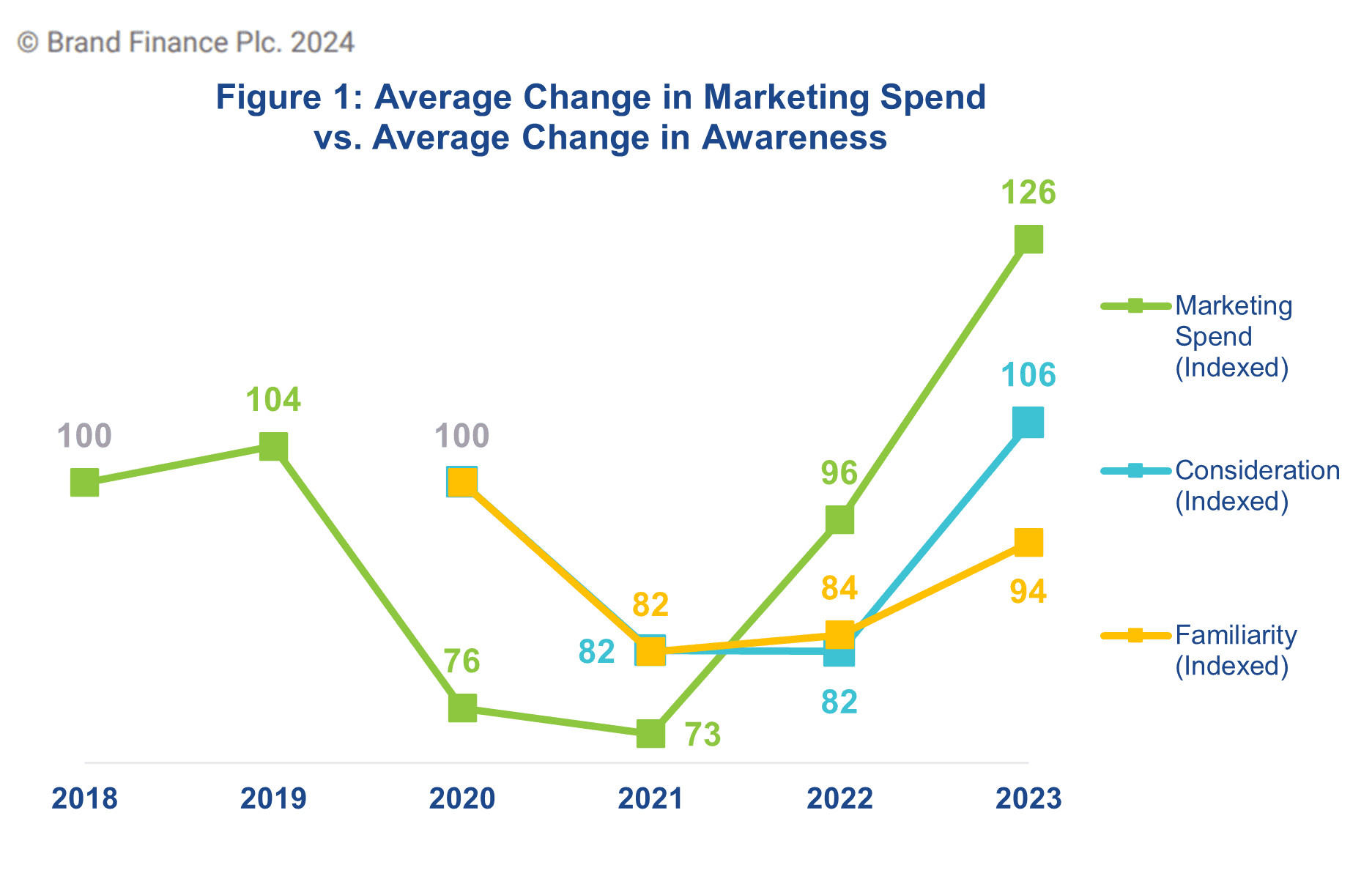

Our analysis showed a considerable drop in marketing spend across the board. On average, marketing expenditure decreased 27% from 2019 to 2020 (Figure 1) as hotels sought to offset the dramatic fall in revenue during the early stages of the pandemic. This reduction had far-reaching implications for brand perceptions. Among hotel brands researched in the United States, Familiarity and Consideration experienced an average decline of 18% between 2020 and 2021.

