This article was originally published in the Brand Finance Global 500 2025 report.

Director,

Brand Finance

Online gambling in the U.S. is now a high-stakes race to secure market dominance.

As iGaming and online sports betting become legal in a rapidly growing number of states, the brand value of key players such as FanDuel and DraftKings has skyrocketed, exemplifying the transformative power of strategic branding in a dynamic and fiercely competitive sector.

The context: A new frontier

The U.S. gambling market, traditionally dominated by physical casinos and state lotteries, has experienced a seismic shift over the past decade. The majority of Americans now live in states that have legalised online sports betting and iGaming over the past decade.

This dramatic expansion has turned the U.S. into a frontier market, where brands must operate with a dual focus: acquiring customers in a burgeoning space and building long-term brand loyalty. Unlike more mature markets, where online gambling is substantially saturated, the U.S. offers a unique opportunity for companies to capture and retain customer allegiance.

That allegiance is often based on customer “stickiness,” a phenomenon where customers are likely to stick with a brand as long as the experience meets their expectations.

Unlike consumer goods, where customers can easily choose a different brand any time they shop, gambling requires a level of set up that makes a customer less likely to leave a brand once they’re invested in the platform, have funds deposited, and are familiar with its features and user experience.

FanDuel: The pioneer

FanDuel’s growth trajectory offers a compelling case study in brand value. Originally focused on fantasy sports, FanDuel leveraged its existing customer base and brand equity to dominate the online sports betting space:

- Brand awareness campaigns:

FanDuel has invested heavily in visibility, deploying a mix of television ads, social media campaigns, and high-profile sponsorships. - Seamless customer experience:

The brand's app interface and functionality have received widespread acclaim, helping to solidify user trust and engagement. - Leveraging analytics data:

By using customer data to personalise experiences and refine better recommendations, FanDuel has created a sticky ecosystem that appeals to casual and frequent bettors alike.

FanDuel's brand value has doubled since 2023, underpinned by double-digit revenue growth, and growing brand equity among consumers.

DraftKings: The contender

DraftKings, FanDuel’s closest competitor, has charted

a similar path of fast growth. Its entry into the Brand

Finance Global 500 ranking for the first time this year

is a testament to its strategic brand-building efforts.

Notable aspects of DraftKings’ approach include:

- Strong differentiation:

By maintaining a distinctive focus on innovative features, DraftKings has carved out a unique market position. For example, its gamified elements and live betting interfaces appeal to a younger demographic. - High-impact partnerships:

Strategic partnerships with sports leagues, individual teams, and even celebrities have amplified brand recognition. - Early-mover advantage:

In states where online gambling was legalised early, DraftKings was often among the first to launch, giving it a head start in acquiring loyal customers.

Lessons from mature markets

Comparing these brands to established U.K. incumbents like Bet365 and Sky Bet reveals stark differences. Many U.K. brands have relied on years of trust and sustained reputation-building.

For example, Bet365’s focus on competitive odds and transparency has made it a favourite among professional gamblers. However, in the U.S., where brand awareness campaigns dominate, the focus is less on pricing and more on customer acquisition and engagement.

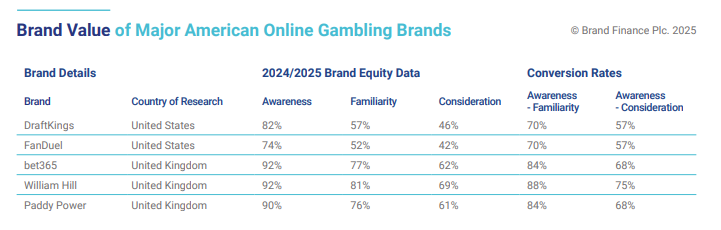

Whereas FanDuel (74%) and DraftKings (82%) have increased awareness in the US in each of the past 3 years, this still trails that of bet365 (92%), William Hill (92%) and Paddy Power (90%) in the UK.

Similarly, both US leaders convert awareness into familiarity at a lower rate (~70%) than their UK counterparts (~85%). This suggests that their mass marketing is getting eyeballs but is not yet as effective at improving consumer understanding.

Strategic brand value drivers

Several factors underpin the growth of brand value in the U.S. online gambling space:

- Massive advertising budgets:

The U.S. market is flooded with marketing spend as brands race to acquire users. For example, DraftKings reportedly spent over USD500 million on marketing in a single year, emphasising the scale of the battle for customer attention. This is viable because of the expected lifetime value of acquired, propped up by the relatively high wealth of American consumers and the stickiness factor described above. - Technology integration:

The seamless integration of technology, from apps to wearable devices, enhances customer experience and drives engagement. Real-time updates, personalised notifications, and loyalty rewards contribute to the perception of value. The American brands are built upon more recent tech platforms, while brands operating in more established markets are mostly based upon legacy platforms dating back as much as twenty years. - Cultural adaptation:

Recognising the cultural nuances of individual states has allowed brands to tailor their offerings and marketing strategies effectively, ensuring relevance and resonance with local audiences.

Challenges and risks

Despite these successes, the industry faces challenges

that could impact long-term brand value:

- Sustainability of marketing spend:

Current spending levels on customer acquisition are unlikely to be sustainable in the long-term – once the consumer market reaches saturation, it is unlikely to be viable to invest in brand building activities at such high levels. Brands will need to pivot towards retention strategies to ensure long-term profitability. - Regulatory scrutiny:

With rapid growth comes increased oversight. Brands must navigate a complex web of state and federal regulations, ensuring compliance while maintaining operational flexibility. The extremely high visibility of marketing campaigns in recent years may provoke a regulatory backlash from legislators. - Market saturation:

As more brands enter the space, differentiation will become increasingly difficult, potentially driving down profit margins.

The future of brand value in U.S. online gambling

The trajectory of U.S. online gambling brands offers a fascinating insight into how markets evolve under conditions of rapid change. While FanDuel and DraftKings currently lead, the long-term winners will be those who can transition from aggressive customer acquisition to meaningful brand loyalty. Leveraging technology, refining customer experiences, and maintaining trust will be critical.

As the dust settles on this gold rush, the U.S. may well emerge as the world’s most dynamic online gambling market, not just in size but in the sophistication of its brands. The lessons learned here could very well influence the global gambling industry for decades to come