Place Branding Director, Brand Finance

What is Soft Power and how is the Global Soft Power Index constructed?

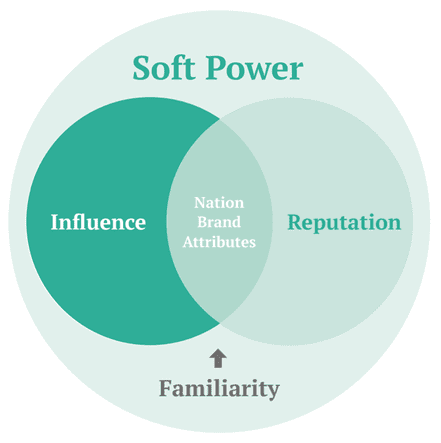

Soft Power is a nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics, etc.) through attraction or persuasion rather than coercion.

Brand Finance’s Global Soft Power Index is the industry’s most comprehensive research study on Soft Power and perceptions of nation brands in general, surveying opinions of 150,000+ respondents in 100+ markets. The fifth iteration of the Index, which will be published in a few months’ time in February 2024, will rank all 193 member states of the United Nations for the first time.

The term Soft Power was popularised by Professor Joseph Nye of Harvard University in the 1980s. Brand Finance has consulted the development of the Global Soft Power Index with academics from around the world, including Professor Nye. Dr Paul Temporal of the University of Oxford, who is known in ASEAN for having helped develop the Malaysia – Truly Asia tourism brand strategy among his numerous other professional achievements, has supported us as the chief academic advisor to the Index.

The Global Soft Power Index quantifies an overall score of a nation’s Soft Power, thanks to evaluating both its Reputation and Influence. Grouped into thematic pillars such International Relations and Sustainable Future, a wide range of nation brand attributes are measured in their own right as well as to analyse their role in driving performance in both KPIs of Reputation and Influence. The third KPI – Familiarity – enables respondents to form their perceptions in the first place.

What are the results of the Global Soft Power Index like for ASEAN nations?

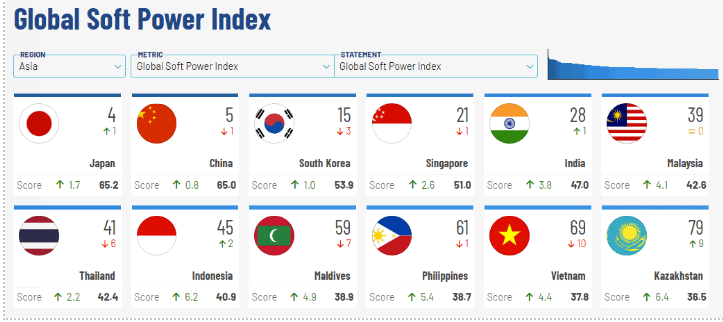

In the Global Soft Power Index 2023, the United States wins the top spot in the ranking, followed by the United Kingdom and Germany.

However, Asian nations are steadily growing their Soft Power too, with different nations gaining their edge thanks to different advantages. Japan (4th) and China (5th) are economic powerhouses as well as crucial players in international relations which secures their places in the global Top 5 for Soft Power. South Korea (15th) has become particularly influential in technology – thanks to global electronics brands like Samsung – and entertainment – owing to K-Pop and award-winning cinema. Also, India (28th) is taking an increasingly prominent role in the world thanks to the fast growth of its population and economy as well as the steady appeal of its culture – from yoga to Bollywood.

In ASEAN specifically, Singapore is leading the way in Soft Power, being a major financial hub and a role model for good governance for many nations in the region. In the world, it ranks 21st. In Asia, it is behind only Japan, China, and South Korea as well as ahead of much larger India.

Malaysia (39th), Thailand (41st), and Indonesia (45th) all rank in the Top 50 globally too. Having become more familiar to people around the world as tourist destinations, they are simultaneously investing in developing strong corporate brands that are increasing their Soft Power internationally.

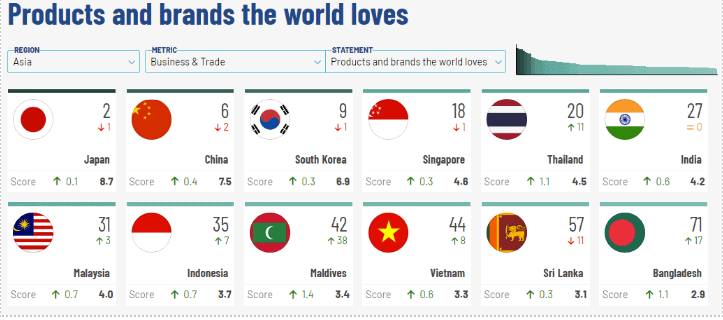

It is worth noting that all four of these ASEAN nations are punching above their weight in terms of perceptions of corporate brands. All rank higher on the particular attribute within the Index that measures perceptions of products and brands, than in terms of overall Soft Power. In this attribute, also Vietnam makes the global Top 50, which is explained by its exponential economic growth in recent years.

How does this matter to corporate brands?

The relationship between nation brands and corporate brands deserves special attention. Perceptions of the economic standing of a nation and brands of products and services originating there play a key role in forming its Soft Power. Our statistical drivers’ analysis, conducted on the Global Soft Power Index data to understand which particular nation brand attributes drive Reputation and Influence, has identified perceptions of the Business & Trade pillar as being the most important in growing Soft Power. Within this pillar, the attributes “a strong and stable economy” and “easy to do business in and with” are among the Top 5 drivers of both Reputation and Influence. The attribute “products and brands the world loves” is not far behind as the 15th most important driver of Reputation and 7th most important with regards to Influence.

Moreover, we set about conducting an analysis earlier this year that would allow us to better understand how the dynamics of Soft Power are intertwined with the performance and economic gains of nation brands. We looked at two of our annual rankings – the Global Soft Power Index, which measures perceptions and the Brand Finance Nation Brands ranking, which assesses the value and strength of nation brands.

Our analysis tells us that despite the existence of many and various factors that affect the performance of nation brands, perceptions and Soft Power that come with them correlate very strongly with performance, suggesting that improving perceptions and strengthening Soft Power can boost performance.

There are five key areas of financial impact that are measured within the Nation Brands ranking: economy, investment, trade, talent, and tourism. In our analysis, the Global Soft Power Index score demonstrated a strong statistical relationship with the Nation Brand Performance score across these five areas combined.

We then narrowed the analysis from the relationship between the overall Global Soft Power Index and Nation Brand Performance scores, to assess the relationship between perceptions captured in a particular Global Soft Power Index pillar focusing on Business & Trade on the one hand and economic performance measures in the Nation Brands study – namely GDP per capita and GDP growth – on the other. The results showed a strong correlation again, suggesting that improving perceptions towards a nation’s Business & Trade pillar attributes can support stronger macroeconomic performance.

This supports the gut feeling that most marketers have that strong corporate brands mean a strong nation brand, and a strong nation brand means a strong economy, creating a virtuous circle that reinforces corporations based in the country.

Invitation to the Global Soft Power Summit 2024

The findings of the new iteration of the Global Soft Power Index will be inaugurated at the Global Soft Power Summit on 28th and 29th February 2024 in London and streamed live online. This time, we will also unveil the findings of additional new research identifying the best nations in investment, trade, talent, and tourism attraction. The data will tell us even more about the relationship between corporate and nation brands.

The previous iterations of the Global Soft Power Index can be accessed on Brand Finance’s website at: https://brandfinance.com/softpower. Attendance at the Global Soft Power Summit is free and all delegates can register to join in-person or online on Brand Finance’s website. We look forward to your participation.