Our findings revealed that hotels with higher levels of Familiarity were better positioned to withstand the initial impact of the pandemic and recover more quickly. Among US hotels, Holiday Inn led with an impressive average Familiarity of 80% from 2020 to 2023. Hilton, Marriott, Hampton Inn, and Comfort Inn also performed strongly, maintaining Familiarity levels of around 70% during the same period.

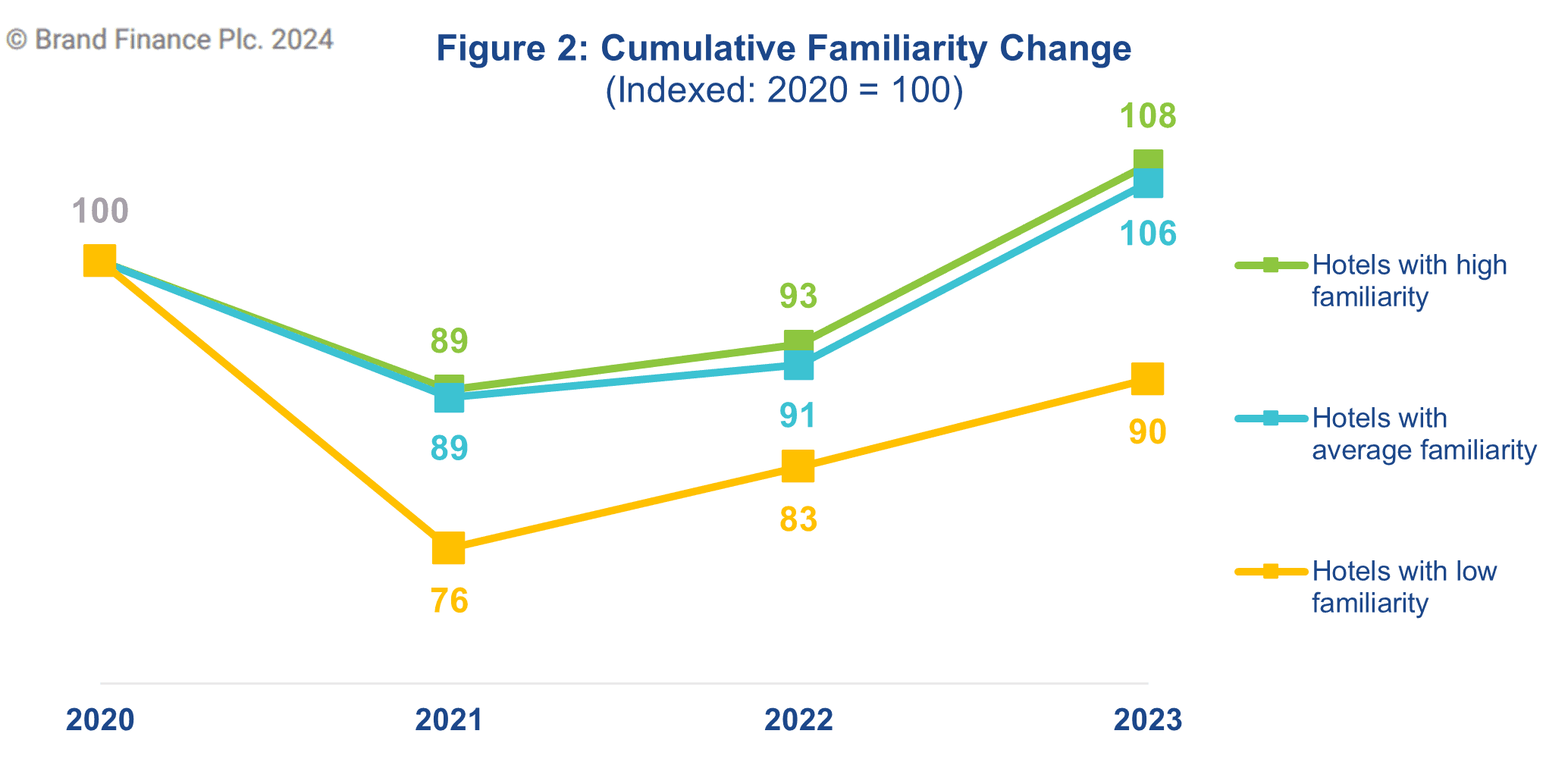

Figure 2 demonstrates that hotels with relatively higher Familiarity, established through long-term brand-building, are more resilient during periods of lower marketing spend. While hotels with high (green) and average (blue) Familiarity have now returned to and even surpassed their pre-COVID Familiarity levels, hotels (yellow) with lower Familiarity are still struggling to reach their pre-COVID levels.

In contrast, brands with lower Familiarity levels experienced more pronounced declines and slower recoveries. For instance, Ibis averaged only 25% Familiarity over the three-year period.

The luxury segment also faced substantial challenges. Mandarin Oriental saw its Familiarity drop significantly from 38% to 29% between 2020 and 2021, reflecting a similar decline in marketing spending, which decreased by 19% in 2020 and 34% in 2021. Despite a rebound in marketing efforts since 2022, the brand has struggled to recover fully, achieving just 33% Familiarity in 2023, still five points shy of its 2020 level.

Marketing spending isn’t the only way to maintain visibility: Hampton Inn demonstrated resilience during the pandemic through community-supportive initiatives, such as housing soldiers. Similarly, Days Inn maintained stability by offering lower rates for hospital workers during the early stages of the pandemic.

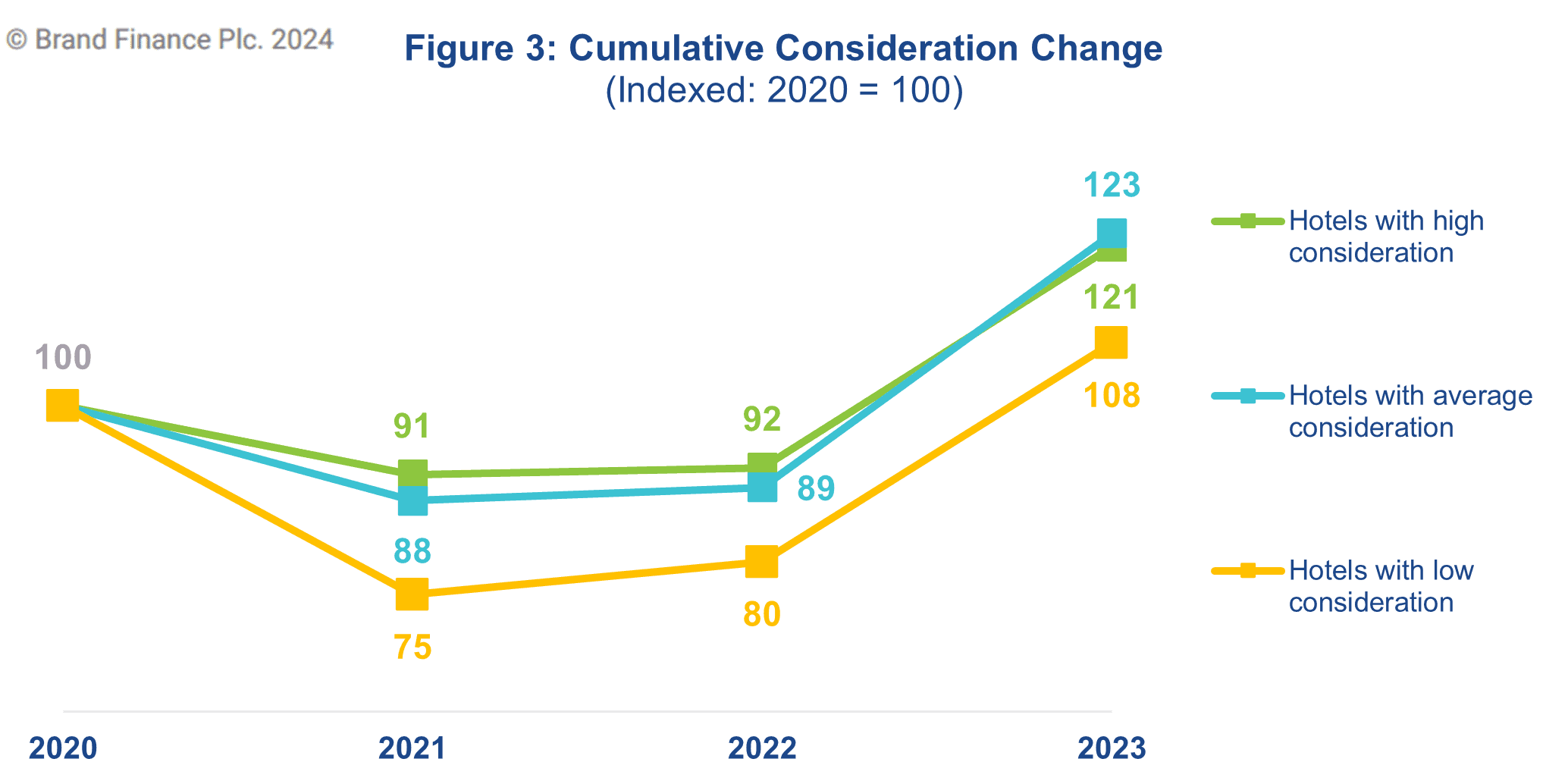

Consideration trends mirrored those of Familiarity but showed milder fluctuations (Figure 3). Hotels with the lowest Consideration levels saw the most significant initial drop but recovered slightly faster later in the pandemic. Consideration levels have rebounded considerably, with an average increase of 30% from 2022 to 2023, due to a surge in consumer enthusiasm for travel and the desire to combine remote work with leisure travel. This resurgence presents a prime opportunity for hotel brands to intensify their marketing efforts to attract and engage consumers more effectively.

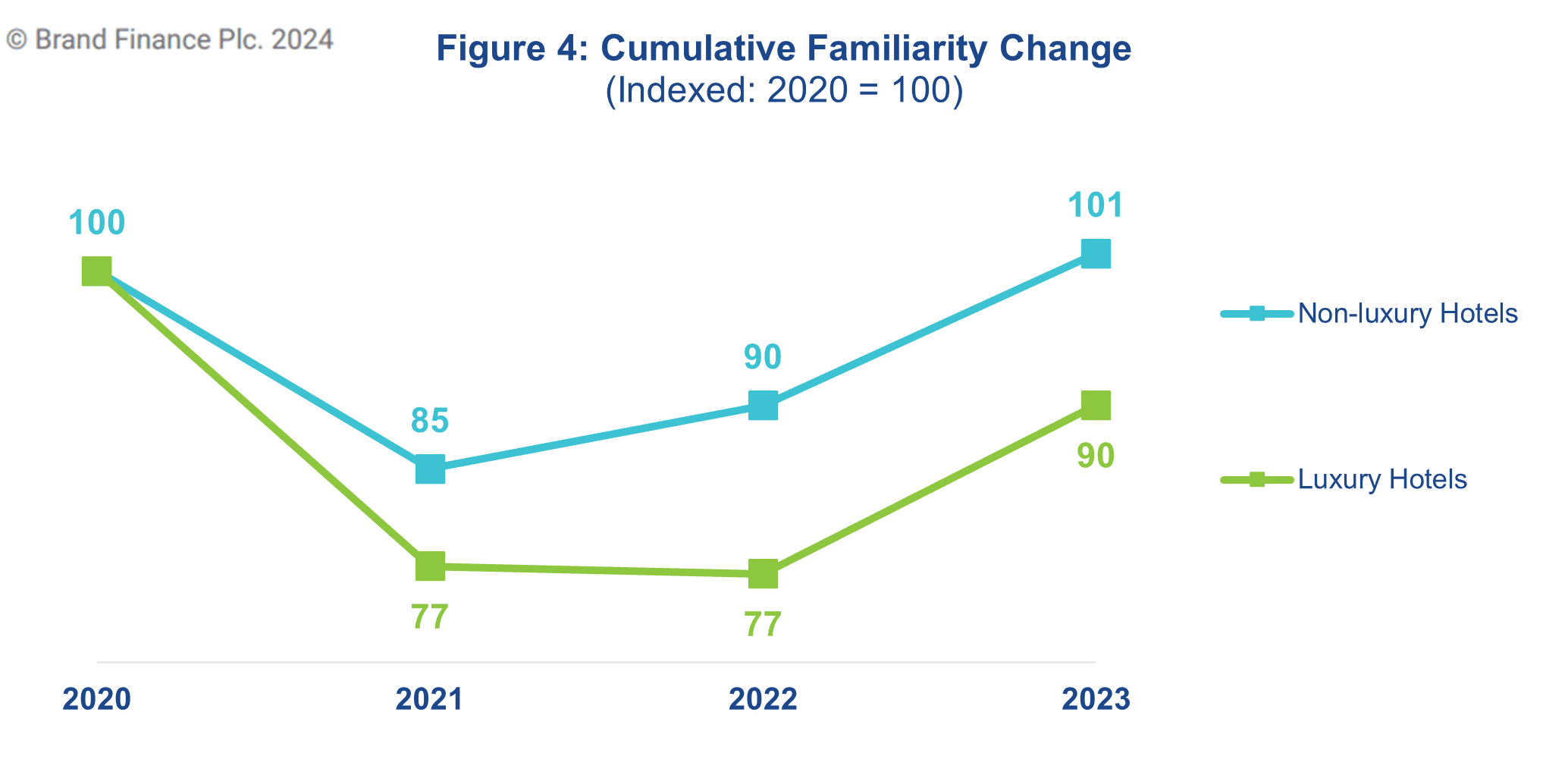

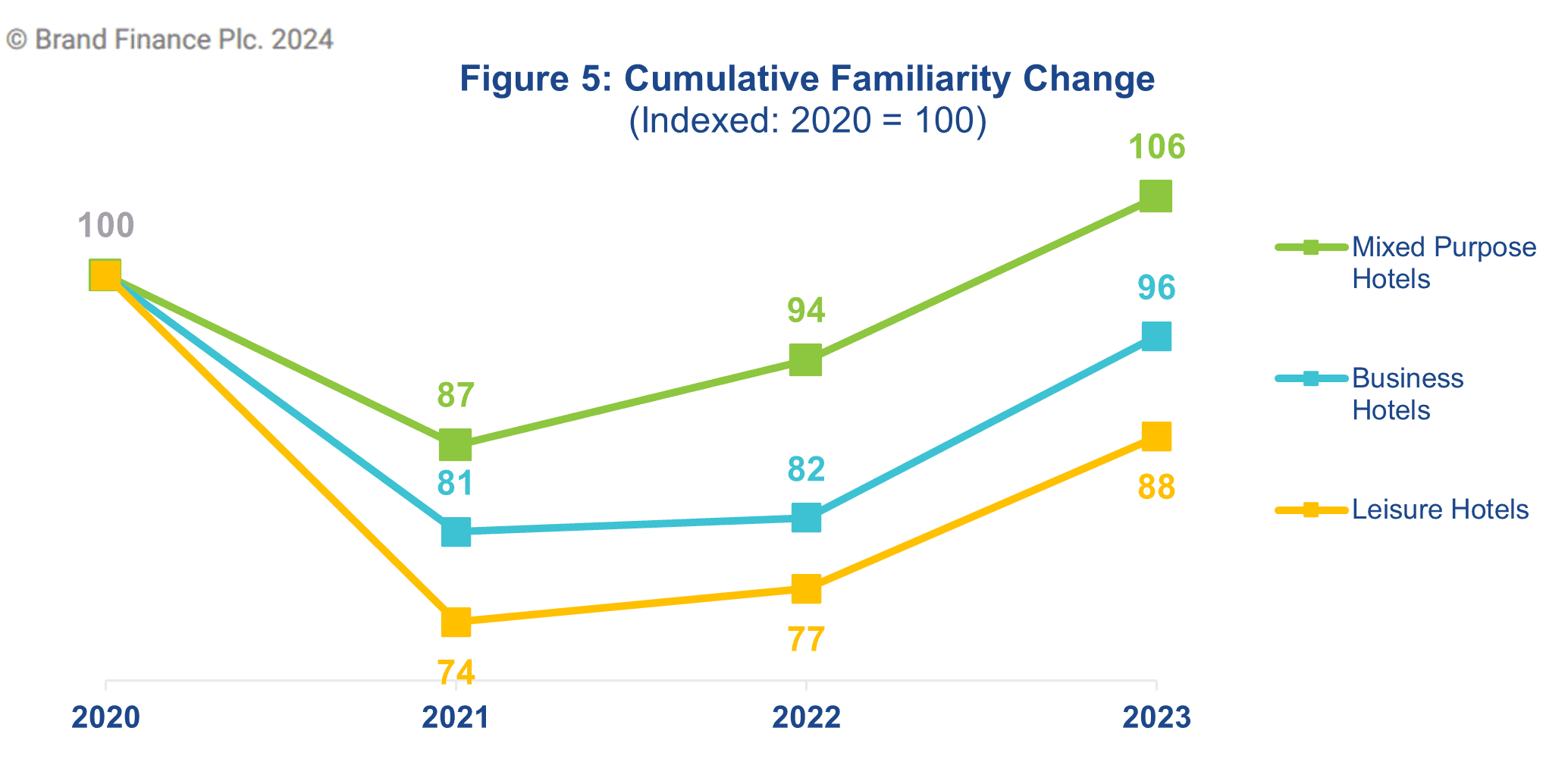

In the luxury segment, hotels experienced a more substantial decline in Familiarity levels compared to their non-luxury counterparts. This decline is primarily due to the severe impact on tourism since luxury hotels mainly cater to leisure travelers and thus faced a more significant drop in demand. Brand Finance's research indicates that luxury hotels saw a 23% decline in Familiarity from 2020 to 2021, while non-luxury hotels experienced a smaller decrease of 15% during the same period (Figure 4). Leisure hotels suffered the most, with a 26% drop in Familiarity, compared to smaller declines in business and mixed-purpose hotels (Figure 5).

However, in the post-pandemic period, luxury hotels are recovering more quickly than non-luxury hotels. This trend highlights the elastic nature of demand within the luxury segment, which appears to be rebounding faster as travel restrictions eased and consumer confidence returned.

The importance of consistent marketing

The importance of consistent marketing cannot be overstated. Sustained marketing investment is essential for robust brand building. Short-term marketing tactics may yield temporary sales boosts, but they must be combined with longer-term brand-building activities to contribute to the enduring strength of a brand and improve future earnings.

Consistent marketing fosters consumer loyalty and reinforces brand resilience in competitive industries. Consistency in messaging strengthens brand identity and nurtures a strong connection with consumers. Regular advertising campaigns maintain brand visibility and remind consumers of its value, fostering loyalty and attracting new customers. A cohesive brand story across multiple channels builds a recognizable and trustworthy image, driving consumer preference and loyalty.

Long-term marketing investments require comprehensive data collection and analysis so brands can understand consumer behavior and refine their strategies accordingly. Ongoing engagement allows brands to adapt swiftly to changes in consumer needs and market conditions. In times of crisis, an established presence and consistent communication build trust and credibility, crucial for maintaining customer loyalty.

Looking ahead: strategies for hotel executives

As the hotel industry navigates its path to recovery, it is essential to recognize that the road ahead requires more than simply resuming operations. Rebuilding consumer trust and adapting to evolving market conditions are crucial for longer-term success. The following strategies provide an approach to achieving these goals:

- Reinvest in marketing but revisit the strategy

Allocate resources to consistent and strategic marketing efforts. Effective marketing campaigns are vital for enhancing brand visibility and engagement. Hotels should focus on developing and executing campaigns that address current challenges and build a robust brand presence. Investing in marketing will help restore Familiarity and Consideration and create a competitive edge in a recovering market.

- Leverage data-driven insights

Utilize market research and data analysis to understand consumer segmentation, behavior, and preferences. By tailoring marketing strategies based on actionable insights, hotels can better meet the needs of their target audiences. Data-driven decisions enable hotels to refine their approaches, optimize marketing spend, and respond more effectively to market trends.

- Embrace digital transformation

Invest in digital marketing channels to reach a broader audience and stay relevant in an increasingly online world. Leverage social media, content marketing, and online advertising to enhance brand presence and engage with potential and existing customers. Embracing digital tools meets modern consumer expectations and positions hotels as innovative and adaptive to changing market conditions.

- Focus on customer experience

Prioritize customer satisfaction and experience to foster positive interactions and build long-term loyalty. Exceptional customer experiences lead to word-of-mouth recommendations and repeat business. Hotels should invest in staff training, personalization, and high service standards to ensure guests have memorable stays and encourage return visits and referrals.

- Incorporate sustainable practices

Integrate sustainability into brand strategy (as appropriate) as consumers increasingly value environmentally responsible brands. Brands that implement and report their eco-friendly practices meet the growing customer demand for sustainability, enhance brand reputation, drive consumer preference, and boost loyalty. However, ensure that actions genuinely live up to or surpass communications to maintain credibility and trust.

- Rebuild consumer trust

Restore consumer trust with transparent communication about health and safety measures. Hotels should convey their commitment to guest safety and hygiene through consistent messaging. Effective communication can help reassure travelers and rebuild confidence, which is essential for attracting guests as the industry recovers.

- Enhance brand loyalty

Strengthen loyalty programs and engage with guests through personalized rewards and targeted offers. Consistent engagement and value-added incentives can drive repeat business and reinforce brand loyalty. Building a robust loyalty program can help hotels maintain a strong connection with customers and differentiate themselves from competitors.

- Adapt to changing expectations

Understand and address shifting consumer expectations, such as the demand for flexibility and unique experiences. Adapting to these changes will allow hotels to meet evolving traveler needs and stay competitive. Flexible booking options, personalized services, and unique experiences can help hotels remain relevant and appealing.

- Navigate the competitive landscape

As competition intensifies, hotels must leverage their strengths and differentiate themselves through unique offerings and consistent branding. Staying attuned to market trends and consumer needs will enable hotels to effectively navigate the competitive landscape and position themselves for long-term success.